App for credit card payment sets the stage for this enthralling narrative, offering readers a glimpse into the modern landscape of digital transactions. In today’s fast-paced world, these apps have transformed the way we handle our finances, providing a seamless and secure method for managing credit card payments. From their core functionalities to the diverse audience they cater to, credit card payment apps are not just a convenience; they are essential tools for both consumers and businesses alike.

With a range of features designed to enhance user experience, these applications streamline transactions, making it easier than ever to pay bills, shop online, and manage spending. As we delve deeper, we’ll uncover the benefits of using these apps, the security measures in place, and the future trends shaping the credit card payment ecosystem.

Overview of Credit Card Payment Apps

Credit card payment apps have transformed the way consumers and businesses handle transactions. These applications provide a seamless interface for users to make payments, manage their finances, and track their spending—all from their mobile devices. As digital payment solutions rise in popularity, understanding the core functionalities of credit card payment apps becomes increasingly important for both users and developers.Credit card payment apps facilitate electronic transactions that allow individuals and businesses to make payments using credit cards.

These apps typically enable users to store multiple credit card details securely, making it easy to pay for goods and services either online or in physical stores. Key functions of these apps include transaction history tracking, budget management tools, and security features such as biometric authentication. Moreover, many credit card payment apps offer rewards programs that allow users to earn points or cashback on their purchases, enhancing user engagement and satisfaction.

Primary Functions and Features

The primary functions of credit card payment apps encompass a variety of features aimed at enhancing the user experience and ensuring secure transactions. The following are significant features commonly found in credit card payment applications:

- Payment Processing: The core function of these apps is to process credit card payments swiftly and securely, allowing users to buy products and services on-the-go.

- Transaction History: Users can access detailed records of their spending, which helps in budgeting and monitoring financial habits.

- Security Features: Enhanced security measures, including encryption and tokenization, safeguard sensitive data against unauthorized access.

- Integration with Rewards Programs: Many apps provide users with the ability to access loyalty and rewards programs, allowing them to earn benefits from their spending.

- User-Friendly Interface: A simple and intuitive design ensures that users can navigate the app effortlessly, making payments convenient and fast.

Target Audience

Credit card payment applications cater to a diverse range of users, each with specific needs and preferences. Understanding the target audience helps developers tailor functionalities to suit various demographics. The key user segments include:

- Millennials and Gen Z: Younger generations, often more tech-savvy, prefer mobile payment solutions that provide convenience and quick access to financial data.

- Small Business Owners: Entrepreneurs looking for efficient payment processing solutions benefit from features that facilitate recurring payments and invoice management.

- Frequent Travelers: Users who travel often appreciate apps that offer currency conversion, travel rewards, and global acceptance features.

- Budget-Conscious Consumers: Individuals focused on financial management seek apps with comprehensive budgeting tools and spending insights to help them maintain control over their expenses.

Benefits of Using Credit Card Payment Apps

Credit card payment apps are transforming the way consumers and businesses handle transactions. These apps not only streamline the payment process but also offer a variety of advantages that enhance the overall experience for both parties involved. Understanding these benefits can help users make informed decisions about adopting this technology.Businesses and consumers alike reap significant advantages from utilizing credit card payment applications.

For consumers, the ease of transactions leads to a more satisfying shopping experience, while businesses can enjoy increased sales and improved customer loyalty. Key benefits include:

Advantages for Consumers

Credit card payment apps provide numerous benefits that enhance the shopping experience for consumers. Some of these advantages include:

- Speed and Convenience: Transactions can be completed swiftly, reducing the time spent at checkout and allowing easier purchases on-the-go.

- Security: Features like tokenization and advanced encryption protect personal data, making consumers feel safer when making purchases.

- Accessibility: Users can manage multiple cards in one app, making it easier to track spending and rewards across different credit accounts.

- Instant Notifications: Users receive real-time alerts for transactions, helping them monitor their spending and enhance budget management.

Advantages for Businesses

Implementing credit card payment applications can be a game-changer for businesses. The benefits they experience include:

- Increased Sales: Faster transactions and the ability to accept payments online can lead to higher sales volumes.

- Customer Retention: Streamlined payment processes improve customer satisfaction, helping to build lasting relationships.

- Diverse Payment Options: Offering various payment methods attracts a broader customer base, catering to different preferences.

- Data Insights: Many apps provide analytics that help businesses understand customer behavior and trends, allowing for better marketing strategies.

