get credit card payments sets the stage for this enthralling narrative, offering readers a glimpse into the intricate world of credit card transactions. Understanding how credit card payments operate is crucial for both businesses and consumers, as it Artikels the process that enables secure and swift transactions. From the parties involved to the various payment systems available, this exploration will illuminate the essential components that contribute to a seamless payment experience.

In this discussion, we will delve into the different types of credit card payment systems, the steps required to set up processing accounts, and the security measures necessary to protect both merchants and customers. Additionally, we will explore the fees associated with credit card transactions and how to enhance customer experiences through streamlined payment processes.

Understanding Credit Card Payments

Credit card payments are a fundamental component of modern commerce, allowing consumers to make purchases quickly and securely. By leveraging credit facilities offered by financial institutions, individuals can buy goods and services without immediate cash on hand, enhancing consumer convenience and stimulating economic activity.The process of credit card transactions involves several steps, ensuring that payments are processed efficiently and securely.

When a consumer uses a credit card for a purchase, the following sequence of events occurs:

1. Cardholder Initiates a Purchase The cardholder presents their credit card to the merchant, either physically or digitally.

2. Transaction Authorization The merchant’s point-of-sale system sends the transaction details to the payment processor, which connects to the cardholder’s bank.

3. Verification and Approval The cardholder’s bank verifies the details, checks available credit, and either approves or declines the transaction.

4. Completion of the Sale If approved, the merchant receives confirmation, the transaction is completed, and the amount is debited from the cardholder’s available credit.

5. Settlement The transaction amount is then settled between the merchant’s bank and the cardholder’s bank, with the merchant receiving payment minus transaction fees.

Parties Involved in a Credit Card Transaction

Understanding the roles of various parties involved in a credit card transaction is crucial for grasping how the payment system operates. Each party plays a significant role in ensuring the transaction is processed correctly and securely. The main parties involved include:

- Cardholder: The individual or business that owns the credit card and initiates the transaction.

- Merchant: The business or service provider that sells goods or services and accepts credit card payments.

- Acquirer: The bank or financial institution that processes credit card payments on behalf of the merchant, receiving and settling funds.

- Issuer: The bank or financial institution that issued the credit card to the cardholder, responsible for approving transactions and managing the cardholder’s credit account.

- Payment Processor: The intermediary that facilitates communication between the merchant’s bank and the cardholder’s bank to ensure the transaction is authorized and settled.

“Each party in a credit card transaction plays a vital role in ensuring a secure and efficient payment process.”

Types of Credit Card Payment Systems

Credit card payment systems have evolved significantly over the years, offering various methods for businesses and consumers to complete transactions. Understanding these systems can help merchants choose the right one for their operations, while also providing customers with seamless payment experiences. This section Artikels the different types of credit card payment systems, comparing in-person and online options, and highlighting mobile payment systems that accept credit cards.

Comparison of In-Person and Online Payment Systems

In-person payment systems allow customers to make purchases directly at the point of sale using a credit card. These systems typically involve card readers or terminals that process the transaction immediately. On the other hand, online payment systems facilitate transactions over the internet, allowing customers to enter their credit card information on a website or mobile app. Here’s a closer look at these systems:

- In-Person Payment Systems:

These systems are designed for face-to-face transactions, enhancing customer interaction.

Examples include:

- Card swipe terminals used in retail stores.

- Mobile Point-of-Sale (mPOS) systems like Square, which enable payments via tablets or smartphones.

- Online Payment Systems:

These systems provide convenience and accessibility for virtual purchases.

Examples include:

- E-commerce payment gateways such as PayPal, Stripe, and Authorize.Net.

- Checkout systems integrated into online stores that securely collect credit card information.

Mobile Payment Systems Accepting Credit Cards

Mobile payment systems have become increasingly popular, offering users the ability to make transactions conveniently using their smartphones. These systems often utilize near-field communication (NFC), allowing phones to communicate with payment terminals or through apps. The following are notable mobile payment systems that accept credit cards:

- Apple Pay:

Utilizes NFC technology for secure and quick payments at participating merchants.

- Google Pay:

Offers a seamless payment experience across devices and platforms, enabling users to pay in stores and online.

- Samsung Pay:

Compatible with a wide range of payment terminals, it uses both NFC and Magnetic Secure Transmission (MST) technology.

