credit card payments in quickbooks sets the stage for an insightful exploration of managing credit card transactions seamlessly within your accounting software. Understanding how to efficiently handle these payments is crucial for smooth business operations, as it directly affects cash flow and customer satisfaction. QuickBooks offers a range of functionalities designed to streamline credit card processing, making it a valuable tool for businesses of all sizes.

From setting up credit card payments to managing transactions and ensuring security, this guide will walk you through the essential steps and tips to optimize your payment processes in QuickBooks. Whether you are new to credit card payments or looking to refine your existing setup, you’ll find valuable insights that will enhance your experience.

Overview of Credit Card Payments in QuickBooks

Efficiently managing credit card payments in QuickBooks is crucial for maintaining healthy cash flow and ensuring accurate financial records. With the rise in digital transactions, businesses need a streamlined approach to handle these payments effectively. QuickBooks offers several functionalities that make this process simpler for users, allowing them to focus on other important aspects of their operations.QuickBooks provides users with essential features for processing credit card transactions, ensuring that payments are tracked accurately and reconciled seamlessly.

These functionalities include the ability to accept payments directly from invoices, record transactions automatically, and manage fees associated with credit card processing. By leveraging these features, businesses can reduce manual entry errors and enhance their overall financial management.

Basic Functionalities of Credit Card Transactions

Understanding the basic functionalities of credit card transactions in QuickBooks can significantly improve how businesses manage their finances. The following points highlight key features that facilitate efficient credit card payment processing:

- Direct Payment Acceptance: Users can accept credit card payments directly from invoices sent to customers, simplifying the payment process and increasing the likelihood of prompt payment.

- Automatic Transaction Recording: QuickBooks automatically records credit card transactions, reducing the need for manual entry and minimizing errors in financial reporting.

- Fee Management: Businesses can track credit card processing fees, which are automatically calculated and recorded, aiding in better expense management and profitability analysis.

- Reconciliation Tools: QuickBooks offers tools that help reconcile credit card payments with bank statements, ensuring accuracy in financial records and simplifying month-end closing processes.

Comparison of Payment Processing Options

When it comes to credit card processing, QuickBooks offers various options that cater to different business needs. Each option has its own set of features and advantages. Below are the primary alternatives available within QuickBooks:

- QuickBooks Payments: This is the most integrated option, allowing users to process payments directly through QuickBooks. It promotes ease of use and provides real-time updates on transactions. Fees are generally competitive, and setup is straightforward.

- Third-Party Processors: Businesses can also choose to integrate third-party payment processors like PayPal or Stripe. While this may offer lower fees in some cases, the integration might require additional setup and could lead to discrepancies in financial tracking if not managed properly.

- Mobile Payment Solutions: QuickBooks supports mobile payment options, enabling businesses to accept credit card payments on-the-go. This is particularly beneficial for service-based industries or businesses with a mobile sales force.

The choice of credit card payment processing method can significantly affect transaction costs and ease of financial management.

Setting Up Credit Card Payments in QuickBooks

Setting up credit card payments in QuickBooks is an essential process that allows businesses to smoothly handle transactions and improve their cash flow. By enabling this feature, companies can offer their customers a convenient way to pay, which can ultimately enhance customer satisfaction and drive sales.To enable credit card payments in QuickBooks, a few straightforward steps must be followed. First, it’s crucial to choose a payment processor that integrates seamlessly with QuickBooks.

Once that’s decided, you can begin the setup process. Below are the detailed steps and considerations for getting started, along with common pitfalls to avoid.

Steps to Enable Credit Card Payments

To successfully set up credit card payments in QuickBooks, take the following steps:

1. Choose a Payment Processor

Select a processor that works with QuickBooks, like Intuit Payments or other third-party options. Ensure it fits your business needs, including fees and features.

2. Access QuickBooks Settings

Open QuickBooks and navigate to the ‘Settings’ gear icon, then select ‘Account and Settings’.