Convenience Features Offered by Credit Card Payment Apps

These applications come packed with features that enhance user convenience. Notable features include:

- Digital Wallet Integration: Users can link their preferred payment methods for quick access and hassle-free payments.

- Loyalty Program Integration: Many apps allow users to earn rewards or cashback, making every purchase more rewarding.

- Bill Splitting: Some apps enable users to easily split bills with friends or family, promoting social sharing of expenses.

- In-App Purchases: Users can make purchases directly within the app, eliminating the need to switch between platforms.

Types of Credit Card Payment Apps: App For Credit Card Payment

Credit card payment apps have revolutionized the way we handle transactions, providing users with a variety of options that cater to their specific needs. From mobile wallets to traditional payment solutions, understanding the different types of apps available can significantly enhance the user experience and transaction efficiency. This section explores the distinctions between mobile wallets and traditional credit card payment apps, highlights popular applications, and categorizes them based on unique features and target markets.

Comparison of Mobile Wallets and Traditional Credit Card Payment Apps

Mobile wallets and traditional credit card payment apps serve the same fundamental purpose of facilitating transactions, but they do so in different ways. Mobile wallets, like Apple Pay and Google Pay, store card information securely on a mobile device, enabling users to make contactless payments directly from their smartphones. This convenience often includes additional features such as loyalty cards and transaction tracking.

In contrast, traditional credit card payment apps, such as PayPal or Venmo, allow users to link their credit cards for online payments and peer-to-peer transfers but may not support contactless payment technology.The benefits of mobile wallets include stronger security measures, such as tokenization and biometric authentication, while traditional apps often focus on broader functionalities, like managing multiple payment types and providing buyer protection.

Both options have their unique advantages, making them suitable for different user preferences.

Popular Credit Card Payment Apps

Several credit card payment apps have gained popularity for their reliability and ease of use. Here is a list of some of the most recognized apps available today, each with its own distinctive features:

- PayPal: A widely used app for online payments, offering buyer protection and the ability to send money to friends and family easily.

- Venmo: A social payment app that allows users to send and receive money from friends, with a social feed to share transactions.

- Square Cash (Cash App): Offers peer-to-peer payments and the ability to buy stocks and Bitcoin, making it versatile for financial transactions.

- Apple Pay: A mobile wallet that allows users to make payments in stores, apps, and online, using their Apple devices.

- Google Pay: Similar to Apple Pay, this app enables users to make transactions using Android devices with added features like loyalty programs.

Table of Credit Card Payment Apps by Features and Target Markets

Organizing credit card payment apps by their unique features and target markets can help users choose the right app for their needs. Below is a table that categorizes these apps, highlighting their primary functionalities and intended audiences.

| App Name | Key Features | Target Market |

|---|---|---|

| PayPal | Online payments, buyer protection, merchant services | Shoppers, online businesses |

| Venmo | Social feed, instant transfers, payment requests | Young adults, social users |

| Cash App | Peer-to-peer payments, investing, Bitcoin trading | Millennials, tech-savvy users |

| Apple Pay | Contactless payments, loyalty card integration | Apple device users |

| Google Pay | Contactless payments, rewards programs | Android device users |

Understanding the different types of credit card payment apps empowers users to make informed decisions about their payment preferences.

Security Features in Credit Card Payment Apps

In today’s digital world, ensuring the security of credit card payment apps is paramount. As these applications handle sensitive financial information, they must incorporate robust security features to protect users from potential threats. This section delves into the essential security measures, common risks, and best practices for consumers using these apps.

Essential Security Measures for Transactions, App for credit card payment

To safeguard transactions, credit card payment apps implement several critical security measures. These features not only protect user data but also enhance trust in the application.

- Encryption: Credit card payment apps use advanced encryption protocols, such as SSL (Secure Sockets Layer) and TLS (Transport Layer Security), to shield user data during transmission. This ensures that the information remains confidential and secure from potential eavesdroppers.

- Two-Factor Authentication: Many apps require a second form of verification, such as a one-time code sent via SMS or an authentication app. This additional layer helps ensure that only authorized users can access their accounts.

- Tokenization: Tokenization replaces sensitive card information with a unique identifier or token. This means that even if data is intercepted, it cannot be used for fraudulent transactions.

- Fraud Detection Systems: Sophisticated algorithms monitor transactions in real-time, flagging any suspicious activity for further verification. This proactive approach helps in mitigating potential fraud before it escalates.

