Apps to take credit card payments are becoming essential tools for businesses in today’s digital age. As more consumers prefer the convenience of cashless transactions, having a reliable payment app can significantly enhance customer satisfaction and streamline operations. With a multitude of options available, from user-friendly interfaces to robust security features, choosing the right app can make a substantial difference in managing financial transactions.

In this discussion, we will delve into the various types of credit card payment apps, their key features, popular options in the market, and important considerations for small businesses looking to implement these solutions. Understanding the advantages and potential pitfalls of each app will equip businesses with the knowledge required to make informed decisions and improve their payment processes.

Overview of Credit Card Payment Apps

In today’s fast-paced business environment, credit card payment apps have become essential tools for facilitating transactions. These apps help merchants streamline their payment processes, enhancing customer satisfaction while also ensuring security and efficiency in financial dealings. With the growth of e-commerce and mobile commerce, utilizing credit card payment apps is no longer a luxury but a necessity for businesses of all sizes.The market offers a variety of credit card payment apps, each catering to different needs and preferences.

Some apps are tailored for retail, while others focus on online transactions or mobile point-of-sale (mPOS) solutions. Popular options include well-known services like Square, PayPal, and Stripe, as well as industry-specific solutions that provide unique features suited to niche businesses.

Types of Credit Card Payment Apps

Understanding the different types of credit card payment apps available can help businesses choose the right solution for their needs. Here are some of the primary categories of these apps:

- Mobile Point-of-Sale (mPOS) Systems: These apps enable businesses to accept card payments using smartphones or tablets, often paired with card readers. They are ideal for small businesses and vendors at events.

- Online Payment Gateways: These apps integrate with e-commerce platforms, allowing businesses to securely accept credit card payments on their websites. Examples include Stripe and PayPal.

- Subscription Billing Apps: Tailored for businesses with recurring payment models, these apps manage billing cycles and automate transactions, making it easier for companies with subscription services.

- Invoicing and Accounting Apps: These apps provide payment processing alongside comprehensive financial management tools, allowing businesses to create invoices and track expenses seamlessly.

The advantages of using mobile apps for managing credit card transactions extend beyond convenience. Efficient transaction processing, security features, and integrated analytics provide valuable insights into sales patterns and customer behavior. Implementing these tools can lead to improved cash flow and reduced operational costs.

Utilizing credit card payment apps not only enhances customer experience but also minimizes the complexities associated with traditional payment methods.

Key Features of Credit Card Payment Apps

In today’s fast-paced business environment, selecting a credit card payment app that suits your needs is essential. Various features can significantly impact the efficiency, security, and user experience of these applications. Understanding these key aspects can help businesses make informed decisions.When evaluating credit card payment apps, it is crucial to identify the features that enhance functionality and security. Businesses should prioritize apps that streamline processes, offer robust security measures, and provide a user-friendly interface.

Below are essential features that should be considered:

Essential Features for Businesses

A comprehensive assessment of credit card payment apps indicates that certain features are pivotal for enhancing business operations and customer satisfaction. The following list details these essential features:

- Multiple Payment Methods: The ability to accept various forms of payment, including debit cards, mobile wallets, and contactless payments, ensures flexibility for customers.

- Real-Time Transaction Tracking: This feature allows businesses to monitor transactions as they occur, helping with accounting and inventory management.

- Integration with Existing Systems: Seamless integration with accounting software, e-commerce platforms, and inventory systems streamlines operational processes.

- Customization Options: Customizable receipts, invoices, and payment pages can improve branding and customer experience.

- Customer Support: Access to reliable customer support is vital for resolving issues quickly and maintaining a smooth operation.

Importance of Security Features

Security is a critical aspect of any payment processing application, and businesses must prioritize it to protect sensitive customer data. The following points highlight the importance of robust security features in credit card payment apps:

- Encryption Technology: Advanced encryption protects data during transactions, ensuring that sensitive information is secure from breaches.

- PCI Compliance: Compliance with Payment Card Industry Data Security Standards (PCI DSS) is essential, as it provides guidelines for securely handling credit card information.

- Fraud Detection Tools: Built-in fraud detection tools help identify suspicious activities, reducing the risk of financial loss due to fraud.

- Two-Factor Authentication: Implementing two-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple means.

- Regular Security Updates: Continuous updates to the app ensure that any emerging threats are addressed promptly, maintaining a secure environment.

