Raymour and Flanigan credit card online payment is designed to streamline your shopping experience, making it as convenient as possible to manage your purchases. With a plethora of features, this credit card not only offers financial flexibility but also a range of benefits tailored for your home furnishing needs. Understanding how to navigate the online payment process can enhance your overall customer experience, ensuring you can enjoy your new furniture hassle-free.

From easy payment options to security measures that protect your transactions, this overview aims to cover everything you need to know about managing your Raymour and Flanigan credit card online payments effectively. Whether you’re a new cardholder or someone looking to optimize your usage, we’ve got you covered with essential information and tips.

Overview of Raymour and Flanigan Credit Card

The Raymour and Flanigan credit card is designed for customers seeking flexibility and rewards while shopping for furniture and home goods. This card offers unique features that cater specifically to those who frequently shop at Raymour and Flanigan, enhancing the shopping experience and providing financial benefits.The Raymour and Flanigan credit card comes with several notable features. One of the primary benefits is the ability to finance purchases over time with special promotional offers.

For instance, cardholders often have access to financing options that allow them to spread payments over 12 or even 24 months, depending on the amount spent. Additionally, the card provides exclusive discounts and promotional events throughout the year, allowing customers to save more on their purchases. Another significant feature is the rewards program, which lets cardholders earn points on purchases that can later be redeemed for discounts or store credit.

Benefits of Using the Raymour and Flanigan Credit Card

Utilizing the Raymour and Flanigan credit card offers various advantages to consumers looking to enhance their purchasing power and financial flexibility.

- Exclusive Financing Offers: Cardholders can take advantage of promotional financing options that allow for low or no interest on large purchases, making it easier to afford high-quality furniture.

- Rewards Program: Every purchase earns points which can be redeemed for future discounts, effectively lowering the cost of subsequent purchases.

- Special Offers: Cardholders receive exclusive access to sales events and promotional offers that are not available to non-cardholders, providing additional savings opportunities.

- Online Account Management: The ability to manage the account online allows users to track spending, make payments, and view statements conveniently.

Eligibility Criteria for Obtaining the Credit Card

To qualify for the Raymour and Flanigan credit card, applicants must meet certain eligibility criteria set by the issuer.

- Age Requirement: Applicants must be at least 18 years old to apply for the credit card.

- Credit Score: A good credit score is typically required, which may vary depending on the financial institution’s criteria. Generally, a score of 650 or higher is viewed favorably.

- Income Verification: Proof of stable income may be required to demonstrate the ability to make timely payments on the card.

- Residency Status: Applicants must be legal residents of the United States.

“The Raymour and Flanigan credit card not only simplifies the purchasing process but also enhances the shopping experience with rewards and exclusive offers.”

