Mobile payments with stripe have revolutionized the way we conduct transactions today, making payments faster and more convenient than ever. With the rapid growth of mobile payment technologies, consumers and businesses alike are reaping the benefits of a seamless payment experience. From the ability to pay with just a tap to the enhanced security features that protect sensitive information, mobile payments have transformed traditional methods into a streamlined process that meets the demands of a fast-paced world.

As digital wallets and mobile transactions gain traction, Stripe emerges as a leading player in this space, providing flexible solutions that cater to various needs. With its robust features and user-friendly interface, Stripe not only simplifies payment processing but also empowers businesses to thrive in the competitive fintech landscape.

Overview of Mobile Payments

Mobile payments represent a transformative shift in how consumers conduct transactions, leveraging smartphones and other mobile devices to facilitate payments quickly and efficiently. This technology allows users to send or receive money, make purchases, and manage transactions directly from their handheld devices, enhancing convenience and accessibility.In recent years, mobile payments have experienced remarkable growth. According to industry reports, global mobile payment transaction volume is projected to reach trillions of dollars by 2025, underscoring the increasing reliance on mobile technology.

This surge can be attributed to the proliferation of smartphones, improvements in security protocols, and the rise of contactless payment systems, which have made mobile payments an attractive option for consumers and businesses alike.

Benefits of Mobile Payments for Consumers and Businesses

Mobile payments offer several advantages that enhance the purchasing experience for consumers and streamline operations for businesses. Here are key benefits that highlight the significance of adopting mobile payment solutions:

- Convenience: Consumers can make purchases anytime and anywhere. Mobile payments simplify the checkout process, eliminating the need for cash or physical cards.

- Speed: Transactions are processed quickly, reducing wait times at points of sale. This efficiency can lead to increased customer satisfaction and loyalty.

- Security: Mobile payment systems utilize advanced encryption and tokenization methods, which reduce the risk of fraud. Many platforms also offer biometric authentication options, like fingerprint or facial recognition.

- Budget Management: Many mobile payment apps provide tracking features that help users monitor their spending habits, making financial management easier.

- Contactless Options: During the COVID-19 pandemic, the demand for contactless payments surged as consumers preferred safer transaction methods, leading to greater adoption of mobile wallets.

Businesses benefit from mobile payments through improved transaction efficiency and enhanced customer engagement. With the integration of mobile payment solutions, businesses can offer loyalty programs, discounts, and tailored marketing campaigns directly to consumers’ devices, fostering a more personalized shopping experience.

“The rapid growth of mobile payments signifies a fundamental change in consumer behavior, driven by convenience and security.”

Introduction to Stripe: Mobile Payments With Stripe

Stripe is a leading payment processor known for its robust features and user-friendly interface. Founded in 2010 by brothers Patrick and John Collison, Stripe has transformed the way businesses manage online payments, providing a seamless transaction experience for both merchants and customers. With a strong focus on developers, Stripe offers a suite of tools that enable easy integration of payment systems into websites and mobile applications.The journey of Stripe in the fintech landscape is remarkable.

Initially, it started as a simple payment gateway to help startups accept payments online. Over the years, it has evolved into a comprehensive financial platform that supports a variety of payment methods, including credit cards, digital wallets, and bank transfers. As of 2023, Stripe powers millions of businesses in over 120 countries, solidifying its position as one of the top choices for online payment processing.

Features and Capabilities of Stripe

Stripe boasts a wide array of features that cater to different business needs. Its API is renowned for being easy to use, allowing developers to implement payment solutions quickly and efficiently. The following highlights key features that make Stripe a favorite among businesses:

- Global Support: Stripe supports multiple currencies, enabling businesses to operate internationally with ease.

- Customizable Payment Flow: It offers tailored solutions that allow businesses to create a unique checkout experience for their users.

- Advanced Security: Stripe utilizes strong encryption and compliance measures, such as PCI DSS, to protect customer data during transactions.

- Analytics and Reporting: The platform provides detailed insights and reporting features, helping businesses track their sales and optimize their operations.

- Subscription Management: Stripe has built-in tools for managing recurring billing, making it ideal for SaaS and subscription-based businesses.

