Apps to accept credit card payments have revolutionized how businesses engage with customers, enabling seamless transactions at the tap of a finger. These applications not only facilitate easy payment processing for merchants but also enhance the shopping experience for consumers by offering convenience and security. With a plethora of options available in the market today, understanding the features and functionalities of these apps is essential for any business looking to thrive in the digital age.

Whether you run a small local shop or a large e-commerce platform, choosing the right credit card payment app can significantly impact your sales and customer satisfaction. From essential security measures to user-friendly interfaces, this overview will guide you in making an informed decision about which app suits your business needs best.

Overview of Credit Card Payment Apps

Credit card payment apps have revolutionized the way businesses and consumers conduct transactions by offering a streamlined, convenient, and secure method for processing payments. These applications enable users to accept credit card payments directly from their smartphones or tablets, thereby facilitating commerce in an ever-more mobile world. The significance of credit card payment apps extends beyond mere convenience; they empower small business owners, freelancers, and service providers to manage payments with ease.

The ability to accept credit card payments increases sales opportunities and enhances customer satisfaction, as it offers a fast and reliable way to complete transactions. With the growing trend towards cashless payments, these apps have become indispensable tools in modern business operations.

Popular Credit Card Payment Apps

Several credit card payment apps have gained popularity for their user-friendly features and robust security measures. Understanding the available options can help businesses select the best app for their needs. Here are some of the most widely used credit card payment apps today:

- Square: Known for its free card reader and straightforward fee structure, Square is favored by small businesses and mobile vendors. Its comprehensive point-of-sale (POS) system integrates sales and inventory tracking.

- PayPal Here: This app allows businesses to accept payments in-person and online, providing flexibility for various transaction types. PayPal’s established reputation adds a layer of trust for consumers.

- Stripe: Mainly focused on online businesses, Stripe offers powerful API tools for developers, enabling customizable payment solutions. It’s widely used by e-commerce platforms.

- Venmo for Business: Initially popular for personal transactions, Venmo’s business profile allows businesses to accept payments seamlessly while leveraging its social features to enhance customer interactions.

- Shopify POS: Tailored for retail environments, Shopify POS combines online and offline sales, allowing merchants to manage inventory and process transactions in a cohesive manner.

These apps not only enhance the payment process but also provide additional functionalities such as sales analytics, customer tracking, and inventory management, making them valuable assets for any business.

Features to Look for in Payment Apps

Choosing the right payment app is crucial for businesses that want to ensure smooth and secure transactions. A great payment app not only enhances the customer experience but also streamlines operations for merchants. Here are essential features to consider when selecting a payment app.

Essential Features

When evaluating payment apps, businesses should look for several key functionalities that can significantly improve transaction efficiency and customer satisfaction. These features can vary widely, but the following elements are fundamental:

- Multi-Platform Compatibility: The app should work seamlessly across various devices such as smartphones, tablets, and desktops. This allows merchants to accept payments anytime, anywhere.

- Payment Options: Support for various payment methods, including credit cards, debit cards, mobile wallets, and even cryptocurrency, is essential to accommodate diverse customer preferences.

- Invoicing and Reporting Tools: Built-in features for invoicing and detailed sales reporting aid businesses in tracking their finances more effectively and managing cash flow.

- Customer Support: Accessible customer support is vital for resolving issues quickly. Look for apps that offer 24/7 support via chat, email, or phone.

- Integration Capabilities: The ability to integrate with other business tools like accounting software, inventory management, and e-commerce platforms is essential for smooth operations.

Security Measures

Security is a top priority for payment apps to protect sensitive customer data and prevent fraud. Therefore, businesses should ensure that the app they choose implements robust security features. Important security measures include:

- Encryption Technology: Look for apps that utilize strong encryption protocols, such as SSL or TLS, to protect transaction data during transmission.

- Two-Factor Authentication (2FA): This adds an extra layer of security, requiring users to verify their identity through a second method, such as a text message or authentication app.

- Compliance with PCI DSS: Payment apps should comply with the Payment Card Industry Data Security Standard (PCI DSS), ensuring they meet strict security requirements for handling credit card information.

- Fraud Detection Mechanisms: Advanced fraud detection tools can help identify suspicious activity and prevent fraudulent transactions before they occur.