3. Select Payments Tab

In the left-hand menu, click on the ‘Payments’ tab to access credit card payment settings.

4. Enable Credit Card Payments

Toggle the option to accept credit card payments and follow the prompts to link your chosen payment processor.

5. Enter Required Information

Fill in necessary details like your business information, bank account for deposits, and any other information requested by the payment processor.

6. Review Terms and Conditions

Carefully read through the terms, as this will Artikel fees and other important information regarding your credit card processing agreement.

7. Test the Integration

Once enabled, perform a test transaction to confirm that everything is working correctly and that payments are being processed accurately.

Common Pitfalls to Avoid

During the setup process, businesses may encounter several pitfalls that can lead to issues down the line. Being aware of these can help ensure a smoother setup:

Not Understanding Fees

Many payment processors have varying fee structures. Make sure to compare and understand these costs to avoid unexpected expenses.

Skipping the Test Transaction

Failing to test the payment processor integration can lead to missed transactions or customer dissatisfaction. Always conduct a test run.

Ignoring Security Features

Ensure that the payment processor provides robust security measures to protect customer data. This is crucial for maintaining trust.

Inadequate Business Information

Ensure all business details entered are accurate and up-to-date, as discrepancies can lead to processing issues.

Checklist for Setup Information

Having a checklist can simplify the setup process and ensure that all necessary information is gathered beforehand. Here is a list of essential information needed:

- Business name and contact information

- Merchant account details (if applicable)

- Bank account information for fund deposits

- Tax identification number (EIN or SSN)

- Personal identification for the business owner

- A clear understanding of the chosen payment processor’s fee structure

- Any additional required documentation as specified by the payment processor

By following these steps and avoiding common pitfalls, you can enable credit card payments in QuickBooks effectively, paving the way for smoother transactions and improved customer experiences.

Processing Credit Card Payments

Processing credit card payments in QuickBooks is an essential task for managing cash flow effectively and maintaining accurate financial records. This section Artikels the procedures for recording credit card payments, handling refunds and chargebacks, and reconciling these transactions with bank statements to ensure your accounts are balanced.

