Flash mobile payment is swiftly transforming the way we conduct transactions, making them faster, safer, and more convenient than ever before. As digital wallets and payment apps gain popularity, it’s essential to understand how this modern payment method fits into our increasingly tech-savvy lifestyle. With the integration of cutting-edge technologies, flash mobile payment not only simplifies everyday purchases but also enhances the overall user experience.

From its evolution through various mobile payment methods to the technological innovations shaping its landscape, flash mobile payment stands at the forefront of the digital economy. As consumers and businesses alike embrace this payment solution, understanding its benefits, security features, and future potential becomes paramount.

Overview of Flash Mobile Payment

Flash mobile payment represents a cutting-edge approach to financial transactions, leveraging the convenience and accessibility of mobile technology to streamline payment processes. In today’s fast-paced digital economy, where consumers expect instant gratification and seamless experiences, flash mobile payment systems have emerged as pivotal tools for both merchants and consumers, enabling quick and secure transactions with just a few taps on a smartphone.The technology behind flash mobile payment systems relies on a combination of Near Field Communication (NFC), QR codes, and secure digital wallets.

These technologies allow users to make payments without the need for physical cash or cards, enhancing both convenience and security. As mobile devices continue to become more integrated into everyday life, the infrastructure supporting these payment systems, including encryption protocols and tokenization, ensures that sensitive financial data remains protected during transactions.

Evolution of Mobile Payment Methods Leading to Flash Mobile Payment

The journey of mobile payment methods has witnessed significant transformations over the past decade, evolving from rudimentary systems to sophisticated platforms that facilitate instantaneous transactions. Understanding this evolution provides insight into the rise of flash mobile payment and its relevance today.

1. Early Mobile Payments

The initial forays into mobile payments involved basic SMS transactions and mobile web payments, primarily for purchasing digital goods like ringtones or apps. These methods, while innovative, lacked the security and user-friendliness of later developments.

2. Introduction of Mobile Wallets

The launch of mobile wallets like Google Wallet and Apple Pay marked a turning point in mobile payment technology. These wallets integrated payment card information securely, allowing users to pay at physical retail locations using NFC technology. The ease of use and enhanced security provided by tokenization fostered consumer trust.

3. Peer-to-Peer Payment Systems

Services such as Venmo and Cash App revolutionized how individuals transferred money to one another. These platforms simplified the process of sending money using just a phone number or email address, emphasizing speed and social interaction in financial transactions.

4. Integration of QR Codes

The adoption of QR code payments, especially prevalent in markets like China with platforms such as WeChat Pay and Alipay, demonstrated the effectiveness of visual payment methods. Users could simply scan a code to complete transactions, streamlining the checkout process even further.

5. Rise of Flash Mobile Payment

The culmination of these advancements has led to the emergence of flash mobile payment systems characterized by rapid transaction speeds, enhanced security features, and intuitive user interfaces. These systems allow for payments to be made in mere seconds, making them ideal for high-volume retail environments and everyday transactions alike.

“Flash mobile payment systems epitomize the blend of technology and convenience, fundamentally changing how we perceive and engage with financial transactions.”

Benefits of Flash Mobile Payment

Flash mobile payment solutions offer a range of advantages that significantly enhance the payment experience for both consumers and businesses. With the rapid evolution of technology, embracing mobile payment options has become essential in today’s fast-paced environment. This discussion explores the benefits that these solutions bring, helping to clarify why they are becoming increasingly popular.

Advantages for Consumers

Consumers benefit greatly from the adoption of flash mobile payment systems. These advantages include:

- Convenience: Users can make payments swiftly using their smartphones, eliminating the need for cash or physical cards. This is particularly advantageous during shopping sprees or when dining out.

- Speed: Transactions are processed almost instantly, reducing the time spent at checkout lines and enhancing overall shopping efficiency. For instance, a user can complete a purchase in mere seconds, allowing for a more enjoyable experience.

- Security: Flash mobile payments often incorporate advanced security features, such as biometric authentication and encryption, which help keep personal information safe and mitigate the risk of fraud.

