quickbooks credit card payment stands at the forefront of modern financial solutions, seamlessly integrating credit card processing into everyday business operations. With its user-friendly interface and robust functionality, QuickBooks simplifies the often-complex world of credit card transactions, making it an ideal choice for businesses of all sizes. This overview delves into the features, benefits, and practical applications of QuickBooks credit card payment systems.

From setting up your account to managing transactions effectively, QuickBooks provides comprehensive tools that allow businesses to streamline payment processing, reduce fees, and enhance security. Whether you’re a small business owner or part of a larger enterprise, QuickBooks can elevate your payment experience and improve customer satisfaction.

Overview of QuickBooks Credit Card Payment

QuickBooks offers a seamless way for businesses to manage their credit card transactions, providing a comprehensive solution that integrates accounting with payment processing. This functionality is designed to simplify financial operations, making it easier for businesses to track their income and expenses while ensuring efficient transaction management.QuickBooks allows users to accept credit card payments directly through its platform, facilitating smooth customer transactions.

This integration not only streamlines the payment process but also automates record-keeping, ensuring that every transaction is reflected accurately in the business’s financial records. The software supports various payment methods, enhancing flexibility for both businesses and their customers.

Benefits of Using QuickBooks for Credit Card Transactions

Utilizing QuickBooks for credit card processing brings numerous advantages that can significantly improve business operations. The following points highlight key benefits:

- Time Efficiency: QuickBooks automates payment processing, reducing manual entry and minimizing errors, which saves time for business owners and their teams.

- Integrated Financial Management: Transactions automatically sync with accounting records, providing real-time insights into cash flow and financial health.

- Enhanced Security: QuickBooks employs advanced security measures to protect sensitive customer information, ensuring secure transactions.

- Customer Satisfaction: Offering multiple payment options, including credit cards, enhances customer convenience, leading to improved satisfaction and repeat business.

- Detailed Reporting: Users can generate detailed reports on sales and expenses, facilitating better financial planning and decision-making.

QuickBooks has been effectively adopted by various businesses, regardless of their size or industry. Small retail shops, tech startups, and large service providers have integrated QuickBooks credit card payments to facilitate smooth transactions. For instance, a local coffee shop utilizes QuickBooks to manage daily credit card sales, which allows them to track their revenue with ease and maintain accurate records for tax purposes.

Another example is a digital marketing agency that leverages QuickBooks to handle client payments efficiently. By allowing clients to pay via credit card, the agency has streamlined its billing process, resulting in faster payments and reduced outstanding invoices. These real-world applications illustrate the powerful impact that QuickBooks can have on simplifying financial transactions and improving overall business efficiency.

