Payment app credit card is reshaping the way we handle our finances, making transactions easier and more efficient than ever. With the rise of digital technology, payment apps have become essential tools for managing money, allowing users to send and receive funds directly from their smartphones. These apps not only simplify the payment process but also provide additional features that enhance user experience and security, making them a popular choice over traditional banking methods.

From popular options like Venmo and PayPal to new players in the market, payment apps equipped with credit card functionality offer a seamless experience that caters to the needs of modern consumers. As we dive into the details of how these apps work, you’ll discover the benefits they bring, the integration of credit cards, and the overall impact on our banking habits.

Overview of Payment Apps

Payment apps have revolutionized the way we conduct transactions, enabling users to make payments using their smartphones or devices with ease. These applications provide a convenient and secure platform for transferring money, paying bills, or making purchases without the need for physical cash or cards. With the growing adoption of technology in our daily lives, payment apps are becoming an essential tool for both consumers and businesses.Payment apps function by linking a user’s bank account or credit card to the app, allowing for seamless transactions.

Users can send money to friends, pay for services, or shop online by simply entering the amount and confirming the payment. Popular payment apps that support credit card transactions include PayPal, Venmo, Cash App, and Apple Pay. Each of these platforms offers unique features, such as social payment functionalities or integration with other financial services.

Benefits of Using Payment Apps

Utilizing payment apps over traditional payment methods presents numerous advantages that cater to modern consumer needs. These benefits include:

- Convenience: Payment apps allow for quick and easy transactions from anywhere, at any time, without the need to carry cash or physical cards.

- Speed: Transactions through payment apps are often processed in real-time, making it faster to send or receive money compared to traditional banking methods.

- Tracking and Management: Many payment apps provide transaction histories and budgeting tools, helping users stay on top of their financial activities.

- Security: Payment apps employ encryption and tokenization to protect sensitive information, reducing the risk of fraud compared to entering card details on various websites.

- Rewards and Incentives: Some payment apps offer cashback or other rewards for usage, providing users with added value for their transactions.

Integration of Credit Cards in Payment Apps

The integration of credit cards into payment apps has revolutionized how consumers engage in transactions. These apps offer a seamless method for users to manage their finances while providing convenience and speed. In this section, we will delve into the process of adding a credit card, the security measures in place to protect sensitive information, and how various payment apps handle credit card transactions.

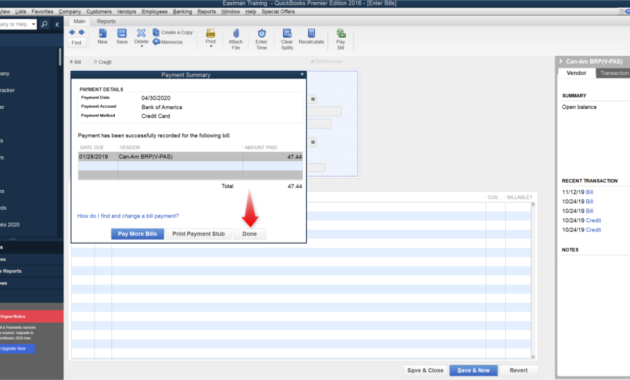

Process of Adding a Credit Card

Adding a credit card to a payment app is designed to be straightforward and user-friendly. Generally, the process involves the following steps:

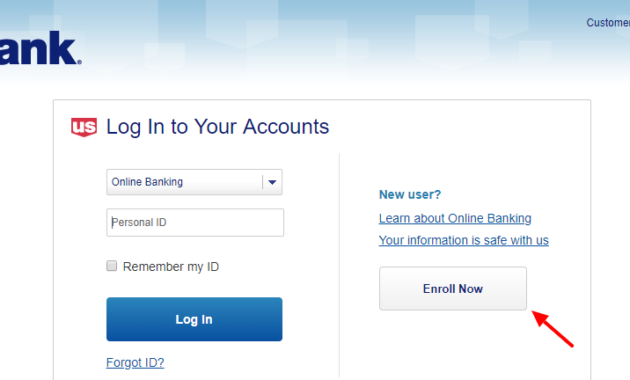

1. User Registration

The user downloads the payment app and creates an account by providing basic personal information and setting up authentication measures.

