Payment plans for Boost Mobile are designed to provide customers with flexibility and convenience in managing their mobile expenses. These plans allow users to break down the cost of their devices and services into manageable payments, making it easier for individuals and families to stay connected without breaking the bank.

With various options available, understanding how these payment plans work and their eligibility criteria can empower customers to make informed choices that align with their budget and needs. Whether you’re looking for a new device or simply want to enhance your service experience, Boost Mobile’s payment plans offer a viable solution to navigate the world of mobile services.

Understanding Payment Plans for Boost Mobile

Boost Mobile offers flexible payment plans to enhance accessibility and affordability for its customers. These plans allow users to manage their smartphone expenses more effectively, enabling them to enjoy seamless connectivity without financial strain. Understanding the options available can empower customers to make informed decisions and choose a plan that best fits their budget and usage needs.Payment plans are structured arrangements that allow customers to pay for their mobile service over time rather than all at once.

This is particularly significant for customers who might be on a budget or those who prefer to spread their payments to maintain financial flexibility. Boost Mobile provides a variety of payment plans, each designed to cater to different customer needs, such as monthly billing cycles, installment payment options for devices, and promotional offers.

Types of Payment Plans Available

Boost Mobile has several payment plans that cater to diverse customer needs and preferences. Understanding these plans can help customers select the option that aligns with their financial situation and mobile usage.

- Monthly Plans: These plans typically include a fixed monthly fee that covers unlimited talk, text, and a set amount of data. Common options range from basic plans with limited data to more comprehensive plans offering high-speed data access.

- Device Payment Plans: When purchasing a phone, customers can opt for an installment plan, allowing them to pay off the device over a specified period. This option usually involves a down payment followed by monthly installments until the device is fully paid off.

- Promotional Offers: Boost Mobile frequently provides limited-time deals that may include discounts on monthly payments, reduced device costs, or added data at no extra charge. These promotions make it easier for customers to switch or upgrade their plans.

Eligibility Criteria for Payment Plans

Eligibility for Boost Mobile payment plans can vary based on several factors, including customer credit history, payment history with Boost, and specific promotional terms. Customers can typically expect the following criteria:

- Credit Check: Some payment plans may require a credit check to assess the customer’s financial reliability. A positive credit history can enhance eligibility for more favorable terms.

- Account Standing: Existing Boost Mobile customers need to maintain good standing on their current accounts, including timely payments on previous bills, to qualify for new payment plans.

- Down Payment: For device installment plans, a down payment may be required. The amount can vary based on the device and plan selected, influencing the overall payment structure.

Benefits of Choosing Payment Plans

Choosing a payment plan can significantly enhance the way customers manage their finances, particularly when it comes to acquiring mobile services. Instead of making a large, upfront payment, payment plans spread the cost over time, making it easier to budget and access the latest devices without financial strain. This option becomes increasingly attractive as it allows customers to enjoy services immediately while maintaining financial flexibility.One of the primary advantages of payment plans is the ability to break down costs into manageable monthly installments.

This approach not only eases the burden on a customer’s wallet but also allows for better financial planning. For instance, instead of paying $600 for a new smartphone all at once, customers can opt for a payment plan that charges them $25 a month for 24 months. This structure aligns better with their monthly budget and reduces the risk of financial stress.

Examples of Budget-Friendly Payment Plans

Understanding how payment plans fit into a customer’s budget is crucial in appreciating their benefits. Here are a few examples highlighting their affordability:

- Smartphone Acquisition: A customer interested in the latest model priced at $800 can choose a payment plan that allows them to pay $33.33 monthly for 24 months, making it easier to manage their finances without a huge upfront cost.

- Monthly Service Fees: Boost Mobile often offers plans that include phone and service packages at a flat monthly rate, which helps customers predict their expenditures effectively each month.

- Accessory Financing: Customers can also opt for payment plans on accessories like cases or headphones, further spreading their expenses without breaking their budget.

Customer Testimonials on Payment Plans

Real-life experiences provide valuable insights into the effectiveness of payment plans. Here are a few testimonials from satisfied customers:

“Using a payment plan with Boost Mobile allowed me to upgrade my phone without the financial strain. I love being able to budget my expenses and still enjoy the latest technology!”

“I never thought I could afford a premium smartphone, but the payment plan made it possible. Instead of worrying about a hefty bill, I now have a manageable monthly payment that fits my budget seamlessly.”