Setting Up Credit Card Payment Processing

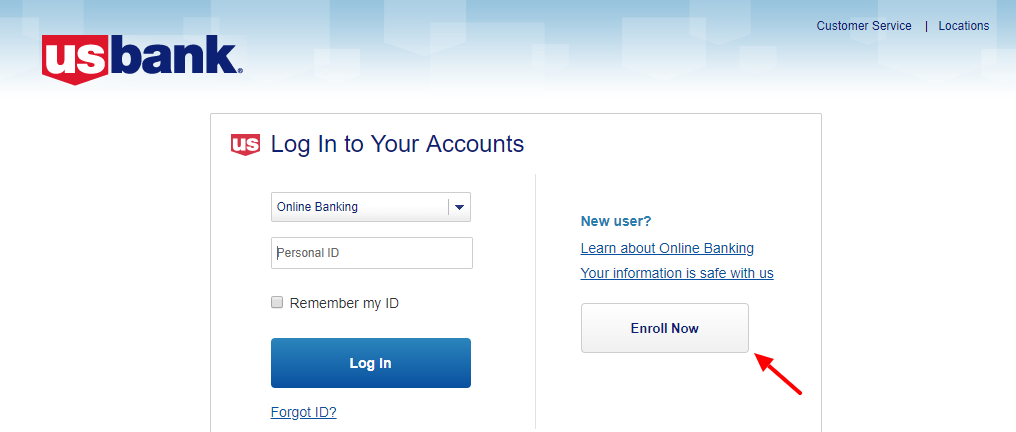

To effectively accept credit card payments, businesses need to establish a reliable payment processing system. This involves a series of important steps, from selecting a payment processor to gathering the necessary documentation. A well-set-up credit card payment processing account not only enhances customer service but also ensures secure transactions.The initial step in setting up credit card payment processing is to choose a suitable payment processor.

This choice impacts transaction fees, security measures, and integration capabilities with your existing systems. Once a processor is selected, certain documentation and prerequisites must be fulfilled to complete the setup.

