Buy crypto with mobile payment is rapidly becoming a preferred method for many investors looking to enter the cryptocurrency market. With the convenience of mobile payment platforms, purchasing digital currencies has never been easier. From established options like PayPal to emerging apps, mobile payments streamline the buying process and enhance accessibility for users across the globe.

This shift to mobile payments reflects a broader trend where technology meets finance, allowing users to manage their transactions directly from their smartphones. With a few simple steps, anyone can navigate the world of crypto purchases while enjoying the benefits of mobile technology, including speed, efficiency, and security.

Understanding Mobile Payments

Mobile payments refer to the process of making financial transactions using a mobile device, typically through a smartphone or tablet. This technology has revolutionized how consumers engage in commerce, enabling them to pay for products and services conveniently and quickly, without the need for physical cash or cards. Mobile payment systems utilize various technologies, including Near Field Communication (NFC), QR codes, and mobile wallets, to facilitate these transactions, making them a popular choice for both everyday purchases and online payments.Popular mobile payment platforms that enable cryptocurrency transactions include:

- Apple Pay: A widely used mobile payment service that allows users to make secure payments through their Apple devices. It supports various cryptocurrencies through compatible apps.

- Google Pay: This platform offers seamless payments across different devices and accepts multiple cryptocurrencies, allowing users to manage their digital assets easily.

- PayPal: Known for online payments, PayPal has integrated cryptocurrency buying, selling, and storing within its mobile app, making it accessible for many users.

- Cash App: A mobile payment service that allows users to buy and sell Bitcoin directly from the app, providing a user-friendly interface for cryptocurrency transactions.

The advantages of using mobile payments for cryptocurrency purchases are substantial. The convenience of mobile payments enables users to make transactions anytime, anywhere, enhancing the overall buying experience. Additionally, mobile payments often come with enhanced security features like biometric authentication and encryption, reducing the risk of fraud. Users can also access detailed transaction histories, helping them to keep track of their digital asset purchases.

Furthermore, the integration of rewards programs and promotional offers within mobile payment platforms creates additional incentives for users to engage in cryptocurrency transactions.

“Mobile payments combine convenience, security, and ease of access, making them an ideal choice for cryptocurrency transactions.”

