Mobile payments apps have swiftly transformed the way we handle financial transactions, making everyday purchases more convenient and efficient. With the rise of technology, these apps have evolved from simple digital wallets to comprehensive platforms that support a variety of payment methods, including peer-to-peer transactions and integrated banking services.

As we explore mobile payments apps, we uncover their significance in today’s economy, the diverse types available, and the security measures that protect users. The increasing adoption of these apps highlights their growing role in commerce and personal finance, making it essential to understand their functionality and the challenges they face.

Overview of Mobile Payments Apps

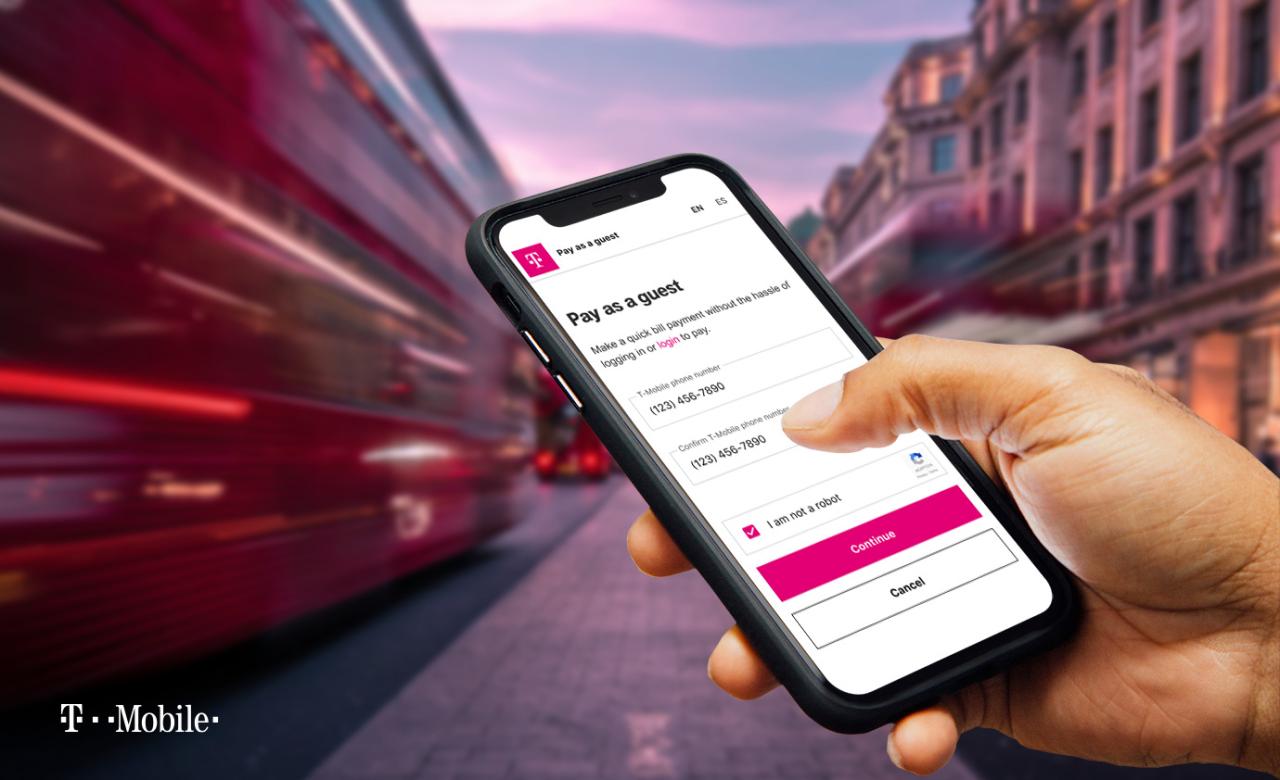

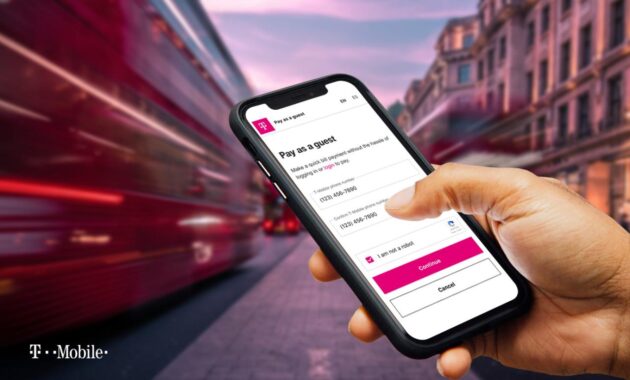

Mobile payment apps have transformed the way consumers handle transactions, allowing for quick, convenient, and secure payment methods through smartphones and other mobile devices. With the rise of digital wallets and contactless technology, these apps enable users to make purchases, transfer money, and manage their finances seamlessly—all from the palm of their hands.The evolution of mobile payment technologies has been significant over the years.