User Interface and Ease of Use

An intuitive user interface can make a significant difference for both merchants and customers. A well-designed payment app should prioritize user experience. Here are aspects to consider regarding usability:

- Simplicity: The app should feature a clear and straightforward design, making it easy for users to navigate and complete transactions without confusion.

- Quick Checkout Process: Streamlined checkout processes reduce cart abandonment rates and enhance customer satisfaction by enabling faster transactions.

- Mobile Optimization: As many consumers use mobile devices for shopping, the app should be fully optimized for mobile use, ensuring a smooth experience on smaller screens.

- Customization Options: Merchants should be able to customize the app’s interface to reflect their branding, creating a consistent customer experience.

Comparison of Top Credit Card Payment Apps

Choosing the right credit card payment app can significantly impact a business’s transaction efficiency and customer satisfaction. With numerous options available, a well-informed decision is essential. The following comparison provides an in-depth look at four popular credit card payment apps, exploring their features, fees, user ratings, and suitability for various markets.

Comparison Table of Features, Fees, and User Ratings

To help visualize the key differences among these apps, here’s a comprehensive comparison table:

| Payment App | Features | Transaction Fees | User Ratings |

|---|---|---|---|

| Square | Point of Sale, Inventory Management, Invoicing | 2.6% + 10¢ per swipe | 4.8/5 |

| PayPal | Online Payments, Invoicing, Buyer Protection | 2.9% + 30¢ per transaction | 4.7/5 |

| Stripe | API Integration, Subscription Management, Data Insights | 2.9% + 30¢ per transaction | 4.8/5 |

| Shopify Payments | eCommerce Tools, Fraud Analysis, Multi-Currency Support | 2.9% + 30¢ per transaction (for Basic plan) | 4.6/5 |

Pros and Cons of Each Payment App

Understanding the strengths and weaknesses of each app can guide businesses in selecting the most suitable one for their needs. – Square

*Pros*

Offers a user-friendly interface, excellent customer support, and robust reporting tools. Ideal for small businesses and retail environments.

*Cons*

Limited international capabilities and additional fees for advanced features. – PayPal

*Pros*

Widely recognized and trusted by consumers, supports multiple currencies, and offers buyer protection, making it great for eCommerce.

*Cons*

Higher fees than some competitors and can be limiting for businesses with high transaction volumes. – Stripe

*Pros*

Highly customizable with extensive API options, perfect for tech-savvy businesses. Supports subscription billing and provides in-depth analytics.

*Cons*

Can be complex for non-technical users, and the setup process may be daunting for some.

Shopify Payments

*Pros*

Seamless integration with Shopify’s eCommerce platform, excellent for online retail, and includes features geared towards fraud prevention.

*Cons*

Limited to Shopify users, and transaction fees can add up for lower-tier plans.

Target Markets and Industries Best Suited for Each App

Different payment apps cater to various industries and business types, making it crucial to align the app with the business model.

- Square is best suited for brick-and-mortar stores and service-based businesses due to its POS systems and inventory management features.

- PayPal excels in eCommerce and online retail markets, especially for businesses looking to reach a global audience.

- Stripe is ideal for tech startups and subscription-based services, where customization and integration with existing platforms are necessary.

- Shopify Payments works best within the eCommerce sector, specifically for businesses using the Shopify platform for their online sales.

Each of these apps has distinct features, fees, and target markets, allowing businesses to select the most fitting option for their specific needs and operational style.