These testimonials reflect the positive impact that flexible payment options can have on the customer experience, allowing individuals to enjoy modern technology while maintaining financial health. By choosing payment plans, customers are empowered to make better financial decisions, ensuring that they can enjoy their mobile services without the stress of overwhelming costs.

How to Apply for a Payment Plan

Applying for a payment plan with Boost Mobile can be a seamless process, whether you choose to do it online or in-store. Understanding the steps involved ensures that you are well-prepared and can have your plan set up quickly. Here’s a breakdown of the application process for both methods.To begin your application, you will need to gather certain documents and personal information.

This will help facilitate a smooth application process and ensure you meet all necessary criteria.

Step-by-Step Application Process

The application process is straightforward, and here’s how it works for both online and in-store options:

| Process Step | Online Application | In-Store Application |

|---|---|---|

| 1. Visit the Website or Store | Go to the Boost Mobile website. | Visit your nearest Boost Mobile store. |

| 2. Select Payment Plan Option | Choose the payment plan option available. | Consult with a sales representative regarding options. |

| 3. Fill Out Application Form | Complete the online application form with required details. | Fill out a physical application form provided by the representative. |

| 4. Provide Necessary Documents | Upload necessary documents electronically. | Present necessary documents in person. |

| 5. Review and Submit | Review your application and submit it. | Submit your application to the representative for processing. |

| 6. Await Approval | Wait for confirmation via email or text. | Receive immediate feedback on your application status. |

Necessary Documents and Information Required

When applying for a payment plan, certain documents and information are essential to ensure a complete application. Being prepared with the right paperwork will help streamline the process.

To successfully apply for a payment plan, you will need to provide identification, proof of income, and credit information.

The following are typically required:

- Valid government-issued ID (such as a driver’s license or passport).

- Proof of residence (such as a utility bill or lease agreement).

- Recent pay stubs or bank statements to verify income.

- Social Security number for identification purposes.

- Any additional documentation specified by Boost Mobile during the application process.

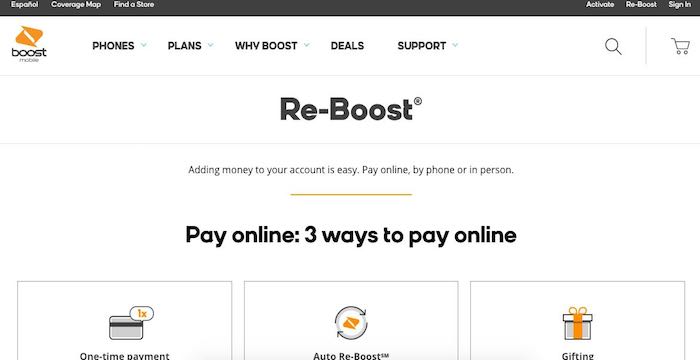

Payment Plan Management

Managing your payment plan with Boost Mobile is a seamless process that allows you to stay on top of your finances while enjoying your mobile service. With the Boost Mobile app and website, you have all the tools at your fingertips to monitor, adjust, and keep track of your payment obligations.Customers can easily manage their payment plans through the Boost Mobile app or website.

Once you log in to your account, you can view your payment history, upcoming payments, and remaining balance. The platform also enables you to make additional payments, change your payment method, and set up reminders to ensure you never miss a due date. This level of accessibility empowers you to take control of your mobile expenses.

Tips for Tracking Payments and Avoiding Late Fees

Keeping track of your payments is crucial to avoiding late fees and maintaining a good payment history. Here are some practical tips to help you stay organized:

- Set up automatic payments: Enroll in automatic payments to ensure your bill is paid on time each month without any effort.

- Use the Boost Mobile app: Regularly check your app for notifications about payment due dates and any important changes to your plan.

- Mark your calendar: Keep a digital or physical calendar to note payment dates and any upcoming billing cycles.

- Review your statements: Make it a habit to review your payment statements each month for accuracy and to stay informed about your usage and charges.

Frequently Used Terms Related to Payment Plans

Familiarizing yourself with common terminology associated with payment plans can enhance your understanding and make managing your account much easier. Here are some key terms to know:

- Due Date: The date by which your payment must be received to avoid late fees.

- Late Fee: A charge incurred when a payment is not made by the due date.

- Payment History: A record of all your payments made over a specific period, showing timeliness and any late payments.