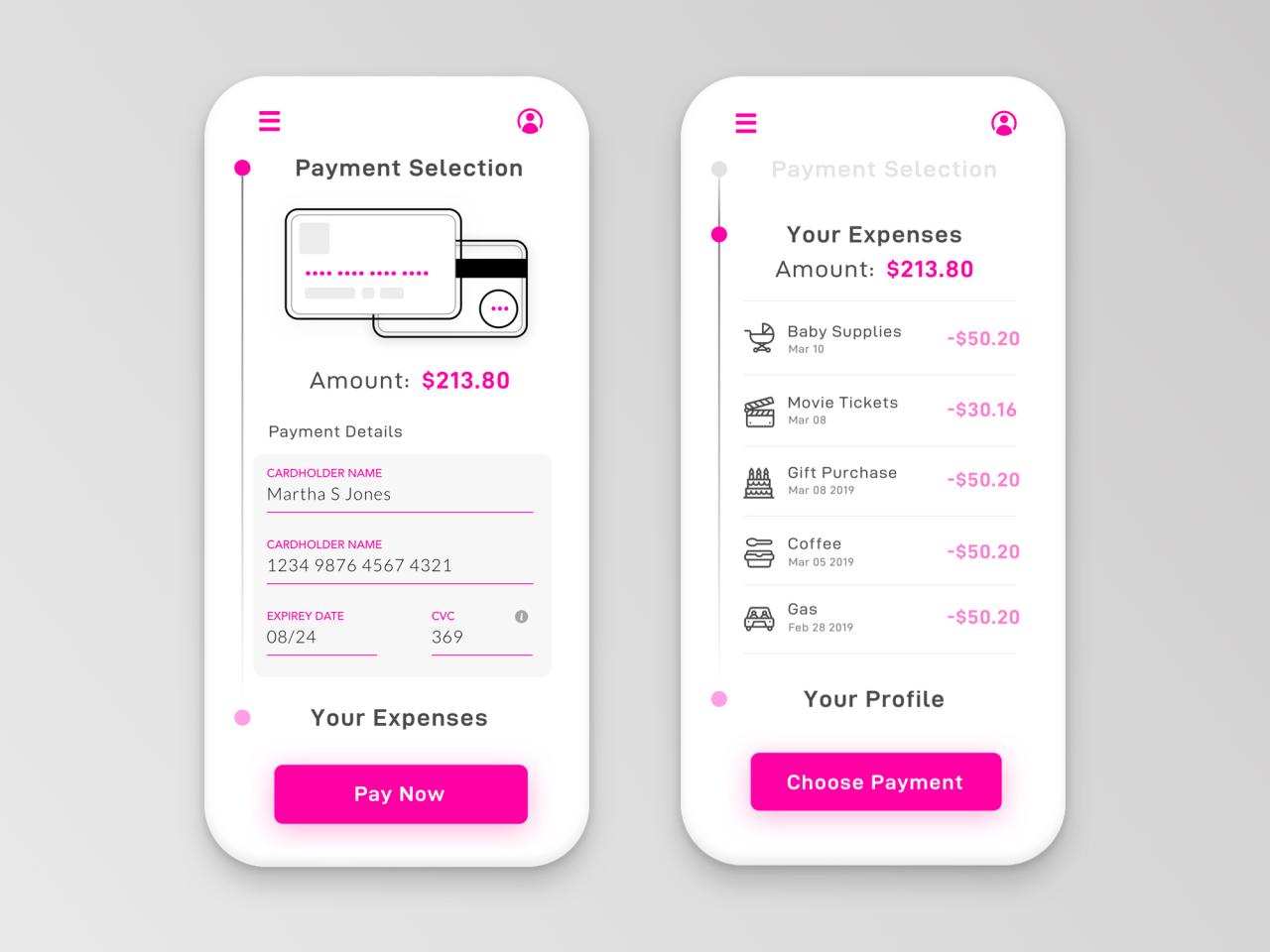

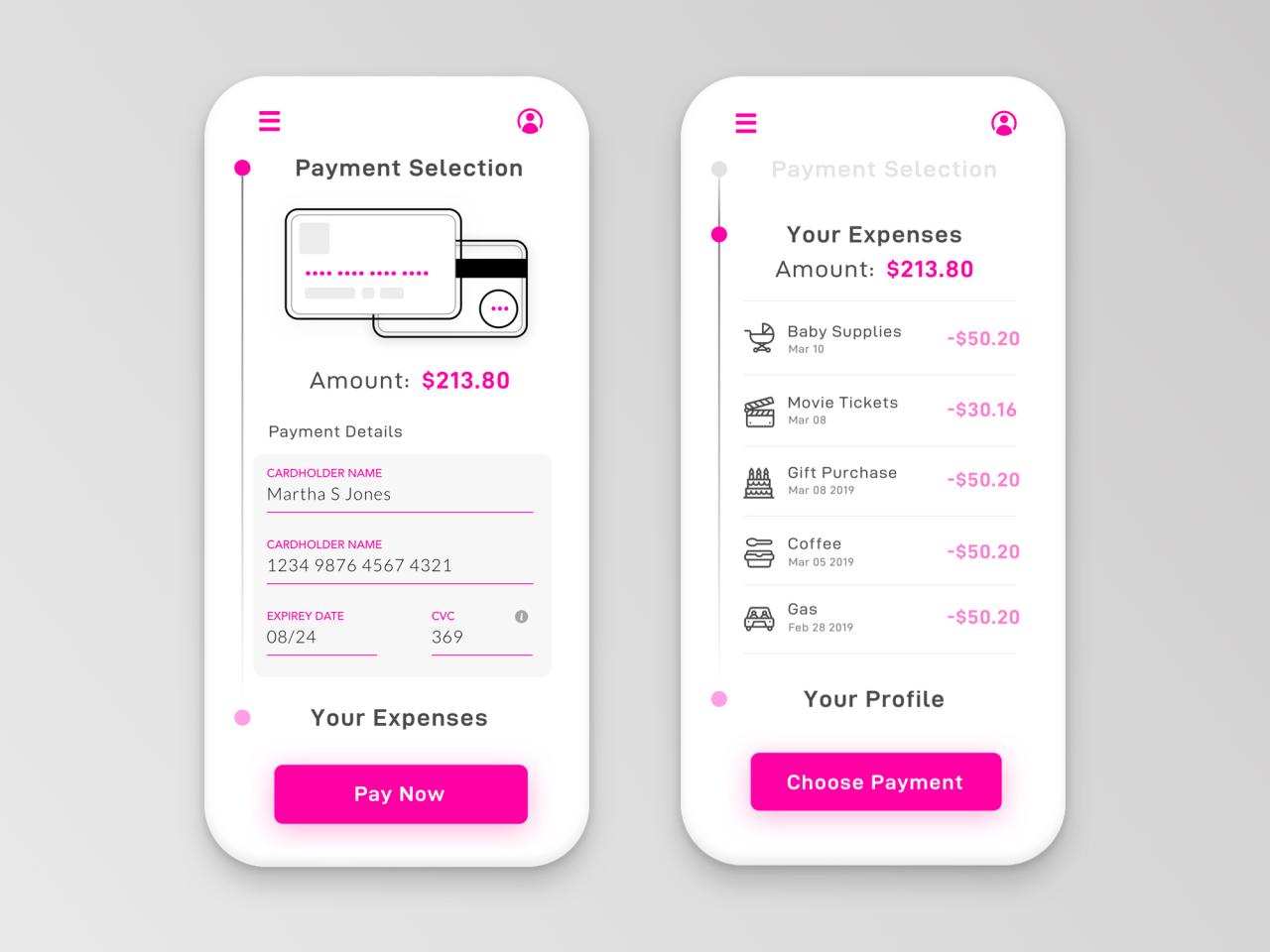

User Interface and Experience

The user interface (UI) and user experience (UX) play a significant role in the effectiveness of credit card payment apps. A well-designed app can enhance customer satisfaction and streamline transactions. Key elements to consider include:

- Intuitive Navigation: A clear and simple navigation system allows users to complete transactions quickly and with minimal confusion.

- Responsive Design: Apps that are optimized for various devices, including smartphones and tablets, provide a seamless experience for users on the go.

- Quick Checkout Process: Reducing the number of steps in the checkout process can significantly lower cart abandonment rates and enhance customer satisfaction.

- Visual Appeal: An aesthetically pleasing design can create a positive impression and encourage users to engage more with the app.

- User Feedback Mechanisms: Providing options for users to give feedback and rate their experience can help developers improve the app continually.

“A credit card payment app that combines robust security, essential features, and an intuitive user interface not only secures transactions but also enhances customer trust and satisfaction.”

Popular Credit Card Payment Apps

In today’s digital economy, credit card payment apps are essential for businesses and consumers alike. They simplify transactions, enhance convenience, and provide a range of features that cater to varying needs. Understanding the popular options available in the market helps in selecting the best app based on specific requirements.Several credit card payment apps stand out due to their ease of use, robust features, and competitive pricing.

Below is a curated list of top-rated apps, along with their features and pricing models to aid in your decision-making process.

Top-rated Credit Card Payment Apps

The following apps are known for their reliability and customer satisfaction, making them popular choices among users:

- Square: Square is versatile and user-friendly, ideal for small businesses. It offers an array of features including payment processing, inventory management, and invoicing. Square charges a flat rate of 2.6% + 10 cents per transaction for card payments.

