Payment arrangement t mobile is an essential option for customers looking to manage their billing more effectively. T-Mobile offers various payment arrangements that cater to individual financial situations, making it easier for users to stay connected without the stress of immediate payment burdens. With options like deferred payments or installment plans, customers can find a solution that fits their needs.

Understanding these arrangements can be crucial, especially during challenging financial times. By setting up a payment arrangement, T-Mobile customers can ensure they maintain their service while also taking control of their expenses.

Overview of Payment Arrangement Options

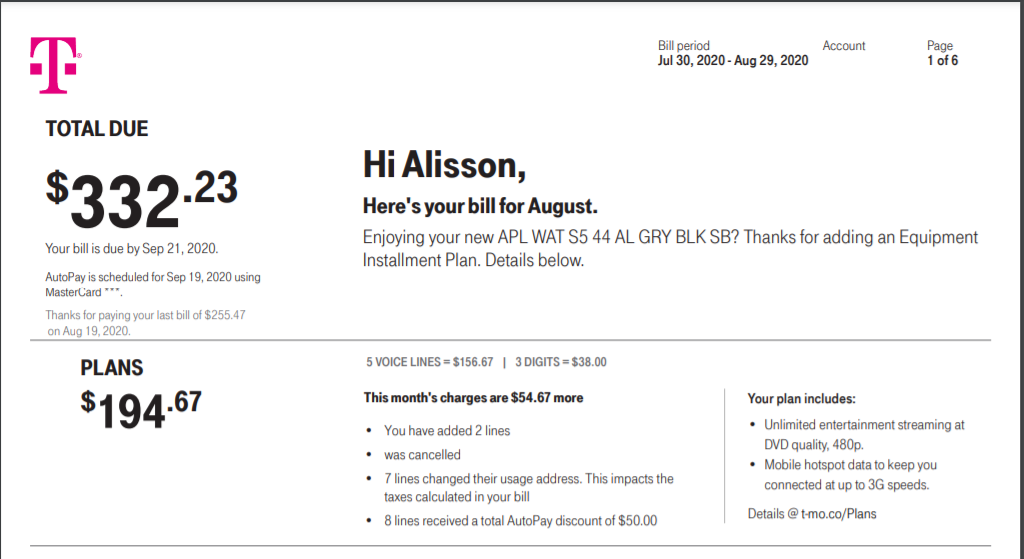

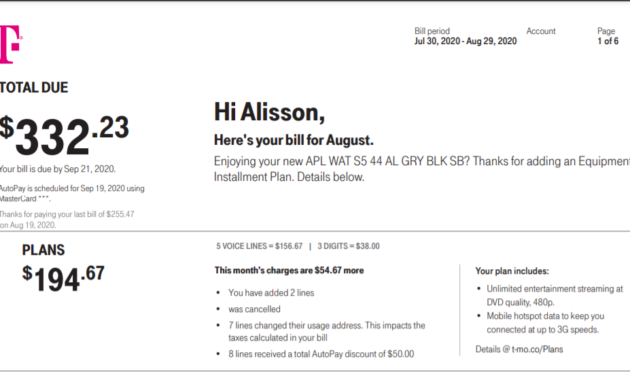

Payment arrangements are flexible solutions designed for T-Mobile customers who may be facing financial challenges and need assistance in managing their phone bills. These arrangements allow customers to maintain their services while spreading out payments over time, ensuring they can stay connected without excessive strain on their finances.T-Mobile offers several types of payment arrangements to cater to various customer needs.

These options include deferred payments, where a customer can postpone their payment to a later date, and installment plans, which allow customers to pay their bills in smaller, manageable amounts over a set period. Both options aim to provide relief while ensuring that services remain active.

Types of Payment Arrangements

Understanding the available types of payment arrangements is crucial for customers looking to manage their bills effectively. The following details Artikel the main types offered by T-Mobile:

- Deferred Payments: Customers can request to delay their payment due date, giving them additional time to gather funds. This option is generally suited for those facing temporary financial hardships.

- Installment Plans: This allows customers to divide their total balance into smaller, scheduled payments over a period of time. Customers can work with T-Mobile to determine a payment schedule that fits their budget.

