Cash app payments have revolutionized the way we handle transactions, making it easier than ever to send and receive money. This innovative platform is not only user-friendly but also accessible to a wide range of demographics, from young adults to small business owners. With cutting-edge technology at its core, Cash App simplifies financial interactions, allowing users to enjoy seamless transactions.

From its inception as a straightforward mobile payment solution, Cash App has grown to incorporate various features and services that cater to different needs. Understanding how to navigate these features, along with the security measures in place, can enhance your experience and confidence while using this platform.

Overview of Cash App Payments

Cash App has rapidly gained popularity as a mobile payment solution, providing users with a versatile platform for financial transactions. Its simplicity and user-friendly interface make it accessible to a wide range of demographics, from young adults to seasoned professionals. This overview will delve into the primary functions of Cash App payments, the technology that supports its transactions, and the typical user demographics.The primary function of Cash App is to facilitate peer-to-peer payments, allowing users to send and receive money instantly.

In addition to this core feature, Cash App users can also utilize various services, such as buying and selling Bitcoin, investing in stocks, and obtaining a Cash Card for in-store purchases. The platform leverages advanced technologies, including encryption and blockchain, to ensure secure transactions while providing a seamless user experience.

Technology Behind Cash App Transactions

Cash App transactions are underpinned by sophisticated technology that ensures both security and efficiency. The app employs end-to-end encryption to protect user data from unauthorized access. Moreover, Cash App utilizes blockchain technology, particularly for its Bitcoin transactions, which offers transparent and immutable records of transactions. To elaborate on the technological aspects, here are some key components that contribute to the functionality of Cash App:

- Encryption: Cash App uses encryption protocols to safeguard sensitive user information, ensuring that personal and financial data is protected during transactions.

- Real-time Processing: Transactions on Cash App are processed in real-time, allowing users to send and receive funds almost instantly, which is crucial for enhancing user satisfaction.

- API Integration: Cash App incorporates various APIs that enable seamless connections with third-party services, enhancing the app’s functionality and expanding its capabilities beyond just money transfers.

- Fraud Detection Systems: The platform is equipped with advanced fraud detection algorithms that monitor transactions for unusual activity, helping to prevent unauthorized transactions.

User Demographics of Cash App

The user demographics of Cash App reflect a diverse range of individuals who benefit from its various features. Primarily, young adults aged 18 to 34 represent a significant portion of the user base, drawn to the app’s ease of use and the millennial trend of digital banking. Additionally, Cash App appeals to a broader demographic for several reasons:

- Financial Accessibility: Cash App provides an opportunity for individuals who may not have traditional banking services to manage their finances effectively.

- Investment Options: Young professionals and first-time investors are increasingly using Cash App to explore stock market investments and cryptocurrency trading.

- Social Integration: The app’s social features, such as the ability to share payment requests with friends and family, resonate well with younger users who prefer cashless transactions.

The combination of these factors demonstrates Cash App’s ability to cater to a wide range of users, making it a preferred option for modern financial transactions.

How to Use Cash App for Payments

Using Cash App for payments is an efficient way to send and receive money instantly right from your smartphone. This platform simplifies various financial transactions, making it user-friendly for both seasoned users and newcomers alike. Here’s a detailed guide on how to set up your Cash App account and navigate through sending and receiving payments.

Setting Up a Cash App Account

To begin using Cash App, you first need to create an account. This process is straightforward and can be completed in just a few minutes. Here’s how to set up your account:

- Download the Cash App from your device’s app store, available on both iOS and Android.

- Open the app, and enter your mobile phone number or email address to create your account.

- You will receive a confirmation code via SMS or email. Enter this code to verify your account.

- Next, you’ll be prompted to link a bank account. You can do this by entering your debit card information or by providing your bank account details.

- Finally, choose a unique username known as a $Cashtag, which others will use to send you money.

Setting up your account only takes a few steps, and once completed, you can start making payments.