- Account Balance: The total amount you owe on your mobile plan at any given time.

- Payment Method: The form of payment used to settle your bill, such as credit card, debit card, or bank transfer.

“Staying informed about your payment schedule and utilizing available tools can significantly reduce the risk of late fees.”

Common Questions and Misconceptions

Many people have questions and misconceptions about payment plans, particularly when it comes to mobile services like Boost Mobile. Understanding these aspects is essential to making informed decisions, avoiding pitfalls, and maximizing the benefits of the payment plans offered. Here, we’ll clarify some common myths and provide you with straightforward answers to frequently asked questions regarding Boost Mobile’s payment plans.

Common Misconceptions about Payment Plans

Despite the growing popularity of payment plans, several misunderstandings persist regarding their structure and benefits. Here are a few common misconceptions:

- Payment Plans Are Just Another Form of Credit: Many people believe that payment plans are equivalent to taking a credit loan, which can negatively impact your credit score. In reality, Boost Mobile’s payment plans do not typically involve credit checks or reporting to credit bureaus, thereby keeping your credit score unaffected.

- Payment Plans Are Always More Expensive: Some assume that opting for a payment plan will automatically result in higher costs due to interest or fees. However, Boost Mobile often offers competitive pricing on payment plans that can actually make devices more affordable in the long run.

- All Payment Plans Are the Same: Another misconception is that all payment plans are uniform. Boost Mobile provides various options tailored to meet different customer needs, including flexible payment durations and terms.

Frequently Asked Questions about Payment Plans, Payment plans for boost mobile

To further assist customers, below are some frequently asked questions regarding Boost Mobile’s payment plans along with clear answers. This can help clarify any uncertainties you may have.

- How do I qualify for a payment plan? Most customers qualify for Boost Mobile’s payment plans without the need for a credit check. Simply choose a device and follow the application process.

- Can I pay off my payment plan early? Yes, customers can pay off their payment plans at any time without any penalties, allowing for greater financial flexibility.

- What happens if I miss a payment? Missing a payment may result in a late fee, and it’s advisable to contact Boost Mobile to discuss your options, such as rescheduling the payment.

- Are there additional fees associated with payment plans? While there are no hidden fees, it’s essential to review the payment plan terms to understand any upfront costs that may apply.

Potential Pitfalls When Choosing a Payment Plan

While payment plans can be beneficial, there are certain pitfalls that customers should be aware of before committing. Recognizing these can help you avoid unexpected issues.

- Overextending Your Budget: Committing to a payment plan that exceeds your budget can lead to financial strain. It’s crucial to assess your monthly finances and choose a plan that fits comfortably within your means.

- Ignoring the Terms and Conditions: Failing to read the fine print can result in misunderstandings about payment amounts, timelines, and potential fees. Always review the terms before signing up.

- Assuming Flexibility with Payments: While Boost Mobile may offer some flexibility, it’s important to understand that payment plans often have specific terms that must be adhered to. Not all plans allow for changes to payment schedules.

“Being well-informed is the first step to making the most of your payment plan and avoiding common pitfalls.”