The impact of Stripe on mobile payments cannot be overstated. By simplifying the payment process and offering innovative solutions like mobile wallets and one-click payments, Stripe has paved the way for enhanced customer experiences. Companies like Lyft, Shopify, and Amazon use Stripe to manage their payment processes, demonstrating its reliability and scalability in handling high transaction volumes.

“Stripe’s seamless integration allows businesses to focus more on growth rather than worrying about payment infrastructure.”

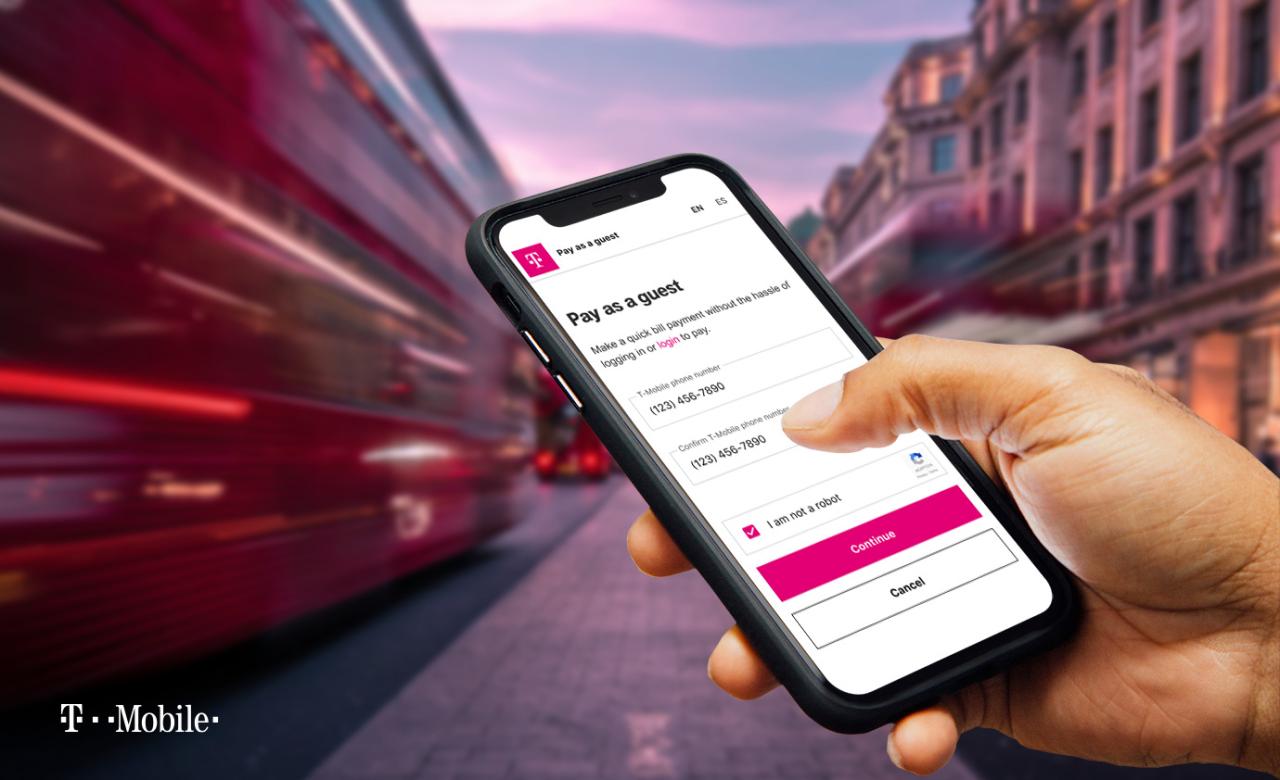

Setting Up Mobile Payments with Stripe

Establishing mobile payments through Stripe can significantly enhance the user experience for your application or website. This section Artikels the essential steps for creating a Stripe account, integrating it with your platform, and highlights the programming languages and frameworks that work seamlessly with Stripe.

Creating a Stripe Account

To begin using Stripe, the first step is to create an account. This process is straightforward and requires basic information from you. Here’s how to do it:

- Visit the Stripe website and click on the “Start now” button.