Integration with Other Business Tools

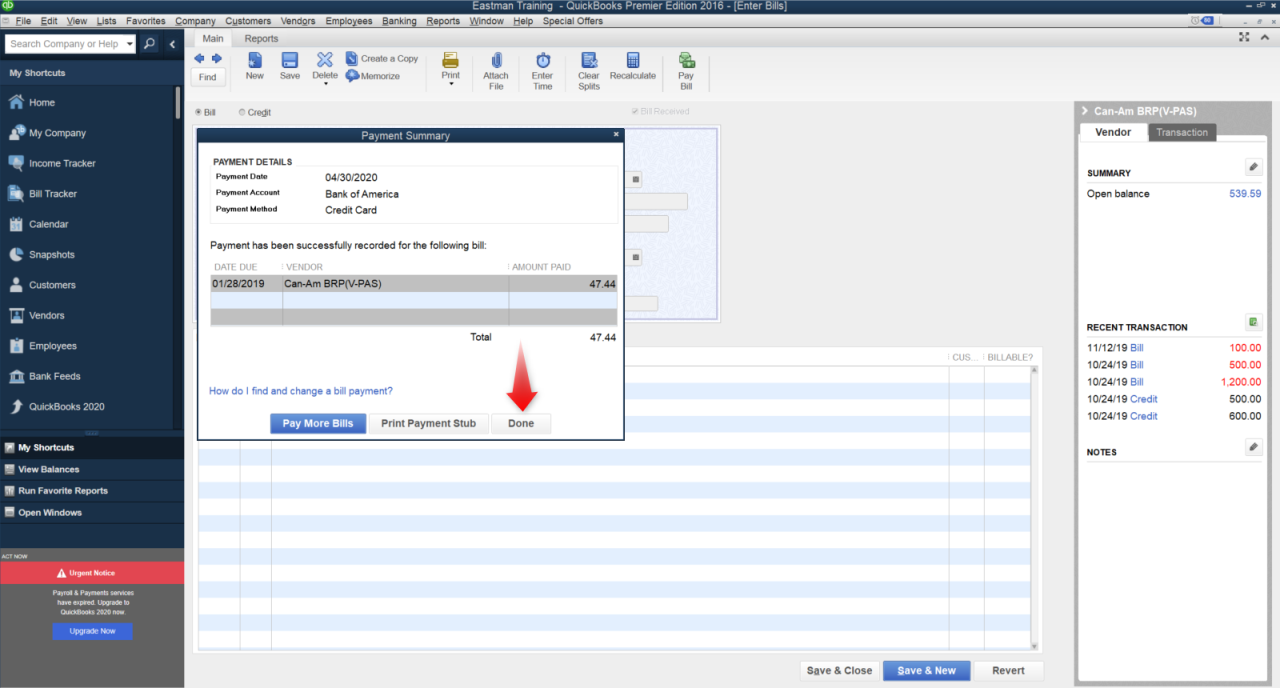

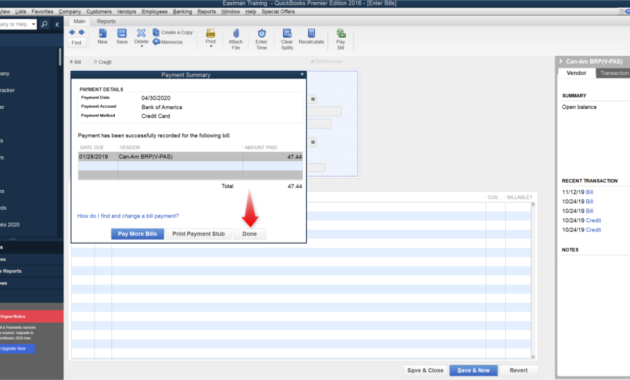

Payment apps are no longer standalone software; they can seamlessly integrate with various other business tools, enhancing efficiency and streamlining operations. This integration allows businesses to synchronize their financial processes, making it easier to manage transactions, track expenses, and analyze sales data without the hassle of manual entry.Payment apps can integrate effectively with accounting software and e-commerce platforms, revolutionizing the way businesses operate.

For instance, when payment apps are linked with accounting software like QuickBooks or Xero, transaction data is automatically recorded, reducing errors and saving time on bookkeeping. Similarly, e-commerce platforms such as Shopify or WooCommerce can directly communicate with payment apps, allowing businesses to manage online transactions and inventory in one cohesive system.

Examples of Successful Integration

Many businesses have leveraged payment app integration to enhance their operational efficiency. A local coffee shop, for instance, uses Square as its payment app, which integrates directly with its inventory management system. This allows the business owner to automatically update stock levels in real-time with each sale, preventing stock shortages and ensuring better inventory control. Another example is a small boutique that utilizes PayPal for transactions on its e-commerce site.

By integrating PayPal with its accounting software, the owner can easily reconcile transactions and generate financial reports without manually entering data, which helps in maintaining accurate financial records.

