Free credit card payment app is revolutionizing the way we handle transactions in our daily lives. As digital payment solutions grow exponentially, these apps are becoming essential for both consumers and businesses alike. They offer convenience, speed, and security, allowing users to make payments effortlessly while also managing their finances more effectively.

With the increasing popularity of these apps, understanding their features, benefits, and how to choose the right one becomes crucial for anyone looking to streamline their payment processes. In this guide, we will delve into the essential aspects of free credit card payment apps, highlighting their significance in today’s fast-paced digital economy.

Introduction to Free Credit Card Payment Apps

Free credit card payment apps are digital platforms that enable users to make payments using their credit cards without incurring transaction fees. Designed to simplify the payment process, these apps cater to both consumers and businesses, providing a seamless way to handle transactions in our increasingly cashless society. With the rise of technology, these applications have become indispensable tools, allowing users to manage their finances conveniently and securely.In recent years, the growth of digital payment solutions has accelerated significantly.

Fueled by advancements in technology, increased smartphone penetration, and changing consumer behavior, the adoption of these apps has surged. A recent report highlighted that digital payment users are expected to surpass 4.4 billion globally by 2026, indicating a strong shift towards online financial transactions. This transformation is not just limited to consumers but also extends to businesses, which increasingly rely on digital solutions to facilitate sales and enhance customer experiences.

Benefits of Using Free Credit Card Payment Apps

Utilizing free credit card payment apps comes with a plethora of advantages for both consumers and businesses. Understanding these benefits can help users make informed decisions about their payment methods. Below are some key benefits:

- Cost-effective Transactions: Many free credit card payment apps do not charge transaction fees, which can lead to significant savings for both consumers and merchants.

- Convenience: Users can make payments anytime, anywhere, with just a few taps on their mobile devices, eliminating the need for cash or physical credit cards.

- Enhanced Security: These apps often incorporate advanced security measures such as encryption and tokenization, making transactions safer than traditional methods.