- Loyalty Rewards: Many mobile payment platforms integrate loyalty programs that allow consumers to earn points or discounts with each transaction, enhancing their shopping experience while saving money.

Advantages for Businesses

Businesses adopting flash mobile payment solutions can also reap numerous benefits that contribute to their growth and efficiency. Key benefits include:

- Increased Sales: By offering multiple payment options, including mobile payments, businesses can cater to a broader customer base, ultimately driving more sales.

- Operational Efficiency: Flash mobile payments streamline the payment process, reducing the time employees spend on transaction handling and allowing them to focus on customer service.

- Reduced Costs: The use of mobile payment systems can minimize overhead costs associated with cash handling, such as counting cash or making bank deposits.

- Customer Insights: Businesses can gain valuable insights into customer behavior through transaction data, enabling them to tailor marketing efforts and improve customer satisfaction.

Enhancing User Experience

Flash mobile payment solutions significantly enhance user experience in various situations, leading to higher customer satisfaction. Notable examples include:

- Food Trucks and Events: Payment processing at busy food trucks can be optimized with mobile payments, allowing customers to order and pay without lengthy waits, making the experience more enjoyable.

- Retail Stores: In retail environments, mobile payment options minimize checkout times. Consumers can quickly pay at self-service kiosks or through mobile apps, enhancing their shopping experience.

- E-commerce: Online shopping experiences are improved through mobile payments, as customers can complete transactions effortlessly on their smartphones without the hassle of entering credit card information repeatedly.

- Travel: Travelers benefit from mobile payments when booking tickets or accommodations, allowing them to make purchases on-the-go, reducing the stress of carrying cash in foreign countries.

“Flash mobile payment solutions not only modernize transactions but also create a seamless experience that fosters customer loyalty and encourages repeat business.”

Security Features of Flash Mobile Payment

In today’s digital landscape, the security of mobile payment systems is paramount. Flash Mobile Payment incorporates advanced security features that aim to protect users’ sensitive information and ensure safe transactions. Understanding these features not only highlights the technological advancements in mobile payments but also emphasizes the importance of consumer trust in adopting these platforms.One of the foremost security measures integrated into Flash Mobile Payment systems is end-to-end encryption.

This technology protects personal and financial data from the moment it is entered until it reaches the payment processor, ensuring that sensitive information remains confidential. Additionally, Flash Mobile Payment often utilizes tokenization, which replaces sensitive data with a unique identifier that cannot be reversed, making it more difficult for cybercriminals to access actual payment information.

Comparison of Security with Traditional Payment Methods

When comparing the security of Flash Mobile Payment to traditional payment methods, several key differences emerge. Traditional methods, such as using credit or debit cards, often rely on magnetic stripe technology that is less secure than the methods employed in mobile payments. Here are some notable distinctions:

- Data Protection: Flash Mobile Payments use advanced encryption and tokenization, while traditional card transactions may expose card numbers during processing.

- User Authentication: Flash Mobile Payment often includes biometric authentication (like fingerprint or facial recognition), which is generally absent in traditional methods.

- Transaction Monitoring: Mobile payment systems frequently employ real-time fraud detection mechanisms, enabling immediate responses to suspicious activities, unlike traditional systems that may only review transactions post-factum.

These security features not only enhance the safety of transactions but also build consumer confidence in using mobile payment options as a viable alternative to cash or card payments.

Consumer Trust and Security Concerns

Consumer trust is a crucial element in the adoption of Flash Mobile Payment solutions. While many users appreciate the convenience and efficiency of mobile payments, there remain concerns regarding security. Issues such as potential data breaches, unauthorized transactions, and the risk of device theft can hinder users’ willingness to embrace this technology. To address these concerns, educational efforts are essential.

Informing users about the robust security protocols in place can significantly enhance their confidence. For example, companies can provide detailed guides on how to safely use mobile payments and the importance of keeping their devices secure.

“The security of a payment system is only as strong as its weakest link, making consumer awareness and education critical.”