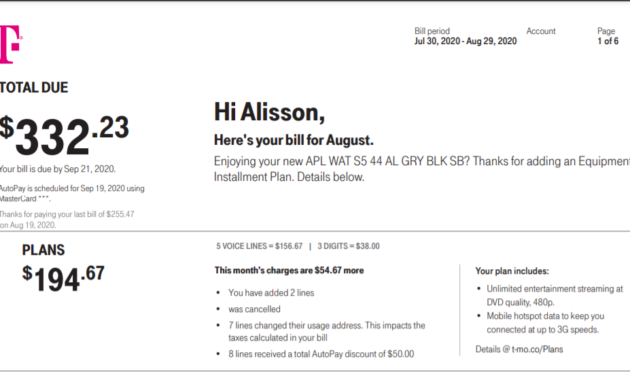

Comparing Boost Mobile Payment Plans with Competitors

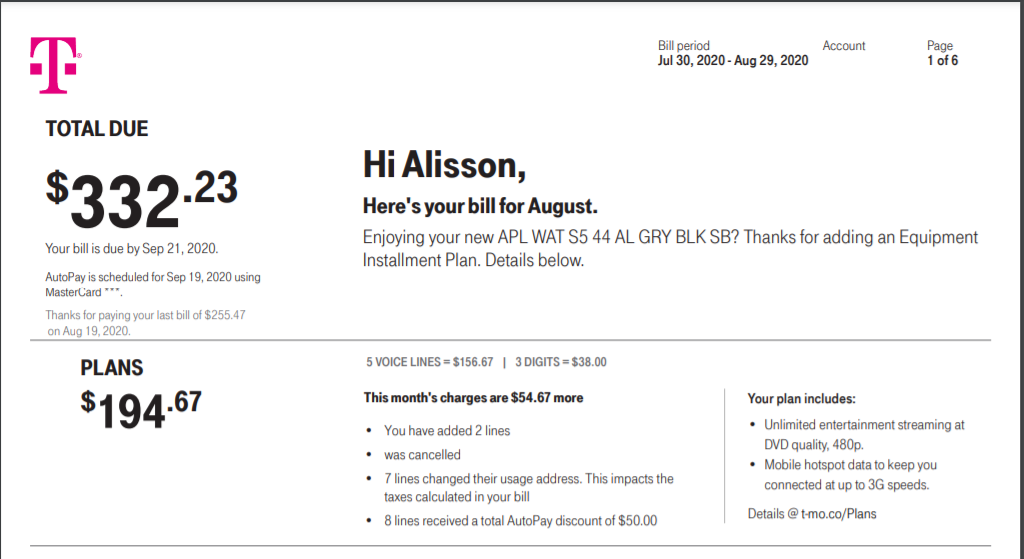

Boost Mobile offers a variety of payment plans designed to meet diverse customer needs. To understand how these plans compare to those from other carriers, it’s essential to analyze key features, rates, and benefits offered by Boost Mobile and its competitors. This will help potential customers make informed choices based on their individual requirements and preferences.When comparing payment plans from various carriers, it is pertinent to look at aspects such as monthly costs, data limits, contract obligations, and additional perks.

Below is a comparative table that highlights these aspects, showcasing how Boost Mobile stands alongside its competitors in the telecom market.

| Feature | Boost Mobile | T-Mobile | AT&T | Verizon |

|---|---|---|---|---|

| Monthly Cost | $25 – $60 | $30 – $70 | $30 – $75 | $35 – $90 |

| Data Limit | Unlimited (with deprioritization) | Unlimited (with deprioritization) | Unlimited (with deprioritization) | Unlimited (with deprioritization) |

| Contract Requirements | No contract | No contract | Contracts available | Contracts available |

| Hotspot Feature | Included | Included | Additional fee required | Additional fee required |

| Device Financing Options | Available | Available | Available | Available |

| Customer Service | 24/7 support | 24/7 support | Limited hours | Limited hours |

Boost Mobile may be a preferred choice for certain customers due to its competitive pricing and flexibility. The absence of long-term contracts allows customers to switch plans or providers without penalties. Additionally, Boost Mobile’s integrated hotspot feature is appealing for users who require mobile data on multiple devices without significant extra charges. Moreover, Boost Mobile’s customer service is available 24/7, providing support whenever customers need assistance.

This level of service, combined with affordable pricing and no lengthy contracts, makes Boost Mobile an attractive option, especially for budget-conscious consumers and those who value convenience and flexibility in their mobile plans.

Tips for Maximizing Payment Plan Usage: Payment Plans For Boost Mobile

Understanding how to optimize your payment plan with Boost Mobile can significantly enhance your service experience. With the right strategies, you can ensure that you are not only getting the most out of your plan but also making sound financial decisions that benefit your lifestyle.To effectively utilize your payment plan, consider employing a few strategic approaches that can enhance your overall experience while keeping your finances in check.

Balancing your payment obligations with available promotions can also yield substantial benefits.

Strategies for Effective Utilization

Implementing certain strategies can help you maximize your payment plan benefits. Here are some key points to consider:

- Monitor your usage regularly: Keeping an eye on your data and call usage can help you determine if you need to adjust your plan or payment schedule. This way, you can avoid overage charges and utilize your plan effectively.

- Set up reminders: Utilize calendar alerts to remind you of payment dates. This will ensure you never miss a payment, helping you maintain a positive payment history.

- Take advantage of auto-pay options: Setting up automatic payments can help you stay organized and avoid late fees, which can affect your credit if you are financing a device.