Common Security Risks in Credit Card Payment Applications

Despite the security measures in place, credit card payment apps face various vulnerabilities that can compromise user safety. Understanding these risks is essential for users to remain vigilant.

- Phishing Attacks: Cybercriminals often employ phishing tactics to trick users into providing personal information. This can happen through fraudulent emails or websites mimicking legitimate services.

- Malware Attacks: Malicious software can infiltrate users’ devices, capturing sensitive data without their knowledge. Users must ensure their devices are equipped with reliable security software.

- Public Wi-Fi Risks: Using credit card payment apps over unsecured public Wi-Fi can expose users to interception and data theft. It’s advisable to use these apps on secured networks only.

Best Practices for Secure Usage of Credit Card Payment Apps

To maximize the security of credit card payment apps, consumers should adopt several best practices. These practices help mitigate risks and ensure safe transactions.

- Regular Updates: Keeping the app and device software updated is crucial, as updates often include security patches that protect against newly discovered vulnerabilities.

- Strong Passwords: Users should create complex passwords that combine letters, numbers, and symbols. Avoiding easily guessed passwords is essential for account security.

- Monitoring Account Activity: Regularly reviewing account statements for unauthorized transactions can help detect fraudulent activity early.

- Be Cautious with Links: Users should avoid clicking on suspicious links in emails or messages, which may lead to phishing sites aimed at stealing personal information.

Staying informed and practicing secure habits are key to protecting oneself in the digital payment landscape.

Integration with Other Financial Tools

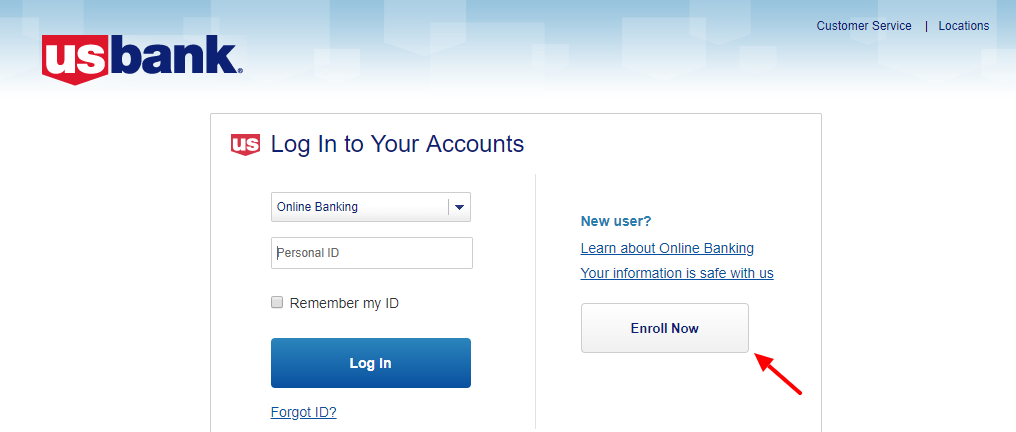

Credit card payment apps have evolved significantly, now offering seamless integration with various financial tools that enhance budgeting, spending analysis, and overall financial planning. This integration allows users to manage their finances more efficiently by consolidating transaction histories and tracking expenses all in one place.Linking credit card payment apps with bank accounts or other payment methods is typically a straightforward process.

Most apps provide a user-friendly interface that guides you through the steps of connecting your accounts. Users usually need to provide their bank account details or log in through their bank’s online portal for verification. This connection allows for real-time updates on spending, making it easier to adhere to budgets and financial goals.

Financial Tools Compatible with Credit Card Payment Apps

Several financial tools work exceptionally well with credit card payment apps, enhancing the user experience and improving financial management. Below is a list of notable tools that complement credit card payment apps:

- Budgeting Software: Tools like Mint and You Need A Budget (YNAB) help users track expenses and set budgets based on transactions recorded in credit card apps.

- Personal Finance Management Apps: Applications like Personal Capital provide insights into net worth and investment tracking, often syncing with credit card data to show spending trends.

- Expense Tracking Apps: Apps such as Expensify and PocketGuard allow users to check and categorize expenses in real-time, integrating with credit card transaction histories.

- Tax Preparation Software: Services like TurboTax and H&R Block can import credit card transactions, simplifying tax filing and ensuring all possible deductions are accounted for.

- Investment Platforms: Some investment apps allow users to analyze spending habits alongside investment performance, providing a holistic view of their financial health.

Integrating these tools with credit card payment apps not only streamlines financial management but also empowers users to make informed decisions based on comprehensive data analysis. The synergy between these financial platforms enhances user experience, encouraging responsible spending and efficient budgeting.

