Quickbooks online credit card payment takes center stage as one of the most efficient ways for businesses to manage their transactions. With its user-friendly interface and seamless integration with various credit card processors, QuickBooks Online simplifies the process of accepting credit card payments. Not only does it help streamline your accounting, but it also offers valuable features that enhance your business’s financial tracking.

In this guide, we’ll walk you through everything you need to know about setting up and managing credit card payments in QuickBooks Online, from the initial setup to processing transactions, and even troubleshooting common issues. Whether you’re a new user or looking to optimize your existing setup, this overview will equip you with the necessary insights to make the most of your QuickBooks experience.

Overview of QuickBooks Online Credit Card Payment

QuickBooks Online offers a seamless solution for businesses looking to manage their credit card payments efficiently. With its user-friendly interface and robust features, QuickBooks simplifies financial transactions while enhancing cash flow management. By integrating credit card payments directly into the platform, users can streamline their accounting processes and reduce manual entry errors.QuickBooks Online supports various credit card processors, making it adaptable to different business needs.

This integration enables businesses to accept payments from their customers directly within the software, transforming the way they handle transactions. Users can choose from multiple payment processors, ensuring flexibility and convenience.

Features and Benefits of Credit Card Payments

Utilizing credit card payments in QuickBooks Online comes with numerous advantages that can significantly enhance operational efficiency. The following points Artikel key features and benefits:

- Instant Payment Processing: QuickBooks Online allows businesses to receive payments instantly, improving cash flow and reducing waiting times for fund availability.

- Automated Record Keeping: Transactions are automatically recorded in the accounting system, minimizing manual data entry and reducing the chances of errors.

- Enhanced Customer Experience: Customers can make payments quickly and easily, leading to higher satisfaction and potentially increased sales.

- Secure Transactions: QuickBooks Online ensures that all credit card transactions are processed securely, protecting sensitive customer information.

- Comprehensive Reporting: The platform provides detailed reports on credit card payments, helping businesses track income and expenses effectively.

Integration with Various Credit Card Processors

QuickBooks Online seamlessly integrates with a wide range of credit card processors, facilitating diverse payment acceptance options. The integration process is straightforward, allowing businesses to connect their existing accounts or create new ones directly from QuickBooks. Here are some notable processors supported:

- PayPal: A popular choice for many businesses, PayPal enables quick transactions and is widely recognized by consumers.

- Square: Known for its versatility, Square integrates with QuickBooks Online to simplify payment acceptance across various platforms.

- Stripe: This processor is favored for online businesses, offering robust security and easy integration with the QuickBooks platform.

- Intuit Payments: As a native option within QuickBooks Online, Intuit Payments provides a seamless experience for users, offering competitive rates and fast deposits.

Types of Credit Cards Accepted, Quickbooks online credit card payment

QuickBooks Online supports a variety of credit cards for payment processing, allowing businesses to cater to their customers’ preferences. The following types of credit cards are typically accepted:

- Visa: One of the most widely used credit cards globally, accepted by virtually all merchants.

- MasterCard: Another major credit card provider, offering extensive acceptance across different industries.

- American Express: Known for its premium offerings, Amex is widely accepted, particularly in retail and hospitality sectors.

- Discover: This card has gained popularity and is accepted at a growing number of retailers.

“The integration of credit card payments within QuickBooks Online not only streamlines transactions but also enhances the overall financial management experience for businesses.”

Setting Up Credit Card Payments in QuickBooks Online

To start accepting credit card payments in QuickBooks Online, you’ll need to enable the feature that connects your business to a merchant account. This setup allows you to efficiently process customer transactions, boosting cash flow and simplifying bookkeeping. Follow the steps Artikeld below to establish credit card payment capabilities in your QuickBooks Online account.

Step-by-Step Guide for Enabling Credit Card Payments

Enabling credit card payments involves a series of straightforward steps to ensure your account is properly configured.