Advantages of Using Payment Apps with Inventory Management Systems, Apps to accept credit card payments

Integrating payment apps with inventory management systems offers numerous advantages that can significantly benefit businesses. The primary benefits include:

- Real-Time Inventory Updates: Payments made through the app automatically adjust inventory levels on the back end, allowing businesses to have accurate data at their fingertips.

- Streamlined Operations: By automating the data transfer between the payment app and inventory system, businesses can reduce the workload on staff and minimize the risk of errors associated with manual data entry.

- Enhanced Sales Analytics: Integration provides insights into sales trends directly linked to inventory levels, enabling businesses to make informed purchasing and marketing decisions.

- Improved Customer Experience: With accurate stock information, businesses can prevent overselling items, thereby enhancing customer satisfaction and trust.

Overall, the integration of payment apps with other business tools plays a crucial role in streamlining operations, enhancing efficiency, and ultimately contributing to the success of modern businesses. The ability to have a unified view of transactions, inventory, and finances allows for better decision-making and operational agility.

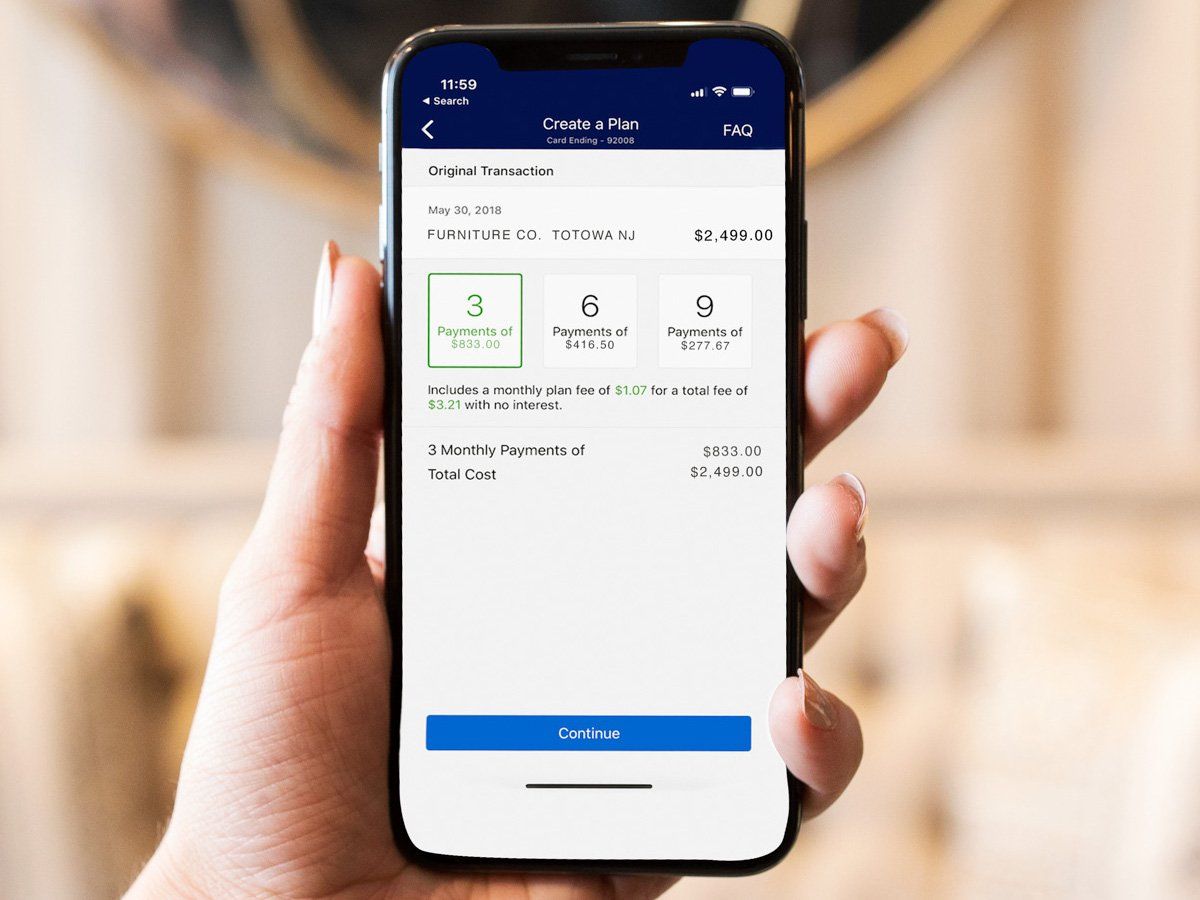

Steps to Set Up a Credit Card Payment App

Setting up a credit card payment app can streamline your small business operations and enhance customer satisfaction. It’s essential to follow a systematic approach to ensure a smooth implementation. By preparing adequately and understanding the necessary steps, you can avoid common pitfalls and set your business up for financial success.The setup process of a credit card payment app involves several crucial steps, each designed to ensure you meet both legal and operational requirements.