- Fill in the necessary details, including your email address, full name, and a secure password.

- Verify your email address through the confirmation link sent to your inbox.

- Log in to your account and complete the onboarding process by providing business details such as your business name, type, and address.

- Link your bank account to enable fund transfers.

Once your account is set up, it can take a few minutes for your account to be approved.

Integrating Stripe with Applications or Websites

Integrating Stripe into your mobile app or website is a critical step to enable seamless payment processing. Stripe offers various integration methods that cater to different needs. Below are the key steps to accomplish this integration:

- Choose an integration method, such as Stripe’s API, pre-built checkout, or Stripe Elements, based on your needs.

- Obtain your API keys from the Stripe dashboard which you will need for the integration.

- Implement the Stripe library in your code by following the documentation specific to your chosen method.

- Set up payment intents to manage the payment workflow.

- Test your integration using Stripe’s test mode to ensure everything works as anticipated before going live.

Implementing these steps will allow you to facilitate secure and efficient mobile payment transactions.

Programming Languages and Frameworks Compatible with Stripe

Stripe supports a wide variety of programming languages and frameworks, making it versatile for developers. Here are some of the most notable ones:

- JavaScript (Node.js)

- Python

- Ruby

- PHP

- Java

- Go

Additionally, popular frameworks such as React, Angular, and Django have libraries that simplify the integration process with Stripe. This compatibility ensures that developers can use their preferred tools and technologies while implementing Stripe’s functionalities.

“Stripe provides comprehensive documentation and SDKs to assist developers in creating a robust payment processing solution.”

Features of Stripe for Mobile Payments

Stripe is a powerful tool for businesses looking to streamline their mobile payment processes. With its extensive range of features, Stripe caters to various payment methods, prioritizing security, and offers competitive fees compared to other payment processors. This section delves into the key features, highlighting how they enhance the mobile payment experience for both merchants and customers.

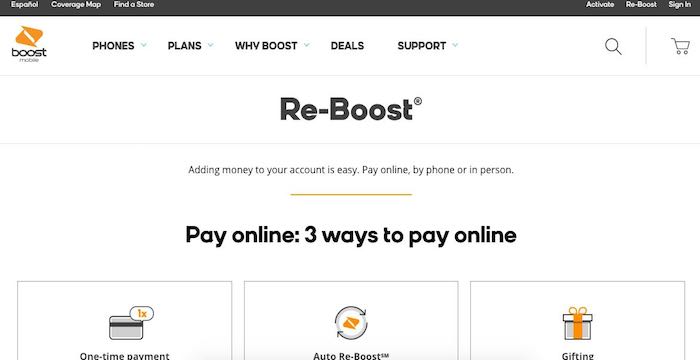

Supported Payment Methods

Stripe supports a diverse array of payment methods, making it easier for businesses to cater to customers’ preferences. The variety of options ensures that customers can complete transactions seamlessly, which is crucial for mobile payment success. Here are the key payment methods supported by Stripe:

- Credit and Debit Cards: Stripe accepts major credit and debit cards, including Visa, MasterCard, American Express, and Discover. This feature ensures broad accessibility for users.

- Digital Wallets: Stripe integrates with popular digital wallets like Apple Pay and Google Pay, allowing customers to make quick payments using their mobile devices.

- Bank Transfers: Businesses can facilitate bank transfers directly through Stripe, providing an alternative for users who prefer not to use cards.

- Local Payment Methods: Stripe supports regional payment methods, like SEPA Direct Debit in Europe and Alipay in China, enhancing its global reach.

Security Features and Fraud Protection

Security is paramount in mobile payments, and Stripe excels in providing robust security features to protect both merchants and customers. Stripe employs various technologies and practices to minimize the risk of fraud and ensure safe transactions. Some notable security features include:

- PCI Compliance: Stripe is certified as a PCI Service Provider Level 1, the highest level of certification, ensuring stringent protection of cardholder data.

- Encryption: Sensitive data is encrypted with AES-256 encryption, safeguarding it during transmission and storage.

- Fraud Detection: Stripe’s machine learning algorithms analyze transactions in real-time to identify and flag potentially fraudulent activities, reducing the likelihood of chargebacks.