2. Navigating to Payment Settings

Once registered, the user selects the option to add a payment method, usually found within the app’s settings or wallet section.

3. Entering Card Details

Users input essential information such as the credit card number, expiration date, and security code (CVV). Some apps also allow scanning the card for convenience.

4. Verification

The app may perform a verification step by charging a small amount to the card, which is refunded later. This step ensures that the card is valid and belongs to the user.

5. Confirmation

After successful verification, users receive a confirmation message, and the credit card is now linked to the app, ready for transactions.

Security Measures for Credit Card Information, Payment app credit card

Security is paramount when handling credit card information within payment apps. Several robust measures are commonly adopted:

Encryption

Payment apps utilize end-to-end encryption to protect sensitive data as it travels between the user’s device and the servers.

Tokenization

Instead of storing credit card details, many apps use a process called tokenization. This replaces sensitive data with a unique identifier, referred to as a token, which can be used to complete transactions without exposing the actual card details.

Two-Factor Authentication (2FA)

Many apps implement 2FA, requiring users to provide additional verification, such as a code sent to their mobile device, before completing a transaction.

Fraud Detection Systems

Advanced algorithms monitor transactions for unusual patterns, flagging potentially fraudulent activities for further review.

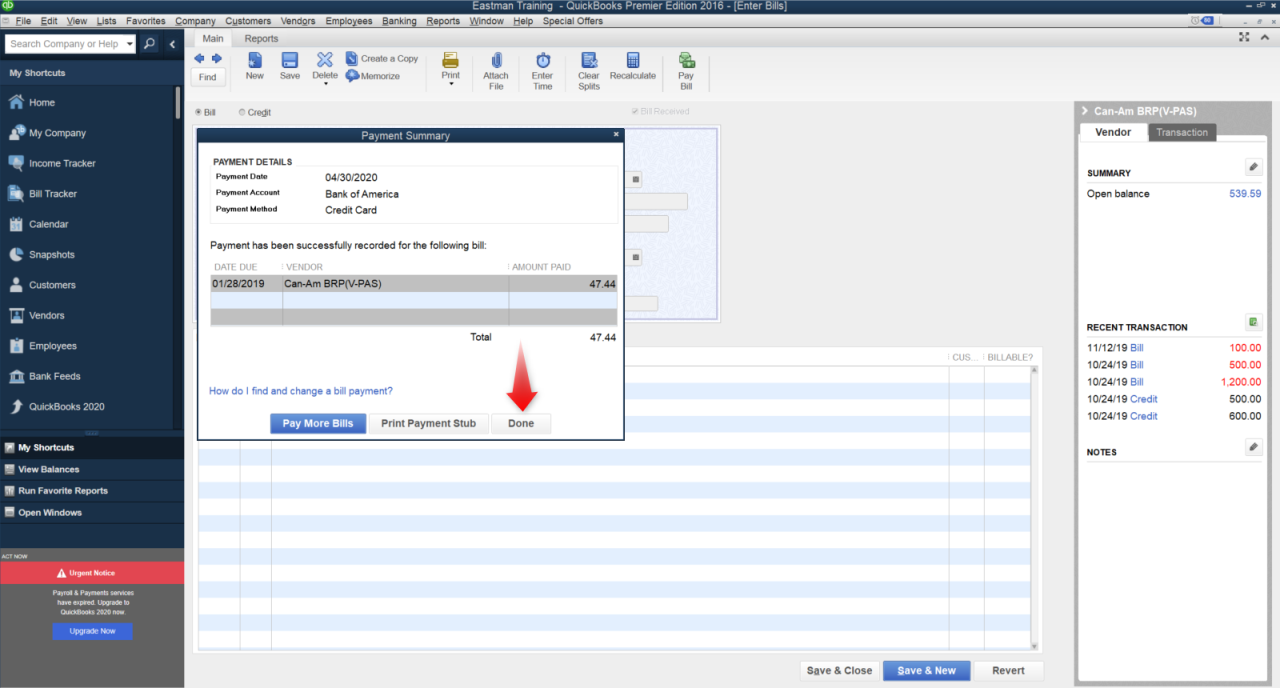

Handling Credit Card Transactions Across Different Payment Apps

Different payment apps adopt various methods for processing credit card transactions, tailored to their specific user base and operational model. Here are key insights into how some popular apps manage these transactions:

PayPal

Offers a comprehensive platform for credit card transactions, allowing users to link multiple cards and choose their preferred payment method at checkout. PayPal also acts as a buffer, keeping users’ credit card information hidden from sellers.