Through transparency and ongoing education about security measures, Flash Mobile Payment can increase consumer trust while reducing the perceived risks associated with mobile financial transactions.

Popular Flash Mobile Payment Platforms

As the landscape of mobile payments rapidly evolves, a host of flash mobile payment platforms have emerged, providing users with swift and efficient payment solutions. These platforms cater to various consumer needs, from everyday transactions to business payments, making them integral to the modern economy. Below, we explore several notable platforms and their unique offerings.

Notable Flash Mobile Payment Platforms

The following platforms stand out in the flash mobile payment space, each offering distinct features that cater to different user preferences:

- PayPal: A well-known player in the payment industry, PayPal allows users to send and receive money instantly using their mobile app. It supports various transactions, including online purchases and bill payments, and is widely accepted by numerous merchants.

- Venmo: Owned by PayPal, Venmo is particularly popular among younger users for its social features. It enables users to share transactions on a social feed, making it a go-to for splitting bills with friends and family.

- Square: Known for its point-of-sale systems, Square also offers a mobile payment app that caters to small businesses. It allows merchants to accept payments easily while providing users with a seamless checkout experience.

- Apple Pay: This service allows iPhone users to make payments directly from their devices. Apple Pay is noted for its user-friendly interface and integration with various apps, making in-store and online transactions effortless.

- Google Pay: Google Pay provides an easy way to pay for items online and in-store using Android devices. It combines all the payment options and loyalty programs into one app, enhancing the user experience.

Comparison of Features and Functionalities

To facilitate a better understanding of how these platforms stack up against each other, the following comparison table summarizes key features and functionalities:

| Platform | Transaction Speed | Social Features | Merchant Compatibility | Security Measures |

|---|---|---|---|---|

| PayPal | Instant | No | Widely accepted | Encryption, two-factor authentication |

| Venmo | Instant | Yes | Limited | Encryption, two-factor authentication |

| Square | Instant | No | Small businesses | Encryption, fraud detection |

| Apple Pay | Instant | No | Widely accepted | Tokenization, biometric security |

| Google Pay | Instant | No | Widely accepted | Encryption, biometric security |

Market Trends and Competitive Landscape

The flash mobile payment market is characterized by rapid growth and evolving consumer preferences. The increasing adoption of smartphones and advancements in technology have significantly influenced this sector. Notably, the COVID-19 pandemic has accelerated the shift towards contactless payments, prompting both consumers and businesses to seek faster, safer payment methods. In addition, competition among major players has led to continuous innovations in features and security measures.

For instance, biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming standard as users demand more secure payment solutions. Moreover, partnerships between these platforms and various merchants are expanding, increasing the acceptance and versatility of mobile payment options across multiple industries.The competitive landscape is also witnessing the entry of fintech startups that aim to disrupt traditional payment systems with unique offerings and niche services, further intensifying competition in this dynamic market.