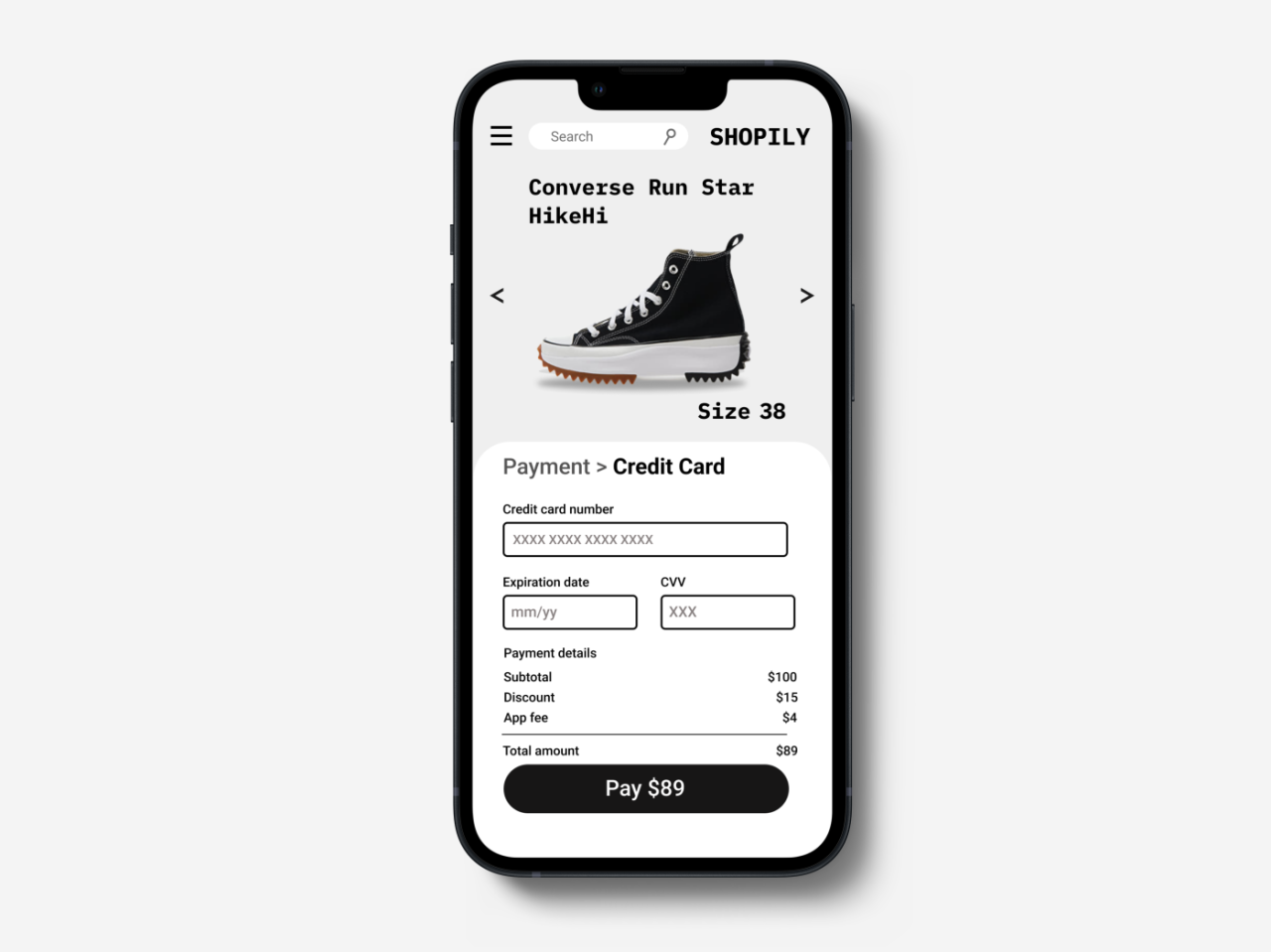

User Experience in Credit Card Payment Apps

User experience (UX) plays a pivotal role in the success of credit card payment applications. A seamless, intuitive interface not only enhances user satisfaction but also influences customer retention and loyalty. The design elements and features embedded in these apps significantly contribute to the overall user journey, making it essential to focus on creating an optimal experience.A user-friendly interface is characterized by several key elements that facilitate easy navigation and effective transactions.