Venmo

Primarily a peer-to-peer transfer app, Venmo allows users to pay each other using linked credit cards. The transactions incur a small fee when funded by credit cards, while bank transfers remain free.

Square

Frequently used by small businesses, Square’s payment app allows merchants to accept credit card payments via a card reader. It provides instant notifications upon transaction completion and detailed analytics for users.The integration of credit cards into payment apps not only enhances user convenience but also necessitates stringent security measures to protect sensitive information. Each app has its unique approach to handling transactions, catering to its specific audience while prioritizing safety and efficiency.

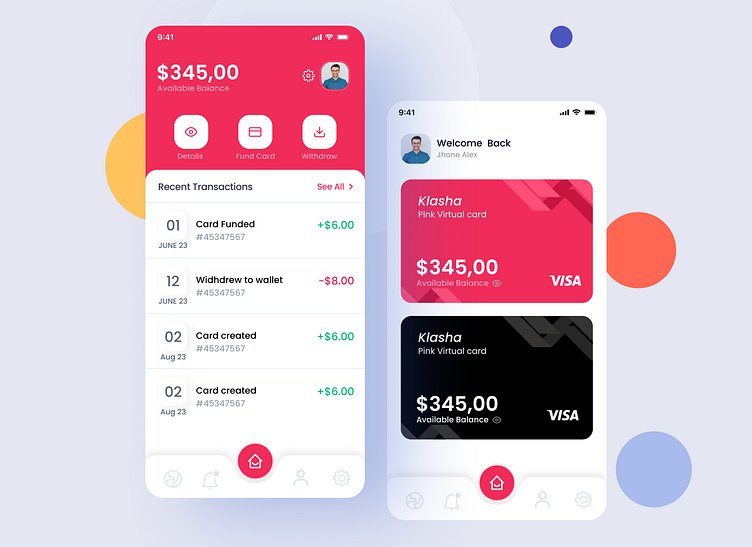

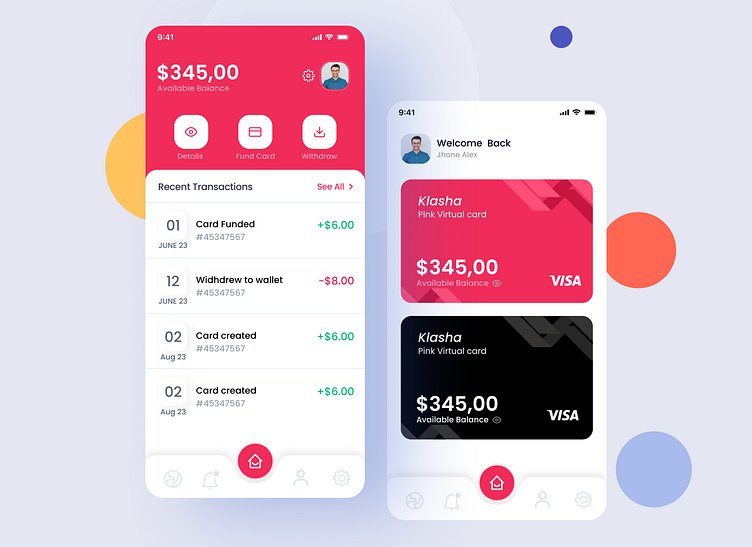

User Experience and Interface

The user experience (UX) and interface of payment apps are crucial to their effectiveness and overall user satisfaction. A seamless navigation process can significantly impact how users interact with credit card transactions. By prioritizing intuitive design and responsiveness, payment apps can streamline the payment process, making it easier for users to complete transactions securely and swiftly. This section delves into how users navigate these apps, compares interfaces among leading options, and highlights features that enhance the overall user experience.