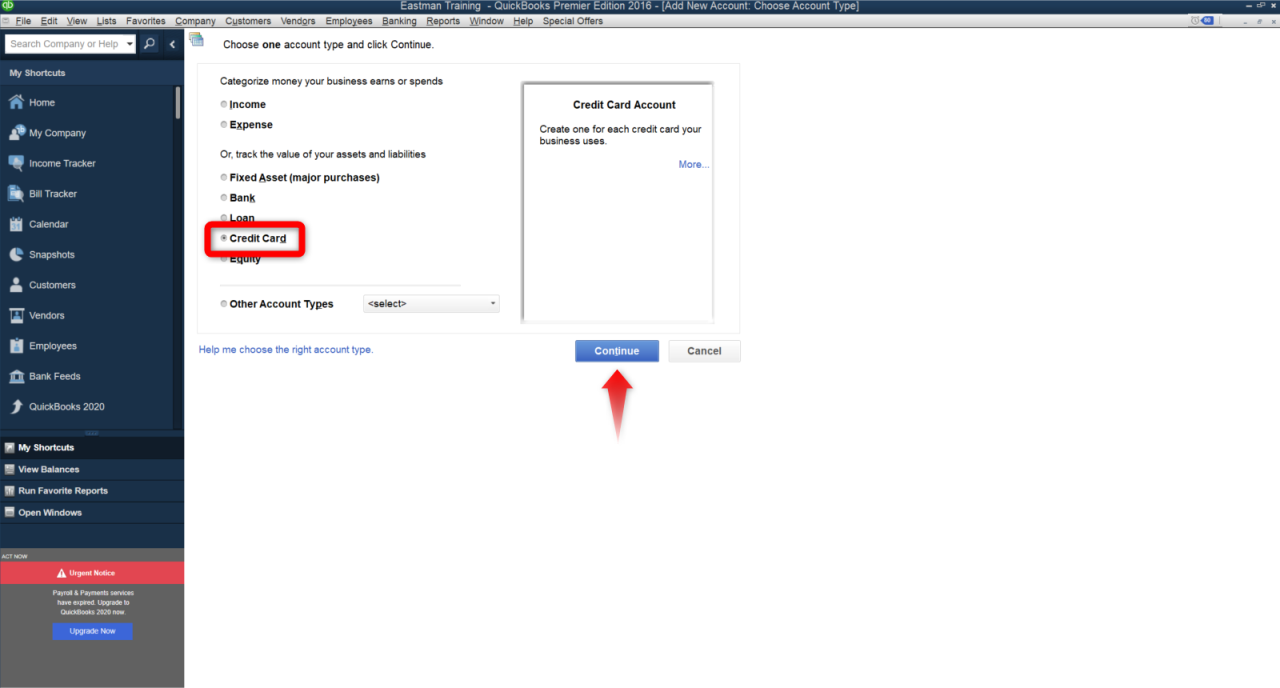

Setting Up QuickBooks for Credit Card Payments

To effectively manage your business finances with QuickBooks, setting up credit card payment processing is essential. This feature allows you to accept payments seamlessly, improving cash flow and customer satisfaction. Let’s delve into the steps and requirements for a successful setup.

Steps for Setting Up Credit Card Payment Processing

The process of setting up credit card payments in QuickBooks involves several key steps. Each step is crucial for ensuring that your payment processing works smoothly and securely.

- Access the QuickBooks Account: Log into your QuickBooks account and navigate to the “Settings” option.

- Select ‘Payments’: Under the “Settings” menu, find and click on the “Payments” section to begin the setup process.

- Choose Your Payment Processor: Select a payment processor that suits your business needs, such as QuickBooks Payments. Follow the prompts to create an account if you don’t have one.

- Enter Required Information: Input the necessary business information, including your business name, address, contact details, and Social Security number or Employer Identification Number (EIN).

- Configure Payment Preferences: Specify your preferred payment options, including credit card types you wish to accept (e.g., Visa, Mastercard, American Express).

- Review Terms and Conditions: Read and accept the terms and conditions provided by the payment processor.

- Complete Setup: Finalize the setup by confirming your information and settings. QuickBooks will process your application, and you’ll receive a confirmation once set up is complete.

Checklist for Necessary Information and Documentation

Having the right information and documentation ready is vital for a smooth setup process. Below is a checklist to guide you through what you’ll need:

Gathering the following information will streamline your setup:

- Business Legal Name

- Business Address

- Business Phone Number

- Bank Account Information (for deposits)

- Social Security Number or Employer Identification Number (EIN)

- Personal Identification (e.g., driver’s license) for verification

Troubleshooting Tips for Common Setup Issues

During the setup process, you may encounter some common issues. Here are troubleshooting tips to help you resolve them effectively:

“Most issues can be resolved with a few simple checks and adjustments.”

Consider the following tips for troubleshooting:

- Ensure all business information is entered accurately without typos or missing fields.

- Verify that your internet connection is stable while completing the setup.

- Check that your QuickBooks software is updated to the latest version to avoid compatibility issues.

- If you receive an error message, take note of the specific code or message, as this can provide clues for resolution.

- Consult the QuickBooks Help Center or contact customer support for guidance on persistent issues.

Accepting Credit Card Payments through QuickBooks

Accepting credit card payments is a vital part of modern business transactions, allowing you to streamline your payment process and enhance customer satisfaction. QuickBooks provides various ways to accept credit card payments, ensuring that you can cater to your customers’ preferences while maintaining accurate financial records.Understanding the steps involved in accepting credit card payments through QuickBooks can simplify your workflow, making it easier to keep track of sales and customer interactions.