- Two-Factor Authentication: For added security, Stripe offers two-factor authentication for merchants, ensuring that only authorized users can access their accounts.

Comparison of Stripe’s Fees with Other Payment Processors

When selecting a payment processor, understanding the fee structure is crucial for managing costs effectively. Stripe offers competitive pricing, which can be advantageous for businesses of all sizes. The standard fee for Stripe is 2.9% + 30¢ per successful card charge. However, this can vary depending on the payment method and country. Here’s how Stripe’s fees stack up against other popular payment processors:

| Payment Processor | Standard Fee |

|---|---|

| Stripe | 2.9% + 30¢ |

| PayPal | 2.9% + 30¢ |

| Square | 2.6% + 10¢ |

| Authorize.Net | 2.9% + 30¢ + monthly fee |

The comparison illustrates that while Stripe’s fees are comparable to other platforms, its absence of monthly fees and transparent pricing structure makes it an attractive option. This cost-effectiveness, combined with the advanced features and security measures, positions Stripe as a top choice for mobile payments.

User Experience and Interface Design

Creating an exceptional user experience is paramount in mobile payment applications, especially given the rapid adoption of digital wallets and mobile transactions. A positive user experience not only encourages customer loyalty but also increases the likelihood of repeated transactions. Users expect seamless, quick, and secure payment processes, and any friction can lead to abandoned carts and lost revenue. Therefore, understanding the principles of user experience design can significantly influence the success of your mobile payment app.When designing a payment interface, focusing on user-friendly elements can greatly enhance usability and satisfaction.

An intuitive layout not only aids in user navigation but also strengthens trust in the application. Here are some best practices for designing an effective payment interface using Stripe:

Best Practices for Intuitive Payment Interface Design

To achieve a successful mobile payment experience, consider the following best practices:

Simplified Navigation

An intuitive navigation structure helps users understand where they are in the payment process. Ensure that the path to complete a transaction is as short and clear as possible, minimizing the number of screens required.

Clear Call-to-Action Buttons

Buttons for actions like “Pay Now” or “Complete Purchase” should stand out visually. Use contrasting colors and large, legible fonts to enhance visibility.

Minimalist Design

A clutter-free interface allows users to focus on the payment process without being distracted. Use ample white space and avoid overwhelming users with unnecessary information.

Quick Input Fields

Optimize input fields for mobile devices by allowing for autofill and ensuring that keyboard types (numeric, email, etc.) match the information being requested. This can significantly reduce user errors and streamline the payment process.

Feedback Mechanisms

Providing immediate feedback after actions, such as a brief confirmation message or a visual indicator that a payment has been processed successfully, enhances user confidence in the app.

Security Indicators

Displaying security features like SSL certification and payment protection badges assures users that their personal information is safe. This can help build trust with new users.

Responsive Design

Ensure your payment interface works seamlessly across various devices and screen sizes. A consistent experience boosts usability and ensures all users can navigate the payment process effectively.

Test with Real Users

Conduct usability testing with real users to gather feedback on the interface. This will help identify pain points and areas for improvement, ensuring your design meets user needs.For example, popular mobile payment apps like Venmo and Square Cash exemplify these principles. Venmo’s clean interface with clear labeling and swift navigation permits users to send money quickly, while Square Cash employs a straightforward payment layout that minimizes steps, making transactions a breeze.

Their success showcases the impact of effective user experience and interface design in the realm of mobile payments.

Challenges and Solutions in Mobile Payments

Implementing mobile payments can bring numerous benefits, but it also poses a range of challenges that businesses must navigate. Recognizing these challenges aids in formulating effective strategies for implementation and ongoing management. Understanding the possible pitfalls allows businesses to enhance user satisfaction and streamline operations.Common challenges in mobile payments include security concerns, integration issues, user experience hurdles, and varying regulations across different regions.

Each of these challenges can impact both merchants and consumers, but they can be addressed with innovative solutions and proactive planning.

Security Concerns in Mobile Payments, Mobile payments with stripe

Security is a top priority in mobile payments, as data breaches can lead to significant financial losses and damage to brand reputation. Here are some effective strategies to mitigate security risks:

- Encryption Techniques: Implement end-to-end encryption to protect sensitive user data during transactions. This ensures that even if data is intercepted, it remains unreadable.