Navigation in Payment Apps

Navigating payment apps for credit card transactions is designed to be straightforward, ensuring that even users who are not tech-savvy can complete their payments with ease. Most payment apps utilize a minimalist design that focuses on essential functions, reducing cognitive load on users. Key elements often include a home screen displaying recent transactions, quick access to payment options, and easy navigation to settings or help sections.

Below are vital aspects that contribute to a smooth user experience:

- Intuitive Layout: Clear categorization of services and easily identifiable buttons make navigation effortless.

- Quick Access Features: One-click payment options for frequent transactions enhance convenience.

- Responsive Design: Apps are optimized for different screen sizes, maintaining usability across devices.

- Search Functionality: A search bar allows users to find specific transactions or features quickly.

- User-Friendly Guides: Tooltips and tutorials assist users in unfamiliar sections of the app.

Comparison of User Interfaces Among Leading Payment Apps

The user interface of a payment app can greatly influence user satisfaction and retention. Below is a comparison table showcasing the UI of popular payment apps, focusing on key features that enhance user interaction.

| Payment App | UI Design | Ease of Navigation | Customization Options |

|---|---|---|---|

| PayPal | Modern, clean interface with a focus on transactions. | Very intuitive with a prominent home dashboard. | Allows users to customize their home screen and notifications. |

| Venmo | Social media-like layout with transaction feed. | Easy to navigate and user-friendly, especially for younger audiences. | Users can personalize their profile and payment notes. |

| Cash App | Sleek, minimalist design with vibrant colors. | Navigation is straightforward, with prominent buttons for sending and receiving money. | Provides options for customizing the app’s theme and layout. |

| Google Pay | Simple yet functional layout focusing on transactions and offers. | Fast navigation with quick access to payment methods and transaction history. | Customizable settings allowing users to manage payment methods easily. |

Features Enhancing User Experience

Several features incorporated into payment apps significantly elevate user experience. Notifications and transaction history are among the most impactful:

- Real-Time Notifications: Users receive immediate alerts regarding transactions, ensuring they stay informed about their spending.

- Transaction History: A detailed record of past transactions helps users track their expenses and manage budgets effectively.

- Customer Support Access: Quick access to customer support enhances user confidence, allowing for immediate assistance if issues arise.

- Security Features: Features like biometric authentication and two-factor authentication reassure users about the safety of their transactions.

- Loyalty Program Integration: Some apps allow users to earn rewards or cashback, enhancing the overall value of using the app.

Fees and Charges

When using credit cards in payment apps, understanding the various fees and charges involved is crucial for effective financial management. These fees can significantly impact the overall cost of transactions, making it essential for users to be informed about what to expect.Payment apps often impose several common fees associated with credit card transactions. These include transaction fees, annual fees, foreign transaction fees, and convenience fees.

Transaction fees are typically a percentage of each purchase or a flat rate charged per transaction. Annual fees may be charged for specific credit cards, providing cardholders with benefits like rewards or cash back. Foreign transaction fees are applicable when transactions are made in a currency other than the card’s native currency, often around 1-3% of the transaction amount. Convenience fees can occur when using a credit card for certain payments, such as bills or services, where a surcharge is added for the convenience of using a credit card.

Variations in Fees Among Payment Apps and Card Providers

Fees can vary significantly between different payment apps and card providers, affecting the cost of using credit cards for transactions. Each payment app has its own fee structure, and card providers may offer different terms based on the type of credit card. For example, some apps may offer free transactions for specific merchants or promotional periods, while others may have higher fees for credit card payments.

It’s also important to consider how the card provider’s fee structure complements or conflicts with the payment app’s charges. For instance, a payment app might not charge any fees for transactions if the user links a bank account instead of a credit card, while the credit card provider might still impose fees on certain types of transactions. Understanding these variations can help users choose the best payment app and credit card combination to minimize costs.

Tips to Minimize Fees When Using Credit Cards on Payment Apps

To help users navigate the often confusing landscape of fees associated with credit cards in payment apps, here are some practical tips:When considering fees, it’s beneficial to adopt a proactive approach to minimize costs:

- Choose the right payment app that offers the lowest fees for your transaction types.

- Opt for credit cards with no foreign transaction fees if you frequently make international purchases.