This knowledge not only improves your cash flow but also builds customer loyalty as they enjoy convenient payment options.

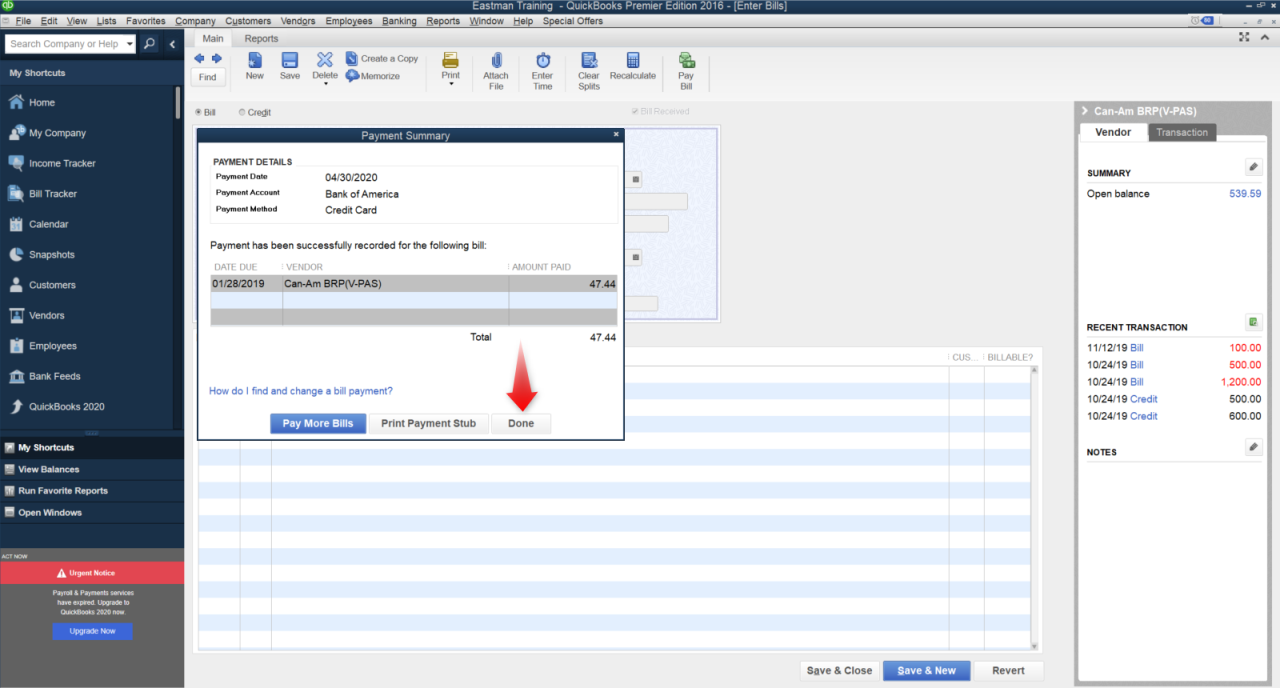

Process of Accepting Credit Card Payments

To efficiently accept credit card payments from customers through QuickBooks, follow the Artikeld steps below. This will help ensure that you are recording transactions accurately, which is essential for your accounting and reporting purposes.

1. Setup Payment Method

First, ensure that you have set up a payment method within QuickBooks specifically for credit card payments. Navigate to the ‘Settings’ and select ‘Payments’ to add or modify your payment options.

2. Create an Invoice

Generate an invoice for the customer transactions. This can be done from the ‘Sales’ tab where you can create a new invoice, adding the necessary details such as items sold, prices, and customer information.

3. Send Invoice

Once the invoice is ready, send it to your customer via email directly through QuickBooks or provide a printed copy if preferred.

4. Receive Payment

When the customer decides to pay via credit card, they can either click the payment link in the email or provide the card details directly to you. If they opt for direct payment, ensure you collect the card information securely.