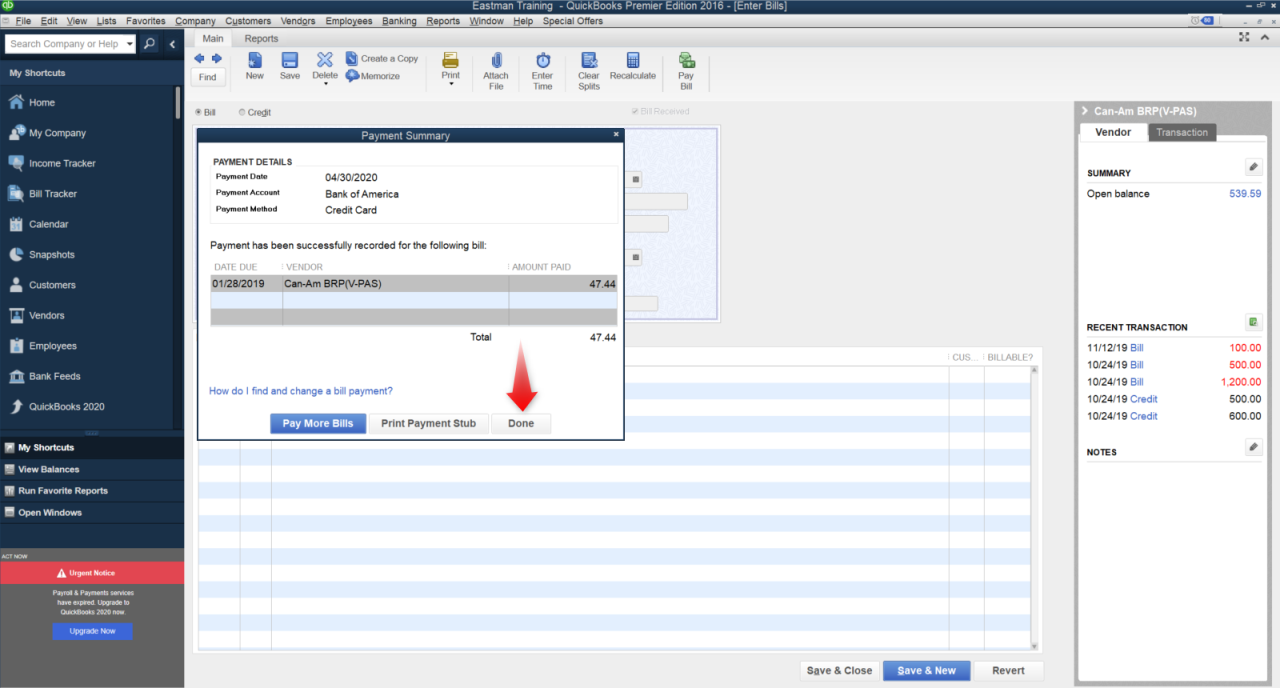

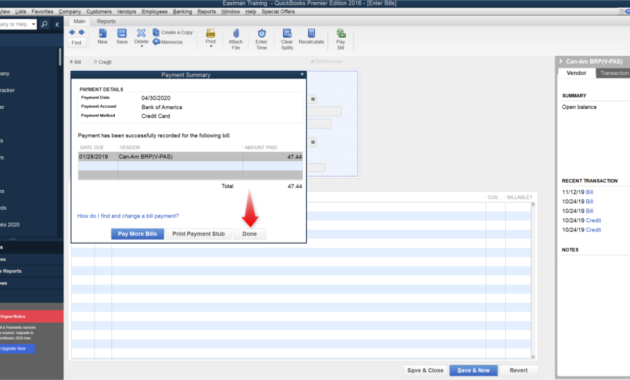

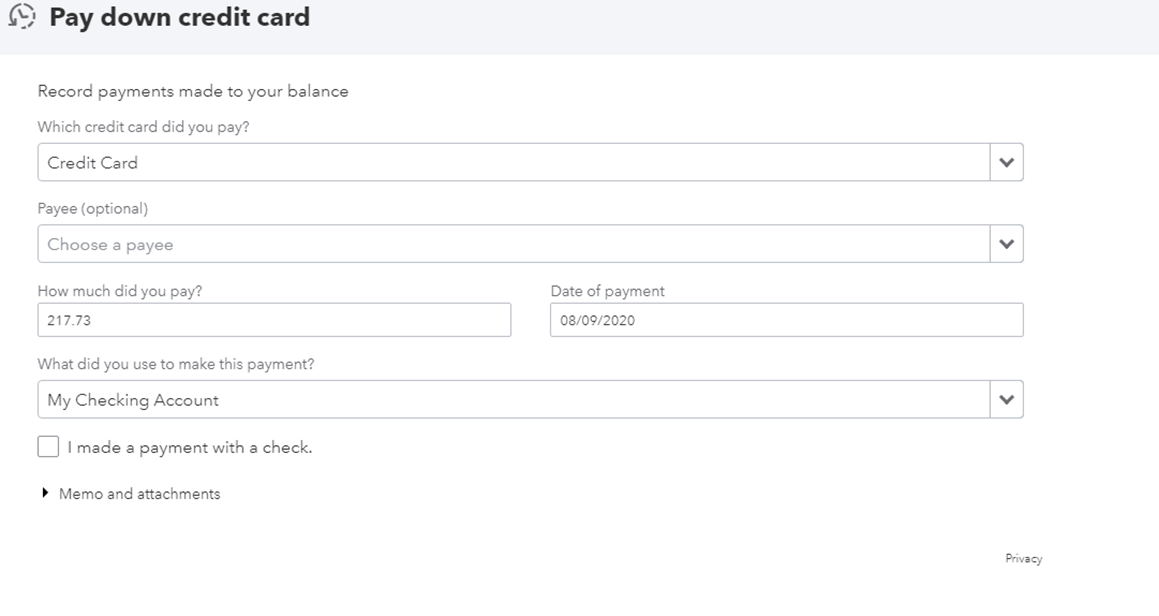

Recording Credit Card Payments in QuickBooks

When a customer makes a payment via credit card, it’s crucial to accurately record this transaction in QuickBooks to reflect your sales and cash flow. The steps to record a credit card payment are straightforward:

1. Access the Sales Receipt

Navigate to the ‘Sales’ section in QuickBooks and select ‘Sales Receipts’.

2. Create a New Sales Receipt

Click on ‘New Sales Receipt’ and fill in the necessary customer information, including the amount received.

3. Select Payment Method

Choose ‘Credit Card’ as the payment method from the dropdown menu.

4. Fill in Credit Card Details

Input the credit card information as required, ensuring you comply with PCI standards for security.

5. Save the Receipt

Once all details are correctly entered, save the sales receipt to update your records.

Handling Refunds and Chargebacks

Refunds and chargebacks are inevitable parts of processing credit card payments. QuickBooks provides a systematic approach to handle these transactions effectively:

Processing a Refund

Begin by locating the original sales receipt linked to the payment. Select ‘Refund Receipt’ from the transaction options, enter the amount to refund, and complete the transaction. This action will adjust your income and reflect the decrease in cash flow.

Managing Chargebacks

In cases where a customer disputes a charge, a chargeback may occur. To process a chargeback, record the transaction by creating a new expense for the amount disputed. Label this transaction clearly as a chargeback and categorize it appropriately to maintain accurate accounting records.

Always keep documentation related to refunds and chargebacks to support your accounting entries and ensure compliance.