Combining Payment Plans with Promotions

Boost Mobile regularly offers promotions that can be combined with payment plans for greater savings. Knowing how to leverage these opportunities is essential:

- Stay updated on deals: Regularly check Boost Mobile’s website or app for promotional offers that can be applied alongside your payment plan, such as discounts on accessories or service upgrades.

- Utilize referral bonuses: If you have friends or family interested in Boost Mobile, refer them to earn credits that can be applied to your payment plan.

- Participate in loyalty programs: Engaging in Boost Mobile’s loyalty programs can provide you with discounts or credits that enhance your payment plan’s value.

Assessing Financial Capacity Before Commitment

Before committing to a payment plan, it is vital to assess your financial capacity to ensure it aligns with your budget and lifestyle.

- Evaluate your monthly income and expenses: Creating a detailed budget can provide insight into how much you can comfortably dedicate to a payment plan without straining your finances.

- Consider unexpected expenses: Always account for potential unforeseen costs, such as car repairs or medical bills, to ensure that your payment plan remains manageable.

- Review your credit report: Understanding your credit situation can help you gauge if a payment plan aligns with your financial health and assist you in making informed decisions.

Assessing your financial capacity helps avoid future stress and ensures that your payment plan supports, rather than hinders, your financial goals.

Future Trends in Payment Plans

The mobile service industry is always evolving, and payment plans are no exception. As consumer behavior shifts and technology advances, payment plans are expected to adapt to meet the changing needs of customers. The future of payment plans for companies like Boost Mobile will likely focus on flexibility, transparency, and technological integration, providing customers with more options and better experiences.The landscape of payment plans is being influenced by several key trends that are reshaping how users interact with their mobile services.

One significant factor is the growing preference for subscription-based models, which offer predictable billing and the convenience of continuous service. Additionally, advancements in payment technology are paving the way for new payment methods that enhance customer experience and engagement.

Subscription-Based Models and Flexibility

As consumers increasingly favor subscription models across various services, mobile service providers, including Boost Mobile, are expected to incorporate more flexible payment options. This trend allows customers to choose monthly payment plans that can include a combination of data, voice, and device payments. The rise of subscription-based plans offers several benefits:

- Predictability: Users can budget more effectively with fixed monthly payments.

- Customizability: Plans can be tailored to fit individual usage patterns and preferences.

- Ease of Upgrades: Customers can easily transition to newer devices or services without hefty upfront costs.

This shift towards flexibility is likely to be driven by consumer demand for personalized services that match their lifestyle.

Technological Innovations Shaping Payment Plans

Innovations in payment technology are set to revolutionize how Boost Mobile and similar companies manage their payment plans. Emerging technologies such as blockchain, artificial intelligence, and mobile wallets are providing new avenues for secure and efficient transactions. For example, AI-powered analytics can help companies predict customer behavior, leading to more tailored payment plans. Blockchain technology could enhance security and transparency in transactions, building trust among customers.

Mobile wallets are making it easier for consumers to manage their payments seamlessly from their devices, offering greater convenience and efficiency.

Increased Transparency and Consumer Education

Another trend is the push for greater transparency in payment plans. Customers are increasingly seeking clarity regarding fees, terms, and conditions associated with their payment plans. Boost Mobile is likely to enhance its communication strategies to ensure consumers fully understand their options and commitments.Educational initiatives can help demystify complex payment structures, empowering customers to make informed choices. By providing straightforward information and tools for comparison, Boost Mobile can foster loyalty and trust in their offerings.

As the mobile service industry evolves, payment plans must adapt to meet the dynamic needs of consumers, focusing on flexibility, technological advancements, and transparency.

The convergence of these trends will ultimately create a more customer-centric approach to mobile service payments, positioning Boost Mobile to thrive in an increasingly competitive market.

Q&A

What is a payment plan with Boost Mobile?

A payment plan allows you to spread the cost of your mobile device or service over a set period, making it more affordable.

How can I check my payment plan status?

You can check your payment plan status through the Boost Mobile app or website by logging into your account.

Are there any fees associated with payment plans?

There may be fees depending on the plan you choose and the payment method used; it’s best to review the terms for specifics.

Can I change my payment plan after I’ve signed up?

Yes, you can typically change your payment plan, but you should contact customer service to understand the options available.

Do payment plans affect my credit score?

Payment plans generally do not affect your credit score, but late payments may have consequences if reported.

What happens if I miss a payment?

If you miss a payment, you may incur late fees and risk losing your device or service, so it’s important to stay on track.