Eligibility for setting up a payment arrangement typically depends on the customer’s account status and history with T-Mobile. Customers must be in good standing, which means they should not have any recent disconnections or unpaid bills that are significantly overdue. T-Mobile may also require customers to provide documentation or proof of financial difficulty to qualify for certain arrangements.

“Payment arrangements can be a helpful way to manage your T-Mobile bill without losing your service.”

By understanding these options, T-Mobile customers can make informed decisions about their payment plans, ensuring they receive the support they need during challenging times.

Steps to Set Up a Payment Arrangement: Payment Arrangement T Mobile

Setting up a payment arrangement with T-Mobile can help customers manage their bills more effectively, ensuring that they can maintain their service while addressing any financial challenges. By following a clear process, customers can easily set up a plan that fits their needs.To initiate a payment arrangement, customers must gather specific information and choose a method that works best for them.

The following steps Artikel the procedure for setting up a payment arrangement with T-Mobile.

Process for Initiating a Payment Arrangement

Begin the payment arrangement process by collecting the necessary information to streamline the setup. The details required to establish a payment arrangement include:

- Account number

- Service address

- Contact information (phone number and email)

- Preferred payment amount

- Proposed payment date(s)

- Reason for the payment arrangement (optional)

With this information on hand, customers can proceed to request a payment arrangement through various methods available for their convenience:

Methods to Request a Payment Arrangement

Customers can choose from several methods to request a payment arrangement. Each method offers different advantages, allowing individuals to select what suits them best.