- Look for cards that offer rewards or cashback to offset any fees incurred.

- Read the fine print regarding fees for specific transactions and understand the circumstances under which they apply.

- Utilize promotional offers or cashback opportunities that may reduce or eliminate certain fees.

“Informed users can effectively reduce transaction costs by strategically choosing payment methods and understanding fee structures.”

Security and Fraud Prevention

In the digital age, security and fraud prevention are paramount when it comes to payment apps that integrate credit card functionalities. Consumers seek assurance that their financial data is well-protected, and payment service providers have implemented robust protocols to ensure privacy and safety. This section delves into the security measures adopted by payment apps and the steps users should take if they suspect any misuse.Payment apps utilize a variety of security protocols to safeguard credit card data.

These typically include encryption technologies, tokenization, and secure socket layer (SSL) protocols. Encryption involves transforming sensitive data into unreadable formats that can only be decrypted by authorized systems. Tokenization replaces sensitive data with a unique identifier or ‘token’ that has no value outside of the specific transaction context, reducing the risk of data breaches. SSL protocols provide a secure channel over the internet, encrypting data exchanged between the user’s device and the payment processor, which further reduces the likelihood of interception.

Common Fraud Prevention Measures

To combat fraud effectively, payment apps have integrated several preventive measures. Understanding these can help users appreciate the steps taken to protect their information and reduce the risks of fraud.

- Two-Factor Authentication (2FA): Many apps require an additional authentication step beyond just the password, such as a text message or email confirmation, to verify the user’s identity.

- Real-Time Monitoring: Payment apps often employ algorithms that analyze transaction patterns in real-time, flagging any unusual activities for immediate review.

- Fraud Alerts: Users are usually notified of suspicious transactions or login attempts via notifications or emails, prompting immediate action if the user did not initiate the activity.

- Regular Security Updates: Payment apps frequently update their software to patch vulnerabilities and enhance security features, ensuring users benefit from the latest protective technologies.

Steps to Take if Fraud is Suspected

If users suspect fraudulent activity on their accounts, it is crucial to act swiftly to minimize potential damage. Here are the steps that should be taken:

1. Report the Activity Immediately contact the payment app’s customer support or fraud department to report the suspicious transactions. Most apps have dedicated support teams trained to handle such situations.

2. Secure the Account Change your password and enable any additional security measures, such as 2FA, to prevent further unauthorized access.

3. Review Transactions Go through recent transactions to identify any unauthorized charges and document them for reference when reporting.

4. Monitor Accounts Keep a close eye on bank statements and credit reports for any signs of additional fraudulent activity. This can help catch any other potential issues early.

5. Consider Freezing Credit If there is a significant risk of identity theft, consider placing a freeze on your credit report to prevent new accounts from being opened in your name.

“Taking swift action is key in minimizing the impact of fraudulent activities.”

Impact on Traditional Banking

The rise of payment apps has significantly altered the landscape of traditional banking. As these apps gain popularity, they challenge the fundamental role that banks have played in managing money and facilitating transactions. This shift not only affects consumer behavior but also compels banks to reevaluate their services and offerings to remain competitive in a rapidly evolving financial environment.Payment apps provide a convenient and often quicker alternative to traditional banking services, which has implications for daily transactions.

Many users are increasingly opting for payment apps for their ease of use, lower fees, and enhanced user experiences. This trend signifies a broader transformation in how consumers interact with money, leading to implications for banks regarding customer retention and service delivery.

Shift from Banks to Payment Apps

The transition from traditional banking to payment apps is evidenced by numerous case studies highlighting consumer behavior changes. For instance, consider the following scenarios:

- Case Study: Young Professionals

-A group of recent college graduates, previously reliant on traditional banks, has adopted payment apps like Venmo and Cash App for everyday transactions. They prefer these apps for their social sharing features, instant transfers, and the ability to split bills easily, causing a decline in their visits to physical bank branches. - Case Study: Small Business Owners

-A small business owner transitioned from a conventional bank to using Square for payment processing. The lower transaction fees and faster fund availability offered by Square have improved the cash flow of the business, making the traditional banking model less attractive. - Case Study: Families Managing Finances

-A family using their bank’s mobile app for routine transactions found themselves gravitating towards payment apps for budgeting and managing expenses. They appreciate the visual layout and interactive features of these apps over their bank’s interface, effectively reducing their dependence on traditional banking services.