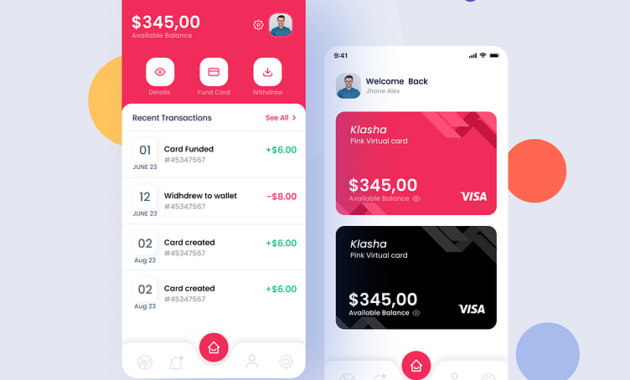

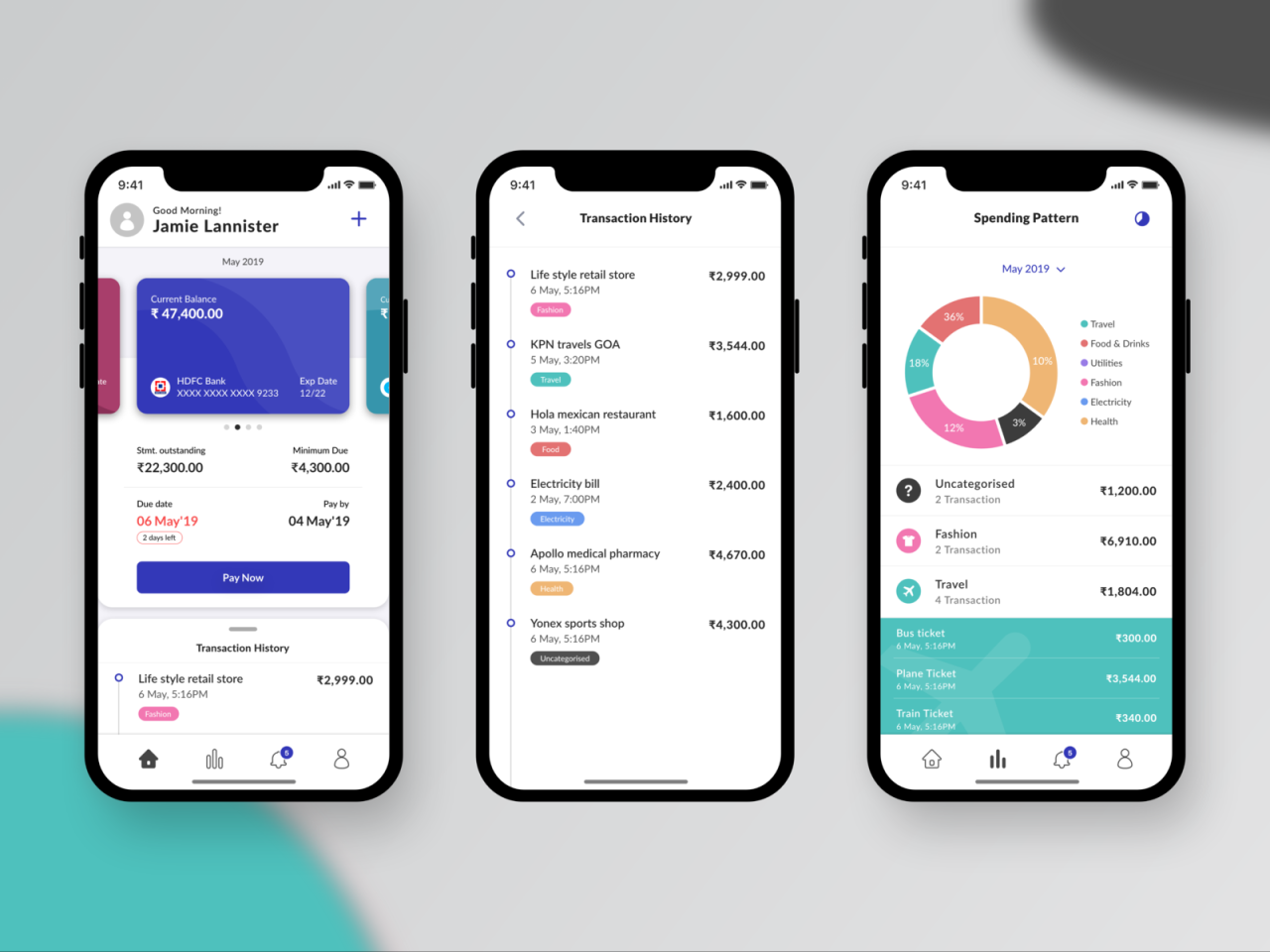

- Transaction Tracking: Users can easily track their spending habits through organized records and receive real-time notifications for transactions, helping them manage their budgets effectively.