Starting from simple SMS-based payments to the introduction of Near Field Communication (NFC) technology, mobile payments have adapted to consumer needs and innovations in technology. Early mobile payment methods depended heavily on carrier billing, while modern solutions such as Apple Pay, Google Pay, and others leverage advanced encryption and biometric authentication to enhance security and user experience. This progression reflects a growing reliance on mobile devices and the internet, reshaping how transactions are conducted globally.

Significance of Mobile Payments in Today’s Economy

Mobile payments have become a crucial component of the modern economy, offering numerous benefits to both consumers and businesses. The rapid adoption of mobile payment solutions demonstrates their importance in enhancing transaction efficiency and customer satisfaction. Key factors contributing to their significance include:

- Increased Convenience: Mobile payment apps allow users to conduct transactions anytime and anywhere, reducing the friction often associated with traditional payment methods. Users can pay bills, purchase items, or send money to friends with just a few taps on their devices.

- Enhanced Security: With features such as biometric authentication and tokenization, mobile payment apps provide a higher level of security compared to cash or card transactions, helping to protect sensitive financial information.

- Boosting Economic Activity: The ease of mobile transactions encourages consumer spending, which can lead to increased sales for businesses, ultimately stimulating economic growth.

- Financial Inclusion: Mobile payment solutions are particularly empowering for underserved populations who may lack access to traditional banking services, allowing them to participate in the digital economy.

The integration of mobile payment systems into retail environments has also changed consumer shopping behaviors. Many businesses are adopting these technologies not only to cater to tech-savvy customers but also to streamline their operations. For instance, restaurants and retail stores are increasingly offering contactless payment options to speed up checkout times and enhance customer experiences.

“The future of payments is mobile; as technology continues to advance, consumer expectations will further drive the adoption of mobile payment solutions.”

In summary, mobile payments are not just a trend but a fundamental shift in how transactions are conducted globally. Their growing prevalence highlights the importance of technology in everyday financial activities, shaping the landscape of commerce in the 21st century.

Types of Mobile Payments Apps

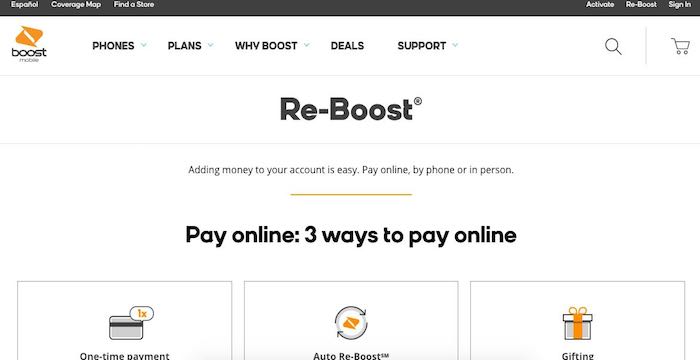

Mobile payments apps have transformed the way we handle financial transactions, making payments seamless, efficient, and often more secure. These apps come in various forms, each designed to cater to different needs and user preferences. Understanding the types of mobile payment apps can help users select the right one for their lifestyle and financial habits.Different types of mobile payment apps include digital wallets, peer-to-peer (P2P) payment apps, and specialized payment solutions for businesses.

Each category has unique features that affect the user experience and functionality.

Digital Wallets

Digital wallets are applications that allow users to store payment information securely and make transactions without using physical cards. These apps often integrate various payment methods, including credit and debit cards, bank accounts, and sometimes cryptocurrencies. A notable feature of digital wallets is their ability to store coupons, loyalty cards, and tickets, enhancing the overall user experience.

Peer-to-Peer Payments

Peer-to-peer payment apps enable users to send and receive money directly between individuals, often requiring only an email address or phone number. These platforms focus on convenience for transactions among friends and family, making splitting bills and sending gifts a breeze. Many P2P apps also provide instant transfers, which makes them highly appealing for quick transactions.