How to Buy Crypto with Mobile Payments

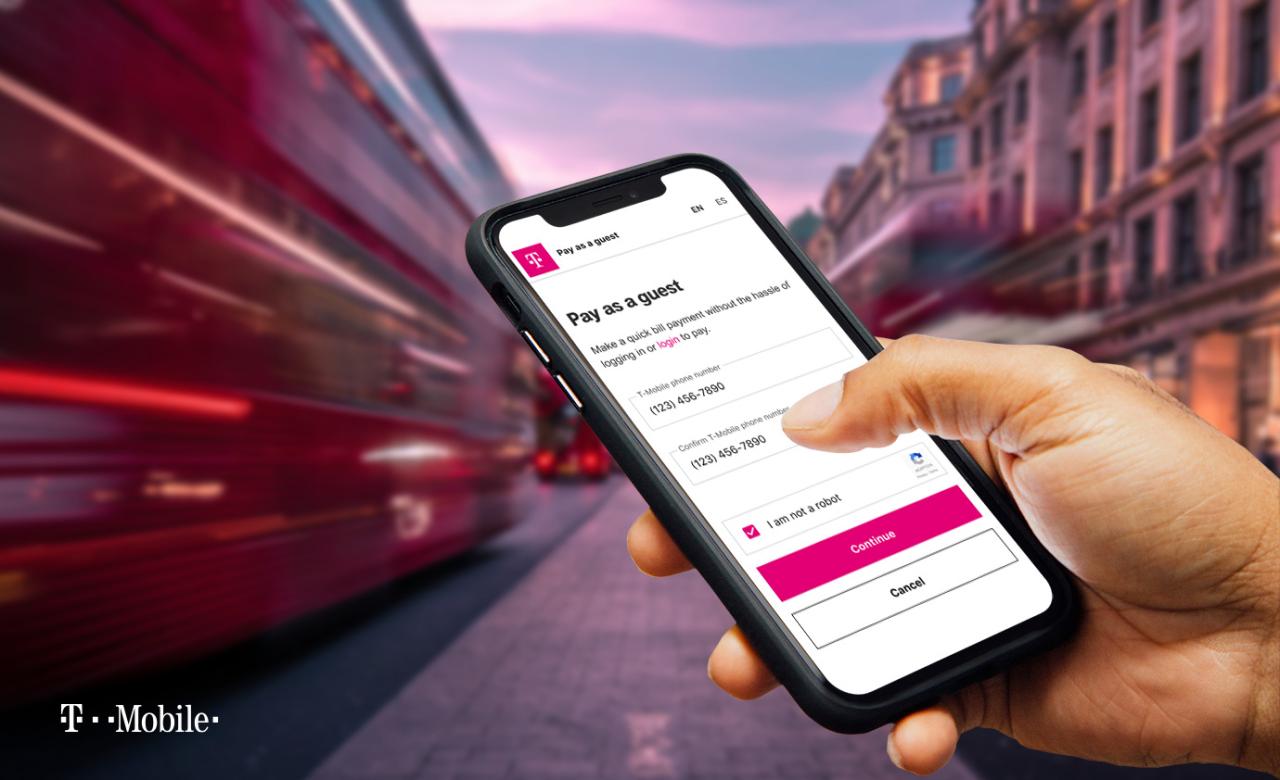

Buying cryptocurrency with mobile payments is becoming increasingly popular due to its convenience and speed. This method allows users to quickly purchase digital assets directly from their smartphones, eliminating the need for traditional banking methods or desktop transactions. The following Artikels the step-by-step process, required accounts, and key security tips to ensure a frictionless experience.

Step-by-Step Process for Buying Cryptocurrency

To effectively buy crypto using mobile payments, follow these essential steps:

1. Choose a Cryptocurrency Exchange or Platform

Select a reputable mobile-friendly crypto exchange or platform that supports mobile payments. Popular options include Coinbase, Binance, and Cash App.

2. Create an Account

Download the chosen app and create an account. This may require providing personal information and verifying your identity.

3. Link a Payment Method

Once your account is set up, link your mobile payment method. This could be a debit/credit card, or a payment service like PayPal or Venmo, if supported.

4. Deposit Funds

Deposit funds into your exchange account using your linked mobile payment method. This process is typically instant.

5. Select Cryptocurrency

Browse the available cryptocurrencies on the platform and select the one you wish to purchase.

6. Make the Purchase

Enter the amount you want to buy and confirm the transaction. Ensure that you review any fees associated with the purchase.

7. Secure Your Crypto

After the purchase, consider transferring your cryptocurrency to a secure wallet for safekeeping.

Necessary Accounts and Apps for Seamless Transactions

To ensure a smooth transaction process, you will need specific accounts and apps. Here’s a list of essential tools:

Cryptocurrency Exchange App

Install apps like Coinbase, Binance, or Kraken to buy and manage your cryptocurrency.

Mobile Payment App

Set up an account with popular mobile payment services such as PayPal, Venmo, or Cash App, which facilitate quicker transactions.

Secure Wallet

Consider a mobile wallet like Trust Wallet or Exodus for added security of your crypto assets.Having these apps and accounts ready will streamline your buying experience and help you manage your investments more effectively.

Tips for Ensuring Secure Transactions

When buying cryptocurrency via mobile payments, security should be a top priority. Here are some critical tips to keep your transactions safe:

Enable Two-Factor Authentication (2FA)

Always activate 2FA on your accounts for an extra layer of security.

Use Strong Passwords

Create complex passwords that combine letters, numbers, and symbols, and avoid using the same password across multiple platforms.

Keep Apps Updated

Regularly update your apps to ensure you have the latest security features and patches.