- PayPal Here: A well-known name in online payments, PayPal Here allows users to accept payments both in-person and online. It has a competitive fee structure, charging 2.7% per transaction. PayPal also offers robust customer support and a seamless integration with existing PayPal accounts.

- Stripe: Primarily aimed at online businesses, Stripe offers a powerful API for developers to integrate payment processing into websites and apps. Stripe charges 2.9% + 30 cents per transaction and is known for its security features and advanced reporting tools.

- Zelle: More of a peer-to-peer payment service, Zelle allows users to send money directly between bank accounts. It’s free to use, making it appealing for personal transactions. However, it lacks dedicated business features found in other apps.

- Shopify Payments: Targeted at eCommerce merchants, Shopify Payments integrates seamlessly with Shopify stores, allowing for easy checkout and management. The fees vary based on the Shopify plan but are generally around 2.9% + 30 cents per transaction. It includes tools for fraud analysis and chargeback handling.

Comparison of Features and Pricing Models

Understanding the features and pricing structures of these apps is crucial for choosing the right one for your needs. Here’s a comparison of the major features and pricing models of the highlighted apps:

| App | Transaction Fee | Key Features | Best For |

|---|---|---|---|

| Square | 2.6% + 10 cents | Point of sale, invoicing, inventory management | Small businesses |

| PayPal Here | 2.7% | In-person and online payments, POS solutions | Retailers and online businesses |

| Stripe | 2.9% + 30 cents | API for custom integration, subscription billing | Developers & online merchants |

| Zelle | Free | Instant bank transfers | Peer-to-peer transactions |

| Shopify Payments | Varies by plan (2.9% + 30 cents) | Integrated eCommerce tools, fraud analysis | Online retailers |

User Reviews and Ratings

User feedback is essential for assessing the strengths and weaknesses of credit card payment apps. Here are some insights drawn from customer reviews:

“Square is incredibly user-friendly, and its comprehensive features help me manage my business efficiently.”

User Review

However, users have pointed out that Square’s transaction fees can add up for high-volume transactions.

“PayPal Here offers great customer support and security. I love how it easily integrates with my existing PayPal account.”

User Review

On the downside, some users find PayPal’s fees slightly higher compared to competitors.

“Stripe is perfect for developers. The customization capability is unmatched, but it might be overwhelming for non-tech users.”

User Review

Many users also appreciate Stripe’s security but mention the learning curve involved in setup.Overall, while each app has its distinct advantages, potential users should consider their specific needs, transaction volume, and business model to make the best choice.

Setting Up Credit Card Payment Apps

Setting up a credit card payment app is crucial for small businesses looking to streamline their payment processes and enhance customer experience. With the right app, businesses can accept payments efficiently, manage transactions, and provide various options to their customers. This guide will walk you through the process of setting up a credit card payment app, integrating it with existing systems, and training staff to use it effectively.

Step-by-Step Guide for Setting Up a Credit Card Payment App

The setup process for a credit card payment app typically involves several essential steps, ensuring that your business is equipped to handle transactions securely and efficiently. Here’s a straightforward guide:

- Choose the Right Payment App: Research and select an app that fits your business needs. Consider factors such as transaction fees, compatibility with your devices, and customer support.