Online Payment Process

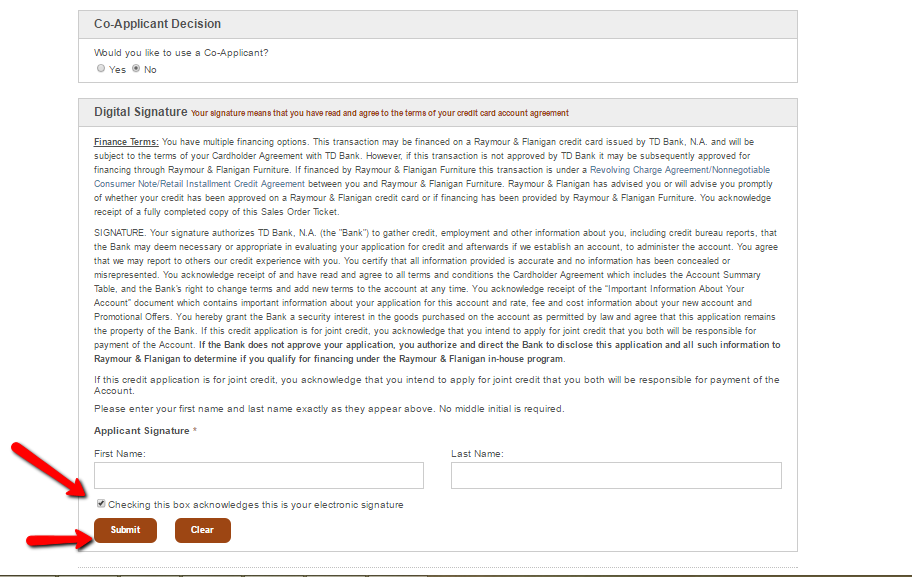

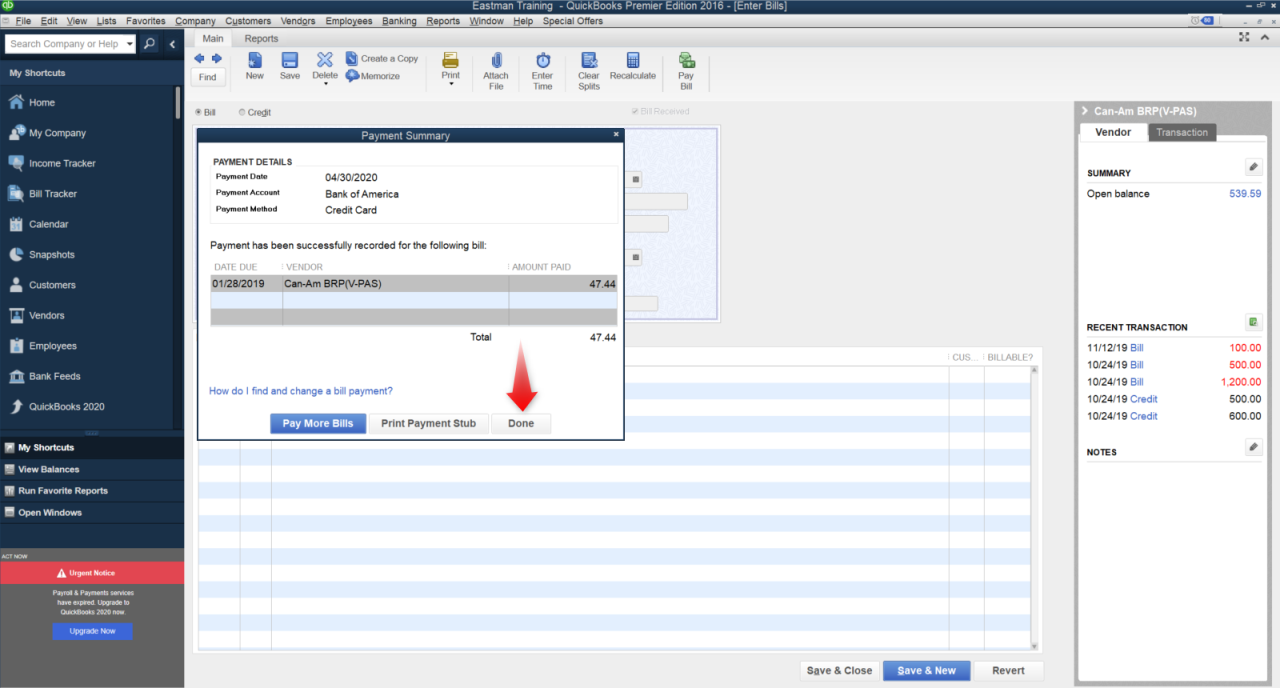

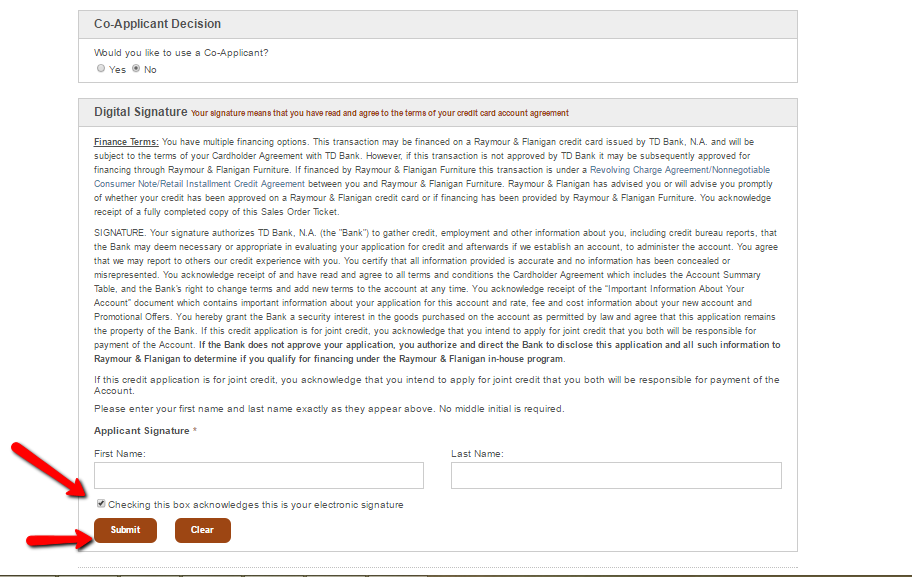

Making an online payment with your Raymour and Flanigan credit card is designed to be quick and straightforward. Following a simple step-by-step process ensures that your transaction is processed smoothly and securely. Here’s how you can easily manage your payments online.To complete your payment, you need to follow these steps:

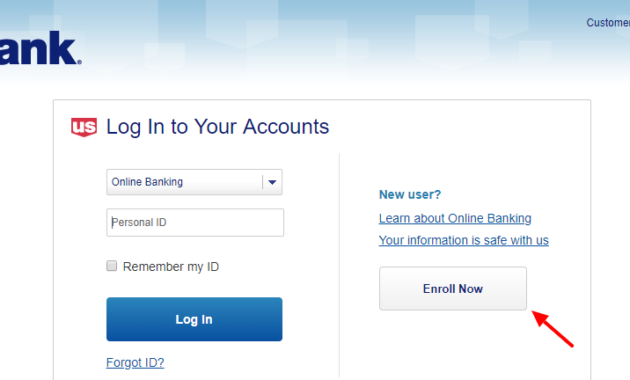

- Visit the Raymour and Flanigan official website and log into your account. If you do not have an account, you’ll need to create one.

- Navigate to the payment section, which is generally found under your account settings or billing information.

- Select the option to make a payment and enter the amount you wish to pay.

- Provide your Raymour and Flanigan credit card information, including the card number, expiry date, and CVV code.

- Review your payment details to ensure everything is correct.

- Submit your payment. You should receive a confirmation message once the transaction is completed.

Before initiating the payment process, gather the following necessary information to streamline your transaction:

Necessary Information for Payment:

- Your Raymour and Flanigan credit card number

- Expiry date of the credit card

- Card Security Code (CVV)

- Your billing address associated with the credit card

While making online payments, you may encounter some common issues. Addressing these effectively can help ensure a seamless payment experience.

Common Issues During Online Payments

When processing online payments, users often face various challenges. Understanding these issues and their resolutions can facilitate a smoother transaction process.

Common Issues and Resolutions:

- Incorrect Card Information: Double-check that your card details are entered correctly, including the expiry date and CVV.

- Insufficient Funds: Ensure that your account has enough available credit to cover the payment amount.

- Website Errors: If the Raymour and Flanigan website is unresponsive, try refreshing the page or clearing your browser cache.

- Payment Declined: Contact the bank or financial institution that issued your credit card to verify that there are no blocks on your account.

- Security Verification: Sometimes, additional security measures may prevent the transaction. Follow any prompts or verification steps provided.

By understanding these steps and common issues, you can confidently manage your Raymour and Flanigan credit card payments online.

Security Measures

Online security is of utmost importance when it comes to handling financial transactions, especially those involving credit cards. Raymour and Flanigan have implemented several robust security features to protect customers during online payments. Understanding these measures can provide peace of mind while shopping online.Raymour and Flanigan utilize advanced security technologies to safeguard customer information. These include encryption protocols that secure data during transmission, ensuring that sensitive details such as credit card numbers and personal information are protected from unauthorized access.