Reconciling Credit Card Payments with Bank Statements

Reconciling your credit card payments with bank statements is crucial for maintaining accurate financial reports. This step ensures that your records match what the bank reports. Here’s a step-by-step guide for effective reconciliation:

1. Gather Your Bank Statement

Obtain your bank statement that includes all credit card transactions for the period you are reconciling.

2. Open QuickBooks

Access the ‘Banking’ section in QuickBooks and select ‘Reconcile’.

3. Select Bank Account

Choose the bank account associated with your credit card transactions.

4. Enter Statement Information

Input the ending balance from your bank statement and the statement date.

5. Compare Transactions

Go through each transaction in QuickBooks and match it with your bank statement. Use the checkboxes to mark off matched items.

6. Identify Discrepancies

Any transactions that do not match should be reviewed carefully. Verify details such as amounts, dates, and transaction types.

7. Finalize Reconciliation

Once all transactions are accounted for and discrepancies resolved, finalize the reconciliation. This step confirms that your books are in line with the bank’s records.By following these procedures, you can ensure streamlined processing of credit card payments, manage refunds and chargebacks efficiently, and maintain accurate financial records through effective reconciliation.

Managing Transactions and Reports

In the realm of managing credit card payments in QuickBooks, understanding how to efficiently track and report transactions is crucial for maintaining financial health. QuickBooks provides robust tools that allow users to access detailed transaction reports, monitor outstanding payments, and generate insightful financial reports, all of which can enhance decision-making and streamline reconciliation processes.