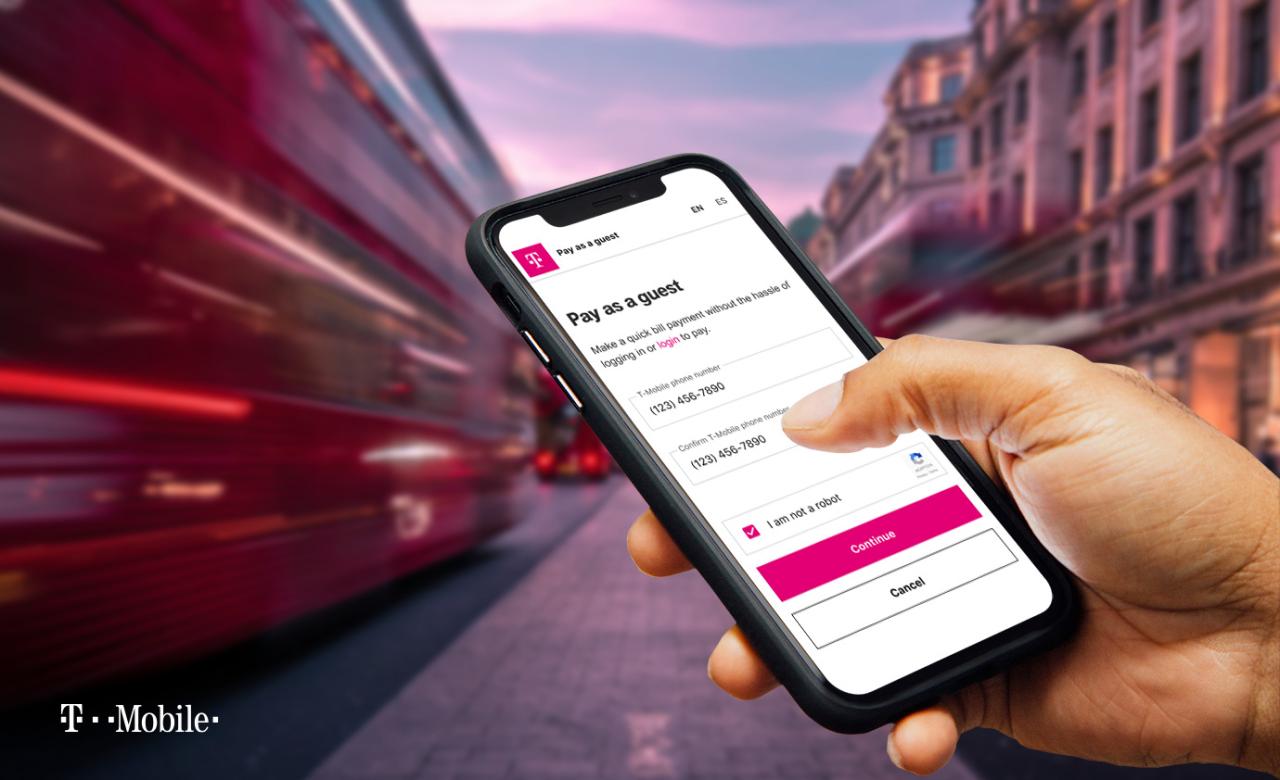

- Online: Log into your T-Mobile account on the official website or app. Navigate to the billing section where you can request a payment arrangement directly.

- Phone: Call T-Mobile customer support at 1-877-746-0909. Have your account information ready for a representative who can assist in setting up the arrangement.

- In-store: Visit a local T-Mobile store for face-to-face assistance. Bring your account details, and an employee will help you establish a payment arrangement.

By following these steps and utilizing the available methods, T-Mobile customers can effectively manage their payment arrangements, ensuring continued service and financial peace of mind.

Benefits of Payment Arrangements

Payment arrangements with T-Mobile can provide significant advantages for customers navigating their financial obligations. These options are designed to offer flexibility and ease during challenging financial periods, ensuring that customers can manage their bills without excessive strain. By understanding the benefits, customers can make informed decisions that best suit their financial situations.Payment arrangements not only assist in the management of T-Mobile bills but also offer crucial support for those facing temporary financial difficulties.

These arrangements can help customers avoid late fees, maintain service continuity, and ultimately reduce stress related to unpaid bills.

Assistance for Customers Facing Financial Difficulties

Many individuals encounter unexpected financial challenges that can complicate their ability to pay bills on time. Utilizing T-Mobile’s payment arrangements provides several key benefits:

- Prevention of Service Disruption: Customers can avoid service interruptions that often occur due to unpaid bills, allowing them to stay connected without added stress.

- Flexible Payment Terms: Arrangements can be tailored to fit individual financial circumstances, allowing customers to select payment dates and amounts that work for them.

- Reduced Late Fees: Establishing a payment plan can help customers avoid the penalties associated with late payments, saving money in the long run.

- Peace of Mind: Knowing that a payment plan is in place can alleviate anxiety, enabling customers to focus on other important aspects of their lives.

Impact on Customer Credit Scores

Establishing payment arrangements can have a positive impact on a customer’s credit score, particularly when managed correctly. Payment behavior is a significant factor in credit scoring models, and timely payments can contribute positively.

“Timely payments on arranged plans can help maintain or improve credit scores, while missed payments can severely impact credit ratings.”

The benefits of maintaining a good payment history include:

- Positive Credit History: Making timely payments as per the arrangement can enhance a customer’s credit history, reflecting responsible financial behavior.

- Increased Credit Opportunities: A better credit score can lead to more favorable terms on loans, credit cards, and other financial products in the future.

- Credit Score Preservation: Preventing late payments through arrangements can protect against score drops that can occur from defaults or delinquencies.

By taking advantage of payment arrangements, customers not only manage their current financial responsibilities but also work towards securing a healthier financial future.

Potential Drawbacks of Payment Arrangements

Payment arrangements can provide flexibility for managing bills, but they also come with certain disadvantages that need careful consideration. While they may seem like a practical solution during financial hardships, understanding the potential drawbacks can help customers make informed decisions.Payment arrangements can sometimes lead to additional financial burdens. For instance, if a customer does not adhere to the terms of the arrangement, they might incur late fees or additional penalties.

Furthermore, while payment arrangements offer immediate relief, they may not address the underlying financial issues. A comprehensive approach to managing finances, such as budgeting, often provides a more sustainable solution in the long run.