This organized approach can help you navigate the complexities of digital payment processing without a hitch.

Checklist of Requirements for Setup

Before diving into the setup process, gathering all necessary requirements will save time and prevent delays. Below is a checklist of essential items you need to have ready:

- Business registration documents to verify your company’s legitimacy.

- Bank account information for linking to the payment app for transaction deposits.

- Tax identification number (TIN) or Employer Identification Number (EIN) for tax purposes.

- Merchant account to facilitate credit card processing.

- Payment processing fees comparison to choose the most cost-effective solution.

- Compatible hardware (if applicable), such as card readers or point-of-sale systems.

Steps to Set Up the App

The setup process involves several key steps. Following these systematically can lead to a successful implementation of your payment app:

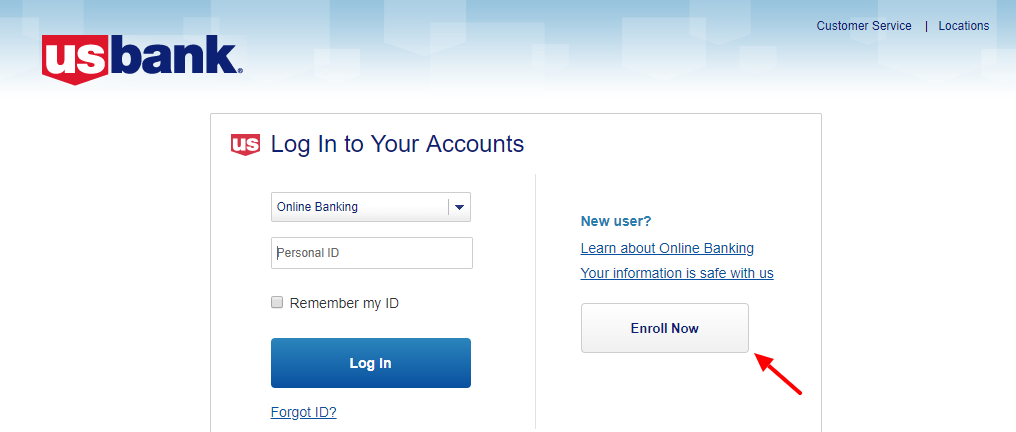

- Choose the Right Payment App: Research and select a payment app that suits your business needs, considering fees, features, and customer support.

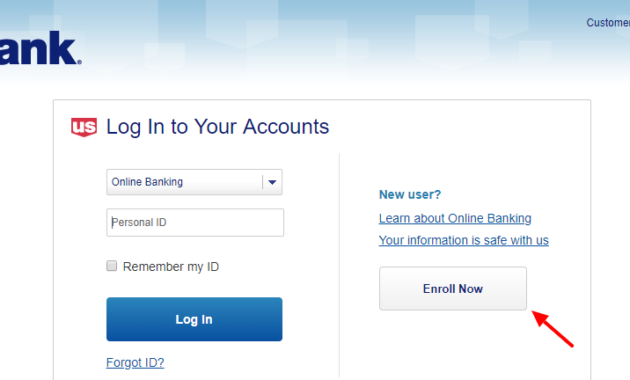

- Create an Account: Sign up for the selected payment app using your business information, including the checklist items above.

- Link Your Bank Account: Provide your bank account details to enable seamless transfer of funds from transactions.

- Configure Settings: Customize settings within the app, including payment options, currency settings, and notification preferences.