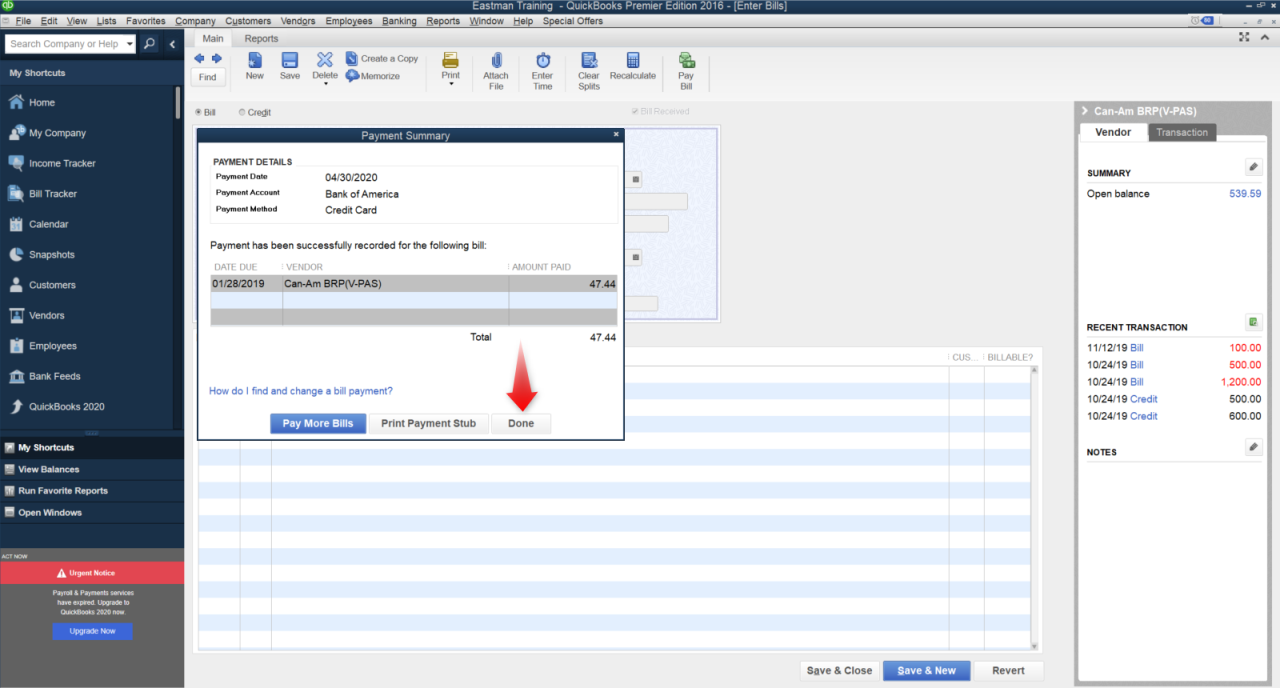

- Integration with Other Services: Many payment apps offer features like loyalty programs, discounts, and integration with accounting software, creating a more holistic financial management experience.

“The adoption of digital payments is transforming the way we interact with money, making transactions faster, safer, and more efficient.”

The rising trend of using free credit card payment apps illustrates a significant shift in the financial landscape, benefiting all parties involved in the transaction process. As technology continues to evolve, the future of payments looks promising, with innovations aimed at improving user experience and security.