Comparison with Other Financial Management Strategies, Payment arrangement t mobile

When evaluating payment arrangements, it’s essential to compare them with other financial management strategies. Budgeting, for example, allows individuals to allocate their income effectively and plan for upcoming expenses, reducing the likelihood of needing payment arrangements in the first place. The following points illustrate the differences between payment arrangements and budgeting:

- Long-term Financial Health: Budgeting promotes awareness of spending habits and encourages savings, enhancing overall financial stability.

- Flexibility: Payment arrangements may offer short-term solutions but can lead to long-term financial strain if not managed correctly.

- Debt Management: Budgeting helps in prioritizing debts and payments, potentially avoiding the need for payment arrangements altogether.

Scenarios Where Payment Arrangements May Not Be Advisable

In certain situations, opting for payment arrangements might not be the best course of action. Here are scenarios where such arrangements can lead to complications:

- Recurring Financial Issues: If a customer consistently struggles to meet their financial obligations, a payment arrangement might only delay the inevitable instead of resolving the root cause.

- High-Interest Accounts: Relying on payment arrangements for bills associated with high interest rates can lead to increased overall costs, exacerbating financial difficulties.

- Limited Income: Individuals with a fixed or limited income may find it challenging to meet the terms of payment arrangements, thus leading to further financial distress.

Understanding the limitations of payment arrangements is crucial for making the best financial decisions.

Customer Experiences and Testimonials

Many T-Mobile customers have shared their experiences regarding payment arrangements, highlighting both the positive aspects and challenges of these options. These testimonials provide valuable insight into how payment arrangements can ease financial burdens while also revealing common hurdles faced during the process. Understanding these experiences can help new customers navigate their own arrangements more effectively.One significant aspect of customer experiences is the variety of challenges users encounter.

From unexpected fees to miscommunication about due dates, customers often find themselves in stressful situations. However, some customers have developed strategies to overcome these obstacles and successfully manage their payment plans, showcasing the resilience and resourcefulness of T-Mobile users.

Customer Testimonials

Numerous customers have positively expressed their appreciation for T-Mobile’s flexibility in payment arrangements. Here are a few testimonials that highlight these experiences:

“I was going through a tough time financially, and T-Mobile allowed me to set up a payment plan that really helped me get back on track. Their customer support was understanding and patient.”

Sarah J.

“The payment arrangement option made it easy for me to keep my service without stressing about my bill. I appreciate T-Mobile’s willingness to work with me.”

James T.

In contrast, some customers have faced challenges with their payment arrangements. Key issues often include:

- Misunderstandings regarding the terms of the arrangement, leading to confusion about payment schedules.

- Unexpected changes in payment amounts that were not communicated clearly.

- Difficulty reaching customer service for assistance when issues arise.

Best Practices for Managing Payment Arrangements

To effectively manage payment arrangements, many customers have adopted practices that contribute to smoother experiences. These strategies can help avoid common pitfalls:

- Reviewing the terms of the payment arrangement thoroughly to understand obligations fully.

- Setting reminders for payment due dates to avoid late fees and maintain service.

- Keeping a record of all communication with T-Mobile regarding payment arrangements, including confirmation emails and chat transcripts.

- Utilizing mobile apps or online accounts to monitor payment statuses and any changes in the arrangement promptly.

By implementing these best practices, customers can better navigate the complexities of payment arrangements and enjoy the benefits they offer.

Frequently Asked Questions About Payment Arrangements

Payment arrangements can often raise questions for customers looking to manage their T-Mobile bills effectively. Understanding the nuances of these arrangements helps customers make informed decisions, ensuring they choose the right plan that suits their needs. Here is a breakdown of common inquiries and their concise answers to shed light on payment arrangements.