Sending Money Through Cash App

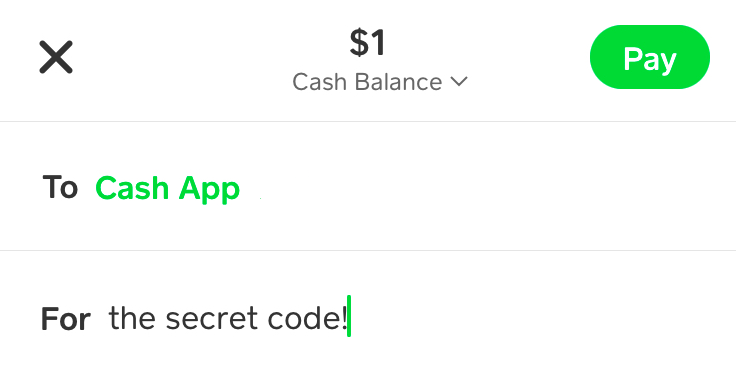

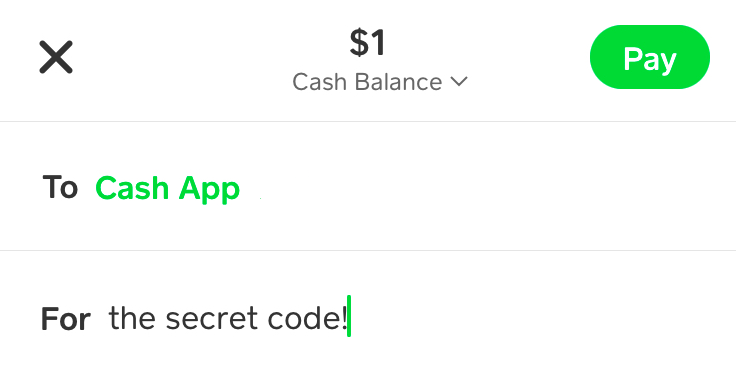

Once your account is set up, sending money through Cash App is quick and easy. Here is a step-by-step process to ensure you can make transactions securely:

- Open Cash App on your device.

- On the home screen, you’ll see a dollar sign icon. Tap this icon to enter the amount you wish to send.

- After entering the amount, tap “Pay.”

- You will need to enter the recipient’s $Cashtag, phone number, or email address to identify them.

- Optionally, you can add a note to indicate the purpose of the payment.

- Once you’ve confirmed all the details are correct, tap “Pay” to finalize the transaction.

It’s essential to double-check the recipient’s details, as transactions cannot be reversed once sent.

Receiving Payments via Cash App

Receiving payments is equally straightforward. When someone wishes to send you money, they’ll need your $Cashtag, phone number, or email address. Here’s how to manage incoming payments:

- Provide your $Cashtag, which is a unique identifier to ensure the sender gets the funds to the right account.

- When the sender completes the transaction, you will receive a notification confirming the payment.

- The funds will appear in your Cash App balance immediately and can be transferred to your linked bank account or spent directly using the Cash App debit card.

In case you need to accept a payment request, ensure that you have an active account and that the person sending you money has correctly entered the necessary information.

Cash App allows for instant payments, making it a convenient choice for everyday transactions.

Security Features of Cash App Payments

Cash App takes the security of its users very seriously, implementing various measures to safeguard transactions and sensitive information. With the rise of digital payment platforms, ensuring the safety and privacy of users has become paramount. Cash App employs a combination of technology and user-driven strategies to create a secure environment for all transactions.

Security Measures Employed by Cash App

Cash App utilizes several advanced security features to protect user transactions. These measures include encryption, fraud detection systems, and user verification processes that collectively work to minimize the risk of unauthorized access and fraudulent activities. Key security features provided by Cash App include:

- Data Encryption: Cash App uses end-to-end encryption to protect user data during transmission. This means that sensitive information is scrambled and unreadable to anyone who might intercept it.

- Two-Factor Authentication: Users can enable two-factor authentication (2FA) to add an extra layer of security to their accounts. This requires an additional verification step when logging in or making transactions.

- Fraud Monitoring: The platform employs real-time monitoring systems to detect and alert users of any suspicious activity, helping to prevent potential fraud before it occurs.

- Secure Payment Methods: Cash App allows transactions only after users confirm payment requests, ensuring that unauthorized transactions cannot take place without consent.

- Transaction Limits: To further protect users, Cash App imposes limits on transactions, which can help reduce the impact of any potential fraud or theft.

Enhancing Security for Cash App Accounts

While Cash App has robust security measures in place, users also play a critical role in keeping their accounts secure. By following certain best practices, users can enhance the security of their Cash App accounts and reduce the risk of unauthorized access.

- Strong Passwords: Users should create complex passwords that include a mix of letters, numbers, and special characters. Avoid using easily guessed information such as birthdays or common phrases.