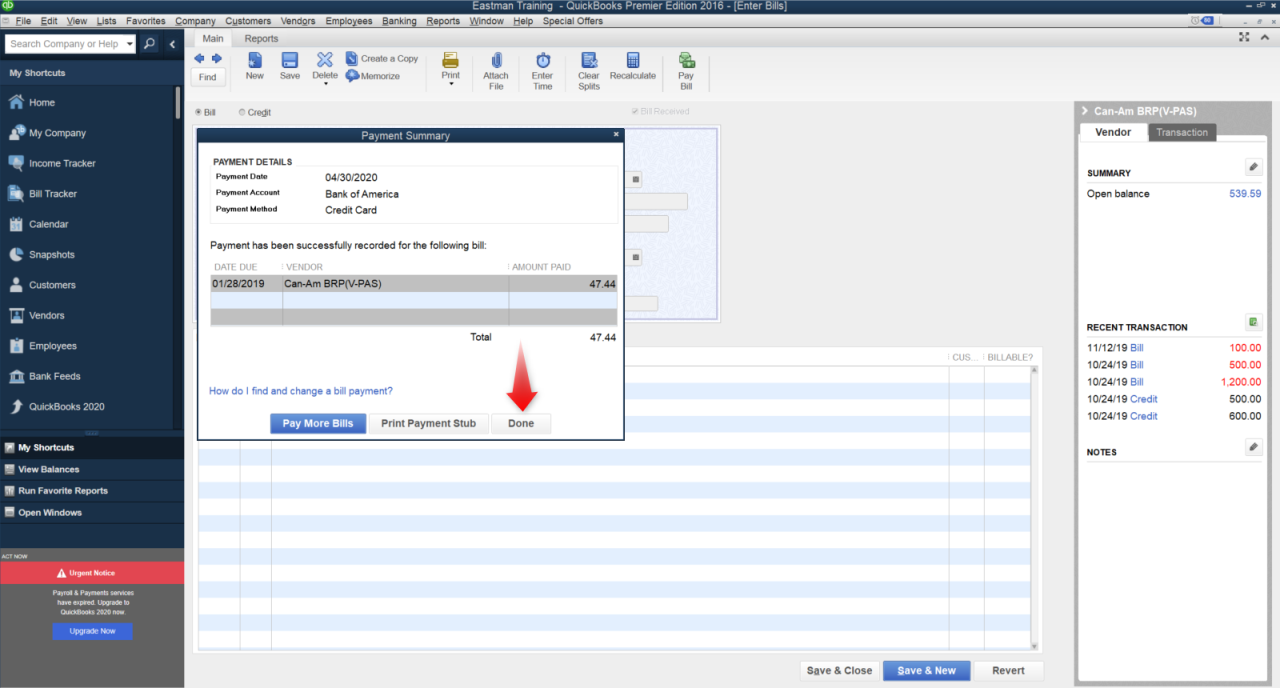

5. Record Transaction

After receiving the payment, record the transaction in QuickBooks. Go to the invoice, select ‘Receive Payment’, and input the payment details. Ensure to select credit card as the payment method.

6. Confirm Payment

Verify the payment has been processed successfully, and your accounts will reflect the transaction. QuickBooks will update the invoice status to ‘Paid’.

7. Reconcile Accounts

At the end of the month, reconcile your accounts to ensure that all credit card transactions match up with your bank statements. This will help maintain accurate records.

Methods of Accepting Credit Card Payments

QuickBooks offers various methods for accepting credit card payments, suitable for different business needs. Here’s a comparison of online and in-person methods, outlining the key differences and benefits of each. Online Payment Acceptance:

Convenience

Customers can pay from anywhere at any time, providing flexibility and ease.

Integration

Directly integrates with your QuickBooks account, simplifying record-keeping.

Payment Links

You can send payment links via email or text which directs customers to a secure payment portal. In-Person Payment Acceptance:

Immediate Transactions

Payments are processed in real-time during face-to-face interactions.

Mobile Payment Options

With mobile card readers, you can accept payments anywhere, making it ideal for markets or events.