Eligibility Criteria

Customers often want to know if they qualify for a payment arrangement. Eligibility generally depends on the account status, payment history, and any outstanding balances. T-Mobile typically reviews the account before granting arrangements.

| Criteria | Description |

|---|---|

| Account Status | Accounts must be in good standing or have a manageable balance. |

| Payment History | Consistent payment history may increase the likelihood of approval. |

| Outstanding Balances | Accounts with larger unpaid balances may face stricter eligibility. |

Setting Up Payment Arrangements

Understanding the steps to set up a payment arrangement can ease the process for customers. The procedure is straightforward and can usually be completed through customer service representatives or online platforms.

| Step | Description |

|---|---|

| Contact T-Mobile | Reach out via customer service or the T-Mobile app. |

| Provide Account Information | Verify your identity and share your account details. |

| Discuss Arrangement Options | Explore available options that fit your financial situation. |

| Confirm Agreement | Review and accept the terms before finalizing the arrangement. |

Consequences of Payment Arrangements

While payment arrangements can provide relief, it’s essential to understand their potential implications. Customers might experience temporary impacts on their credit scores or account status.

| Consequence | Description |

|---|---|

| Credit Score Impact | Payment arrangements may reflect on credit reports and affect scores. |

| Service Limitations | Some arrangements might lead to limited account functionalities. |

| Fees and Penalties | Late fees or additional charges could apply if terms are not met. |

Resources for Additional Information

For customers seeking more details about payment arrangements, various resources are available. These resources can assist in clarifying any lingering questions or confusion.

- T-Mobile Customer Service: Reachable via phone or online chat for direct assistance.

- T-Mobile App: Offers a user-friendly interface for managing accounts and payment arrangements.

- T-Mobile Website: Contains comprehensive guides and FAQs related to payment arrangements.

- Account Manager: A personalized service for those looking for tailored assistance.

Contact Information for Payment Arrangement Support

When in need of assistance regarding payment arrangements with T-Mobile, having the right contact information can streamline the process significantly. T-Mobile offers various support channels to help customers navigate their payment plan options effectively, ensuring that any financial concerns are addressed promptly.T-Mobile provides several ways for customers to get in touch with their support team, especially for issues related to payment arrangements.

Here are the primary methods of contact available to customers:

Customer Support Contact Methods

Knowing how to reach T-Mobile’s customer support is crucial for resolving payment arrangement issues swiftly. Here are the main contact options:

- Phone Support: You can call T-Mobile’s customer service at 1-877-746-0909. This number is available for any customer inquiries, including payment arrangements.

- Online Chat: T-Mobile’s website features a live chat option where you can speak with a representative in real-time for assistance with your payment concerns.

- My T-Mobile App: Through the My T-Mobile app, customers can access support options and manage their payment arrangements directly from their mobile devices.

- Social Media: T-Mobile is active on various social media platforms, including Twitter and Facebook. Direct messaging them can provide assistance for your payment arrangement queries.

Hours of Operation for Payment Support

Understanding the hours of operation for T-Mobile’s customer support is essential to ensure you reach them at the right time. Customer support for payment arrangements is available during the following hours:

- Monday to Sunday: 6 AM to 10 PM (local time)

This ensures that you can reach out for assistance at a time that is convenient for you.

Effective Communication with T-Mobile Representatives

When contacting T-Mobile for support on payment arrangements, effective communication can lead to a more productive interaction. Here are some tips for ensuring that your conversation is as helpful as possible:

- Be Prepared: Have your account information handy, including your phone number and any recent billing statements.

- Clearly State Your Needs: Explain your situation concisely, focusing on your payment arrangement needs and any deadlines you may have.

- Take Notes: Document any important details or instructions provided by the representative for your future reference.

- Stay Polite and Patient: Keeping a calm demeanor, even when facing issues, can help the representative assist you more effectively.

Using these contact methods, hours of operation, and communication tips can help you address payment arrangement concerns with T-Mobile more efficiently.

FAQ Resource

What types of payment arrangements are available?

T-Mobile offers options like deferred payments and installment plans to help customers manage their bills.

How can I initiate a payment arrangement?

You can set up a payment arrangement via T-Mobile’s website, by calling customer service, or by visiting a T-Mobile store.

Will a payment arrangement affect my credit score?

When managed well, payment arrangements can positively impact your credit score by demonstrating responsible payment behavior.

Are there any fees associated with payment arrangements?

Typically, T-Mobile does not charge fees for setting up payment arrangements, but it’s best to confirm with customer support for specific cases.

What should I do if I can’t meet the payment arrangement?

If you anticipate difficulties, contact T-Mobile as soon as possible to discuss your options; they may be able to modify your arrangement.