These elements are designed to minimize friction and enhance the overall user experience, which leads to higher customer satisfaction.

Elements of a User-Friendly Interface

Creating a user-friendly credit card payment app involves multiple design considerations. Here are the primary elements that contribute to an effective interface:

- Intuitive Navigation: The layout should guide users effortlessly through the app, allowing them to complete transactions with minimal steps.

- Clear Call-to-Action Buttons: Prominent and clearly labeled buttons for actions such as “Pay Now” or “Add Card” help users understand what to do next.

- Consistent Design Language: Uniformity in colors, fonts, and icons across the app fosters familiarity, making it easier for users to navigate.

- Responsive Design: The app should perform well across various devices and screen sizes, ensuring a smooth experience whether on a smartphone or tablet.

- Visual Feedback: Providing visual cues, such as loading animations or confirmation messages, reassures users that their actions are being processed.

Importance of Customer Support and Accessibility Features

Customer support is a critical aspect of user experience in credit card payment apps. Users often encounter issues or have questions that require immediate assistance. An effective strategy incorporates accessible customer support options, such as live chat, FAQs, or a dedicated support line, which can significantly enhance user confidence in the app.Moreover, accessibility features ensure that the app caters to a diverse range of users, including those with disabilities.

This can include:

- Voice Command Integration: Allowing users to navigate the app and perform transactions using voice commands enhances accessibility for visually impaired users.

- Text-to-Speech Capabilities: Implementing text-to-speech for instructions and prompts can make the app more usable for individuals with reading difficulties.

- Customizable UI Options: Users should have the ability to adjust font sizes and color contrasts to suit their individual needs.

Impact of Design on Customer Retention and Satisfaction

The overall design of a credit card payment app directly impacts customer retention and satisfaction. A beautifully designed app that prioritizes user experience can convert first-time users into loyal customers. Consider the following aspects:

- First Impressions Matter: A visually appealing and well-organized interface can create a positive initial impression, encouraging users to explore the app further.

- Ease of Use Reduces Frustration: Apps that offer a straightforward, hassle-free experience are more likely to retain users who may otherwise abandon complex or confusing applications.

- Regular Updates and Improvements: Continuously updating the app based on user feedback and industry trends can keep the design fresh and engaging, enhancing long-term satisfaction.

Future Trends in Credit Card Payment Apps

As technology continues to evolve, so does the landscape of credit card payment applications. Emerging trends are shaping how consumers and businesses interact with digital payments, providing new avenues for convenience, security, and efficiency. Understanding these trends is crucial for users and developers alike to stay ahead in a competitive market.

Emerging Technologies Influencing Credit Card Payment Apps

Several cutting-edge technologies are significantly changing the way credit card payment apps function. These innovations enhance user experience, streamline transactions, and improve security measures. Key technologies include:

- Artificial Intelligence (AI): AI is being utilized for fraud detection and personalized customer service, offering users tailored experiences and enhanced security.

- Blockchain: This technology ensures secure, transparent transactions by creating immutable records, reducing fraud and enhancing trust between parties.

- Contactless Payments: Near Field Communication (NFC) technology allows users to make quick payments by simply tapping their devices, improving transaction speed and convenience.

- Augmented Reality (AR): AR can enhance shopping experiences by integrating payment features into virtual environments, making transactions seamless and intuitive.

Impact of Cryptocurrency on Credit Card Payment Landscape

The rise of cryptocurrency is reshaping traditional payment methods, including credit card transactions. As digital currencies gain traction, several implications arise:

- Merchant Adoption: More businesses are beginning to accept cryptocurrencies as a payment method, integrating them into credit card payment apps for greater versatility.

- Transaction Speed: Cryptocurrency transactions can be processed faster than traditional credit card payments, especially for international transfers, reducing waiting times for consumers.

- Lower Fees: Using cryptocurrencies can often result in lower transaction fees compared to conventional credit card processing, appealing to both merchants and consumers.

- Regulatory Considerations: As cryptocurrency continues to flourish, regulatory bodies are likely to implement new guidelines affecting how credit card apps incorporate these digital assets.

Potential Regulatory Changes Affecting Credit Card Payment Applications

The regulatory environment surrounding credit card payments is continuously evolving, particularly as new technologies emerge. Upcoming changes can have a significant impact on how payment apps operate:

- Data Protection Laws: Stricter regulations for data privacy, such as GDPR in Europe, are forcing credit card payment apps to enhance their data security measures to protect user information.