Customer Interaction

Allows for personal engagement that can enhance customer satisfaction and loyalty. Considerations for Choosing a Method:

- Evaluate your business model and customer preferences.

- Consider transaction fees associated with each method, as they can vary.

- Review the ease of use and integration with existing QuickBooks features.

In conclusion, understanding the process and options for accepting credit card payments through QuickBooks not only enhances your business operations but also improves customer experience. By following the Artikeld steps and choosing the right method, you can effectively manage your transactions and maintain accurate financial records.

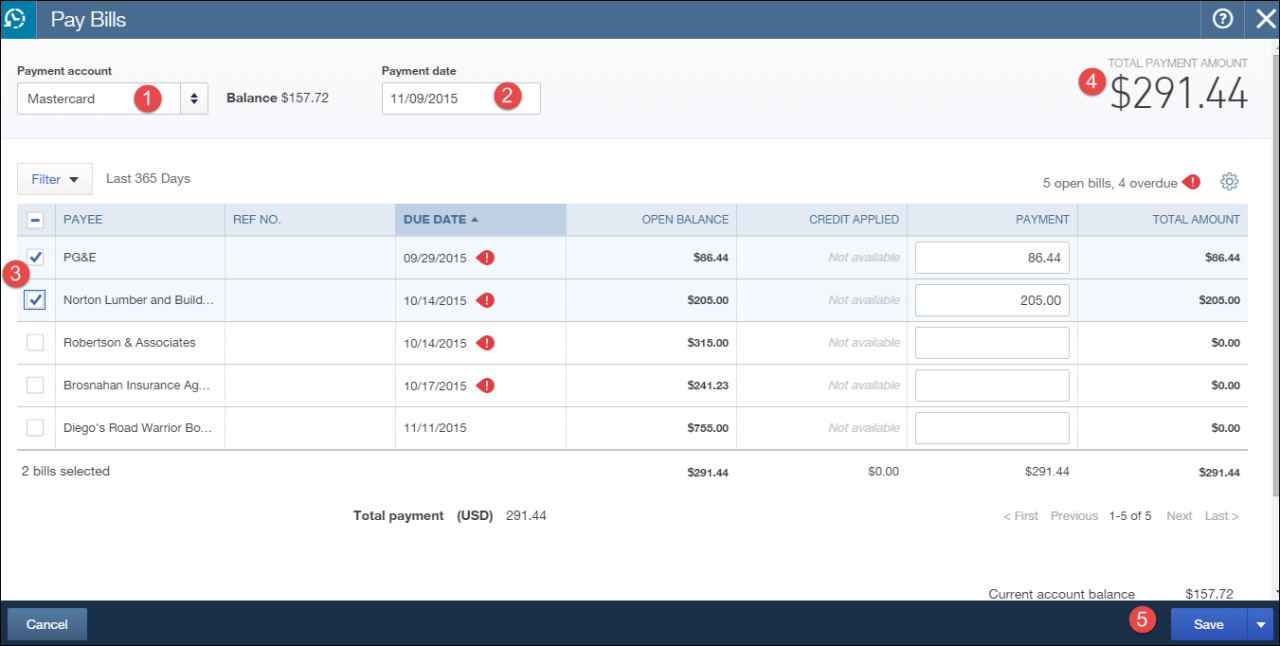

Managing Credit Card Transactions

Effectively managing credit card transactions in QuickBooks is crucial for maintaining accurate financial records and ensuring smooth business operations. This process involves tracking incoming payments, reconciling statements, and generating useful reports to monitor financial health. Utilizing QuickBooks features can simplify these tasks, enabling businesses to focus on growth rather than administrative burdens.Tracking and managing credit card transactions can be efficiently conducted using QuickBooks.

By leveraging the software’s capabilities, businesses can ensure that all transactions are recorded, categorized, and easily accessible for future reference. QuickBooks allows users to enter transactions manually or automatically import them from their bank accounts, which helps maintain an organized financial record.