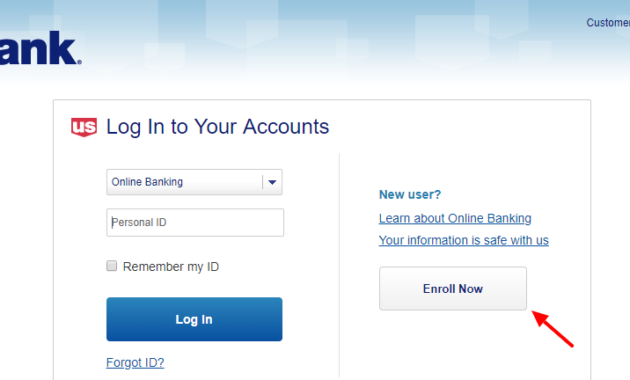

1. Log into QuickBooks Online

Start by signing in to your QuickBooks Online account.

2. Access the ‘Settings’ Menu

Click on the gear icon located in the top right corner of the dashboard.

3. Select ‘Account and Settings’

From the drop-down menu, choose ‘Account and Settings.’

4. Navigate to ‘Payments’

In the left-hand menu, select ‘Payments.’

5. Choose ‘Get Started’

If you haven’t set up payments before, click the ‘Get Started’ button.

6. Fill in Business Information

Enter the required details about your business, including your business name, address, and contact information.

7. Set Up Merchant Account

You’ll be prompted to set up or connect an existing merchant account for processing payments.

8. Complete Verification Steps

Follow any verification procedures required by the payment processor, such as providing banking details for deposits.

9. Review and Accept Terms

Read through the terms and conditions and accept them to finalize setup.

Required Information for Setting Up a Merchant Account

When setting up a merchant account, certain information is essential to facilitate smooth processing of credit card transactions. Gather the following details to ensure a seamless setup:

Business Legal Name

The name registered for your business.

Employer Identification Number (EIN)

A unique identifier for tax purposes, issued by the IRS.

Business Type

Specify whether your business is a sole proprietorship, LLC, corporation, etc.

Contact Information

Provide a reliable phone number and email for communications.

Bank Account Details

Include your bank account number and routing number for deposits.

Sales Volume Estimates

Provide an estimate of your monthly sales volume to help the payment processor evaluate your application.

Checklist for Accepting Credit Card Payments

To ensure you are fully prepared to start accepting credit card payments, here is a checklist of configurations that need to be in place:

- Review and configure payment methods in QuickBooks Online.

- Ensure you have a secure internet connection and an updated web browser.

- Confirm your business information is accurate and up-to-date in QuickBooks.

- Set payment preferences, including which credit cards you will accept.

- Enable email receipts for transactions for customer convenience.

“Proper setup of credit card payments streamlines customer transactions and promotes efficient cash flow management.”

By following these guidelines, you can effectively enable credit card payments in QuickBooks Online and enhance your business’s payment processing capabilities.

Processing Credit Card Transactions: Quickbooks Online Credit Card Payment

Accepting credit card payments from customers has become a standard practice for many businesses due to its convenience and efficiency. QuickBooks Online streamlines this process, allowing you to manage your transactions seamlessly. This section Artikels the steps involved in processing credit card payments and how to track them effectively within the software.

Accepting Credit Card Payments from Customers

To process credit card transactions, you’ll typically follow a straightforward procedure. First, ensure that your QuickBooks Online account is set up for credit card processing. Once set up, you can accept payments via various methods, such as in-person transactions using a card reader or online payments through invoices sent to customers. When a customer is ready to pay, you simply enter their payment details into the QuickBooks interface.

This includes the credit card number, expiration date, and CVV. Once you submit the payment, QuickBooks will communicate with the payment processor, verify the transaction, and complete the sale.