- Consumer Protection Regulations: Governments may enact laws to enhance consumer rights, requiring credit card apps to provide clearer information about fees and interest rates.

- Anti-Money Laundering (AML) Regulations: As payment apps expand their capabilities, they must comply with AML laws, which may require implementing more robust customer verification processes.

- Cryptocurrency Regulations: As the use of cryptocurrency grows, regulatory frameworks will likely evolve to cover digital currencies, impacting how credit card payment apps integrate these options.

Case Studies of Successful Credit Card Payment Apps

The evolution of credit card payment apps has transformed the way consumers and businesses handle transactions. This section delves into notable case studies of successful credit card payment applications, examining their launches, user adoption rates among various demographics, and insights drawn from user feedback. By understanding these aspects, we can discern the factors that contribute to the success of these applications.

Successful Launches of Notable Apps

Several credit card payment apps have made significant strides in the market. Notably, apps like PayPal, Venmo, and Square Cash have established themselves as leaders due to their innovative features and user-friendly interfaces. Each of these applications has undergone meticulous planning and execution during their launch phases.For instance, PayPal revolutionized online payments in 1998 and has since expanded its services to include both personal and business transactions.

Its seamless integration with e-commerce platforms has led to its widespread adoption among users of all ages, especially millennials and Gen Z, who value convenience and speed.Venmo, which launched in 2009, quickly became popular among younger demographics, particularly college students who appreciated the social aspect of sharing payments. Its clean interface and ability to connect with social media have contributed to rapid user growth.

By 2021, Venmo reported over 70 million users, highlighting its appeal and effectiveness in engaging a younger audience.Square Cash, now known simply as Cash App, has thrived since its 2013 launch by simplifying the payment process. Targeting small businesses and individuals looking for easy peer-to-peer transactions, it has seen exponential growth. The app’s ability to allow users to buy stocks and Bitcoin has further broadened its appeal, particularly among tech-savvy users.

User Adoption Rates Across Demographics

Understanding user adoption rates across different demographics is crucial in evaluating the success of various credit card payment apps. The following statistics illustrate the varying levels of adoption among different age groups and income brackets:

- PayPal: With approximately 392 million active user accounts as of 2021, PayPal attracts a diverse audience, though it is especially favored by middle-aged users who appreciate its broad acceptance and reliability.

- Venmo: This app boasts a significant user base, predominantly among individuals aged 18-34. The app has a remarkable 80% adoption rate among college-aged users, emphasizing its popularity in vibrant social circles.

- Cash App: Targeting primarily younger adults aged 18-34, Cash App has surged in popularity, especially among users keen on cryptocurrency investments. The app has recorded a 42% increase in user engagement since 2020.

The adoption rates highlight distinct trends, suggesting that younger users gravitate towards applications that provide social interaction and financial investment options, while older demographics prefer apps that offer more traditional payment solutions.

User Feedback and Reviews

Analyzing user feedback is essential to identifying the strengths and weaknesses of specific credit card payment apps. Customer reviews often provide insight into user experience, satisfaction levels, and areas requiring improvement.

“Venmo offers a fun interface and makes splitting bills easy, but the customer service leaves much to be desired.”

Common points raised in user reviews include:

- PayPal: Users appreciate PayPal’s security and broad merchant acceptance but often mention the high fees for certain transactions as a drawback.

- Venmo: The social features are a highlight, yet users frequently express dissatisfaction with the lack of customer support and some privacy concerns regarding transaction visibility.

- Cash App: Many users praise the seamless interface and cryptocurrency features, though they cite issues with account freezes and slow customer service response times.

User feedback consistently emphasizes the need for enhanced customer support and transparency regarding fees, which are critical factors in maintaining user trust and satisfaction. By addressing these concerns, credit card payment apps can continue to evolve and meet the demands of their user base effectively.

Key Questions Answered

What types of devices can I use credit card payment apps on?

You can use credit card payment apps on smartphones and tablets, with both iOS and Android support widely available.

Are credit card payment apps safe to use?

Yes, most credit card payment apps implement strong security measures like encryption and biometric authentication to protect user data.

Can I link multiple credit cards to one app?

Yes, many credit card payment apps allow users to link multiple credit cards for added flexibility while making payments.

Do credit card payment apps charge fees?

Some credit card payment apps may charge transaction fees or subscription fees, while others are completely free to use.

How do I troubleshoot issues with my credit card payment app?

If you encounter issues, check for app updates, ensure a stable internet connection, or consult the app’s customer support for assistance.