Reconciling Credit Card Payments

Reconciling credit card payments is essential for confirming that the transactions recorded in QuickBooks match those on credit card statements. This ensures accuracy and helps identify discrepancies early on. The reconciliation process typically involves comparing the amounts in QuickBooks with the statements from the credit card provider.To facilitate effective reconciliation, follow these steps:

1. Collect your credit card statement

Gather the most recent statement from your credit card provider.

2. Access the reconciliation tool in QuickBooks

Navigate to the Banking menu, select Reconcile, and choose the appropriate credit card account.

3. Match transactions

Review each transaction listed in QuickBooks against those on your statement, marking them as cleared once matched.

4. Address discrepancies

Investigate any differences by checking for duplicate entries or missed transactions. Rectify any errors found.

5. Finalize reconciliation

Once all transactions are matched, complete the reconciliation process and generate a reconciliation report for your records.A well-structured approach to reconciliation not only prevents potential financial issues but also provides insights into business spending patterns.

Key Reports for Credit Card Transaction Management, Quickbooks credit card payment

Utilizing reports in QuickBooks can significantly enhance credit card transaction management. These reports provide valuable insights into spending, payment trends, and overall financial health. Below is a table outlining key reports available for managing credit card transactions:

| Report Name | Description | Purpose |

|---|---|---|

| Transaction Detail by Account | Displays all transactions including credit card charges. | Helps track all expenses made with the credit card. |

| Profit and Loss Report | Shows overall income and expenses, including credit card payments. | Provides insight into business profitability. |

| Expenses by Vendor | Breaks down expenses incurred through credit card purchases by vendor. | Assists in identifying spending patterns with specific vendors. |

| Account Reconciliation Report | Summarizes the reconciliation process for credit card accounts. | Confirms that all transactions are accurately recorded. |

These reports not only aid in tracking credit card transactions but also support strategic financial decision-making, helping businesses stay informed about their spending and cash flow.

Fees and Pricing for QuickBooks Credit Card Payments

Understanding the fees and pricing associated with QuickBooks credit card payment processing is essential for businesses looking to streamline their financial operations. QuickBooks offers a competitive pricing model that can either benefit or burden a business, depending on how well one understands the fees involved. QuickBooks charges different fees based on the type of transaction, the payment method used, and the business’s sales volume.

These fees typically include a transaction fee, which is a percentage of the sale, and a per-transaction fee. Businesses should be aware of these costs to avoid unexpected charges.

Transaction Fees for QuickBooks Credit Card Payments

Transaction fees can significantly impact your overall processing costs. Here’s a breakdown of common fees associated with QuickBooks credit card processing:

- Standard Rates: QuickBooks generally charges around 2.4% + $0.25 for swiped transactions, 2.9% + $0.25 for keyed-in transactions, and 3.4% + $0.25 for transactions over a certain amount.

- Monthly Fees: A monthly service fee may apply, which varies based on the subscription plan chosen. Higher-tier plans often come with lower transaction fees.

- Chargeback Fees: If a customer disputes a charge, QuickBooks may impose a chargeback fee, typically around $20.

- Refund Fees: While issuing a refund generally doesn’t incur a fee, the original transaction fee remains non-refundable.

Understanding these fees is crucial for businesses to calculate their net revenue accurately.

Comparison of Pricing Structures with Other Platforms

When comparing QuickBooks credit card processing fees to other platforms like PayPal, Square, or Stripe, it’s essential to consider not just the fees, but also the services provided. QuickBooks charges competitive rates, but here’s how it stacks up against others:

| Service Provider | Swiped Transactions | Keyed-in Transactions | Monthly Fee |

|---|---|---|---|

| QuickBooks | 2.4% + $0.25 | 2.9% + $0.25 | Varies |

| PayPal | 2.7% | 3.5% + $0.15 | No monthly fee |

| Square | 2.6% + $0.10 | 3.5% + $0.15 | No monthly fee |

| Stripe | 2.9% + $0.30 | 2.9% + $0.30 | No monthly fee |

While QuickBooks offers certain advantages, such as integration with its accounting software, other platforms might provide better rates for specific business needs.