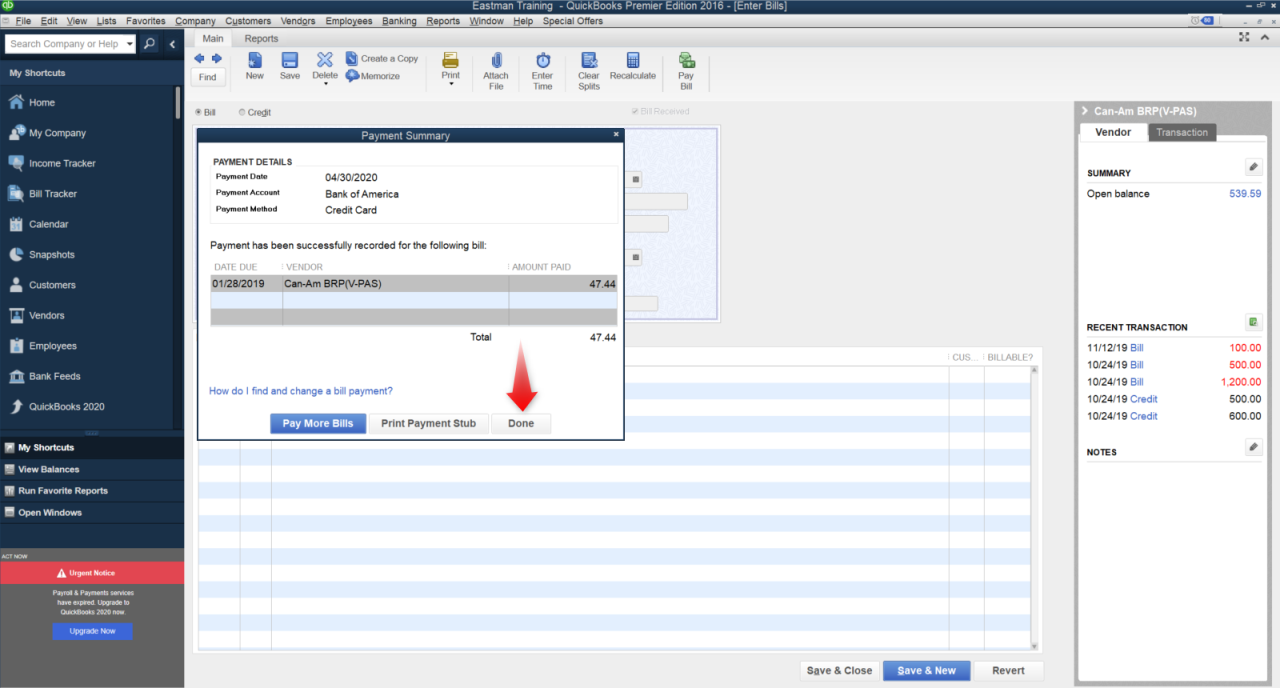

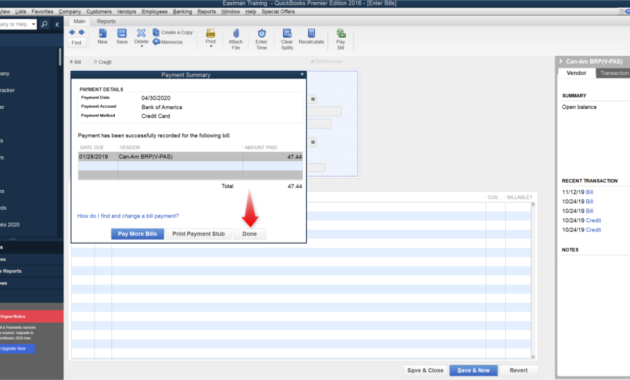

Steps to Set Up a Credit Card Payment Processing Account

Setting up a credit card payment processing account involves several key steps. Understanding these steps ensures a smooth transition into accepting credit card payments.

- Research and select a payment processor that aligns with your business needs and offers competitive rates.

- Gather required documentation, which typically includes business registration details, bank account information, and proof of identity.

- Complete the application process provided by the payment processor, ensuring all information is accurate to avoid delays.

- Set up the payment gateway, integrating it with your website or point of sale (POS) system as needed.

- Test the payment processing system to ensure transactions are processed correctly and securely.

- Start accepting payments and keep communication open with your payment processor for any ongoing support.

Required Documentation and Prerequisites, Get credit card payments

Before initiating the setup, certain documentation and prerequisites must be in place to comply with regulations and facilitate a smooth processing experience.

Documentation is critical for establishing your business’s credibility and ensuring compliance with payment processing standards.

The necessary documentation typically includes:

- Business license and registration information.

- Tax identification number (TIN) or Employer Identification Number (EIN).

- Bank account details for direct deposit of funds.

- Personal identification of the business owner or authorized signer.

- Business financial statements, which may include profit and loss statements.

Checklist of Features to Consider When Choosing a Payment Processor

Selecting the right payment processor is crucial for a seamless transaction experience. Here’s a checklist of features to keep in mind while evaluating different options.Consider the following features:

Choosing the right payment processor can significantly affect your operational efficiency and customer satisfaction.

- Transaction fees and structure, including flat fees, percentage rates, and any additional hidden costs.

- Integration capabilities with existing software, websites, or POS systems.

- Customer support availability, including responsiveness and problem-solving efficiency.

- Security features such as PCI compliance, encryption, and fraud detection systems.

- User interface and ease of use for both customers and staff during transactions.

- Reporting and analytics tools for tracking sales, chargebacks, and customer behavior.

- Support for multiple payment methods, including debit cards, digital wallets, and international currencies.

Security and Compliance in Credit Card Payments

In today’s digital economy, securing credit card transactions is paramount for businesses and consumers alike. With increasing incidents of data breaches and fraud, it is vital to understand the measures required to protect sensitive financial information during credit card payments. This section Artikels the importance of security in credit card transactions, the compliance standards that businesses must follow, and common security threats along with effective mitigation strategies.

Importance of Security in Credit Card Transactions

The security of credit card transactions is essential to maintain customer trust and protect financial data. A single data breach can lead to significant financial loss, not only for consumers but also for businesses that face penalties, lawsuits, and reputational damage. Implementing robust security measures is not just a compliance requirement; it’s a critical component of customer service and business integrity.

Secure transactions foster a safe shopping environment, encouraging more consumers to make purchases online without fear of fraud.

Major Compliance Standards

Compliance with industry standards is crucial for businesses involved in processing credit card payments. The most recognized standard is the Payment Card Industry Data Security Standard (PCI DSS), which Artikels security measures to protect cardholder data. Compliance with PCI DSS is mandatory for all businesses that accept credit card payments, regardless of size. Below are key compliance requirements businesses must adhere to:

- Secure Networks: Maintain secure systems and networks to protect cardholder data.

- Data Protection: Protect stored cardholder data to prevent unauthorized access.

- Access Control: Implement strong access control measures to limit access to cardholder data.

- Regular Monitoring: Monitor and test networks continuously to identify and mitigate security vulnerabilities.

- Security Policy: Develop and maintain a security policy that addresses information security for employees and contractors.

Common Security Threats and Mitigation Strategies

Various security threats can compromise credit card transactions, but understanding these threats allows businesses to implement effective mitigation strategies. Common threats include phishing attacks, malware, and data breaches. The following measures can significantly reduce the risk of these security threats:

- Employee Training: Regular training for employees on identifying phishing attempts and fraudulent activities.