- Regular Password Updates: Changing passwords regularly and avoiding reuse of previous passwords can help maintain account security.

- Awareness of Phishing Scams: Users should be cautious of unsolicited messages or emails that request sensitive information. Always verify requests through official channels.

- Device Security: Keeping devices secure with up-to-date antivirus software, and using secure Wi-Fi connections, can help protect against unauthorized access.

Common Security Concerns with Digital Payment Platforms

Digital payment platforms like Cash App are not without their risks. Understanding common security concerns can empower users to take proactive steps to protect themselves. Some prevalent issues include:

- Identity Theft: Cybercriminals may attempt to steal personal information to gain access to financial accounts.

- Fraudulent Transactions: Users may be targeted by scammers who trick them into sending money or providing sensitive information.

- Account Takeover: If a user’s credentials are compromised, unauthorized individuals can gain control of their account, leading to possible financial loss.

- Insufficient Regulation: As a relatively new financial service, digital payment platforms may not be subject to the same level of regulation as traditional banks, raising concerns about consumer protection.

Cash App Payment Fees

Using Cash App for payments can be convenient, but it’s essential to understand the associated fees to avoid any surprises. These fees can vary depending on the type of transaction and the payment method used. Knowing these details helps users make informed decisions about using the app for their financial transactions.Cash App charges various fees for its services, which include sending money, receiving payments, and using certain features.

Understanding these fees allows users to compare Cash App with other payment platforms effectively. Below is a detailed comparison of Cash App fees with those from other popular payment services in the market.

Overview of Cash App Fees

Cash App employs several fee structures based on transaction types. Below are the primary fees associated with using Cash App:

- Standard Transfer Fee: There is no fee for sending money from a Cash App balance or linked bank account. However, transfers funded by a credit card incur a fee of 3%.

- Instant Transfer Fee: Users can opt for instant transfers, which charge a fee of 1.5% of the transfer amount, with a minimum fee of $0.25.

- ATM Withdrawal Fee: Cash App users can withdraw cash from ATMs, but a fee is charged for using ATMs not within the Cash App network. This fee can vary based on the ATM operator.

- Card Replacement Fee: If you lose your Cash Card and need a replacement, there is a fee of $5. This fee applies regardless of whether the card is lost or stolen.

To provide a clearer comparison, here’s how Cash App fares against other payment platforms, along with their transaction fees.

| Payment Platform | Standard Transfer Fee | Instant Transfer Fee | ATM Withdrawal Fee | Card Replacement Fee |

|---|---|---|---|---|

| Cash App | No fee (bank account/Cash App balance), 3% (credit card) | 1.5% (min. $0.25) | Varies by ATM | $5 |

| PayPal | No fee (PayPal balance), 2.9% + $0.30 (credit card) | Not available | $2.00 | $0 |

| Venmo | No fee (bank account/Venmo balance), 3% (credit card) | 1.5% (min. $0.25) | $2.50 | $0 |

| Zelle | No fee (bank account) | Not applicable | N/A | $0 |

“Understanding transaction fees is crucial for maximizing your savings and choosing the right payment platform for your needs.”

By assessing these fees, users can determine the most cost-effective option for their payment needs. Each platform has its advantages and potential drawbacks, making it important to consider individual usage patterns when selecting a payment service.

Cash App Payment Limits: Cash App Payments

Cash App has specific limits in place for sending and receiving money, which can vary based on user verification status and account activity. Understanding these limits is essential for effective management of your transactions, ensuring you have clarity on how much you can send or receive at any given time.Cash App imposes limits on the amount of money you can send and receive to maintain security and prevent fraud.

Initially, unverified users face lower limits, while verified users can access higher limits by completing additional verification steps.

Sending and Receiving Limits

For users who have not verified their identity, the limits tend to be quite restrictive. Here are the key figures regarding sending and receiving capabilities:

- Unverified users can send up to $250 within a 7-day period.

- Unverified users can receive a maximum of $1,000 in any 30-day period.

- Once a user verifies their account by providing personal information, such as their full name, date of birth, and Social Security number, the limits can increase significantly.

- Verified users can send up to $7,500 per week.

- There is no limit on the amount of money a verified user can receive in their Cash App account.

Increasing Transaction Limits for Verified Users

To increase transaction limits, users must complete the verification process within the Cash App platform. This process is straightforward and involves:

- Accessing the profile section in the Cash App.