Minimizing Credit Card Processing Fees Using QuickBooks

Businesses can adopt several strategies to minimize their credit card processing fees when using QuickBooks:

- Encourage Swiped Transactions: Whenever possible, prompt customers to swipe their cards rather than keying them in, as swiped transactions incur lower fees.

- Set Up a Merchant Account: Utilizing a dedicated merchant account can sometimes yield lower processing fees compared to QuickBooks’ standard processing options.

- Monitor Transactions: Regularly reviewing transaction statements can help identify unnecessary charges or patterns that can be adjusted to minimize fees.

- Choose Appropriate Plans: Evaluating and selecting the right QuickBooks subscription plan based on sales volume can lead to significant savings on fees.

By implementing these tactics, businesses can effectively reduce their operational costs associated with credit card processing while using QuickBooks.

Security Measures for Credit Card Payments

When it comes to handling credit card payments, security is non-negotiable. QuickBooks provides a robust set of features designed to protect sensitive customer information, ensuring that transactions are safe and secure. By implementing these security measures, businesses can minimize the risk of data breaches and build trust with their customers.QuickBooks employs several security features to safeguard credit card transactions. These include end-to-end encryption, tokenization, and compliance with Payment Card Industry Data Security Standards (PCI DSS).

End-to-end encryption protects data as it travels between the customer and the merchant, making it unreadable to any potential interceptors. Tokenization replaces sensitive credit card numbers with unique identification symbols, or tokens, which cannot be reverse-engineered. Compliance with PCI DSS ensures that QuickBooks adheres to industry standards for security protocols and practices.

Best Practices for Ensuring Safety of Credit Card Information

To complement QuickBooks’ built-in security features, businesses should adopt best practices that further enhance the safety of credit card information. These practices can significantly reduce the likelihood of data breaches and fraud.Regularly updating software and systems is essential to protect against vulnerabilities. QuickBooks frequently releases updates that patch security flaws, so keeping the software current is critical. Another important measure is to use strong, unique passwords for QuickBooks accounts, which can deter unauthorized access.

Additionally, enabling two-factor authentication adds an extra layer of security by requiring a second form of verification beyond just a password.

Common Security Risks and Mitigation Strategies

Understanding potential security risks is crucial for any business using QuickBooks for credit card payments. Being aware of these threats allows for proactive measures to mitigate them effectively. Below is a list of common risks and corresponding strategies to address them:

“Awareness and preparedness are key to minimizing security threats.”

- Phishing Attacks: These attacks often trick users into providing sensitive information. To combat this, educate employees about recognizing suspicious emails and ensure they verify requests for sensitive data.

- Data Breaches: Unauthorized access to customer data can lead to significant financial losses. Implementing strong passwords and enabling two-factor authentication can help secure accounts against such breaches.

- Malware Attacks: Malware can steal or compromise sensitive information. Regularly updating antivirus software and conducting system scans can reduce the risk of malware infections.

- Weak Endpoint Security: Devices that access QuickBooks should have security measures in place. Enforce security protocols for all devices accessing the QuickBooks account, ensuring they have firewalls and encryption enabled.

Customer Support for QuickBooks Credit Card Payment Issues

Navigating payment processing can sometimes come with challenges, and having reliable customer support is crucial for QuickBooks credit card payment users. QuickBooks provides various resources to assist users in addressing their payment-related inquiries and issues effectively. One of the primary resources is the QuickBooks Support website, where users can find articles, FAQs, and troubleshooting guides tailored to different aspects of credit card payments.

Additionally, users can access live chat support and forums, fostering a community where they can share experiences and solutions with other QuickBooks users.

Customer Support Resources for QuickBooks Credit Card Payments

Effective customer support is essential in maintaining smooth payment processing. Here are the key resources available to users facing credit card payment issues:

- QuickBooks Help Center: This online hub offers a wealth of articles and guides specifically about credit card payments, providing step-by-step instructions for common issues.

- Live Chat Support: Users can engage with customer support representatives in real-time to resolve urgent issues related to credit card transactions.

- Community Forums: QuickBooks hosts community forums where users can pose questions and receive answers from both support staff and fellow users, creating a collaborative problem-solving environment.