Customers can engage in their online shopping with confidence, knowing that the company prioritizes their security.

Security Features for Online Payments

A variety of security features are integral to ensuring the safety of online transactions with the Raymour and Flanigan credit card. These components work together to create a secure shopping environment for customers:

- SSL Encryption: All transactions are protected by Secure Socket Layer (SSL) encryption, which encodes the data exchanged between the customer and the website.

- Fraud Detection Systems: The company employs sophisticated fraud detection systems that monitor transactions for suspicious activity in real-time.

- Two-Factor Authentication: Customers can set up two-factor authentication for added security, requiring a second form of verification during the login process.

- Regular Security Audits: Raymour and Flanigan conduct regular security audits and updates to their systems, ensuring they are equipped to handle any emerging threats.

To further enhance online security, customers should also adopt certain best practices. Implementing these measures can significantly reduce the risk of fraud during online transactions.

Best Practices for Secure Transactions, Raymour and flanigan credit card online payment

Following best practices is essential for customers looking to secure their online transactions. These practices can help minimize vulnerabilities and enhance the safety of financial information:

- Use Strong Passwords: Customers should create complex passwords that include a mix of letters, numbers, and special characters to prevent unauthorized access to their accounts.

- Monitor Account Statements: Regularly checking account statements for any unauthorized transactions enables customers to quickly address potential fraud.

- Secure Wi-Fi Connections: Avoid making transactions over public Wi-Fi networks, as they can be easily intercepted. Opt for secure home or cellular connections whenever possible.

- Keep Software Updated: Keeping operating systems, browsers, and security software updated helps protect devices from vulnerabilities that might be exploited by cybercriminals.

In the unfortunate event of fraudulent activity, it is critical for customers to know how to report such incidents effectively. Prompt action can help mitigate damage and protect personal information.

Reporting Fraudulent Activities

If customers suspect fraudulent activity on their Raymour and Flanigan credit card, they should act immediately. The reporting process is straightforward and designed to provide assistance in resolving issues quickly.

- Contact Customer Service: Customers should immediately call Raymour and Flanigan’s customer service to report any suspicious transactions or lost/stolen cards.

- Review Transaction History: Thoroughly reviewing recent transactions can help identify unauthorized charges that need to be reported.

- File a Fraud Report: Customers may need to file a formal fraud report, providing details of the unauthorized transactions to facilitate the investigation.

- Notify Credit Bureaus: If necessary, contacting credit bureaus to place a fraud alert on credit reports can prevent further unauthorized activity.

Customer Support and Resources

Raymour and Flanigan understands that effective customer support is essential for credit card holders, particularly when it comes to payment-related inquiries. Whether you are experiencing issues with your online payment or have questions regarding your account, the support options available can help you resolve your concerns swiftly and efficiently. Accessing FAQs and online resources is a key way for customers to find answers to their payment-related questions.

These resources provide essential information regarding payment processes, fees, and general account management, making it easier for customers to navigate their financial transactions.

Customer Support Options for Credit Card Holders

To ensure a seamless experience for credit card users, Raymour and Flanigan offers several customer support options. Here are the primary resources available:

- Phone Support: Customers can reach out to the dedicated customer service line for immediate assistance. Trained representatives are available to help with any inquiries about billing, payments, or account issues.

- Online Chat: For those who prefer real-time assistance, the online chat feature on the Raymour and Flanigan website provides quick responses to customer questions.

- Email Support: Customers can send detailed inquiries via email, and the support team typically responds within 24 hours, offering a convenient way to address less urgent matters.

- Account Management Portal: Credit card holders can log into their accounts to manage payments, view statements, and access important account information at their convenience.

- Social Media Support: Raymour and Flanigan actively monitors their social media accounts, allowing customers to engage with the brand and receive support through platforms like Facebook and Twitter.