- Providing the required information, including your full name, date of birth, and Social Security number.

- Verifying your identity may take a few moments to a couple of days, depending on Cash App’s review process.

This verification not only raises your limits but also enhances your account’s security.

Factors Affecting Payment Limits, Cash app payments

Several scenarios can influence the payment limits for Cash App users. Some of these include:

- Account standing: Accounts that show irregular activity or suspicious transactions may have restricted limits.

- Geographic location: Certain regions may be subject to different financial regulations, which can affect limit adjustments.

- Account age: Newer accounts might have lower limits until a history of transactions is established.

As users actively engage with the app and maintain a good standing, they may find their limits are adjusted accordingly, allowing for more flexibility in their transactions.

Cash App Payment Problems and Solutions

Cash App, while designed for ease of use, can present some challenges for its users. Understanding these potential issues and knowing how to troubleshoot them can ensure a smoother payment experience. Here, we will explore common problems that may arise during Cash App transactions and provide effective solutions along with customer support resources.

Common Issues with Cash App Payments

Users may encounter several issues while making payments on Cash App. Recognizing these problems can aid in quick resolutions. Some frequent payment-related concerns include:

- Payment Declines: Transactions may be rejected due to insufficient funds, incorrect card details, or the recipient’s account settings.

- Transaction Delays: Payments may not be processed immediately, which can be frustrating when time is of the essence.

- Errors in Payment Amounts: Users sometimes mistakenly enter the wrong amount, leading to unintentional overpayments or underpayments.

- Account Verification Issues: New users may face challenges in verifying their accounts, which can hinder their ability to send or receive money.

Troubleshooting Payment Failures

When payments fail, specific steps can be taken to resolve the issues. Here are some troubleshooting tips to address common payment failures:

- Check Account Balance: Ensure that there are sufficient funds in your Cash App account or linked bank account before attempting a payment.

- Verify Payment Details: Double-check the recipient’s information, including their $Cashtag, email, or phone number, to ensure accuracy.

- Update App Version: Keeping the Cash App updated can prevent glitches and bugs that may cause payment errors.

- Clear App Cache: Clearing the app cache in your device settings can help resolve performance issues that may affect payment processing.

- Check Internet Connection: A poor or unstable internet connection can hinder payment processing, so ensure you have a reliable connection.

Customer Support Resources

For issues that cannot be resolved through troubleshooting, Cash App provides several customer support avenues. Utilizing these resources can lead to effective solutions for payment problems:

- In-App Support: Users can access the support feature directly within the Cash App for immediate assistance with payment issues.

- Cash App Website: The official website offers comprehensive FAQs and guides that address common problems and their solutions.

- Email Support: Users can reach out to Cash App’s customer service via email for more specific inquiries or unresolved issues.

- Social Media: Cash App is active on platforms like Twitter, providing updates and support for users facing problems.

“Knowing how to troubleshoot payment issues can save time and minimize frustration when using Cash App.”