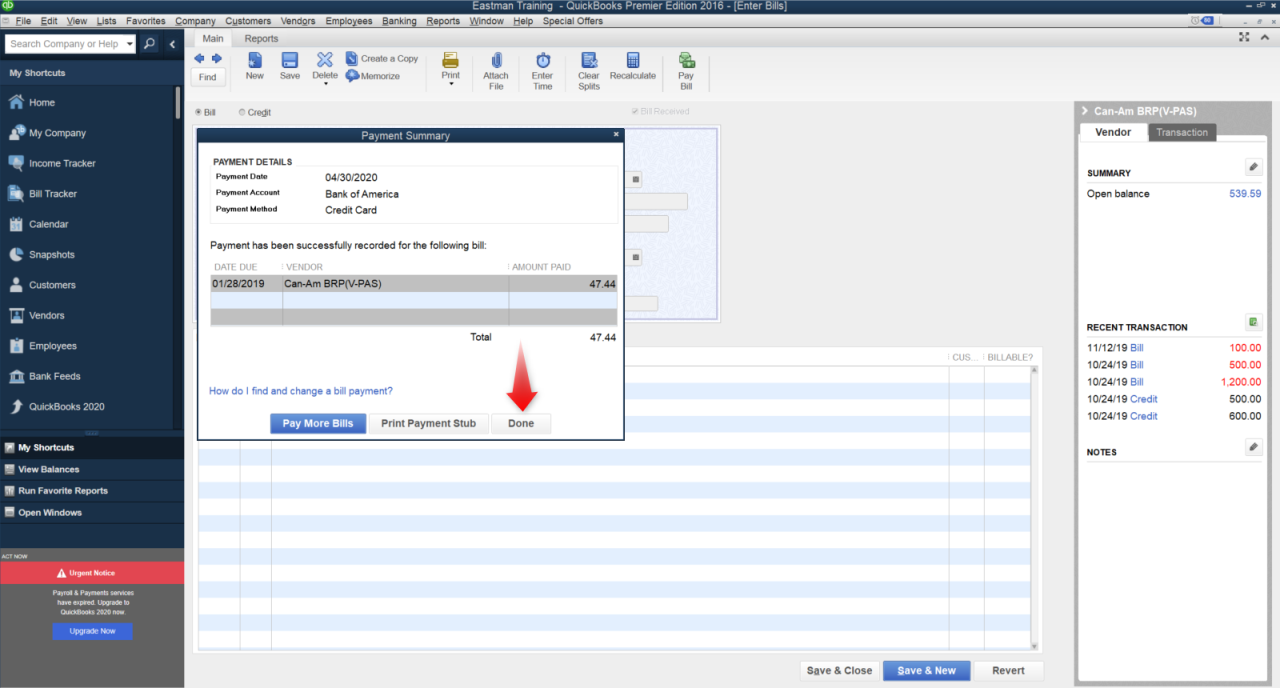

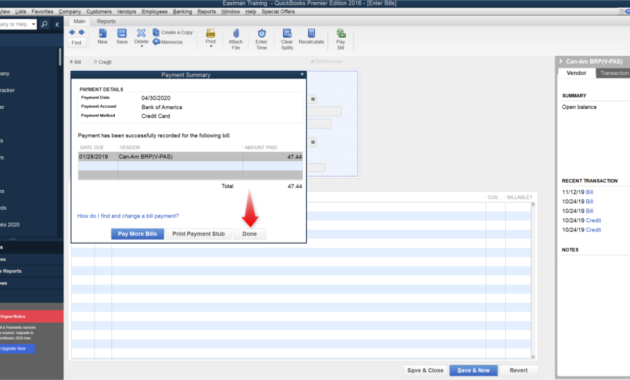

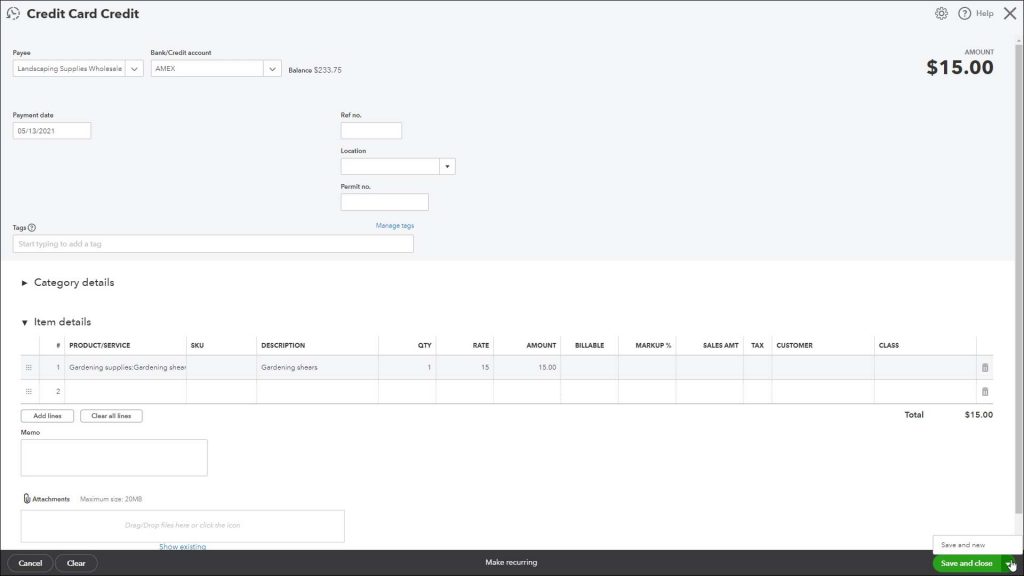

Recording Credit Card Transactions in QuickBooks Online

Accurate recording of credit card transactions is essential for maintaining your financial records. After accepting a payment, QuickBooks automatically generates a record of the transaction. This record includes crucial details such as the amount, payment method, and customer information.To manually record a credit card transaction, navigate to the “Sales” tab, select “Customers,” and choose the customer who made the payment.

Click on “Receive Payment,” fill in the payment details, and ensure the payment method is set to credit card. After saving, the transaction will be reflected in your account history.

Tracking Pending and Completed Transactions

Effective tracking of both pending and completed transactions is vital for managing cash flow. QuickBooks Online provides various tools to help you monitor these transactions easily. Pending transactions are typically those that have been initiated but not yet fully processed. You can view pending payments by going to the “Sales” tab and selecting “Payment Links.” Here, you will find a list of transactions waiting for approval or completion.Completed transactions are accessible in the “Transactions” menu under “Sales.” This section displays all payments received and processed, categorized by date, customer, or amount.

The ability to filter and sort these transactions helps you gain quick insights into your business’s cash flow.To enhance your transaction tracking, you may also consider utilizing the “Reports” feature. This allows for in-depth analysis of your sales and payment history over specified periods.

“Accurate tracking of transactions ensures financial integrity and aids in timely decision-making.”