Features of Free Credit Card Payment Apps

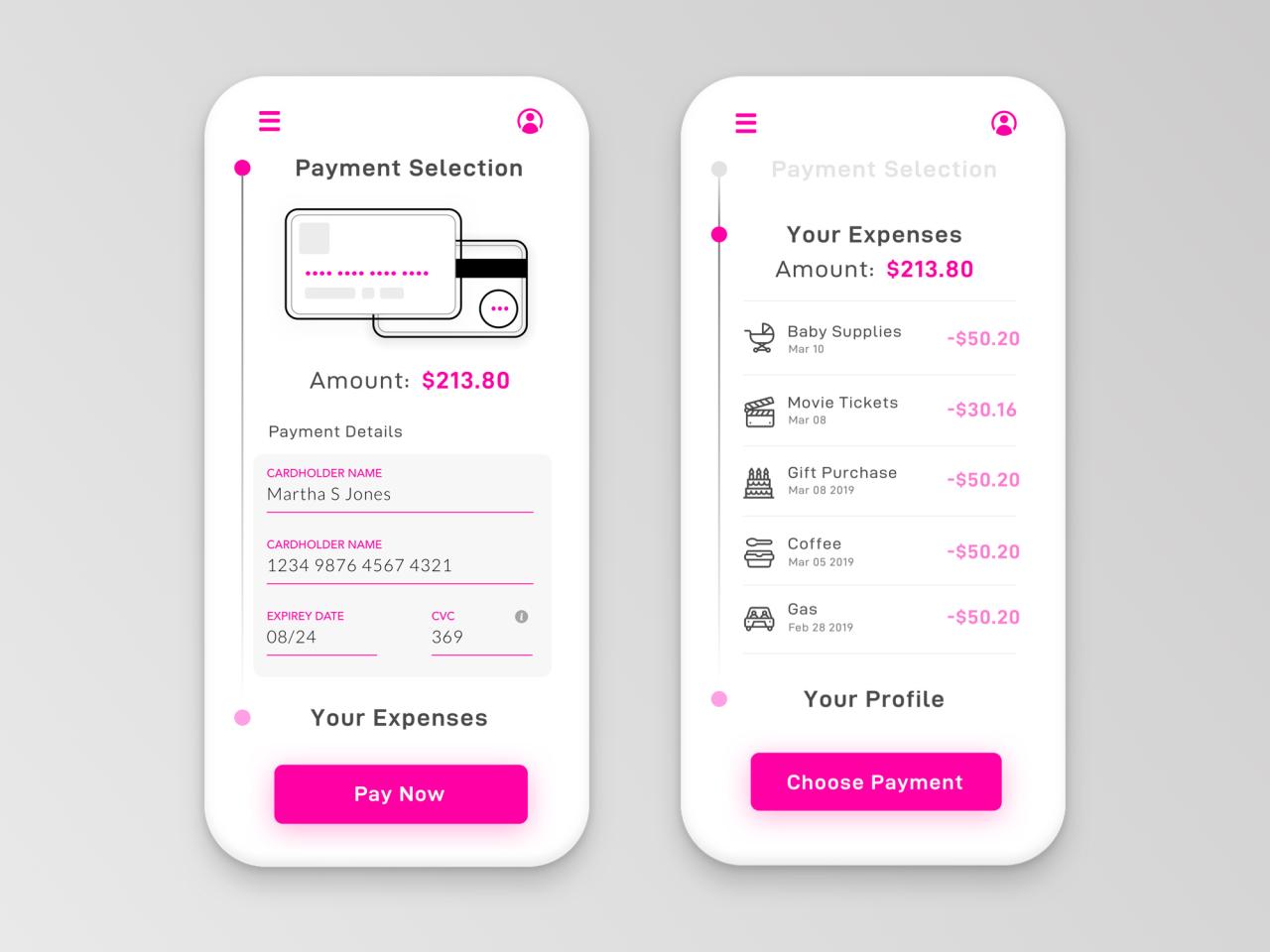

Free credit card payment apps have revolutionized the way consumers and businesses handle transactions. With user-friendly features and robust security protocols, these apps offer convenient solutions for managing payments. Understanding the key features provides insight into their effectiveness and advantages over traditional payment methods.One of the standout aspects of these apps is their array of features designed to enhance the payment experience.

Users can expect a variety of functionalities that streamline transactions, promote security, and facilitate ease of use. Here are some key features commonly found in free credit card payment apps:

Key Features

The following features are essential in providing a comprehensive payment solution for users:

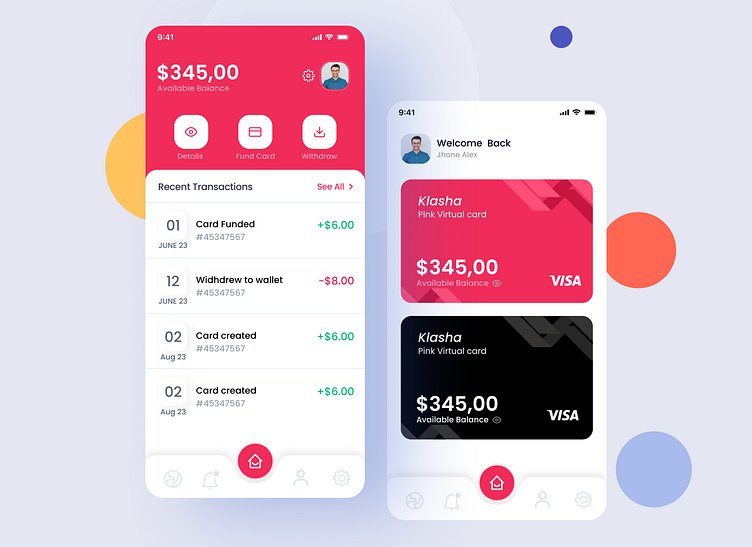

- Instant Transactions: Users can send and receive payments in real time, which is particularly beneficial for small businesses and peer-to-peer transactions.

- Multiple Payment Methods: Most apps support various payment options, including debit and credit cards, bank transfers, and even digital wallets.

- Transaction Tracking: Users can easily monitor their transactions, providing them with an organized view of all payments made and received.

- Bill Splitting: Many apps offer features for splitting bills among friends or family, making it easy to manage shared expenses.

Security Measures

Security is a cornerstone of any financial app, especially for payment processing. Free credit card payment apps implement several security measures to protect user information and transactions.Key security measures include:

- Encryption: Data is encrypted, ensuring that sensitive information such as credit card numbers and personal details are secure during transactions.

- Two-Factor Authentication: Many apps employ two-factor authentication to add an extra layer of security when accessing accounts, requiring users to verify their identity through multiple methods.

- Fraud Detection Systems: Advanced algorithms are used to detect unusual activity and potential fraud, alerting users and preventing unauthorized transactions.

- Compliance with Regulations: Most apps comply with Payment Card Industry Data Security Standards (PCI DSS), ensuring robust security practices are in place.

User Interface and User Experience Considerations, Free credit card payment app

A seamless user interface (UI) and user experience (UX) are fundamental in attracting and retaining users. Free credit card payment apps prioritize intuitive design, making it easy for users of all tech-savviness levels to navigate.Characteristics of an effective UI/UX include:

- Simple Navigation: Clear menus and straightforward navigation paths facilitate quick access to essential features.