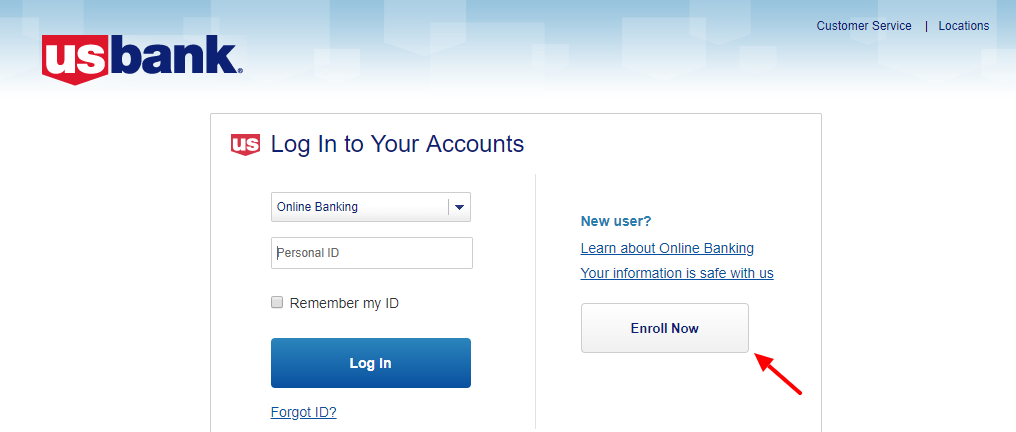

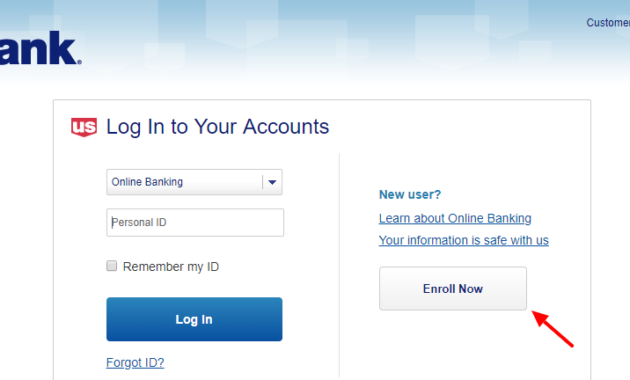

- Create an Account: Sign up for an account with the chosen payment app. You’ll need to provide basic information about your business and verify your identity.

- Link Your Bank Account: Connect your business bank account to the payment app to facilitate the transfer of funds from customer transactions.

- Configure Payment Settings: Set up preferences for payment types, currency options, and any additional features you wish to enable, such as invoicing or recurring billing.

- Test the System: Run test transactions to ensure that everything is functioning correctly before going live. Confirm that payments are processed smoothly and that funds are correctly deposited into your bank account.