- Test Transactions: Run several test transactions to ensure everything is functioning correctly before going live.

- Train Employees: Ensure that all employees who will use the app are trained on its functionalities and troubleshooting.

- Launch the App: Once testing is complete and all settings are confirmed, officially start accepting payments through the app.

Common Pitfalls to Avoid

During the setup phase, it’s essential to be aware of potential mistakes that can hinder your payment app’s effectiveness. Here are some common pitfalls to avoid:

- Neglecting to read the fine print regarding fees and terms of service can lead to unexpected costs.

- Overlooking security features may expose your business to fraud or data breaches.

- Failing to test the payment process thoroughly may result in technical issues when you start accepting real transactions.

- Not training staff adequately can lead to confusion and errors during customer transactions.

- Choosing an incompatible hardware setup can result in additional costs or delays in accepting payments.

“Thorough preparation and awareness of potential pitfalls can significantly enhance the efficiency of your payment processing setup.”

Understanding Fees and Payment Processing Costs

When utilizing credit card payment apps for your business, understanding the associated fees and costs is crucial. These fees can eat into your profits, so being informed can help you choose the right service and manage your expenses effectively. This section delves into the various types of fees you may encounter and gives you tips on how to minimize these costs.

Types of Fees Associated with Credit Card Payment Apps

Credit card payment apps come with several types of fees that can impact your bottom line. Here’s a detailed look at the various fees you might encounter:

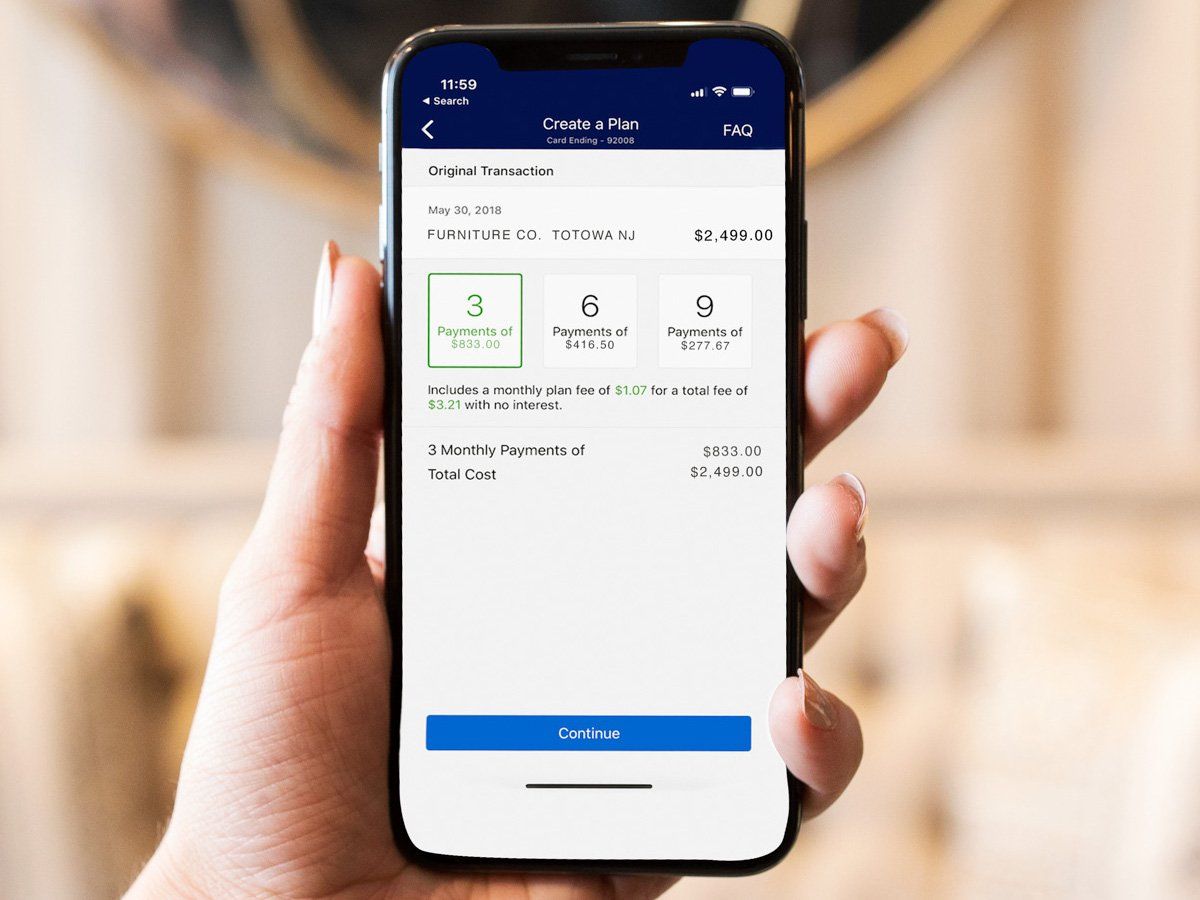

- Transaction Fees: This is the most common fee and typically ranges from 1.5% to 3.5% of each transaction. These fees apply every time a customer makes a purchase using a credit card.

- Monthly Fees: Some payment processors charge a monthly subscription fee, which can range from $0 to $30 or more. This fee often covers access to additional features and support.

- Chargeback Fees: If a customer disputes a charge, you may incur a chargeback fee, which can be anywhere between $15 and $50, depending on the processor.

- Setup Fees: Some services may require an initial payment to set up your account. This fee can vary widely.

- Hidden Costs: Be wary of hidden fees such as fees for international transactions, batch processing, or even inactivity fees if your account remains dormant.

Comparing Transaction Fees, Monthly Fees, and Hidden Costs

When choosing a credit card payment app, it’s essential to compare not just the transaction fees, but also the monthly fees and potential hidden costs. Different apps have varying structures, and understanding these can save you money. For example, one app might offer a lower transaction fee but charge a higher monthly fee, while another might have a higher transaction fee but no monthly charge.

Assessing the total cost of ownership over a month can give you a clearer picture.Consider the following factors:

- Evaluate the total costs based on your average monthly sales volume.

- Compare how different apps handle chargebacks and whether they offer any protections.

- Read the fine print on any contracts to ensure you are aware of all costs involved.

Tips to Minimize Costs with Payment Processing Services

To keep your expenses in check while utilizing credit card payment processors, here are several strategies you can implement:

- Negotiate Rates: Many providers are open to negotiation, especially if you have a good sales volume. Don’t hesitate to ask for lower rates.

- Choose the Right Plan: Select a payment processor that suits your business model. Some businesses benefit from flat-rate pricing, while others might find tiered pricing more economical.

- Utilize Free Trials: Many payment processors offer trial periods with no fees. Use this to evaluate the service without incurring costs.

- Monitor Your Reports: Keep an eye on your transaction reports to identify discrepancies and ensure you are not overcharged.

“Understanding and managing payment processing fees can significantly impact your business’s profitability.”

Security Considerations for Payment Processing

In today’s digital landscape, ensuring the security of credit card transactions is paramount for both businesses and customers. With the rising prevalence of online payments, the importance of secure payment apps cannot be overstated. This section delves into the encryption technologies, compliance standards, and best practices that safeguard sensitive user data during transactions.

Encryption Technologies in Payment Apps

Encryption plays a crucial role in protecting user data from unauthorized access. Payment apps utilize various encryption methods to ensure the safety of credit card information. One of the primary technologies used is SSL (Secure Sockets Layer), which creates a secure connection between the user’s device and the payment processor, ensuring that all data transmitted is encrypted.Another vital technology is tokenization, which replaces sensitive card information with a unique identifier or token.

This means that even if data is intercepted, it would be useless without the corresponding tokenization system. For instance, a payment app might tokenize a credit card number, allowing transactions to be processed without ever exposing the actual card details to the vendor or during transmission. This significantly reduces the risk of data breaches.

Compliance with PCI DSS Standards

To enhance transaction security, credit card payment processors must adhere to stringent compliance standards, notably the Payment Card Industry Data Security Standard (PCI DSS). This standard is designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. PCI DSS compliance encompasses multiple requirements, including:

- Maintaining a secure network with firewalls and encryption protocols.

- Implementing strong access control measures to limit access to cardholder data.