- Responsive Design: Apps are designed to work efficiently on various devices, ensuring a consistent experience whether on smartphones or tablets.

- Visual Feedback: Users receive immediate feedback on actions taken, such as payment confirmations or error messages, enhancing user confidence.

- Customization Options: Some apps allow users to personalize their experience, including themes or notification preferences to suit individual needs.

“An effective payment app not only prioritizes functionality but also enhances the user experience through thoughtful design and robust security measures.”

Popular Free Credit Card Payment Apps

In today’s digital age, free credit card payment apps have revolutionized the way we handle transactions. These apps not only provide a seamless payment experience but also come loaded with features that enhance user convenience and security. As the market grows, several apps have emerged as popular choices among users, each boasting unique capabilities that cater to different needs and preferences.When selecting a payment app, users often consider factors such as features, user experience, and security.

The following table Artikels some of the popular free credit card payment apps along with their unique features, helping users make informed decisions.

| App Name | Unique Features |

|---|---|

| Venmo | Social payment platform with a social feed, easy splits, and direct bank transfer. |

| Cash App | Instant transfers, Bitcoin trading, and Cash Card for in-store purchases. |

| PayPal | Widely accepted, robust buyer protection, and international payments. |

| Zelle | Instant transfers between bank accounts with no fees, integrated into major banks. |

Strengths and Weaknesses of Specific Apps

Examining the strengths and weaknesses of popular apps provides insight into their functionality and suitability for various users. Below are discussions on Venmo, Cash App, and PayPal, highlighting what they do well and where they may fall short. Venmo

Strengths

* Venmo’s social aspect allows users to share payments in an engaging way. It is particularly popular among younger audiences for splitting bills or paying friends in a casual setting.

Weaknesses

* Venmo lacks robust security features compared to other platforms, and it is not suitable for business transactions beyond small amounts. Cash App

Strengths

* Cash App offers instant transfers and the ability to trade Bitcoin, enhancing its appeal for tech-savvy users. The Cash Card allows for easy in-store purchases, making it versatile.

Weaknesses

* Cash App may charge fees for certain transactions, and customer support has received mixed reviews, leading to user frustration in resolving issues. PayPal

Strengths

* With its long-standing reputation, PayPal offers extensive buyer protection and is widely accepted by merchants globally. It also provides options for sending money internationally.

Weaknesses

* PayPal can have higher transaction fees compared to other apps, especially for currency conversions, and some users find the interface less user-friendly compared to competitors.

User Feedback and Ratings

User feedback plays a crucial role in understanding the effectiveness of these apps. Reviews often highlight both positive experiences and areas for improvement. Venmo has received high ratings for its social features, often around 4.5 out of 5 stars, with users appreciating the ease of splitting bills. However, some express concerns about security. Cash App enjoys a similar rating, around 4.6 stars, with fans praising its fast transactions but noting issues with customer service.

PayPal holds a strong position with an average rating of about 4.4 stars; users appreciate its security and ease of use, but some cite high fees as a drawback.By exploring the strengths and weaknesses of these popular apps, along with user ratings, individuals can make informed choices tailored to their payment needs.

How to Choose the Right Free Credit Card Payment App

Selecting the right free credit card payment app can make a significant difference in how you manage transactions and streamline payments. With a plethora of options available, understanding what features and functionalities to prioritize is crucial for a satisfying experience.When choosing a credit card payment app, it’s essential to evaluate several key factors that cater to your specific needs. Below is a checklist that highlights important considerations to guide your selection process.

Checklist of Factors to Consider

Identifying the right free credit card payment app requires careful consideration of various factors. Each factor can impact usability, security, and overall satisfaction with the app. The following checklist serves as a useful guide:

- Security Features: Look for apps that offer encryption and fraud protection to ensure your transactions are safe.

- Transaction Fees: While the app may be free, be aware of any hidden fees associated with transactions.

- Integration Capabilities: Ensure the app can integrate smoothly with your existing business tools or accounting software.

- User Experience: A user-friendly interface can save time and reduce frustration during transactions.

- Customization Options: Check if the app allows you to personalize features to fit your business needs.