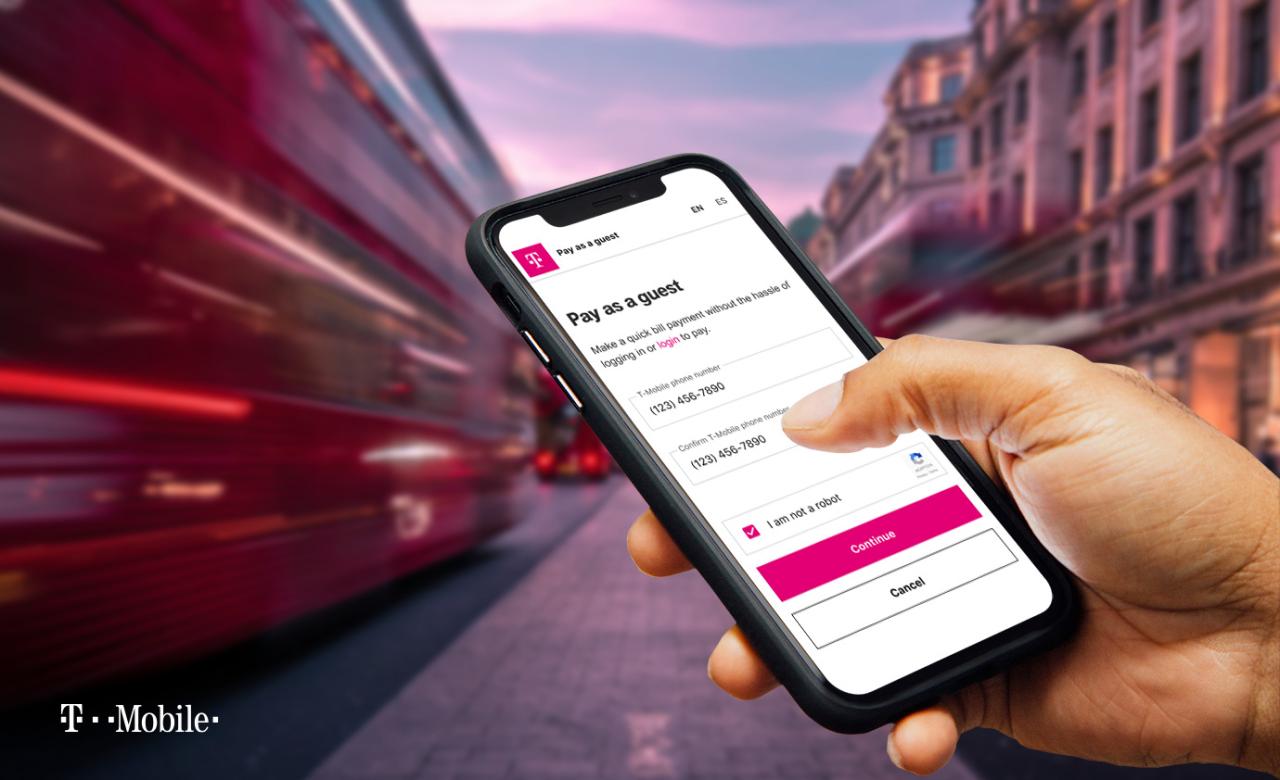

User Experience and Interface Design

User interface design plays a crucial role in the success of flash mobile payment applications. A well-thought-out interface can significantly enhance user satisfaction, drive engagement, and promote the adoption of mobile payment technologies. When users find an app easy to navigate and visually appealing, they are more likely to utilize the service regularly.The importance of intuitive user experience can’t be overstated.

An effective interface design streamlines the payment process, minimizes friction, and helps users feel secure and confident while making transactions. Key elements that contribute to an intuitive user experience include simplicity, consistency, responsive feedback, and accessibility.

Elements of an Intuitive User Experience

Creating an intuitive user experience in flash mobile payment apps involves several vital components. Each element plays a significant role in ensuring that users can complete transactions smoothly and efficiently.

- Simplicity: The interface should be clean and clutter-free. Essential functions, such as payment buttons and transaction history, must be easily accessible without unnecessary distractions.

- Consistency: Visual consistency across all screens and menus allows users to familiarize themselves quickly with app functionalities. Using similar colors, fonts, and layouts helps reinforce their understanding.

- Responsive Feedback: Providing immediate feedback when users interact with the app—such as button presses or loading indicators—instills a sense of control and reassurance that their actions are being processed.

- Accessibility: The app design must cater to all users, including those with disabilities. Implementing features like voice commands or high-contrast modes can significantly broaden the app’s audience.

- User Onboarding: A clear onboarding process helps users understand how to utilize the app effectively. Tutorials or tooltips can guide new users without overwhelming them.

The effectiveness of these elements can be seen in various well-designed flash mobile payment apps. For instance, platforms like PayPal and Venmo have adopted user-centric designs that prioritize ease of use. PayPal’s interface simplifies transaction processes with prominent action buttons and straightforward navigation paths, while Venmo integrates social elements that make payments feel more interactive and engaging. Both apps effectively balance functionality with an attractive design, which enhances user experience and fosters loyalty.