Monitor Transactions

Regularly check your transaction history for any unauthorized activity.

Beware of Phishing Attempts

Always double-check URLs and messages to avoid phishing scams that may compromise your account security.By following these steps and tips, you can confidently buy cryptocurrency using mobile payments while ensuring your transactions remain secure and efficient.

Popular Cryptocurrencies for Mobile Payment Purchases

In the dynamic world of cryptocurrencies, several digital currencies stand out as favorable choices for mobile payment transactions. Their increasing adoption by merchants and ease of access via mobile payment methods make them particularly appealing to users. Understanding which cryptocurrencies are most popular for mobile purchases can enhance your trading strategy and facilitate seamless transactions.When it comes to purchasing cryptocurrencies via mobile payments, it’s essential to consider not only the popularity of these coins but also the associated transaction fees and their unique market characteristics.

The following section details the most widely accepted cryptocurrencies for mobile payment purchases, helping you make informed decisions.

Top Cryptocurrencies for Mobile Payments

Several cryptocurrencies have gained traction as viable options for mobile payment transactions. They are often chosen based on their market appeal, transaction fees, and overall utility. Below is a list of some of the top cryptocurrencies for mobile payments:

- Bitcoin (BTC): The pioneer of cryptocurrency, Bitcoin is widely accepted for mobile payments across numerous platforms. Its liquidity and recognition make it a top choice among users.

- Ethereum (ETH): Known for its smart contract capabilities, Ethereum also serves as a popular choice for mobile payments, especially in decentralized applications (DApps).

- Ripple (XRP): Designed for rapid, low-cost international transactions, Ripple is increasingly adopted by financial institutions and mobile payment systems alike.

- Litecoin (LTC): Often referred to as the ‘silver to Bitcoin’s gold,’ Litecoin offers quicker transaction times and lower fees, making it a favorite for mobile users.

- Bitcoin Cash (BCH): A fork of Bitcoin that focuses on faster transaction speeds and lower costs, Bitcoin Cash is gaining traction among mobile payment users.

- Stellar (XLM): Aimed at facilitating cross-border transactions, Stellar is popular for its low fees and speed, making it ideal for mobile payments.

The transaction fees associated with these cryptocurrencies can vary significantly. Below is a comparison of transaction fees that users can expect when making mobile payments with these cryptocurrencies:

| Cryptocurrency | Average Transaction Fee |

|---|---|

| Bitcoin (BTC) | Approximately $1-$5 |

| Ethereum (ETH) | Approximately $2-$10 |

| Ripple (XRP) | Less than $0.01 |

| Litecoin (LTC) | Approximately $0.01-$0.10 |

| Bitcoin Cash (BCH) | Approximately $0.05-$0.20 |

| Stellar (XLM) | Less than $0.01 |

The characteristics of these cryptocurrencies contribute significantly to their market appeal. Bitcoin remains the most recognized and secure option, appealing to long-term investors. Ethereum’s functionality as a platform for DApps attracts tech-savvy users. Ripple’s focus on institutional adoption makes it appealing to businesses, while Litecoin and Bitcoin Cash appeal to users seeking low fees and fast transactions. Stellar’s emphasis on financial inclusion resonates with those looking for efficient cross-border payment solutions.

“Understanding the strengths and fees associated with each cryptocurrency can significantly influence your choice for mobile payments.”

Security Concerns and Best Practices: Buy Crypto With Mobile Payment

When engaging in mobile payments for cryptocurrencies, understanding security is paramount. The convenience of mobile transactions is often accompanied by various security risks that users need to be aware of. By adopting best practices and utilizing available security features, you can significantly reduce the likelihood of falling victim to cyber threats.Common security risks associated with using mobile payments for crypto include phishing attacks, malware, and unsecured networks.

Phishing attacks often come in the form of fraudulent emails or messages that appear legitimate, tricking users into providing sensitive information. Malware can compromise your device, capturing keystrokes or personal data without your knowledge. Moreover, using public or unsecured Wi-Fi networks can expose your financial information to hackers, increasing the risk of data breaches.