Comparison of Popular Mobile Payments Apps

When comparing mobile payment apps, factors such as transaction fees, supported platforms, and additional features play a significant role in user satisfaction. Below is a comparative table summarizing key features of various popular mobile payment apps:

| App Name | Type | Key Features | Supported Platforms |

|---|---|---|---|

| PayPal | Digital Wallet/P2P | International transfers, buyer protection, linked bank accounts | iOS, Android, Web |

| Venmo | P2P | Social payment features, instant transfers, linked debit cards | iOS, Android |

| Apple Pay | Digital Wallet | In-store payments, online transactions, loyalty card integration | iOS |

| Google Pay | Digital Wallet | Contactless payments, rewards programs, online shopping | Android, iOS |

| Cash App | P2P | Direct deposit, Bitcoin trading, cash card feature | iOS, Android |

The choice of a mobile payment app often depends on the specific needs of the user, such as whether they prioritize ease of use, transaction rates, or additional features like cryptocurrency support. With the growing trend towards cashless transactions, understanding the different types of mobile payment apps and their features can help users make informed decisions.

Security Features in Mobile Payments Apps

Mobile payments apps have become a fundamental part of the financial landscape, allowing users to conduct transactions swiftly and conveniently. However, with the rise of mobile payment technologies comes the critical concern for security. Users must trust that their financial information is safe from theft and fraud. This section delves into the security measures that mobile payment apps implement to protect users, the common vulnerabilities faced in this digital arena, and best practices for enhancing security.

Security Measures in Mobile Payments Apps

Mobile payment apps utilize a range of sophisticated security features to safeguard user data and transactions. These measures include encryption protocols, biometric authentication, and tokenization. Encryption is a primary defense mechanism that scrambles user data into an unreadable format during transmission. This ensures that even if data is intercepted, it remains protected. Biometric authentication, such as fingerprint or facial recognition, adds an additional layer of security.

This method ensures that only authorized users can access their accounts and authorize transactions, significantly reducing the potential for unauthorized access.Tokenization replaces sensitive information with unique identification symbols or tokens that retain essential information without compromising security. For instance, when making a transaction, the actual credit card number is never shared with the merchant; instead, a token is used, minimizing the risk of data breaches.

Common Vulnerabilities and Mitigation Strategies

Despite robust security measures, mobile payments are not immune to vulnerabilities. Some common issues include phishing attacks, malware, and unsecured public Wi-Fi networks. Phishing attacks involve attempts to deceive users into providing personal information through fake emails or messages. To combat this, mobile payment apps often educate users on identifying legitimate communications and encourage them to enable two-factor authentication, adding a second layer of verification.Malware can infiltrate mobile devices, capturing sensitive information.

Regular updates and using apps from reputable sources are crucial in mitigating this threat. Mobile payment apps frequently release updates to patch vulnerabilities and enhance security protocols.Unsecured public Wi-Fi networks pose another significant risk, as they can be exploited by cybercriminals to intercept transactions. Users are typically advised to avoid conducting financial transactions over public networks or to utilize a virtual private network (VPN) for added security.

Best Practices for Users to Enhance Security

Users can take proactive steps to enhance their security when using mobile payment apps. Implementing these best practices can significantly reduce the risk of unauthorized transactions or data breaches.Regularly updating the mobile payment app and the device’s operating system ensures that all security features are current and weaknesses are addressed. Enabling two-factor authentication where available adds an extra layer of protection, requiring not just a password but also a verification code sent to the user’s device.Using strong, unique passwords for each app minimizes the risk of account takeovers.

Password managers can assist in generating and storing complex passwords securely.Being cautious about downloading apps and only using trusted sources, such as official app stores, helps prevent malware infections. Lastly, users should monitor their account activity regularly and report any suspicious transactions immediately, allowing for swift action in the event of fraud.

“Security in mobile payments is not just about technology, but also about user awareness and proactive measures.”

User Adoption and Market Trends

The rapid evolution of technology has significantly influenced how consumers handle their finances, with mobile payments apps at the forefront of this transformation. Factors such as convenience, security, and the growing reliance on smartphones drive the widespread adoption of these apps among users. The increase in mobile payments usage is fueled by various elements ranging from the proliferation of smartphones to the enhancement of digital infrastructure.

As more consumers feel comfortable with online transactions, the trend towards mobile payments is becoming increasingly pronounced. Factors contributing to this adoption include designated user-centric features, seamless transaction processes, and the overarching trend towards cashless societies.

Factors Driving User Adoption

Understanding the elements that persuade consumers to embrace mobile payments is crucial for predicting market trends. Several key factors influence user adoption:

- Convenience: Mobile payments allow users to make transactions quickly and effortlessly, eliminating the need for physical cash or cards.

- Security: Innovations in security features, such as biometric authentication and encryption technologies, enhance consumer trust in mobile payment systems.