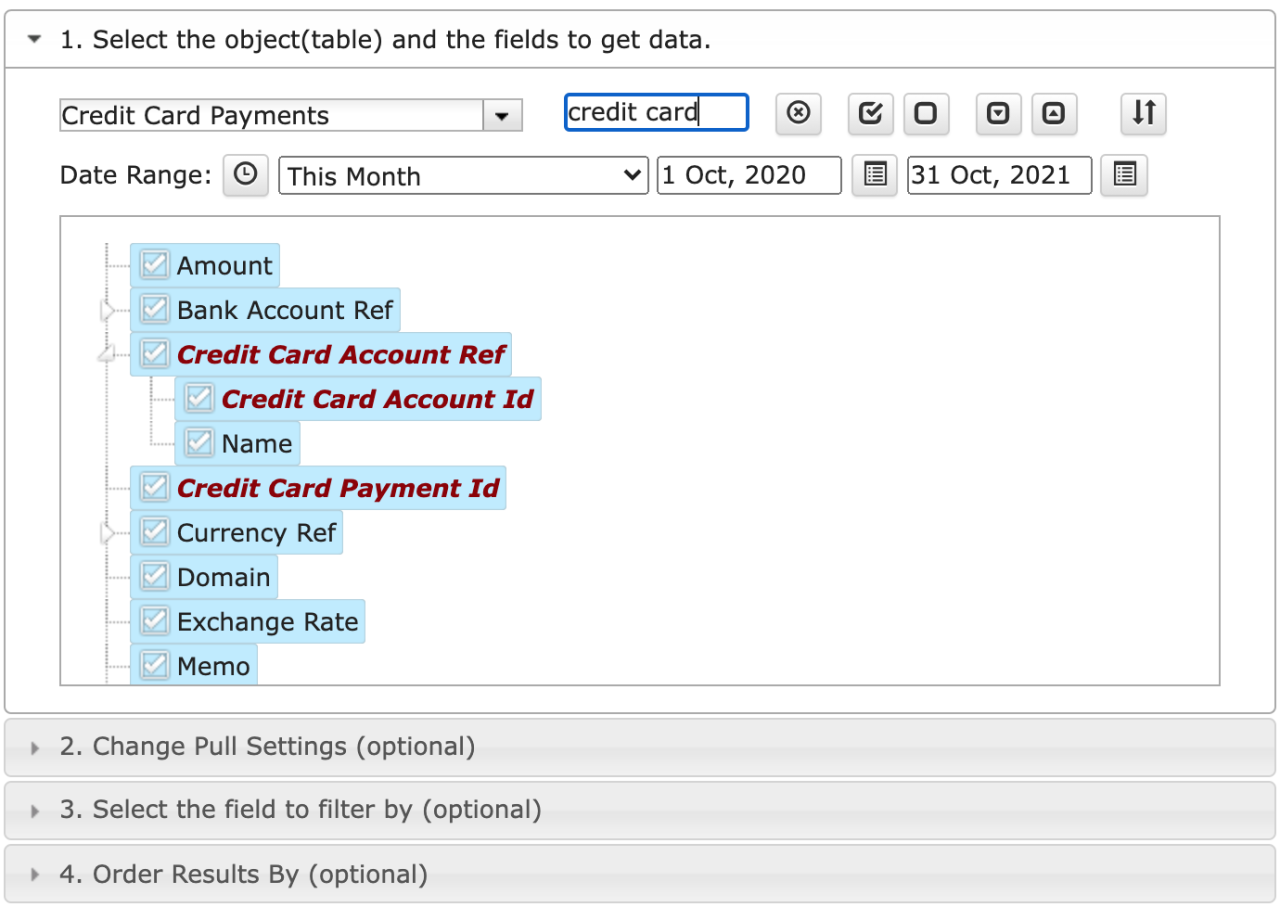

Accessing Credit Card Transaction Reports

QuickBooks offers a straightforward way to access credit card transaction reports, which are essential for reviewing your business’s credit card activity. To find these reports, navigate to the “Reports” menu located in the main toolbar. From there, you can choose the “Banking” section and select “Credit Card Charges” or “Credit Card Payments.” These reports will display all transactions associated with credit card accounts, allowing for easy review and analysis.Key points to note about interpreting these reports include:

- Transaction Date: The date on which the transaction occurred.