- Encryption: Utilize strong encryption methods to protect sensitive data during transmission.

- Firewalls: Deploy robust firewalls to protect networks from unauthorized access.

- Regular Updates: Keep software and systems updated to defend against known vulnerabilities.

- Fraud Detection Tools: Implement advanced fraud detection and prevention tools to monitor transactions for suspicious activity.

“Data security is not just about technology; it is about protecting the trust that consumers place in businesses.”

By understanding and implementing effective security measures and compliance standards, businesses can safeguard credit card transactions and maintain customer trust in the ever-evolving digital landscape.

Fees and Charges Associated with Credit Card Processing: Get Credit Card Payments

Credit card processing involves a variety of fees that businesses need to account for when they accept card payments. Understanding these fees is crucial for managing costs effectively and ensuring the longevity of your business. The fees can vary significantly depending on the payment processor and the way transactions are handled.

Overview of Credit Card Processing Fees

Credit card processing fees can be categorized into several types, each impacting a business’s bottom line differently. Here’s a breakdown of the main fees associated with credit card processing:

- Transaction Fees: This is a fee charged by the payment processor for each transaction processed. It typically includes a fixed fee plus a percentage of the transaction amount. For example, a common structure might be $0.30 per transaction plus 2.9% of the sale amount.

- Interchange Fees: These fees are set by the card networks (Visa, MasterCard, etc.) and are paid to the card-issuing bank. Interchange fees are a significant portion of the total cost of credit card processing and can vary based on the type of card used and how the transaction is processed.

- Monthly Fees: Many payment processors charge a monthly fee for maintaining your account. This can vary widely based on the services offered, such as customer support or additional features like reporting tools.

- Chargeback Fees: If a customer disputes a charge, leading to a chargeback, processors often impose a fee. This can be around $15 to $25 per chargeback, adding another layer of cost to businesses.

- Gateway Fees: For online businesses, a payment gateway fee may apply, which is the fee for the service that processes credit card transactions over the internet. This can be charged as a flat monthly fee or per transaction.

Interchange Fees and Their Impact on Businesses

Interchange fees are a critical component of the credit card processing landscape. These fees are typically a percentage of the transaction amount, which can range from 1.5% to 3.5%, depending on the transaction type. The structure of these fees can significantly impact businesses, especially those with tight profit margins.

“The interchange fee structure often rewards certain types of transactions, such as those made with premium credit cards, which typically carry higher fees.”

This means businesses that frequently process high-value transactions or utilize specific card types may face increased costs. Understanding these nuances can help businesses negotiate better terms with their payment processors or adjust their pricing strategies accordingly.

Comparison of Payment Processor Cost Structures

Different payment processors offer varying cost structures, which can have substantial implications for businesses. When comparing options, consider the following aspects:

- Pricing Model: Payment processors typically offer three pricing models: flat-rate pricing, tiered pricing, and interchange-plus pricing. Flat-rate charges a single percentage for all transactions, while tiered pricing varies depending on transaction types. Interchange-plus tends to be more transparent, as it combines interchange fees with a fixed markup.

- Setup and Termination Fees: Some processors may charge setup fees to establish your account, while others might impose early termination fees if you decide to switch processors before the contract ends.

- Additional Features: Evaluate payment processors based on additional features they provide, such as fraud protection, analytics tools, and customer support. These may come at an extra cost but can offer value that justifies the fees.

Investing time in understanding and comparing these costs can lead to significant savings and improved profitability for your business in the long run.

Enhancing Customer Experience with Credit Card Payments

Creating a seamless payment experience is essential for businesses aiming to retain customers and encourage repeat purchases. Credit card payments, being one of the most popular payment methods, play a crucial role in this process. By optimizing the customer’s interaction with payment systems, businesses can significantly enhance satisfaction and increase conversion rates.A user-friendly payment interface can make a substantial difference in customer experience.

Customers appreciate simplicity and clarity during the payment process, which can be achieved through intuitive design. For example, a streamlined checkout page that minimizes the number of necessary fields can reduce friction, making it easier for customers to complete their transactions. Providing multiple payment options, such as digital wallets alongside credit card payments, also caters to a broader audience and adds convenience.

User-Friendly Payment Interfaces

To illustrate the importance of user-friendly payment interfaces, here are some key features that enhance usability:

- Minimalistic Design: A clean and straightforward layout prevents overwhelming customers. Fewer distractions mean focus remains on completing the purchase.