Device and Operating System Compatibility

Compatibility with various devices and operating systems is a critical aspect when selecting a credit card payment app. Many apps are designed for both iOS and Android platforms, ensuring widespread accessibility. Additionally, consider whether the app offers a web-based version for desktop use, which can enhance usability for businesses that prefer managing transactions from a computer. For example, a popular app may work seamlessly on smartphones and tablets but might not be optimized for all web browsers. Always check the app’s compatibility with your devices before making a decision.

Importance of Customer Support and User Community

Robust customer support and an active user community are vital for addressing any issues that may arise while using a free credit card payment app. Reliable customer support can provide assistance during critical transactions and help you navigate any challenges. A strong user community offers additional benefits, including shared experiences, troubleshooting tips, and insights into best practices. Many users find that engaging in forums or community groups can enhance their understanding of the app and improve their overall experience.

Having access to responsive customer support and a vibrant user community can significantly influence your satisfaction and effectiveness in using a credit card payment app.

Setting Up a Free Credit Card Payment App

Setting up a free credit card payment app is a straightforward process, enabling users to manage their financial transactions efficiently. With the increasing reliance on digital payments, having a user-friendly app can simplify payments, tracking expenses, and maintaining financial records. This guide will walk you through the steps involved in downloading and setting up your chosen app, ensuring a seamless experience from start to finish.

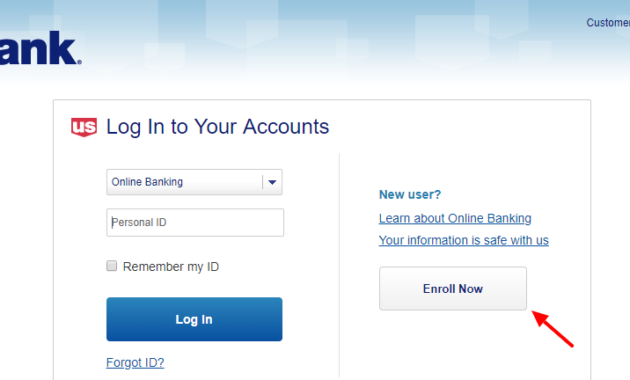

Step-by-Step Process for Downloading and Setting Up

To begin using a free credit card payment app, follow these essential steps. First, ensure your smartphone is compatible with the app you choose, as this can significantly affect functionality.

1. Download the App

Visit your device’s app store (Google Play Store for Android or Apple App Store for iOS). Search for the desired app by name and tap on the install button.

2. Open the App

Once the installation is complete, find the app on your device and open it. This typically involves an icon on your home screen or app drawer.

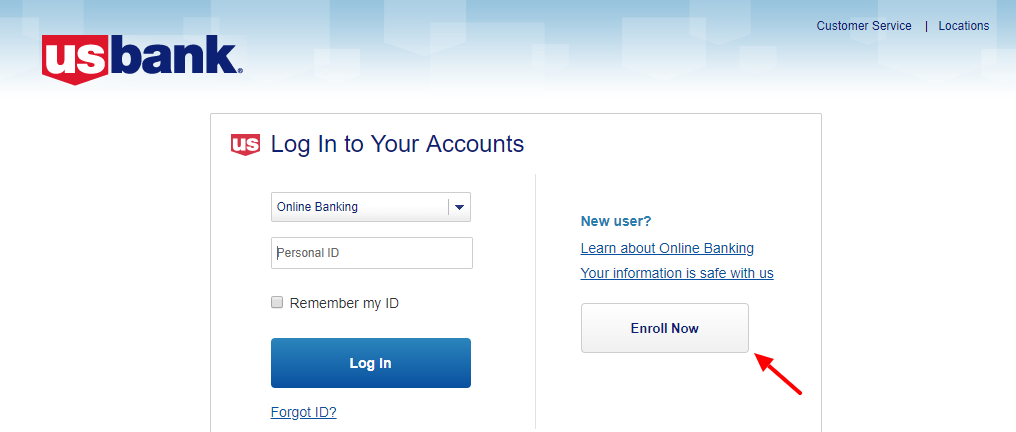

3. Create an Account

Follow the prompts to create a new account. You will typically need to provide an email address, create a password, and possibly verify your email.

4. Enter Personal Information

Most apps require you to input personal information such as your name, address, and phone number. This data is vital for account verification and security.

5. Link Your Credit Card or Bank Account

For transactions, you must securely link your credit card or bank account. This usually involves entering your card number and expiration date, as well as completing a verification step, such as a text message code sent to your phone.