- Incentives: Many apps offer rewards, discounts, or cashback incentives, motivating users to choose mobile payments over traditional methods.

- Ubiquity of Smartphones: As smartphone ownership continues to rise globally, more people have access to mobile payment options, increasing overall usage.

- COVID-19 Pandemic: The push towards contactless transactions during the pandemic accelerated the acceptance and integration of mobile payments in daily life.

Current Market Trends

The mobile payments landscape is continuously evolving, showcasing a range of trends that indicate its future trajectory. Current market trends include:

Increased Adoption of Contactless Payments More merchants are equipping their payment systems with contactless technology, facilitating faster checkouts.

Integration of Digital Wallets Services like Apple Pay, Google Pay, and various banking apps are incorporating features that allow users to store multiple payment methods in one location.

Emergence of Cryptocurrencies As cryptocurrencies gain traction, mobile payments apps are beginning to integrate these digital currencies, allowing users to transact in new ways.

Expanding into Emerging Markets Companies are focusing on developing markets where mobile payment adoption is still growing, tapping into new user bases.

Enhanced Customer Experience Businesses are focusing on offering personalized services through mobile payment apps, tailoring user experiences to increase engagement.

Growth of Mobile Payment Transactions

The growth of mobile payment transactions has been significant over the past few years, reflecting the increasing user adoption and market potential. The following chart Artikels the projected growth in mobile payments:

| Year | Global Mobile Payment Transactions (in billions) |

|---|---|

| 2020 | 3,000 |

| 2021 | 4,500 |

| 2022 | 6,000 |

| 2023 | 8,000 |

| 2024 (Projected) | 10,500 |

“The mobile payments market is projected to reach $10 trillion by 2025, emphasizing the significant shift towards digital wallets and cashless transactions.”

Integration with Other Financial Services

Mobile payment apps have transformed the way consumers and businesses conduct transactions by seamlessly integrating with various banking and financial services. This integration not only enhances user experience but also streamlines financial operations for both individuals and merchants. As mobile payments become increasingly prevalent, their ability to connect with other financial platforms is essential in fostering a cohesive digital financial ecosystem.Mobile payments play a crucial role in e-commerce and retail settings.

They allow for instant transactions that facilitate quick checkouts, reducing cart abandonment rates and enhancing overall customer satisfaction. Consumers today prefer the convenience of paying via their smartphones rather than traditional payment methods. Furthermore, mobile payment apps often provide features such as digital wallets, loyalty programs, and transaction tracking, making them appealing to both consumers and merchants.

Benefits of Integrating Mobile Payments with Other Financial Platforms

Integrating mobile payment apps with other financial services offers a range of advantages that can significantly improve the user experience and operational efficiency. These benefits include:

- Enhanced User Convenience: Users can manage their finances in one place, consolidating payments, budgeting tools, and account information.

- Improved Transaction Speed: Transactions are processed quickly, allowing for real-time payments and reducing wait times.

- Increased Security: Integration with banking services often includes advanced security features, such as two-factor authentication and fraud detection, protecting users from unauthorized transactions.

- Access to Financial Products: Users can easily access loans, credit lines, and investment opportunities directly from their mobile payment app.

- Streamlined Accounting: Businesses benefit from automated transaction recording, simplifying financial reporting and tax preparation.

“Integrating mobile payment solutions with banking services not only facilitates easier transactions but also enhances financial management for users.”

Businesses that adopt integrated mobile payment solutions often report increased customer loyalty and sales. For instance, companies like Starbucks have successfully integrated their loyalty programs with their mobile payment app, resulting in high user engagement and repeat business. Similarly, platforms like PayPal allow users to shop on various e-commerce sites with a single login, streamlining the purchasing process across different merchants.

Challenges Facing Mobile Payments Apps

Mobile payments apps have transformed how we conduct transactions, but they are not without their hurdles. The rapid growth of this technology has brought about various challenges that stakeholders must address to ensure seamless user experiences and secure transactions. Understanding these challenges is crucial for improving mobile payment systems and fostering user trust.One of the primary challenges facing mobile payments apps is the regulatory environment, which can vary significantly from one jurisdiction to another.

Companies must navigate a complex web of laws and guidelines that govern financial transactions, consumer protection, and data security. Compliance with these regulations not only requires significant financial resources but also expertise in legal matters.

Regulatory Hurdles and Compliance Issues

The regulatory landscape for mobile payments is continuously evolving, which can create obstacles for app developers and providers. Key issues include:

- Licensing Requirements: Many regions require mobile payment providers to obtain specific licenses to operate legally. The process can be time-consuming and costly, impacting market entry for new players.