- Multi-factor Authentication: Require users to verify their identity through multiple means, such as a password and a one-time code sent to their mobile device.

- Regular Security Audits: Conduct routine assessments of security systems and protocols to identify and rectify vulnerabilities promptly.

- Tokenization: Utilize tokenization to replace sensitive payment information with non-sensitive equivalents, reducing the risk of fraud.

Integration Issues with Existing Systems

Integrating mobile payment systems with existing platforms can be complex but essential for smooth operations. Here are some strategies to simplify this process:

- Choose Compatible Solutions: Select payment processors that offer APIs and SDKs compatible with existing technology stacks, ensuring a seamless integration process.

- Collaboration with Developers: Work closely with developers to map out integration points and address potential conflicts early in the implementation phase.

- Testing and Iteration: Conduct thorough testing of the payment system in different scenarios to identify integration issues before going live.

User Experience and Interface Challenges

Creating an intuitive user interface is vital for customer satisfaction. Poor user experience can lead to abandoned transactions. Key considerations include:

- Streamlined Navigation: Design a simple and clear checkout process that minimizes the number of steps required to complete a transaction.

- Mobile Optimization: Ensure that the payment interface is fully optimized for mobile devices, providing a responsive design that adjusts to various screen sizes.

- User Feedback Mechanisms: Implement mechanisms to gather user feedback on the mobile payment experience, allowing for continuous improvements based on real user insights.

Regulatory Compliance Challenges

Navigating the regulatory landscape can be daunting for businesses in the mobile payments sector. Adhering to diverse regulations is crucial for operating legally. Strategies to manage compliance include:

- Stay Informed: Regularly update knowledge about local and international regulations affecting mobile payment systems, such as GDPR and PCI DSS.

- Legal Consultation: Engage legal experts to ensure that payment processes are compliant with applicable laws, reducing the risk of penalties.

- Implement Compliance Software: Utilize software solutions designed to monitor compliance and flag potential issues in real-time.

Case Studies Highlighting Successful Strategies

Several companies have overcome these challenges successfully and serve as excellent examples. For instance, a leading e-commerce platform integrated Stripe to streamline payment processing. By focusing on user-friendly design and employing robust security measures, they reported a 30% reduction in cart abandonment rates.In another case, a fintech startup faced significant integration issues when introducing mobile payments. By collaborating with tech partners and utilizing agile development practices, they managed to launch a fully integrated payment solution within three months, earning positive user feedback and increasing transaction volumes significantly.These examples illustrate how identifying challenges in mobile payments and implementing well-thought-out solutions can lead to enhanced performance and customer satisfaction.

Future Trends in Mobile Payments with Stripe

As the landscape of mobile payments continues to evolve, several future trends are emerging that could significantly influence how transactions are conducted. Stripe, as a leading player in the payment processing arena, is well-positioned to adapt and innovate in this changing environment. This discussion will explore the technologies and developments that may shape mobile payments over the next few years.Emerging technologies are likely to have a profound impact on mobile payments.

The integration of artificial intelligence (AI) and machine learning (ML) is expected to enhance fraud detection and improve transaction speed. Additionally, the rise of cryptocurrencies and blockchain technology introduces new avenues for secure and decentralized payments, which could be embraced by platforms like Stripe.

Potential Developments for Stripe

Stripe’s future within the mobile payments ecosystem can be anticipated through several potential developments. The company could broaden its services to accommodate the growing demand for cross-border payments, making it easier for businesses to transact globally. Furthermore, as contactless payment methods gain traction, Stripe might enhance its technology to support advanced biometric authentication methods, such as fingerprint and facial recognition, ensuring a seamless and secure user experience.Another notable development could be the incorporation of augmented reality (AR) in the shopping experience.

Imagine a user being able to view products in their own environment through AR, with Stripe facilitating instant payments once the purchase is confirmed. Such innovations could redefine how consumers interact with brands and make purchasing decisions.In the next five years, the mobile payments landscape is expected to undergo substantial transformation. Analysts predict that the global mobile payment market will continue to grow exponentially, with estimates projecting it could reach over $12 trillion by 2025.