6. Complete Verification Steps

After linking your payment methods, the app may require additional verification through a security question, a government-issued ID upload, or biometric data like a fingerprint or facial recognition.

Necessary Documentation and Verification Steps

During the setup process, specific documentation is typically required to ensure the security of your financial information and compliance with regulations. Here are the common verification steps to expect:

Identification

You may need to provide a government-issued ID, such as a driver’s license or passport, for identity verification.

Proof of Address

Some apps may request recent utility bills or bank statements displaying your name and address.

Social Security Number (SSN)

For certain services, especially those involving more substantial financial transactions, an SSN might be necessary for identity verification.

These documents are crucial for maintaining the integrity and security of your account and should be submitted through secure channels as directed by the app.

Securing Personal and Financial Information During Setup

Protecting your personal and financial information is paramount during the setup process. Here are some tips to enhance your security:

Use Strong Passwords

When creating your account, opt for a complex password that includes a mix of letters, numbers, and special characters. Avoid easily guessed information like birthdays.

Enable Two-Factor Authentication

If available, activate two-factor authentication (2FA) for an extra layer of security. This requires a second verification step, like a code sent to your phone, whenever you log in.

Check App Permissions

Before finalizing the setup, review the permissions the app requests. Make sure they align with the functionality required for the app’s purpose, and deny any unnecessary access.

Utilize Secure Connections

Always set up the app on a secure Wi-Fi connection. Avoid public Wi-Fi networks for sensitive transactions, as these can be less secure.

Following these steps ensures that you set up your credit card payment app effectively while keeping your information secure. The convenience of digital payments can significantly enhance your financial management when done correctly.

Advantages and Disadvantages of Using Free Payment Apps

Using free credit card payment apps offers convenience and accessibility, but it’s essential to weigh their benefits against potential drawbacks. These apps have gained popularity for their user-friendly interfaces and quick setup processes, allowing users to make transactions without hefty fees. However, understanding the limitations and hidden costs can help in making informed choices.One of the significant advantages of free payment apps is the absence of upfront costs, making them ideal for individuals or small businesses looking to manage expenses.

Moreover, many of these apps come equipped with features such as real-time transaction notifications, easy integration with bank accounts, and enhanced security measures to protect users’ information. However, it’s crucial to recognize the potential downsides that could impact user experience.

Comparison of Pros and Cons

When considering free credit card payment apps, it’s vital to understand both their benefits and drawbacks to make an informed decision. Here’s a breakdown of the pros and cons:

- Pros:

- No Transaction Fees: Many free apps offer zero transaction fees for basic services, making them cost-effective for users.

- User-Friendly Interface: These apps often feature intuitive designs, allowing users to navigate and complete transactions effortlessly.

- Instant Transfers: Users can enjoy immediate fund transfers, enhancing the speed of transactions compared to traditional banking methods.

- Accessibility: Free apps can be accessed from various devices, including smartphones and tablets, providing flexibility for users on the go.

- Cons:

- Hidden Fees: While advertised as free, some apps may charge for specific services, such as instant deposits or international transfers.

- Limited Features: Basic versions may lack advanced functionalities found in paid alternatives, which could affect user experience.

- Security Concerns: Some free apps may not offer the same level of security measures that paid services provide, leading to potential risks.

- Customer Support: Free apps often have limited customer support options, making it challenging for users to resolve issues promptly.

Potential Hidden Costs

Despite being marketed as free, users should be aware of possible hidden costs associated with these payment apps. Below are some common fees that can catch users off guard:

- Withdrawal Fees: While deposits may be free, withdrawing funds to a bank account can incur charges, especially for faster processing.

- Conversion Fees: Users making international transactions might face currency conversion fees that can significantly increase the overall cost.

- Inactivity Fees: Some apps charge fees if an account remains inactive for a specified period, which can be a surprise for casual users.

Scenarios Where Free Apps May Not Be Sufficient

There are specific situations in which relying solely on a free credit card payment app may not meet user needs effectively. For instance:

- High Volume Transactions: Businesses with a high volume of transactions might find the limitations of free apps insufficient, leading to delays or transaction failures.

- Advanced Features Required: Users needing advanced features such as analytics or integration with other business systems may find free apps lacking.

- Security Requirements: For businesses dealing with sensitive data, the security measures of free apps may not be robust enough to meet compliance standards.