Cash App Payments in Business

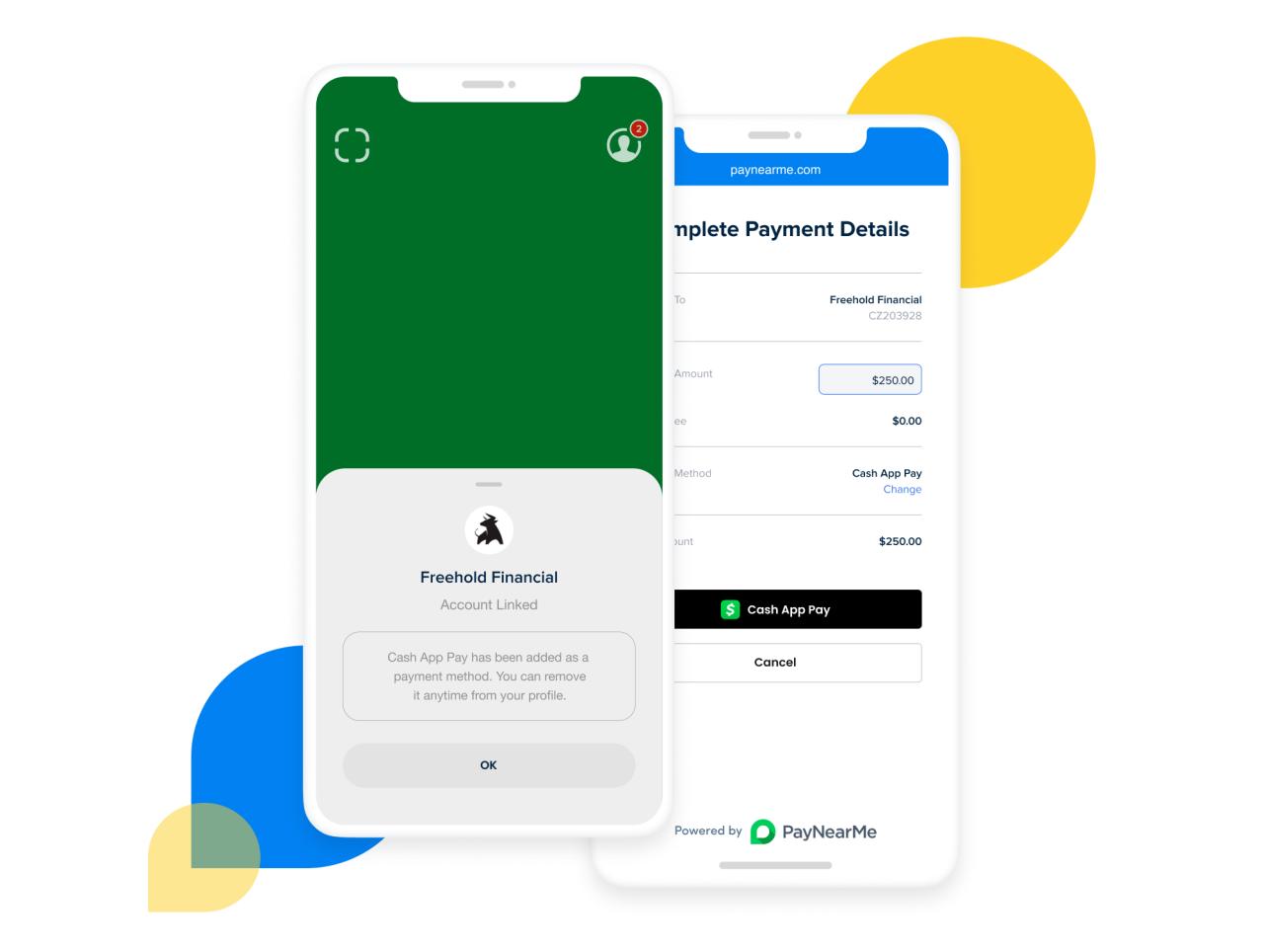

Cash App has rapidly become a preferred payment platform for businesses of all sizes, thanks to its user-friendly interface and efficient transaction process. As the digital landscape evolves, more enterprises are recognizing the potential of Cash App to simplify their payment systems and enhance customer experience. This section explores how businesses can leverage Cash App for seamless transactions, along with real-world examples and the advantages it offers over traditional payment methods.Businesses can utilize Cash App to accept payments from customers directly, making transactions quick and efficient.

This is particularly beneficial for small businesses where every second counts and overhead costs need to be minimized. By integrating Cash App, businesses can provide customers with a simple and familiar way to pay using their mobile devices, thereby enhancing the overall purchasing experience. This eliminates the need for complicated processes often associated with traditional payment methods.

Successful Integration of Cash App in Small Businesses

Many small businesses have successfully adopted Cash App, showcasing its versatility and effectiveness in a variety of industries. Here are a few notable examples:

- Food Trucks: Local food trucks have embraced Cash App, allowing customers to place and pay for orders directly from their phones. This has streamlined operations and reduced waiting times, resulting in increased customer satisfaction and repeat business.

- Freelancers: Independent contractors, such as graphic designers and writers, utilize Cash App to receive payments from clients quickly. The instant transfer feature allows them to access their earnings without delay, which is crucial for managing day-to-day expenses.

- Local Artists: Craft sellers and local artists promote their work at markets and fairs by displaying Cash App QR codes. This enables customers to make payments efficiently, eliminating the hassle of cash handling and providing a secure transaction method.

The benefits of accepting Cash App payments extend beyond convenience. Businesses engaging with this platform experience several advantages in comparison to traditional payment methods:

Benefits of Accepting Cash App Payments

Cash App offers a range of benefits that can significantly enhance business operations:

- Lower Transaction Fees: Cash App generally has lower fees than credit card processors, which allows businesses to retain more of their profits.