Fees and Charges for Credit Card Payments

Credit card payments offer convenience for businesses and customers alike, but they come with a variety of fees that can impact your bottom line. Understanding these fees is crucial for effective financial management within QuickBooks Online.In QuickBooks Online, the processing of credit card transactions typically involves several common fees that businesses should be aware of to avoid unexpected costs. These fees can vary widely based on the payment processor you choose, the type of transaction, and the payment method used.

Common Fees Associated with Credit Card Processing

Processing credit card payments often incurs multiple fees. Here are the most common ones encountered:

- Transaction Fees: These fees are charged per transaction and can be either a flat rate or a percentage of the sale amount. For example, a processor may charge $0.30 per transaction plus 2.9% of the transaction amount.

- Monthly Fees: Some payment processors charge a monthly fee for using their services, which may cover access to their payment gateway and other features.

- Chargeback Fees: If a customer disputes a charge, a chargeback fee is applied. These fees can range from $15 to $50, depending on the processor.

- Cross-Border Fees: When processing international transactions, additional fees may apply due to currency conversion and processing costs.

Flat-Rate vs. Percentage-Based Fees for Credit Card Transactions

When evaluating credit card processing fees, businesses often encounter two primary structures: flat-rate and percentage-based fees. Each has its pros and cons.

Flat-rate fees are straightforward, charging a fixed amount per transaction regardless of the sale size. This predictability can simplify budgeting for smaller businesses.