This growth will be driven by factors such as increasing smartphone adoption, enhanced internet connectivity, and the ongoing shift towards cashless societies.

“The mobile payment market is projected to expand rapidly, fueled by technological advancements and changing consumer preferences.”

With the rise of the Internet of Things (IoT), everyday devices will likely incorporate payment capabilities, further embedding mobile payments into daily life. For instance, smart appliances could facilitate automatic re-ordering and payment for household items, streamlining the purchasing process.As Stripe continues to innovate and adapt to these future trends, its role in shaping the mobile payment landscape will be crucial.

By focusing on user experience, security, and integrating emerging technologies, Stripe is set to remain at the forefront of mobile payment solutions in the years to come.

Conclusion on the Impact of Mobile Payments

Mobile payments have reshaped the landscape of consumer transactions, driving significant changes in behavior and expectations. As more individuals embrace the convenience of mobile payment solutions, businesses must adapt to meet these evolving demands. The advent of technologies like Stripe has simplified the integration of mobile payments, fostering an environment where consumers expect seamless and efficient transactions at their fingertips.

Influence of Mobile Payments on Consumer Behavior

The rise of mobile payments has fundamentally altered how consumers shop and pay for goods and services. Consumers now prioritize speed and convenience, often favoring mobile transactions over traditional payment methods. This shift in behavior is illustrated by the increasing number of mobile wallet users, which reached over 1 billion globally in 2022. The convenience of mobile payments has led to impulsive purchasing, as consumers can complete transactions in seconds.

“Convenience is king in the modern shopping experience.”

This trend is especially prominent among younger demographics, who are more inclined to use mobile devices for financial transactions. As a result, businesses are increasingly optimizing their mobile platforms to enhance user experience and capitalize on this behavioral shift.

Role of Mobile Payments in E-Commerce Growth

Mobile payments have become a crucial driver of e-commerce growth, facilitating transactions that were once hindered by traditional payment methods. The ease of making purchases via smartphones has contributed to a notable increase in online sales. In fact, mobile commerce accounted for approximately 73% of total e-commerce sales in 2021, a number that continues to rise.The integration of mobile payment solutions simplifies the checkout process, reducing cart abandonment rates and encouraging repeat purchases.

Retailers who implement mobile payment options often see higher conversion rates, as consumers are more likely to complete a transaction when the payment method is quick and hassle-free. As mobile payment technology evolves, it is expected to further stimulate growth in the e-commerce sector, making it essential for businesses to adapt to these changes.

Potential for Mobile Payments to Transform Traditional Banking

Mobile payments have the potential to revolutionize traditional banking practices by offering consumers greater accessibility to financial services. With mobile payment platforms, users can conduct transactions, transfer funds, and manage accounts without the need for physical bank branches. This transition is particularly beneficial in underserved regions, where access to traditional banking infrastructure is limited.As an example, in countries with high mobile penetration but low banking access, mobile payment systems have proven to be a lifeline for millions.

Services like M-Pesa in Kenya have successfully enabled individuals to send and receive money, pay bills, and access credit through their mobile devices, showcasing the transformative power of mobile payments in financial inclusion.

“Mobile payments bridge the gap between technology and traditional finance.”

As these technologies continue to gain traction, the banking sector may need to rethink its operational models, focusing on digital innovation to meet customer expectations in a mobile-first world.

FAQ Guide

What types of payments can I accept using Stripe?

Stripe supports various payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, and bank transfers.

Is it safe to use mobile payments with Stripe?

Yes, Stripe employs advanced security measures, including encryption and fraud detection, to ensure safe transactions for both businesses and consumers.

Can I integrate Stripe with my existing website?

Absolutely! Stripe offers easy integration options through various programming languages, making it compatible with most websites and applications.

How does Stripe’s fee structure compare to other payment processors?

Stripe’s fees are competitive, often lower than many traditional payment processors, and are clearly Artikeld on their website for transparency.

What are the common challenges of mobile payments?

Common challenges include security concerns, integration issues, and ensuring a smooth user experience; however, these can often be mitigated with the right strategies.