- Instant Transfers: Unlike traditional banking methods that may take several days for funds to clear, Cash App enables instant transfers, helping businesses maintain healthy cash flow.

- User-Friendly Experience: The straightforward interface and mobile app make it easy for both businesses and customers to conduct transactions without confusion.

- Increased Customer Engagement: By offering a popular payment method, businesses can attract tech-savvy customers who prefer digital payment options, ultimately boosting sales.

In conclusion, integrating Cash App as a payment option not only enhances customer satisfaction but also provides businesses with a competitive edge in a rapidly changing market. Embracing such innovative payment solutions can lead to increased efficiency, greater customer loyalty, and ultimately, higher revenue.

Future Trends in Cash App Payments

As the digital payment landscape continues to evolve, Cash App is poised to adapt and innovate to meet the changing needs of its users. The future of Cash App payments will likely be shaped by advancements in technology, shifting consumer preferences, and new regulatory environments. Understanding these trends will help users leverage the platform effectively.One notable trend is the increasing integration of artificial intelligence (AI) into payment systems.

AI can enhance user experience by personalizing services, detecting fraudulent activities, and streamlining payment processes. This trend not only boosts security but also provides users with insights into their spending habits, making financial management more accessible.

Integration of Cryptocurrencies

Cryptocurrencies are becoming a significant aspect of digital payments, and Cash App is already making strides in this area. Users can buy, sell, and hold Bitcoin directly within the app, which signals a broader acceptance of digital currencies in everyday transactions. This integration encourages users to explore the potential of cryptocurrencies as an investment and as a means of payment.

- Increased merchant adoption: As more businesses begin to accept cryptocurrencies, Cash App users will have more opportunities to spend their digital assets in everyday transactions.

- Enhanced features for crypto management: Future updates may include advanced wallet options, allowing users to manage multiple cryptocurrencies efficiently.

- Potential for lower transaction fees: As blockchain technology matures, it could reduce the cost of transactions compared to traditional banking methods.

Adoption of Contactless Payments

The shift towards contactless payments is another trend likely to influence Cash App’s future. With the increased demand for hygienic transactions, Cash App may enhance its functionalities to enable seamless contactless payments through QR codes or NFC technology.

- Faster transactions: Contactless payments facilitate quick and efficient transactions, reducing wait times at checkout points.

- Greater convenience: Users will appreciate the ability to make payments simply by tapping their devices or scanning a code, improving overall user experience.

- Expansion into physical retail: Partnering with retail locations to accept Cash App payments through contactless methods will increase its reach.

Enhanced Security Features

As digital payments grow, so do the risks associated with them. Cash App will likely continue to implement enhanced security features to protect user information and funds.

- Multi-factor authentication (MFA): More stringent security measures, such as requiring multiple forms of identification before processing transactions, will be essential.

- Real-time fraud detection: Advancements in machine learning can improve the detection of suspicious activities, prompting immediate responses.

- Insurance for funds: Offering insurance options for user balances could provide an additional layer of security and peace of mind.

Expansion of Financial Services

Cash App is likely to broaden its offerings beyond peer-to-peer transfers and Bitcoin transactions. Financial services such as personal loans, investment options, and budgeting tools may be integrated into the platform.

- Personalized financial advice: Using data analytics to offer tailored financial advice based on user behavior and interactions.

- Investment opportunities: Facilitating investments in stocks and funds directly within the app to attract users looking for all-in-one financial management solutions.

- Financial education: Providing resources and tools to educate users about managing their finances effectively, promoting long-term financial health.

Innovative technologies, changing consumer demands, and a focus on security will drive the future of Cash App payments, creating a more versatile and user-friendly experience.

Answers to Common Questions

What types of payments can I make with Cash App?

You can send money to friends, pay for goods and services, and even invest in stocks or Bitcoin using Cash App.

Are there any age restrictions for using Cash App?

Yes, users must be at least 18 years old to create a Cash App account.

How long does it take for Cash App payments to process?

Most payments are processed instantly, but sometimes they may take a few hours, especially for new users or large transactions.

Can I use Cash App internationally?

Cash App is primarily available for use within the United States, but it has limited features for users in the UK.

What happens if I send money to the wrong person?

If you send money to the wrong person, you can request a refund directly through the app, but there’s no guarantee it will be returned.