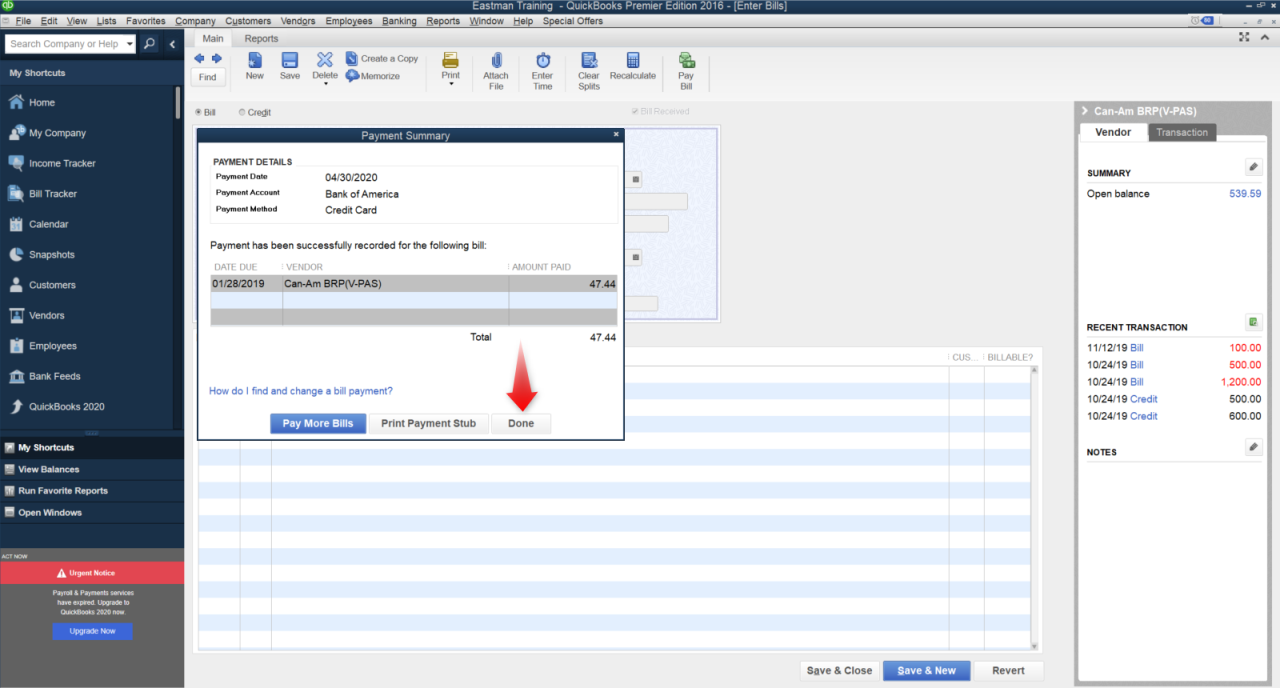

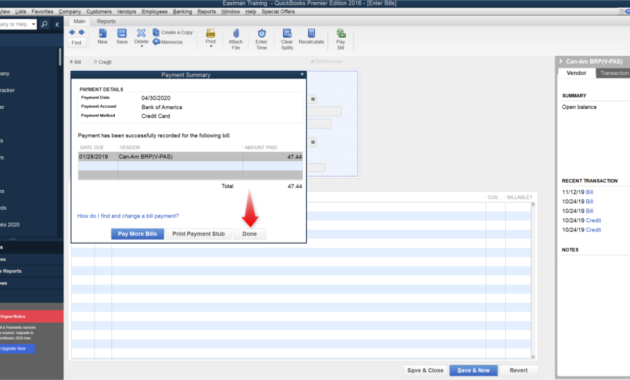

Integrating Payment Apps with Existing Business Systems

Integrating your credit card payment app with existing business systems is key to maintaining seamless operations. Consider the following best practices:

Effective integration minimizes transaction errors and enhances customer satisfaction.

To achieve this, assess the following points:

- Assess Compatibility: Ensure the payment app can integrate with your current accounting software, inventory management systems, and e-commerce platforms.

- Use APIs: Leverage Application Programming Interfaces (APIs) provided by the payment app to enable smooth data exchange between systems.

- Monitor Transactions: Regularly check for discrepancies between your payment app and accounting records to quickly identify and address issues.

Training Staff on Using Credit Card Payment Apps

Effective staff training is essential for maximizing the benefits of a credit card payment app. A well-trained team can handle transactions with confidence and efficiency.

Investing time in training staff leads to improved operational efficiency and customer experience.

Here are key training components:

- Provide Comprehensive Training: Conduct hands-on training sessions covering all aspects of the payment app, from processing transactions to troubleshooting common issues.

- Utilize User Manuals: Distribute user manuals or guides for quick reference, ensuring staff can look up procedures as needed.

- Simulate Scenarios: Create realistic scenarios for staff to practice on, helping them become comfortable with various transaction types and potential challenges.

Cost Considerations of Using Credit Card Payment Apps

When businesses consider adopting credit card payment apps, understanding the associated costs is crucial. Various fees can impact a company’s bottom line, making it essential to evaluate not only the explicit charges but also potential hidden costs. Below, we delve into the fees you might encounter and compare the overall cost-effectiveness of payment apps versus traditional credit card processing methods.

Fees Associated with Credit Card Payment Apps

Credit card payment apps typically involve several types of fees that businesses should be aware of. These can significantly affect the total cost of using these services. Common fees include:

- Transaction Fees: Most payment apps charge a fee for each transaction processed. This fee usually ranges from 1.5% to 3.5% of the transaction amount, which may vary based on the payment method used (e.g., swiped, keyed-in, online). For example, if a customer purchases an item for $100 and the transaction fee is 2.5%, the business will incur a $2.50 fee.

- Monthly Fees: Some apps charge a monthly subscription fee for access to their services. This fee can range from $0 to $30 or more, depending on the features offered. Businesses should evaluate if the features justify the cost.

- Chargeback Fees: In instances where a customer disputes a charge, payment apps may impose a chargeback fee, often around $15 to $25, on top of the original transaction fee. This can accumulate if disputes occur frequently.

- Setup Fees: Certain providers may require a one-time setup fee for account creation or hardware purchases, particularly if a business needs point-of-sale equipment.

- International Transaction Fees: For businesses that sell internationally, additional fees may apply for processing transactions from foreign cards, usually a percentage of the transaction amount.

Comparison of Cost-Effectiveness

The cost-effectiveness of credit card payment apps can be assessed against traditional credit card processing methods, such as merchant accounts through banks. While traditional methods may have lower transaction fees, they often come with higher monthly fees and complex pricing structures. For instance, traditional processors may charge a flat monthly fee, ranging from $20 to $100, plus transaction fees, which can lead to higher overall costs if the business has low sales volume.

In contrast, payment apps typically have no monthly fees, making them attractive for small businesses or those with fluctuating sales. However, businesses that process a higher volume of transactions may find traditional processing more economical in the long run due to reduced transaction fees. A detailed analysis of transaction volumes, average sale amounts, and fee structures is necessary to determine the best option for each business’s unique situation.

Potential Hidden Costs

While evaluating credit card payment apps, businesses should be aware of potential hidden costs that can arise beyond the standard fees. These include:

- Currency Conversion Fees: If a business accepts payments in different currencies, they may incur currency conversion fees that can range from 1% to 3% on each transaction.

- Inactivity Fees: Some payment apps may charge fees for accounts that remain inactive for a set period, often around $10 per month.