- Progress Indicators: Displaying steps in the payment process allows customers to know how far along they are, reducing anxiety associated with long forms.

- Mobile Optimization: With increasing mobile transactions, payment interfaces must be responsive, ensuring a smooth experience across all devices.

- Auto-fill Options: Implementing auto-fill features for returning customers speeds up the transaction process and enhances convenience.

Effective handling of payment-related customer inquiries is critical for maintaining trust and satisfaction. Customers often have questions regarding transaction statuses, refunds, or payment security. Here are some tips for addressing these concerns effectively:

Handling Payment-Related Inquiries

Proactive communication can greatly improve customer relations. Here are some strategies that businesses can utilize:

- 24/7 Support Availability: Offering round-the-clock support through chatbots or live agents ensures customers can get assistance whenever they need it.

- Clear FAQs: A well-organized FAQ section specifically covering payment issues can help customers find answers quickly without needing to reach out.

- Personalized Responses: Training customer service agents to respond to inquiries with empathy and personalized solutions can create a positive experience, even when issues arise.

- Follow-up Communication: After resolving an issue, reaching out to the customer to confirm satisfaction can reinforce the relationship and demonstrate commitment to service.

Enhancing the customer experience during credit card payments not only boosts satisfaction but also fosters loyalty and repeat business.

Trends and Innovations in Credit Card Payments

The landscape of credit card payments is continually evolving, driven by technological advancements and shifting consumer preferences. As we delve into the latest trends and innovations, it’s clear that the payment industry is undergoing significant changes that promise to enhance security, convenience, and overall customer experience.

Emerging Trends in Credit Card Payment Technologies

Today, several emerging trends are reshaping the credit card payment landscape, enhancing both merchant and consumer experiences. These include:

- Contactless Payments: The adoption of Near Field Communication (NFC) technology has enabled contactless transactions, allowing consumers to tap and pay. This trend surged during the pandemic, as it minimizes physical contact and speeds up the checkout process.

- Mobile Wallets: Services like Apple Pay and Google Pay are steadily increasing in popularity, allowing users to store multiple payment methods in one app. Integration with loyalty programs further enhances their appeal.

- Tokenization: This approach replaces sensitive credit card information with a unique identifier or token. It significantly enhances security by ensuring that actual card details are not transmitted during transactions.

- Artificial Intelligence: AI is being utilized to detect fraudulent activity and improve customer service. Chatbots, powered by AI, assist users with payment issues in real-time, streamlining the resolution process.

Impact of Cryptocurrencies on Traditional Credit Card Payments

Cryptocurrencies are making waves in the financial sector, affecting how credit card payments are processed. Major credit card networks are beginning to integrate crypto transactions, allowing users to pay for goods and services using digital currencies.

This integration is noteworthy as it offers several benefits:

- Lower Transaction Fees: Cryptocurrency transactions can often bypass traditional banking fees, making them more appealing to both consumers and merchants.

- Enhanced Security: Cryptocurrencies utilize blockchain technology, which provides a secure framework for transactions, reducing the risk of fraud.

- Global Accessibility: Digital currencies are borderless, making international transactions quicker and often more cost-effective.

Future of Credit Card Payment Systems

Looking ahead, the future of credit card payment systems appears promising, with several trends poised to gain traction. Innovations such as biometric authentication and enhanced fraud detection capabilities are likely to become mainstream.

Additionally, the integration of Internet of Things (IoT) devices with payment systems is expected to create new avenues for transactions. For instance, smart appliances may facilitate payments directly, transforming traditional shopping experiences.

“The future of credit card payments lies not just in technology but in the seamless integration of various payment methods that prioritize user experience.”

As we observe these advancements, it becomes increasingly clear that the credit card payment industry is not merely adapting; it is innovating in ways that promise to redefine how consumers and businesses engage with their finances.

Common Queries

What is a credit card payment?

A credit card payment is a transaction where a consumer uses a credit card to purchase goods or services, which involves a process of authorizing and processing the transaction through various intermediaries.

How long does it take for credit card payments to process?

The processing time for credit card payments can vary, typically taking a few seconds to several days depending on the payment processor and the type of transaction.

Do I need a special account to accept credit card payments?

Yes, you will need a merchant account to accept credit card payments, which allows you to process transactions and receive funds from credit card sales.

What security measures should I consider for credit card payments?

Key security measures include using encryption technologies, securing your payment gateway, and complying with PCI DSS standards to protect sensitive customer information.

Are there alternatives to traditional credit card payments?

Yes, alternatives include digital wallets, mobile payment apps, and even cryptocurrency options, which are gaining popularity among consumers.