Future Trends in Credit Card Payment Technology: Free Credit Card Payment App

The landscape of credit card payment technology continues to evolve rapidly, driven by advancements in digital innovation and changing consumer preferences. With the increasing adoption of mobile solutions and the rise of cryptocurrencies, the future of payment apps is set to transform the way transactions are conducted, making them more secure, convenient, and efficient.Emerging technologies are at the forefront of this transformation, promising to enhance user experience and security in payment solutions.

The integration of artificial intelligence (AI) and machine learning is expected to streamline fraud detection, analyze spending patterns, and enable personalized user experiences. Additionally, biometric authentication methods, such as fingerprint and facial recognition, are becoming more prevalent, providing an added layer of security to transactions.

Role of Mobile Wallets and Cryptocurrencies in Payment Solutions

Mobile wallets and cryptocurrencies are gaining traction as integral components of modern payment solutions. Mobile wallets, such as Apple Pay and Google Wallet, allow users to store their credit card information securely and make payments with just a tap of their devices. These wallets often incorporate various features that enhance user convenience, such as loyalty programs and transaction history tracking.Cryptocurrencies, like Bitcoin and Ethereum, are also starting to play a significant role in the payment landscape.

They offer decentralized and secure transaction options, which can be particularly appealing in regions with unstable financial systems. Some businesses are beginning to accept cryptocurrencies, reflecting a broader trend towards digital currencies in everyday transactions. The evolution of payment technology is likely to influence user behavior significantly. As payment methods become more flexible and integrated into daily life, consumers are expected to gravitate towards solutions that offer speed, security, and ease of use.

The shift towards contactless payments is a prime example, as users increasingly prefer quick and efficient transactions over traditional methods. Moreover, the integration of loyalty programs within mobile wallets is expected to enhance consumer engagement. Users will likely be more inclined to utilize payment apps that reward them for transactions, fostering a deeper connection with brands and services they frequent.

As technology continues to advance, the way consumers interact with payment solutions will adapt, paving the way for a more seamless and rewarding payment experience.

Tips for Maximizing Benefits from Free Credit Card Payment Apps

Using free credit card payment apps can greatly enhance your personal finance management. However, to truly reap the benefits, it’s essential to engage with these apps strategically. This section will provide actionable tips and insights to help you optimize their use for effective budgeting and expense tracking.

Utilizing App Features for Budgeting and Expense Tracking

Many free credit card payment apps come equipped with features designed to simplify budgeting and expense management. Leveraging these capabilities can help you maintain control over your finances. Here are key strategies to consider:

- Set Up Budget Categories: Most apps allow you to categorize your spending. Define categories such as groceries, entertainment, and utilities. Regularly review these categories to identify areas where you can cut back.

- Enable Spending Alerts: Activate notifications for spending limits or unusual transactions. This feature helps you stay informed and prevents overspending.

- Track Transactions in Real-Time: Use the app’s transaction tracking feature to monitor your spending as it happens. This immediate feedback can help you adjust your habits on the fly.

Integrating Payment Apps with Other Financial Tools

Maximizing the benefits of free credit card payment apps can also involve integration with other financial tools. This holistic approach ensures a comprehensive view of your finances. Consider these examples:

- Link to Personal Finance Software: Sync your payment app with popular personal finance software like Mint or YNAB (You Need A Budget). This integration allows for seamless tracking of all your financial activities in one place.

- Combine with Savings Apps: Integrating savings apps such as Acorns can help you round up transactions to save spare change. This not only streamlines saving but also enhances your overall financial health.

- Use with Investment Platforms: Some payment apps have features to invest directly. Combining these apps with platforms like Robinhood can facilitate easy investments from your spending habits.

“The key to effective financial management lies in understanding your spending habits and making informed adjustments.”

FAQ

Are free credit card payment apps safe to use?

Yes, most free credit card payment apps implement robust security measures, including encryption and two-factor authentication, to protect users’ data.

How do I know which app is best for my needs?

Consider factors such as user experience, compatibility, features, and customer support to determine which app best suits your requirements.

Can I use these apps internationally?

Some free credit card payment apps support international transactions, but it’s essential to check their policies and any associated fees.

Do I need a bank account to use a free credit card payment app?

While some apps may allow you to use them without a bank account, linking one typically enhances functionality and ease of transactions.

What should I do if I encounter issues with the app?

Most apps provide customer support options, including FAQs, chat support, or email assistance, to help resolve any issues.