Challenges in Flash Mobile Payment Adoption

The adoption of flash mobile payment systems has been gaining traction, yet several challenges continue to hinder their widespread acceptance. From technical issues to regulatory hurdles, various factors can impede the seamless integration of these payment platforms into everyday transactions. Understanding these challenges is crucial for both providers and users in navigating the evolving landscape of mobile payments.

Common Barriers to Adoption

Several barriers can prevent consumers and businesses from fully embracing flash mobile payment solutions. These barriers include:

- Consumer Awareness: Many users remain unaware of the benefits and functionalities of flash mobile payments, which leads to hesitance in adoption.

- Technological Limitations: Inadequate smartphone penetration and inconsistent internet connectivity can restrict access to mobile payment options, particularly in rural areas.

- User Trust: Concerns regarding data privacy and security can deter users from adopting new payment technologies.

- Merchant Acceptance: Not all businesses are equipped to accept mobile payments, which can limit options for consumers.

Technical and Regulatory Challenges

Flash mobile payment providers face both technical and regulatory challenges that complicate the implementation of their services. These include:

- Integration with Existing Systems: Integrating flash payment systems with legacy banking and payment infrastructures poses significant technical difficulties for providers.

- Regulatory Compliance: Navigating complex regulatory environments across different regions can be a daunting task, often requiring substantial resources to ensure compliance with local laws.

- Interoperability: Ensuring that different mobile payment platforms can work seamlessly together is crucial for enhancing user experience but often presents significant technical challenges.

- Security Standards: Maintaining high-security standards to protect user data amidst evolving cyber threats is vital but can be resource-intensive.

Strategies for Overcoming Obstacles

To foster the adoption of flash mobile payment solutions, various strategies can be employed by providers and stakeholders:

- Education and Awareness Campaigns: Initiatives to educate consumers about the benefits and safety of mobile payments can help alleviate concerns and increase adoption rates.

- Enhancing Security Measures: Investing in advanced security technologies, such as biometric authentication and encryption, can help build consumer trust.

- Partnerships and Collaborations: Collaborating with financial institutions and technology companies can facilitate smoother integration and broaden acceptance among merchants.

- Government Engagement: Advocating for supportive regulatory frameworks can ease compliance burdens and encourage innovation in the mobile payment space.

Building a robust infrastructure and addressing consumer concerns about security and accessibility will be pivotal in driving the adoption of flash mobile payments.

Future of Flash Mobile Payment

The future of flash mobile payment is set to be shaped by several emerging trends that will enhance convenience, security, and user experience. As technology evolves, so too does the landscape of financial transactions, with flash mobile payments at the forefront of this transformation. The integration of advanced technologies such as AI, blockchain, and biometric security is expected to redefine how users interact with payment systems.Innovations in flash mobile payment systems are essential for staying competitive in an increasingly digital economy.

The demand for faster, more secure, and user-friendly payment options is driving the development of new features and functionalities that cater to consumer needs. Below is a table highlighting key predictions for the next five years in mobile payment technology.

Predictions for Mobile Payment Technology

The following table Artikels anticipated developments and trends that will significantly impact the mobile payment industry over the next five years:

| Year | Prediction | Impact |

|---|---|---|

| 2024 | Increased adoption of biometric authentication methods. | Enhanced security and reduced fraud. |

| 2025 | Widespread integration of AI for personalized payment experiences. | Improved user engagement and satisfaction. |

| 2026 | Greater use of blockchain technology for transaction transparency. | Increased trust in mobile payment systems. |

| 2027 | Expansion of contactless payment capabilities globally. | Convenience in everyday transactions. |

| 2028 | Introduction of programmable money and smart contracts. | Automation in payments and enhanced financial services. |

Potential innovations that could further enhance flash mobile payment systems include augmented reality (AR) payment experiences, which allow users to visualize products in their environment before making a purchase. Additionally, the integration of loyalty and rewards programs directly into mobile payment apps could create a more seamless shopping experience, encouraging consumer retention. Another promising avenue is the development of decentralized finance (DeFi) solutions within mobile payments, allowing users to perform complex financial transactions without intermediaries.