Protecting Personal and Financial Information

To safeguard your personal and financial information during mobile payment transactions, consider the following best practices:

- Use Strong Passwords: Create complex passwords that combine letters, numbers, and special characters. Avoid using easily guessable information.

- Regular Software Updates: Keep your device’s operating system and apps updated to protect against vulnerabilities and exploits.

- Install Reputable Security Software: Utilize antivirus and anti-malware applications that offer real-time protection against threats.

- Avoid Public Wi-Fi: Whenever possible, refrain from making transactions over public Wi-Fi networks. Use a secure, private connection instead.

- Verify Source Links: Always check the authenticity of links in emails or messages before clicking to avoid phishing sites.

Two-factor authentication (2FA) is crucial when making purchases. This added layer of security requires not only a password but also a second form of identification, such as a code sent to your mobile device. By implementing 2FA, you significantly increase the difficulty for unauthorized individuals to access your accounts.

“Two-factor authentication is a simple yet powerful tool to enhance security and protect your assets.”

Incorporating these security measures will help protect your investments and give you peace of mind while navigating the world of mobile payments and cryptocurrency purchases.

Future Trends in Mobile Payments and Cryptocurrency

The landscape of mobile payments and cryptocurrency is rapidly evolving, driven by technological advancements and an increasing demand for seamless financial transactions. In the coming years, we can expect a convergence of these two domains, significantly influencing how individuals conduct transactions globally. This transformation is poised to enhance convenience, security, and accessibility for users, paving the way for a digital economy.The rise of mobile payment technology is influencing cryptocurrency transactions in several ways.

As more consumers rely on mobile devices for everyday purchases, the integration of cryptocurrencies into mobile payment platforms becomes increasingly essential. The ability to buy, sell, and use cryptocurrencies via mobile applications not only simplifies the transaction process but also enhances user engagement with cryptocurrencies.

Emerging Trends in Mobile Payment Technology

Several key trends are shaping the future of mobile payments in the cryptocurrency space:

1. Contactless Payments

The demand for contactless payment methods has surged, especially during the pandemic. This trend is likely to continue, with cryptocurrency wallets adopting NFC technology to facilitate instant and convenient payments.

2. Integration with E-commerce

As e-commerce grows, mobile payment systems are being integrated with cryptocurrency exchanges. This allows users to pay for goods and services directly with their digital assets, fostering wider adoption.

3. Enhanced Security Features

With the increasing amount of financial data being processed through mobile devices, security measures are evolving. Multifactor authentication and biometric verification are becoming standard practices, ensuring safer transactions with cryptocurrencies.

4. Decentralized Finance (DeFi) Integration

The rise of DeFi platforms is transforming traditional banking. Mobile payment systems are being designed to support DeFi functionalities, allowing users to engage in lending, borrowing, and earning interest on cryptocurrency.

5. Regulatory Developments

As mobile payments and cryptocurrency transactions grow, so will regulatory scrutiny. Businesses will need to adapt to new regulations while ensuring compliance and maintaining user trust.As mobile payment systems continue to develop, the integration with cryptocurrency will face several challenges that must be navigated to ensure sustainable growth.

“The future of payments is in mobile technology, and cryptocurrency is set to play a pivotal role.”

Forecasting Mobile Payment Evolution in Cryptocurrency Market

Over the next few years, the evolution of mobile payments within the cryptocurrency market is expected to unfold as follows:

Wider Adoption

As mobile payment solutions become more user-friendly and accessible, we can anticipate a notable increase in cryptocurrency adoption among everyday consumers, particularly in emerging markets where traditional banking is less prevalent.

Virtual Reality and Augmented Reality Payments

With advancements in VR and AR technology, we may see the emergence of immersive shopping experiences where users can pay with cryptocurrencies in a virtual marketplace.