- Consumer Protection Laws: Regulations aimed at protecting consumers can impose strict guidelines on how payment data must be handled and reported, creating challenges in operational compliance.

- Cross-Border Transactions: International mobile payment solutions face additional complications due to varying regulations in different countries, which may lead to transaction delays or restrictions.

The risk of regulatory non-compliance can lead to significant penalties, including fines or the suspension of business operations, making it imperative for mobile payment apps to stay informed and adaptable.

User Concerns Regarding Privacy and Data Handling, Mobile payments apps

User trust is an essential component of the success of mobile payments apps. However, privacy concerns pose a significant barrier to adoption. Users are increasingly aware of how their data is collected, stored, and utilized. Common concerns include:

- Data Breaches: High-profile data breaches have made users wary of sharing their personal and financial information, increasing the demand for robust security measures.

- Data Sharing Practices: Users often fear that their information may be sold or shared with third parties without their consent, leading to potential misuse of personal data.

- Lack of Transparency: Many users are uncertain about how their data is managed, which can lead to mistrust in the mobile payment platform.

To address these concerns, mobile payment developers must implement strong data protection measures and maintain transparency about their data handling practices. By prioritizing user privacy and security, mobile payments apps can enhance user confidence and drive adoption in a competitive market.

“User trust is vital; without it, mobile payment apps struggle to gain traction in the market.”

Future of Mobile Payments Technology

As mobile payments continue to reshape the financial landscape, several emerging technologies hold the potential to influence their evolution significantly. Innovations like blockchain and artificial intelligence (AI) are expected to enhance security, efficiency, and user experience. This section explores these technologies and anticipates the innovative features that could soon become standard in mobile payment applications.

Emerging Technologies Impacting Mobile Payments

Blockchain technology, known for its decentralization and transparency, is anticipated to enhance the security of mobile payments by providing a tamper-proof method of recording transactions. This technology can reduce fraud and increase trust among users. AI, on the other hand, is poised to personalize payment experiences and enhance security through advanced fraud detection algorithms. As these technologies evolve, they will likely lead to more efficient payment processing, reduced transaction times, and lower fees.

Innovative Features Anticipated in Upcoming Releases

The next generation of mobile payment applications is expected to integrate several innovative features that enhance user experience and security. Notable potential features include:

- Biometric Authentication: Advanced biometric capabilities such as facial recognition or fingerprint scanning could become commonplace, providing an additional layer of security beyond traditional passwords.

- Instant Cross-Border Transactions: Leveraging blockchain, users might soon enjoy near-instantaneous international payments with reduced fees, democratizing access to global commerce.

- AI-Driven Personalization: Utilizing AI algorithms to analyze user behavior can help in delivering customized offers and promotions, enhancing engagement and customer satisfaction.

- Integrated Loyalty Programs: Future apps may seamlessly integrate loyalty programs, allowing users to earn and redeem rewards in real-time during transactions.

Roadmap for Future Development of Mobile Payments Apps

To stay relevant in the fast-evolving mobile payments sector, developers and businesses should consider a strategic roadmap emphasizing innovation and user-centric features. This roadmap may include the following phases:

- Phase 1: Infrastructure Upgrade

-Invest in robust infrastructure to support advanced technologies like blockchain and AI, ensuring a secure and scalable platform for future enhancements. - Phase 2: User Experience Enhancement

-Focus on intuitive design and seamless integration with other financial services to promote user adoption and retention. - Phase 3: Regulatory Compliance

-Stay updated with evolving regulations around digital payments and data security to maintain compliance and trust with users. - Phase 4: Continuous Innovation

-Foster a culture of innovation by regularly updating features and exploring partnerships with fintech companies to bring cutting-edge technologies to the platform.

Innovation in mobile payments will not only streamline financial transactions but also open new avenues for engagement and commerce.

User Queries

What are mobile payments apps?

Mobile payments apps are software applications that allow users to make financial transactions using their smartphones or tablets, including payments for goods and services.

How secure are mobile payments apps?

Mobile payments apps utilize various security measures, such as encryption, biometric authentication, and tokenization, to protect users’ financial information.

Can I use mobile payments apps internationally?

Many mobile payments apps support international transactions, but availability and fees can vary depending on the app and the countries involved.

Are mobile payments apps free to use?

While some mobile payments apps are free, others may charge fees for certain transactions or services, so it’s important to check the app’s terms.

What should I do if I encounter a problem with a mobile payments app?

If you face issues, you should contact the app’s customer support or help center for assistance and troubleshooting.