- Vendor Name: The name of the vendor for each transaction, aiding in expense categorization.

- Transaction Amount: The total amount of each transaction, which is vital for budgeting purposes.

- Payment Status: Understanding whether payments are pending or completed is crucial for cash flow management.

Tracking Outstanding Credit Card Payments

Monitoring outstanding credit card payments is critical for maintaining a clear financial overview and anticipating cash flow needs. QuickBooks allows users to track these obligations through the “Vendor” section, where you can see all outstanding amounts due. The implications of tracking outstanding payments are significant:

- Improved cash management: Knowing upcoming payment deadlines can help manage cash flow more effectively.

- Reduced late fees: By keeping track of due dates, you can avoid unnecessary penalties.

- Enhanced supplier relationships: Timely payments can lead to better terms with vendors.

Generating Financial Reports with Credit Card Transactions

Producing financial reports that encapsulate credit card transactions can provide a holistic view of your business’s financial standing. QuickBooks allows you to include credit card transactions in various reports, such as Profit and Loss Statements and Balance Sheets. For effective report generation, consider these tips:

- Utilize the “Customize” feature in reports to filter for specific date ranges or categories, ensuring reports reflect your needs.

- Incorporate graphs and charts to visualize credit card expenses against other expenses, helping identify patterns over time.

- Schedule regular report generation (monthly or quarterly) to consistently monitor and analyze trends in credit card usage and spending.

“Regularly reviewing credit card transaction reports will empower businesses to make informed financial decisions and maintain fiscal responsibility.”

Security Considerations

When processing credit card payments through QuickBooks, security is paramount to protect both your business and your customers. QuickBooks implements robust security measures designed to safeguard sensitive payment information during the transaction process. Understanding these measures, alongside the compliance requirements for PCI DSS, is essential for ensuring a secure payment environment.QuickBooks employs a variety of security protocols to secure credit card transactions.

These include encryption of data both at rest and in transit, advanced firewalls to protect against unauthorized access, and continuous monitoring for any suspicious activity. Furthermore, QuickBooks adheres to industry best practices for fraud detection and employs tokenization technology to minimize the exposure of credit card information.

PCI DSS Compliance

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for any business that processes credit card payments. Adhering to these standards helps protect cardholder data and reduces the risk of data breaches. The key requirements of PCI DSS include maintaining a secure network, implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy.To ensure compliance, businesses must complete a Self-Assessment Questionnaire (SAQ) to evaluate their security measures and practices.

This evaluation helps identify areas needing improvement to align with PCI DSS requirements. Regular training for staff on security measures is also crucial.

Best Practices for Safeguarding Customer Payment Information

Implementing best practices for safeguarding customer payment information is essential for maintaining trust and security. The following points provide a guideline for effective security measures:

- Utilize strong encryption for data transmission and storage, ensuring that sensitive information is unreadable to unauthorized parties.

- Limit access to customer payment information only to staff members who need it for their roles, using role-based permissions.

- Regularly update software and payment processing systems to protect against known vulnerabilities.

- Conduct frequent security audits to assess the effectiveness of your current security measures and address any gaps.

- Educate employees about the importance of data security and the risks posed by phishing and other cyber threats.

- Implement two-factor authentication for accessing sensitive financial information, adding an extra layer of protection.

- Keep customer payment information confidential and avoid storing it unless absolutely necessary for ongoing transactions.

“Utilizing strong encryption and limiting access to sensitive data can significantly reduce the risk of data breaches.”

Common Issues and Troubleshooting

When processing credit card payments in QuickBooks, users may encounter various issues that can disrupt their workflow. Understanding these common challenges and their solutions can help streamline the payment process and minimize frustration. This section Artikels the frequent problems users face and provides troubleshooting steps to tackle failed transactions effectively.