Smart Contracts in Mobile Payments

The incorporation of smart contracts will facilitate automated payment processing, reducing the need for intermediaries and increasing efficiency in transactions.

AI-Driven Personal Finance Management

Artificial intelligence will enhance mobile payment applications, providing users with personalized financial management tools that leverage cryptocurrency insights, enabling better spending and investment decisions.The intersection of mobile payments and cryptocurrencies is set to redefine the financial landscape. However, potential challenges exist that must be recognized:

Potential Challenges in Mobile Payment Systems Growth, Buy crypto with mobile payment

As mobile payment systems continue to expand within the cryptocurrency realm, several challenges may arise:

Volatility Issues

The inherent volatility of cryptocurrencies may deter mainstream adoption, as users seek stability in their payment options.

Regulatory Compliance

Navigating the complex regulatory environment can be daunting, requiring innovation and adaptability from companies involved in mobile payments and cryptocurrency.

Consumer Education and Trust

Building consumer confidence is crucial for widespread adoption. Efforts must be made to educate users about the benefits and risks associated with mobile payments and cryptocurrencies.

Technological Barriers

Not all consumers have access to the latest technology or internet connectivity, creating a digital divide that must be addressed to ensure equitable access to mobile payment solutions.As we look to the future, the interplay between mobile payments and cryptocurrency will continue to shape the financial landscape, driving innovation and presenting both opportunities and challenges for consumers and businesses alike.

User Experiences and Case Studies

The experience of buying cryptocurrency through mobile payments is becoming increasingly popular, with many users sharing their journeys. As mobile payment platforms integrate with cryptocurrency exchanges, the process has become more seamless, though not without challenges. By examining real user stories and case studies, we gain valuable insights into the practical implications of mobile transactions in the crypto space.The blend of mobile payments with cryptocurrency has transformed how individuals engage with digital assets.

Users have reported diverse experiences, ranging from excitement over convenience to frustration with security measures. Understanding their challenges and triumphs can help prospective buyers navigate this evolving landscape.

User Experiences

Numerous users have shared their experiences when purchasing cryptocurrencies through mobile payments. A common theme among these accounts is the ease of access provided by apps like Cash App, Venmo, and others. Users frequently highlight the efficiency of purchasing crypto directly from their mobile devices. A noteworthy example is a user who utilized Cash App to buy Bitcoin. They appreciated the intuitive interface and instant transaction confirmations.

However, they faced difficulties when attempting to transfer their Bitcoin to an external wallet due to perceived security risks. Another case involved a user who tried to buy Ethereum using a mobile payment option with a lesser-known exchange. They encountered delays due to verification issues, which sparked anxiety about the safety of their funds. Despite these challenges, they successfully completed their purchase by reaching out to customer support for assistance.

Common Challenges Faced by Users

While many users enjoy the benefits of mobile cryptocurrency purchases, they also encounter several challenges. These common difficulties and their solutions include:

1. Security Concerns

Users often worry about the safety of their funds and personal information. To overcome this, many opt for exchanges with strong security measures, including two-factor authentication (2FA) and cold storage for assets.

2. Transaction Fees

Some users report unexpected fees when using mobile payment options. To address this, they compare different platforms before making a purchase to find the most cost-effective option.

3. Limited Payment Methods

Not every mobile payment app supports cryptocurrency transactions. Users often find success by researching which apps offer integrated crypto purchasing options, such as PayPal or Cash App.

4. Regulatory Restrictions

In some regions, mobile payments for cryptocurrencies may face legal barriers.

Users have navigated this by staying informed about local regulations and using apps that comply with regional laws.

Case Studies of Successful Mobile Payment Implementations

Several case studies illustrate successful implementations of mobile payments for cryptocurrency purchases. These examples highlight the potential of mobile technology in the crypto market.One prominent case involves Cash App, which has allowed users to buy, sell, and transfer Bitcoin directly through their mobile app since 2018. Their strategy focuses on simplicity and accessibility, contributing to a significant increase in Bitcoin adoption.