- Phone Support: For more complex issues that require direct assistance, users can contact QuickBooks support via phone, receiving personalized support from experts.

Escalation Process for Credit Card Payment Issues

In situations where initial support does not fully resolve issues, users should know how to escalate their concerns effectively. Following a structured approach can lead to quicker resolutions:

1. Initial Contact Start by contacting QuickBooks support through the available channels (chat, phone, or email).

2. Document the Issue Keep a record of all communications, including dates, times, and details exchanged. This documentation will be helpful if you need to escalate.

3. Request Escalation If the issue remains unresolved, politely request to escalate your case. Explain your concerns and provide the documentation you have gathered.

4. Follow Up After escalation, follow up regularly to check on the progress of your issue, ensuring it remains a priority.

Importance of Customer Support in Payment Processing

Strong customer support is vital for businesses relying on QuickBooks credit card payments. Efficient support helps avoid potential revenue losses caused by payment issues. Quick and effective resolution of problems ensures that transactions are processed smoothly, maintaining customer satisfaction.Furthermore, access to knowledgeable support can help users maximize the platform’s features, leading to improved payment processing efficiency. Reliable support can also mitigate risks associated with payment fraud or technical failures, safeguarding both the business and its customers.

Efficient customer support is the backbone of a seamless payment processing experience, ensuring that businesses can focus on their operations without interruption.

Integrating QuickBooks with Other Payment Solutions

Integrating QuickBooks with third-party credit card payment solutions enhances the overall functionality of your accounting and payment processing capabilities. This integration not only simplifies payment collection but also streamlines transactions, making it easier for businesses to manage their finances efficiently. With various options available, QuickBooks users can choose the best solutions to fit their needs, ensuring a seamless payment process.Integrating QuickBooks with other payment solutions allows businesses to leverage the strengths of multiple platforms.

This can lead to improved cash flow, better customer experience, and reduced manual data entry. Here are some popular credit card payment providers that integrate seamlessly with QuickBooks, making it easier for businesses to accept payments and manage their accounts.

Popular Payment Solutions for QuickBooks Integration

Several payment providers offer robust integration with QuickBooks, enhancing its functionality:

- PayPal: Known for its user-friendly interfaces and widespread acceptance, PayPal integrates with QuickBooks to facilitate online payments and invoice processing.

- Square: This payment solution allows users to accept payments via credit card, debit card, and mobile wallets, syncing transaction data directly into QuickBooks for easy reconciliation.

- Stripe: Ideal for online businesses, Stripe offers powerful tools for managing credit card payments, which can be integrated with QuickBooks for automated bookkeeping.

- Authorize.Net: A popular choice for eCommerce businesses, Authorize.Net’s integration with QuickBooks allows for smooth payment processing and detailed reporting capabilities.

- Shopify: For retailers using Shopify, the integration with QuickBooks ensures that all sales data is accurately captured and managed within QuickBooks.

Utilizing integrations with these payment solutions brings numerous benefits. For instance, businesses can automate the reconciliation process, ensuring that every transaction is accounted for without manual data entry. This not only saves time but also minimizes errors, allowing business owners to focus more on strategic tasks rather than administrative ones.

Integrating QuickBooks with third-party payment solutions can significantly improve operational efficiency and enhance customer satisfaction.

Frequently Asked Questions

How long does it take to set up QuickBooks credit card payment?

Setting up QuickBooks credit card payment can typically be done within a few hours, provided you have all the necessary documentation ready.

Can I accept credit card payments online with QuickBooks?

Yes, QuickBooks allows you to accept credit card payments online through its integrated solutions.

What types of credit cards does QuickBooks accept?

QuickBooks generally accepts all major credit cards including Visa, MasterCard, American Express, and Discover.

Are there any hidden fees associated with QuickBooks credit card payments?

While QuickBooks is transparent about its fees, it’s essential to review the terms to understand any potential extra charges that may apply.

Is customer support available for QuickBooks credit card payment issues?

Yes, QuickBooks offers customer support for users experiencing issues with credit card payments, ensuring you get the help you need.