- Additional Feature Costs: Advanced features, such as reporting tools or integrations with other software, may come with extra charges that aren’t included in the basic fee structure.

- Hardware Costs: For businesses requiring physical card readers, there may be additional costs for purchasing or leasing equipment, which can add up over time.

- Limited Customer Support: Certain payment apps may offer limited customer service, which could lead to inefficiencies and additional costs if businesses need to resolve issues on their own.

Future Trends in Credit Card Payment Apps

The landscape of credit card payment apps is rapidly evolving, driven by technological advancements, shifting consumer behaviors, and regulatory changes. As more businesses and consumers embrace digital payment solutions, several trends are emerging that will shape the future of these applications. This exploration highlights the innovations on the horizon, how user preferences might change, and the potential impact of new regulations on payment processing.

Emerging Technologies Influencing Development, Apps to take credit card payments

The integration of innovative technologies is paramount for the continued evolution of credit card payment apps. Key advancements include:

- Artificial Intelligence (AI): AI is enhancing user experience through personalized services, fraud detection, and automated customer support. For instance, AI algorithms analyze transaction patterns to identify anomalies, helping to prevent fraud effectively.

- Blockchain Technology: With its decentralized nature, blockchain is revolutionizing transaction security. By using blockchain, credit card apps can offer greater transparency and reduced transaction fees due to the elimination of intermediaries.

- Contactless Payments: The demand for contactless technology has surged, especially post-pandemic. NFC (Near Field Communication) capabilities allow users to make seamless transactions, and this trend is expected to continue growing in popularity.

- Augmented Reality (AR): AR is being explored for enhancing user engagement within apps. For example, visualizing spending habits or rewards through AR can lead to a more interactive user experience.

Consumer Behavior Shaping Payment Processing

The preferences and behaviors of consumers play a critical role in the evolution of credit card payment apps. As users become more tech-savvy, their expectations are shifting towards more integrated and user-friendly solutions. Notable trends include:

- Demand for Seamless Experiences: As consumers favor convenience, payment apps must provide fast, intuitive interfaces that integrate various payment methods, including digital wallets and cryptocurrencies.

- Increased Focus on Security: Users are more aware of security risks and prefer apps that prioritize data protection measures. Implementing biometric authentication can enhance user trust and satisfaction.

- Preference for Loyalty and Rewards: Consumers are increasingly seeking apps that offer personalized rewards and cashback incentives, encouraging frequent usage and customer loyalty.

- Sustainability Considerations: Growing environmental consciousness among consumers is leading to a preference for apps that promote sustainable practices or partner with eco-friendly businesses.

Impact of Regulatory Changes on Development

Regulatory dynamics significantly influence the credit card payment app ecosystem. Factors include:

- Data Privacy Regulations: Initiatives like GDPR and CCPA are pushing companies to enhance data privacy measures, requiring developers to ensure compliance while maintaining user-friendly interfaces.

- Payment Security Standards: Compliance with PCI DSS (Payment Card Industry Data Security Standard) is mandatory, compelling app developers to invest in robust security frameworks to protect consumer data.

- Cross-Border Payment Regulations: As businesses expand globally, payment apps must navigate complex regulatory landscapes that govern cross-border transactions, affecting fees and processing times.

- Consumer Protection Laws: Governments are increasingly implementing regulations to protect consumers from fraud and disputes, thereby shaping how payment apps manage risk and liability.

Security and Compliance in Credit Card Payment Apps: Apps To Take Credit Card Payments

As digital transactions continue to rise, the security of credit card payment apps has become more critical than ever. Consumers expect their payment information to be safeguarded, making it essential for businesses to ensure robust security measures and compliance with standards. In this section, we will explore the significance of PCI compliance, best practices for data security, and notable cases of security breaches that illustrate the importance of vigilance in this area.The Payment Card Industry Data Security Standard (PCI DSS) is a critical framework that Artikels the security measures necessary for organizations that handle credit card information.

Compliance with PCI standards is vital for payment processing apps to protect against data breaches and fraud. These standards require companies to implement stringent security protocols, including encryption, regular security testing, and maintaining a secure network. Non-compliance can result in severe penalties, including hefty fines and loss of customer trust, which can significantly impact a business’s reputation and bottom line.

Best Practices for Data Security in Credit Card Payment Apps

To ensure the security of customer data when using credit card payment apps, businesses should adhere to several best practices. These practices not only safeguard sensitive information but also enhance consumer confidence:

- Encryption: Utilize strong encryption methods to protect cardholder data during transmission and storage. This ensures that even if data is intercepted, it remains unreadable.