This could facilitate instant transfers, lower costs, and broaden access to financial services for underserved populations.

“The future of flash mobile payment lies in the seamless integration of advanced technologies that prioritize user convenience and security.”

Case Studies of Successful Flash Mobile Payment Implementations

Flash mobile payment solutions have transformed the way businesses conduct transactions, enhancing convenience and efficiency for users. Various companies have successfully adopted these technologies, leading to significant improvements in their operations and customer satisfaction. This section presents detailed case studies of businesses that have embraced flash mobile payments, showcasing the outcomes and enhancements observed post-implementation.

Starbucks: Revolutionizing the Coffee Experience

Starbucks has become a pioneer in mobile payments with its innovative app, which allows customers to pay quickly and earn rewards. The implementation of flash mobile payment through their app led to a seamless ordering experience. Users can place orders ahead of time, reducing wait times in-store.Key outcomes include:

- A 20% increase in mobile ordering, resulting in higher overall sales.

- Enhanced customer loyalty, with millions of active users enrolled in the rewards program.

- Data analytics from the app that informs product offerings and marketing strategies.

The success of Starbucks highlights the importance of integrating mobile payments with customer engagement strategies.

Walmart: Streamlining Checkout Processes

Walmart adopted flash mobile payment technology through its proprietary app, which allows customers to scan items for quick checkout. This implementation has streamlined the shopping experience, particularly in-store.The improvements observed include:

- Reduced average checkout times by up to 50% during peak hours.

- A significant increase in customer satisfaction ratings due to the ease of use.

- Enhanced inventory management through real-time data collection at checkout.

Walmart’s case illustrates how mobile payment solutions can directly impact operational efficiency and customer experience.

PayPal and Uber: Transforming Transportation Payments, Flash mobile payment

Uber’s integration of PayPal as a flash mobile payment option has significantly altered how riders pay for rides. This collaboration allows users to link their PayPal accounts for effortless transactions.The outcomes from this partnership include:

- Increased ride bookings, with many customers preferring the ease of PayPal payments.

- Improved financial security for users, as they can avoid sharing credit card information directly with service providers.

- Higher retention rates, as users appreciate the flexibility in payment options.

The collaboration between Uber and PayPal showcases the potential for partnerships in enhancing flash payment solutions.

Amazon Go: A Cashier-less Shopping Experience

Amazon Go stores utilize flash mobile payment technology to provide a cashier-less shopping environment where customers can simply walk in, pick up items, and leave—automatically charged through the Amazon app.Key improvements include:

- A unique shopping experience that eliminates traditional checkout lines.

- Real-time inventory management allowing for immediate restocking and tracking.

- High customer retention, as users appreciate the convenience of the experience.

Amazon Go represents a radical shift in retail shopping, demonstrating the power of mobile payment technology in creating innovative customer experiences.

Sephora: Enhancing Customer Interaction and Loyalty

Sephora’s mobile app incorporates flash mobile payment options and personalized beauty experiences. Customers can quickly pay for products while benefiting from tailored recommendations based on their purchase history.Outcomes of this implementation include:

- Increased sales through personalized marketing and fast transactions.

- Enhanced customer engagement, with users spending more time within the app.

- A boost in loyalty program enrollment due to the reward points earned through app purchases.

Sephora’s case illustrates how integrating mobile payment solutions with customer interaction can drive loyalty and sales.

Helpful Answers

What is flash mobile payment?

Flash mobile payment refers to a quick and secure method of making payments through mobile devices, utilizing digital wallets and apps for transactions.

How does flash mobile payment enhance user experience?

It streamlines transactions, reduces wait times, and offers a convenient way to pay with just a few taps on a smartphone.

Are flash mobile payments safe?

Yes, they incorporate advanced security measures like encryption and biometric authentication to protect user data and transactions.

What are some popular platforms for flash mobile payment?

Notable platforms include Apple Pay, Google Pay, and Samsung Pay, each offering unique features and user experiences.

What challenges do businesses face in adopting flash mobile payment?

Common challenges include technological integration, regulatory compliance, and consumer trust in mobile payment security.