Percentage-based fees scale with the sale amount, making them potentially more cost-effective for larger transactions. However, they can lead to higher costs if small transaction volumes are frequent.

For example, if a business processes a $100 transaction, a flat-rate fee of $0.30 would incur a total cost of $0.30, while a percentage fee of 2.9% would cost $2.90. Therefore, understanding your transaction patterns is essential for choosing the most cost-effective fee structure.

Potential Hidden Costs for Businesses

While reviewing credit card processing fees, businesses must also be vigilant about potential hidden costs that may arise. These costs can catch you off guard and significantly impact your profitability.

- It is crucial to review the service agreement for any clauses that might lead to unexpected charges, such as cancellation fees or fees for non-compliance with payment processor terms.

- Additionally, some processors charge for premium features, such as advanced fraud protection or detailed reporting, which might not be immediately apparent when selecting a service.

By being aware of these factors, businesses can make more informed decisions about the credit card payment options that align best with their operational needs and budget.

Troubleshooting Common Issues

When processing credit card payments in QuickBooks Online, businesses may encounter a variety of issues that can disrupt transaction flow and affect customer satisfaction. Addressing these common problems promptly is essential to ensure a seamless payment experience for both the business and its customers. Understanding the typical challenges and knowing how to resolve them will help maintain a smooth operation.

Frequent Problems Encountered

Processing credit card transactions can sometimes lead to complications. Here are some common issues that users may face:

- Declined Transactions: Often caused by insufficient funds, expired cards, or incorrect card information.

- Errors in Payment Processing: This can stem from connectivity issues, server downtime, or bugs within the application.

- Inconsistent Payment Records: Transactions may not appear correctly in QuickBooks due to syncing issues.

Resolving Declined Transactions

When a transaction is declined, it’s important to understand the potential reasons and how to address them effectively. Here are steps you can take:

- Verify Card Information: Ensure that the card number, expiration date, and CVV are entered correctly. A simple typo can lead to a decline.

- Check Card Status: Confirm that the card is not expired or reported lost or stolen.

- Contact Card Issuer: If everything appears correct, it may be worth reaching out to the card issuer for further clarification regarding the decline.

“A declined transaction is often a temporary setback; addressing the root cause quickly can restore payment processing.”

Ensuring Smooth Payment Processing

To minimize interruptions during credit card processing, businesses can adopt several best practices. Implementing these strategies can lead to smoother transactions and improved customer experience:

- Keep Software Updated: Regular updates for QuickBooks Online and associated payment processing software can help prevent bugs and improve performance.

- Check Internet Connectivity: A stable internet connection is crucial for processing transactions effectively. Ensure your network is reliable.

- Monitor Transaction Limits: Be aware of daily or monthly limits set by the payment processor, as exceeding these can lead to failed transactions.

“Proactive maintenance and monitoring can significantly reduce the chances of payment processing issues.”

Reporting and Analytics for Credit Card Payments

Effective reporting and analytics are crucial for understanding and optimizing your credit card payment processes in QuickBooks Online. By utilizing the reporting features, businesses can gain insights into transaction trends, customer behavior, and overall payment efficiency. This knowledge empowers businesses to make informed decisions regarding their credit card payment strategies and enhances financial oversight.

Generating Reports for Credit Card Transactions

QuickBooks Online offers various report generation tools that allow users to create and customize reports related to credit card transactions. To generate these reports, follow these simple steps:

- Navigate to the “Reports” section on the left-hand menu.

- In the search bar, type “Credit Card” to filter relevant reports.

- Select from options such as “Transaction Detail by Account” or “Sales by Customer Detail.”

- Customize the date range and any other filters as needed.

- Click “Run Report” to generate the report for analysis.

These reports provide a comprehensive overview of all credit card transactions, including amounts, dates, and customer details, thereby facilitating deeper financial analysis.