The implications of this shift are profound. Traditional banks face the challenge of keeping up with technological advancements and consumer demands. As more people embrace payment apps for their convenience and accessibility, banks may have to innovate their services, enhance digital offerings, and focus on customer experience to retain their clientele.

The transition from traditional banking to digital financial services demonstrates a growing preference for convenience and efficiency among consumers.

Overall, the impact of payment apps on traditional banking is a clear reflection of the changing dynamics in financial transactions, requiring banks to adapt or risk losing market share to more agile, tech-savvy alternatives.

Future Trends in Payment Apps

As the digital landscape continues to evolve, payment apps are set to undergo significant transformations influenced by emerging technologies and shifting consumer behaviors. The future of these applications promises enhanced functionality, increased security, and improved user experience, making them an integral part of daily financial activities.One of the most notable trends is the integration of technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT).

These innovations are expected to revolutionize how transactions are processed, enhancing not just speed but also security and transparency. For instance, AI can personalize user experiences by analyzing spending habits, while blockchain can offer a decentralized approach to secure transactions.

Emerging Technologies

The potential impact of emerging technologies on payment apps is profound. Below are key technologies that are anticipated to play a crucial role:

- Artificial Intelligence (AI): AI will enable predictive analytics for personalized user experiences, improving transaction recommendations and fraud detection.

- Blockchain Technology: Utilizing blockchain will enhance transaction security and transparency, reducing fraud and improving trust among users.

- Internet of Things (IoT): IoT devices will facilitate seamless transactions through connected devices, creating an ecosystem where payments can be made effortlessly in real-time.

- 5G Connectivity: The rollout of 5G will increase transaction speed, enhancing mobile payment experiences and reducing latency during transactions.

- Voice and Biometric Authentication: Payment apps are likely to adopt voice recognition and biometric features like fingerprint or facial recognition for enhanced security and ease of use.

Changes in Consumer Behavior

Shifts in consumer behavior are critical to the evolution of payment apps. Increasing reliance on digital payments, especially accelerated by the pandemic, has changed how people perceive transactions. Consumers are likely to favor convenience and security over traditional banking methods, leading to a decline in cash usage and a preference for mobile and contactless payments.As consumers become more tech-savvy, their expectations regarding payment apps are evolving.

They are seeking not only streamlined experiences but also the ability to access integrated financial services that provide insights into spending and savings. Moreover, younger demographics, particularly Gen Z and Millennials, are driving demand for features that support social payments and peer-to-peer transactions.

Anticipated Features

As payment apps continue to develop, several features are expected to become standard. These anticipated updates reflect both technological advancements and changing consumer preferences. Below is a list of features that users can expect in future payment app updates:

- Instant Transfers: Real-time payment processing will be a standard feature, enabling users to send and receive funds instantly.

- Integrated Financial Planning Tools: Features that help users track spending, set budgets, and offer investment advice will be common.

- Enhanced Security Protocols: Advanced encryption and multi-factor authentication methods will be implemented to ensure user safety.

- Cryptocurrency Support: The ability to buy, sell, and hold cryptocurrencies within payment apps will cater to the growing interest in digital currencies.

- Social Payment Features: Enhanced functionalities for social payments, including group expenses and easy splitting of costs among peers.

Query Resolution: Payment App Credit Card

What are payment apps?

Payment apps are digital platforms that allow users to send and receive money electronically, often using linked credit or debit cards.

Are payment apps safe to use?

Yes, most payment apps implement robust security measures like encryption and two-factor authentication to protect user data.

Can I use multiple credit cards on a payment app?

Yes, many payment apps allow users to link multiple credit cards for flexibility in transactions.

How do fees work with credit card transactions in payment apps?

Fees can vary by app and card provider, typically being a small percentage of the transaction amount.

What should I do if I suspect fraud on my payment app?

If you suspect fraud, immediately report it to the payment app’s customer service and monitor your accounts for unauthorized activity.