- Regularly monitoring and testing networks to identify vulnerabilities.

- Maintaining an information security policy that addresses the handling of sensitive data.

Businesses that fail to comply with PCI DSS may face severe penalties and damage to their reputation, emphasizing the importance of these standards in maintaining consumer trust.

Best Practices for Secure Transactions

To ensure secure transactions through payment apps, businesses should adopt several best practices. These practices not only protect customer data but also enhance the overall reputation of the business. Key strategies include:

- Regularly updating software to patch vulnerabilities.

- Utilizing multi-factor authentication to verify user identities.

- Educating employees about phishing and other cyber threats.

- Conducting regular security audits to identify and mitigate risks.

Implementing these practices helps create a secure environment for transactions, safeguarding both the business and its customers from potential fraud and data breaches.

“The strength of a payment app’s security measures is often the first line of defense against cyber threats.”

Future Trends in Payment Processing Technology: Apps To Accept Credit Card Payments

The landscape of payment processing technology is evolving rapidly, driven by advancements in digital technology and changing consumer behaviors. As businesses seek faster, more secure, and efficient ways to accept payments, emerging trends are beginning to reshape how credit card payment apps operate. This section explores the exciting possibilities that lie ahead in the world of payment processing.

Emerging Technologies Influencing Payment Apps

Several cutting-edge technologies are poised to transform the payment processing sector significantly. The integration of these technologies will enhance user experience and streamline transaction processes.

- Artificial Intelligence (AI): AI can analyze large datasets to detect fraudulent transactions in real-time, improving the security of payment apps. Moreover, AI-driven chatbots can provide customer support, making the payment experience smoother.

- Blockchain Technology: Blockchain offers a decentralized and secure method of processing transactions. Its potential to enhance transparency and reduce fraud could revolutionize the way credit card transactions are verified.

- Contactless Payments: NFC (Near Field Communication) technology allows consumers to make wallet-free purchases using their smartphones or contactless cards. This trend is likely to grow as more retailers adopt contactless payment systems.

Impact of Cryptocurrency and Mobile Wallets

Cryptocurrency and mobile wallets are gaining traction as alternatives to traditional payment methods. The rise of digital currencies could significantly influence how payments are processed.

- Cryptocurrency Adoption: Increasing acceptance of cryptocurrencies by mainstream businesses allows consumers to use Bitcoin, Ethereum, and others for transactions. This shift could lead to lower transaction fees and faster cross-border payments, appealing to tech-savvy consumers.

- Mobile Wallet Growth: Mobile wallets like Apple Pay, Google Pay, and Samsung Pay provide consumers with a convenient way to make payments. Their ability to consolidate multiple payment methods into a single app may reduce reliance on traditional credit card processors.

Challenges and Opportunities for Payment Apps

While the future of payment processing presents numerous opportunities, it also comes with its share of challenges that payment apps must navigate.

- Regulatory Compliance: As payment technologies evolve, so do regulations. Payment apps must ensure compliance with varying regulations across different regions, which can be complex and costly.

- Security Concerns: As digital payments become more prevalent, cyber threats are on the rise. Payment apps must continually upgrade their security measures to protect sensitive customer data.

- Market Competition: The growing number of payment solutions can lead to increased competition. Payment apps must differentiate themselves through unique features and excellent customer service to retain users.

- Integration Challenges: Many businesses rely on multiple software solutions. Payment apps that offer seamless integration with existing systems can gain a competitive edge by improving operational efficiency.

Common Queries

What types of businesses benefit from credit card payment apps?

Virtually any business that accepts payments can benefit, including retail shops, restaurants, freelancers, and e-commerce platforms.

Are credit card payment apps secure?

Yes, reputable apps use advanced encryption and comply with standards like PCI DSS to ensure secure transactions.

Can I integrate a payment app with my existing systems?

Most credit card payment apps offer integration with popular accounting and e-commerce platforms, making it easier to manage transactions.

What are typical fees associated with credit card payment apps?

Fees can vary, typically including transaction fees, monthly service fees, and potential hidden charges, which should be reviewed before selection.

How can I minimize costs when using a payment app?

Carefully compare fees between apps and consider volume discounts or flat-rate pricing models that might offer savings based on your transaction volume.