Importance of Tracking Credit Card Payment Trends

Monitoring credit card payment trends is essential for identifying growth opportunities and potential challenges. By analyzing transaction data over time, businesses can uncover patterns in customer spending, seasonal fluctuations, and payment method preferences. This information is invaluable for making strategic decisions, such as adjusting marketing tactics or optimizing cash flow management.Tracking these trends not only aids in forecasting future sales but also helps in assessing the effectiveness of promotional campaigns and customer engagement strategies.

Key Metrics to Monitor for Credit Card Payments

When evaluating credit card payment performance, several key metrics should be monitored to ensure a comprehensive understanding of your payment processing efficiency. These metrics include:

Transaction Volume

The total number of credit card transactions over a specific period, indicating customer engagement levels.

Average Transaction Value

Calculated by dividing total sales by the number of transactions, this metric shows the average amount spent per transaction.

Payment Processing Time

The duration it takes for transactions to be processed, which impacts customer satisfaction and cash flow.

Chargeback Rate

The percentage of transactions that are disputed by customers, providing insight into potential fraud or service issues.

Fees and Costs

Understanding the total fees associated with credit card processing helps in budgeting and assessing profitability.Tracking these metrics provides a clear view of how credit card transactions are affecting your business’s bottom line and can highlight areas for improvement.

“Regularly reviewing these metrics can lead to informed decisions that drive business growth.”

Best Practices for Using Credit Cards with QuickBooks Online

To maximize the efficiency of credit card payments in QuickBooks Online, it is essential for businesses to implement best practices that not only streamline their processes but also ensure security and accuracy. By adopting effective strategies, businesses can enhance their financial management and minimize potential pitfalls associated with credit card transactions.

Maximizing Efficiency of Credit Card Payments

Efficient handling of credit card payments can significantly improve cash flow and customer satisfaction. Here are some tips to consider for maximizing efficiency:

- Integrate Payment Solutions: Use QuickBooks Online’s integrated payment processing feature to streamline transactions directly within the platform, reducing time spent on manual entries.

- Automate Recurring Payments: For regular customers, automate recurring billing to ensure timely payments while saving time and reducing errors.

- Utilize Mobile Payments: Enable mobile payment options to facilitate on-the-go transactions, enhancing convenience for both your business and customers.

Security Measures for Handling Credit Card Information

When dealing with credit card transactions, security should be a top priority. Implementing robust security measures protects sensitive customer data and builds trust. Key recommendations include:

- Use Secure Payment Gateways: Always use reputable and secure payment gateways that comply with PCI DSS (Payment Card Industry Data Security Standard) to protect credit card information.

- Enable Two-Factor Authentication: Add an extra layer of security by enabling two-factor authentication in your QuickBooks Online account, preventing unauthorized access.

- Regularly Update Software: Keep your QuickBooks Online and any associated applications updated to benefit from the latest security patches and features.

Maintaining Accurate Records and Reconciliation

Accurate record-keeping and regular reconciliation are vital for effective financial management. To ensure precision in your transactions, consider the following practices:

- Daily Transaction Review: Conduct daily reviews of credit card transactions to identify discrepancies and resolve issues promptly, ensuring your records are always up-to-date.

- Reconcile Monthly Statements: Regularly reconcile your monthly credit card statements with your QuickBooks Online records to ensure accuracy and identify any unauthorized charges.

- Use Categorization: Properly categorize expenses related to credit card transactions within QuickBooks to provide clarity for reporting and analysis.

FAQ Corner

What types of credit cards can I accept?

You can accept major credit cards including Visa, MasterCard, American Express, and Discover through QuickBooks Online.

Are there any monthly fees for using credit card payments?

While QuickBooks Online does not charge a monthly fee specifically for credit card processing, standard transaction fees apply.

How do I resolve a declined transaction?

To resolve declined transactions, check the card details entered, ensure sufficient funds, and contact the card issuer if necessary.

Can I track my credit card transactions in real-time?

Yes, QuickBooks Online allows you to monitor your credit card transactions in real-time, giving you up-to-date insights into your cash flow.

Is it safe to process credit card payments through QuickBooks Online?

Yes, QuickBooks Online implements strong security measures, including encryption, to protect credit card information during processing.