The app’s user-friendly interface and immediate transaction feedback have garnered a loyal following.Another case is PayPal, which expanded its offerings to include cryptocurrency transactions in 2020. Users can now buy, sell, and hold multiple cryptocurrencies directly within the app. PayPal’s well-established brand and trustworthiness have aided in easing user concerns around security, leading to a successful integration of mobile payments with crypto trading.In conclusion, real user experiences and case studies provide crucial insights into the landscape of buying cryptocurrency with mobile payments.

While users face challenges, the successful implementations of mobile payment solutions demonstrate the potential for growth and innovation in this space.

Regulatory Landscape

The regulatory framework surrounding mobile payments and cryptocurrency is complex and varies widely across different regions. As the use of digital currencies and mobile payment systems has surged, governments and regulators worldwide have sought to establish guidelines to protect consumers, prevent fraud, and ensure financial stability. Understanding these regulations is crucial for users looking to buy crypto using mobile payment methods, as they influence accessibility, legality, and the overall buying experience.Currently, the regulatory landscape involves various elements such as anti-money laundering (AML) laws, know your customer (KYC) requirements, and taxation policies, which vary significantly by country.

In the United States, for instance, the Financial Crimes Enforcement Network (FinCEN) mandates that cryptocurrency exchanges register as money services businesses and comply with both AML and KYC regulations. This means users must provide personal identification when purchasing cryptocurrencies through mobile payment options. In contrast, countries like Japan have more streamlined regulations, having recognized cryptocurrencies as legal tender, which encourages a more accessible and user-friendly crypto buying process.

Comparison of Regulations Across Regions

The differences in regulations regarding mobile payments and cryptocurrency can profoundly impact user experience and market dynamics. Below are key contrasts found in various regions:

- United States: The regulatory environment is fragmented, with federal and state-level authorities overseeing various aspects of mobile payments and cryptocurrencies. Each state may have its own licensing requirements, making it challenging for users to navigate the landscape.

- European Union: The EU is moving towards a more unified regulatory framework with the proposed Markets in Crypto-Assets (MiCA) regulation, aiming to create a single market for crypto-assets, thus simplifying the process for users across member states.

- Asia: Regulatory approaches vary widely; for example, China has taken a severe stance against cryptocurrencies, banning them entirely, while countries like Singapore foster innovation with a balanced regulatory framework that supports both mobile payments and crypto transactions.

- Latin America: Countries like El Salvador have embraced Bitcoin as legal tender, enhancing accessibility for mobile payment crypto transactions, whereas others exhibit cautious or prohibitive stances.

The impact of these regulations is significant, shaping the accessibility and legality of mobile payment methods for purchasing cryptocurrencies. In regions with stringent regulations, users may face challenges in onboarding due to rigorous KYC checks and compliance costs that can lead to higher fees. Conversely, in more lenient regulatory environments, users often enjoy seamless transactions and greater access to a variety of cryptocurrencies without cumbersome bureaucratic hurdles.

“Regulations are not just rules, but frameworks that shape the future of mobile payments and cryptocurrency adoption.”

Understanding the regulatory landscape is essential for users to navigate the complexities of buying crypto with mobile payments effectively. Being aware of local regulations can help prevent legal issues and enhance the overall user experience.

FAQ Overview

What mobile payment platforms can I use to buy crypto?

Popular platforms include PayPal, Cash App, and Venmo, among others that support crypto transactions.

Are there fees associated with buying crypto via mobile payments?

Yes, transaction fees vary between platforms and can depend on the cryptocurrency being purchased.

Is it safe to use mobile payments for crypto transactions?

While generally secure, it’s essential to follow best practices, such as using two-factor authentication and ensuring your app is up-to-date.

Can I buy any cryptocurrency with mobile payments?

Not all cryptocurrencies are available on every platform, so it’s best to check which coins are supported by your chosen mobile payment app.

What should I do if my transaction fails?

First, check for any error messages, ensure your payment method is valid, and contact customer support if issues persist.