Common Issues with Credit Card Transactions

Several issues can arise during credit card payments, impacting both the user experience and customer satisfaction. Recognizing these problems and their resolutions is crucial for maintaining smooth payment processing. Below are some typical challenges along with effective solutions:

- Transaction Declines: Transactions may be declined due to insufficient funds, expired cards, or incorrect card details. Users should double-check the card information and encourage customers to ensure their cards are valid and have enough balance.

- Integration Issues: Users sometimes face difficulties integrating their payment processor with QuickBooks. Ensuring that the latest updates are installed can often resolve compatibility issues, as outdated software may lead to disconnections.

- Timing Out During Processing: Long processing times may lead to timeouts. Optimizing internet speed or switching to a wired connection can improve performance in these situations.

Troubleshooting Failed Credit Card Transactions

It is essential to address failed transactions promptly to maintain cash flow and customer trust. Here are crucial troubleshooting steps to resolve these issues:

- Check Internet Connection: A stable internet connection is vital for processing payments. Ensuring a reliable connection can resolve many transaction failures.

- Verify Payment Details: Confirm that all entered details, including card number, expiration date, and CVV, are correct. Errors in data entry often lead to declined transactions.

- Inspect Payment Processor Settings: Review the settings in QuickBooks for any misconfigurations that might affect payment processing. Retesting the connection with the payment processor can also help identify problems.

- Review Error Messages: Pay attention to any error messages displayed during the transaction. These can provide insights into specific issues such as network errors or incorrect account settings.

Contacting Support for Payment Processing Issues

In cases where troubleshooting does not resolve payment processing issues, contacting QuickBooks support is an essential step. Here’s how to approach this process effectively:

- Gather Relevant Information: Before contacting support, compile necessary details such as transaction IDs, error messages, and the steps already taken to troubleshoot the issue. Being prepared can expedite the support process.

- Use Official Support Channels: Reach out through the official QuickBooks support website or their dedicated phone line to ensure assistance from qualified representatives. Be aware of hours of operation to avoid delays.

- Follow Up: If the issue remains unresolved after the initial contact, do not hesitate to follow up. Keeping track of your case number can help in obtaining updates efficiently.

QuickBooks support is available to help you navigate complex issues, ensuring that you can manage credit card transactions smoothly.

Integrating Third-party Payment Processors: Credit Card Payments In Quickbooks

Integrating third-party credit card processors with QuickBooks can significantly enhance your payment processing capabilities, providing you with flexibility and efficiency in managing transactions. This integration allows businesses to streamline their payment processes by connecting QuickBooks directly with external payment solutions, thus simplifying accounting tasks and improving cash flow management.When integrating third-party credit card processors with QuickBooks, it is essential to consider both the advantages and disadvantages of using these external services.

Third-party processors often offer features that can enhance your payment experience, but they also come with certain limitations that businesses should be aware of.

Integration Process with QuickBooks

To integrate a third-party payment processor with QuickBooks, follow these general steps:

1. Choose a Payment Processor

Select a processor that meets your business needs. Popular options include PayPal, Square, and Stripe.

2. Sign Up for an Account

Create an account with the chosen payment processor if you do not already have one.

3. Connect to QuickBooks

Navigate to the integrations section in QuickBooks and find the option to connect to your chosen payment processor. Follow the prompts to authorize the connection.

4. Configure Settings

Adjust settings in both QuickBooks and the payment processor to ensure seamless transaction processing, including tax settings and transaction types.

5. Test the Integration

Run a few transactions to ensure that everything is working correctly and that data is syncing as expected.

Benefits and Drawbacks of Using External Payment Processors

Understanding the pros and cons of integrating third-party payment processors can help you make an informed decision. Here’s a breakdown of key points: Benefits:

Enhanced Features

Many processors offer advanced features like mobile payments, recurring billing, and customer invoicing.

Simplified Transactions

Integration can reduce manual data entry, minimizing errors and saving time.