- Regular Security Audits: Conduct frequent security assessments to identify vulnerabilities and ensure compliance with the latest security standards.

- User Authentication: Implement multi-factor authentication for both users and administrators to add an extra layer of security.

- Secure Software Development: Follow secure coding practices during app development to minimize vulnerabilities in the software itself.

- Data Tokenization: Replace sensitive card information with a unique identifier or token, reducing the risk if data is compromised.

These practices collectively strengthen the security framework surrounding credit card payment apps, making it difficult for unauthorized access to occur.

Case Studies of Security Breaches

Security breaches in credit card payment apps can have devastating consequences, as evidenced by several high-profile incidents. One notable case is the 2013 Target data breach, where hackers gained access to the personal information of approximately 40 million customers through compromised payment terminals. The breach not only resulted in significant financial losses for Target but also eroded customer trust, leading to long-lasting impacts on the brand’s reputation.Another example is the 2017 Equifax breach, which exposed sensitive information of 147 million consumers, including credit card details.

This incident highlighted the importance of not only securing payment information but also protecting the vast amount of personal data that companies collect. Following these breaches, companies have faced legal repercussions and a push for stricter regulations to prevent future incidents.Investing in security measures and maintaining compliance with PCI standards is no longer optional; it is essential for the continued success of credit card payment apps.

Businesses must learn from these breaches and implement comprehensive security strategies to protect both themselves and their customers.

Case Studies and Success Stories

In the competitive landscape of modern business, the integration of credit card payment apps can significantly influence operations and customer experiences. Many businesses have harnessed the power of these tools, navigating both challenges and triumphs along the way. This section highlights real-life examples of businesses that thrive with credit card payment solutions and discusses lessons learned that can benefit others.

Successful Implementations

Numerous businesses have experienced remarkable growth and improved customer satisfaction through the effective use of credit card payment apps. Here are a few noteworthy examples:

- Revamped Retail Experience: A local boutique implemented a mobile payment app that enabled contactless transactions. As a result, they reported a 30% increase in sales during peak shopping seasons due to faster checkout processes and enhanced customer convenience.

- Streamlined Service Industries: A popular food truck utilized a credit card payment app that allowed customers to pay via their smartphones. This innovation reduced waiting times and increased order accuracy, leading to a 25% improvement in customer satisfaction ratings.

- Online Market Expansion: An e-commerce startup integrated a credit card processing app into their website, which facilitated a seamless checkout experience. This led to a 50% rise in conversion rates within the first quarter of implementation.

Challenges Faced

While the transition to credit card payment apps can yield significant benefits, some businesses encountered challenges that provided valuable lessons.

- Technical Difficulties: A small business faced issues with app compatibility, causing transaction delays during high-traffic times. They learned the importance of thorough testing and vendor support when selecting a payment solution.

- Security Concerns: A service provider experienced data breaches that initially eroded customer trust. They subsequently invested in advanced security measures and transparent communication about their security protocols to regain customer confidence.

- Fee Structures: A mid-sized retailer struggled with high transaction fees that cut into their profits. This prompted them to reassess their payment processing options to find a more cost-effective solution.

Impact on Business Growth and Customer Satisfaction

The adoption of credit card payment apps often leads to measurable improvements in business performance and customer experience.

“The right payment processing solution not only drives sales but also builds long-term customer loyalty.”

Businesses that have embraced these technologies typically report:

- Increased Sales: The ease of credit card payments encourages impulse buying, contributing to overall revenue growth.

- Enhanced Customer Loyalty: Fast and secure transactions improve customer satisfaction, leading to repeat business and positive reviews.

- Operational Efficiency: Automating payment processing reduces the time spent on manual transactions, allowing businesses to focus on core operations.

FAQ Resource

What types of businesses can benefit from credit card payment apps?

Virtually any business that processes transactions, including retail stores, restaurants, and service providers, can benefit from using credit card payment apps.

Are credit card payment apps safe to use?

Yes, most reputable credit card payment apps implement strong security measures, such as encryption and PCI compliance, to protect user data.

Can I use credit card payment apps for online sales?

Absolutely! Many credit card payment apps are designed to facilitate both in-person and online sales, providing flexibility for businesses.

What should I look for in a credit card payment app?

Key features to consider include transaction fees, ease of integration, security measures, and user interface design.

How do transaction fees work with credit card payment apps?

Transaction fees typically vary by app and may include a percentage of the sale, a flat fee per transaction, or a combination of both.

Can I switch credit card payment apps later on?

Yes, most businesses can switch payment apps, but it may require some effort to ensure a smooth transition and data migration.