Access to Analytics

External processors often provide robust reporting features that can help you analyze sales and customer behavior. Drawbacks:

Fees

Third-party processors typically charge transaction fees, which can add up and impact profit margins.

Data Security Concerns

Relying on an external service means trusting them with sensitive customer information; any breach can affect your business’s credibility.

Potential Downtime

If the payment processor experiences outages, it could disrupt your ability to accept payments.

Comparison of Popular Third-party Payment Processors, Credit card payments in quickbooks

Here’s a comparison of some well-known payment processors to help you assess their features:

| Processor | Transaction Fees | Key Features | Best For |

|---|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Mobile payments, invoicing, international transactions | Small to medium businesses looking for versatility |

| Square | 2.6% + $0.10 per transaction | Point of sale systems, inventory management, analytics | Retail businesses needing POS solutions |

| Stripe | 2.9% + $0.30 per transaction | Customizable payment forms, subscription billing, strong API | Online businesses needing robust development features |

| Authorize.Net | $0.10 per transaction + monthly fee | Recurring billing, fraud detection, customer profiles | Businesses requiring advanced security features |

Enhancing Customer Experience

Creating a positive customer experience during credit card payments is vital for businesses in fostering loyalty and satisfaction. The payment process should be seamless, efficient, and reassuring, allowing customers to feel secure and appreciated. By implementing thoughtful strategies, businesses can not only streamline the payment process but also enhance overall customer interactions.One effective strategy for improving customer experience during credit card payments is to ensure that the payment interface is user-friendly and intuitive.

A clean design and easy navigation can significantly reduce the chances of errors and abandoned transactions. Additionally, providing multiple payment options, including various credit card types and alternative payment methods (such as digital wallets), caters to a broader range of customer preferences.

Providing Receipts and Transaction Confirmations

Delivering timely and clear receipts and transaction confirmations is essential in reinforcing customer trust and satisfaction. Here are some techniques to enhance this aspect of the payment process:

- Automated Email Confirmations: Implement a system that automatically sends email confirmations immediately after a transaction is completed, detailing the transaction amount, date, and any relevant product or service details.

- Mobile Receipts: Offer customers the option to receive receipts via SMS or mobile app notifications, which can be more convenient than traditional paper receipts.

- Customizable Receipts: Allow businesses to customize receipts to include logos, messages, or promotional offers, providing a personal touch that can enhance brand loyalty.

Gathering Customer Feedback

Collecting feedback on the payment process is invaluable for ongoing improvement. It helps identify pain points and areas that require attention. Consider the following methods for gathering insights from customers:

- Post-Payment Surveys: Send brief surveys via email or SMS after a transaction, asking customers about their payment experience. Keep questions concise and focused on aspects like ease of use and satisfaction.

- In-App Feedback: If applicable, integrate feedback tools within mobile or web applications to encourage users to share their thoughts about their payment experience promptly.

- Incentivized Feedback: Offer customers small incentives, such as discounts on future purchases, for completing surveys. This can increase participation rates while reinforcing a positive customer relationship.

Implementing these strategies can not only improve the payment experience but also contribute to building long-term customer loyalty. A seamless process, coupled with effective communication and feedback mechanisms, positions businesses advantageously in competitive markets.

Top FAQs

What types of credit cards can I process in QuickBooks?

QuickBooks supports various credit cards, including Visa, MasterCard, American Express, and Discover, depending on your selected payment processor.

Can I set up recurring credit card payments in QuickBooks?

Yes, you can schedule recurring credit card payments in QuickBooks by using the recurring transactions feature.

How do I handle declined credit card transactions?

If a credit card transaction is declined, you should notify the customer and confirm their payment details before attempting to process the transaction again.

Are there additional fees for processing credit card payments?

Yes, most payment processors charge fees for credit card transactions, which can vary based on the processor and your plan.

How do I access customer payment history in QuickBooks?

You can view customer payment history by going to the Customer Center and selecting a customer to see their transaction details.