Accessing FAQs and Online Resources

The FAQs section on the Raymour and Flanigan website is a valuable resource for credit card holders. This section covers a variety of topics, including payment processes, card benefits, and troubleshooting tips. Customers can easily navigate to find solutions to common issues.

“Accessing the FAQs can save time and provide immediate answers to many payment-related inquiries.”

Additionally, the website features a dedicated support page with articles and guides designed to assist customers in managing their accounts and making payments. This resource is especially helpful for first-time users or those unfamiliar with online payment systems.

Importance of Customer Service in Resolving Payment Issues

Customer service plays a vital role in effectively resolving payment issues and ensuring a smooth experience for credit card holders. Quick and responsive support can prevent frustration, protect customer satisfaction, and build long-term loyalty. When customers encounter payment problems, having access to knowledgeable representatives who can address their concerns promptly is crucial. This ensures that customers feel valued and supported throughout the payment process, reinforcing confidence in their financial decisions and the brand itself.

Furthermore, strong customer service can lead to positive word-of-mouth recommendations, benefiting Raymour and Flanigan in the long run.

Comparison with Other Store Credit Cards

When considering store credit cards, it’s essential to weigh the features and benefits of each option. The Raymour and Flanigan credit card stands out in the home furnishings sector, but how does it stack up against other retail store credit cards? This section dives into a comprehensive comparison, highlighting both advantages and disadvantages alongside customer feedback.

Raymour and Flanigan vs. Competitors

The Raymour and Flanigan credit card offers specific advantages that appeal to customers looking for home furniture solutions. Here’s a comparison of its features with other popular store credit cards like IKEA and Home Depot.

- Rewards and Incentives: Raymour and Flanigan provides special financing offers, including deferred interest promotions for qualifying purchases. In contrast, IKEA’s card focuses more on rewards points redeemable for future purchases, appealing to frequent shoppers.

- Interest Rates: The card typically has an APR that is competitive within the furniture sector, but it may be higher than cards from home improvement stores like Home Depot, which often offer lower rates for larger purchases.

- Payment Flexibility: Raymour and Flanigan offers a variety of payment options, including online payments and flexible billing. However, competitors like Lowe’s provide similar flexibility but often include additional tools for managing home improvement expenses.

- Customer Perks: Raymour and Flanigan customers can access exclusive sales events and promotions, but competitors like Macy’s frequently run broader seasonal sales that may attract a wider base.

Comparing these features clarifies that while Raymour and Flanigan has unique offerings pertinent to home furnishings, competitors may provide broader rewards systems and lower interest rates.

Advantages and Disadvantages

The Raymour and Flanigan credit card has its own set of strengths and weaknesses compared to other retail store cards. Understanding these can help prospective cardholders make informed decisions.

- Advantages:

- Store-specific perks, like exclusive discounts and promotional events.

- Special financing options tailored for large purchases, making it easier to manage costs over time.

- Disadvantages:

- Limited to one type of product category, which may not suit all consumers’ needs.

- Potentially higher financing costs if the balance is not paid off during promotional periods.

Considering these factors is crucial for consumers as they evaluate whether the benefits of the Raymour and Flanigan credit card align with their shopping habits.

Customer Feedback on Store Credit Cards

Customer ratings and feedback can offer valuable insights into the user experience with store credit cards. For Raymour and Flanigan, many customers appreciate the financing options but express concerns regarding interest rates and account management.

“The financing options helped me furnish my entire living room, but I wish the APR was lower.”

A typical customer review.

In comparison, other retailers like IKEA or Home Depot often receive praise for their customer service and rewards systems. Users frequently remark on how easy it is to earn points at IKEA and the straightforward terms at Home Depot.In summary, while the Raymour and Flanigan credit card caters specifically to home furnishing needs with unique benefits, it also faces competition from broader retail cards that may appeal to a wider audience.

The decision ultimately depends on individual purchasing habits and preferences.

Managing Your Credit Card Account Online

Managing your Raymour and Flanigan credit card account online is a convenient way to keep track of your finances and make payments. Setting up an online account only takes a few minutes and provides you with valuable tools for managing your billing and transactions effectively.

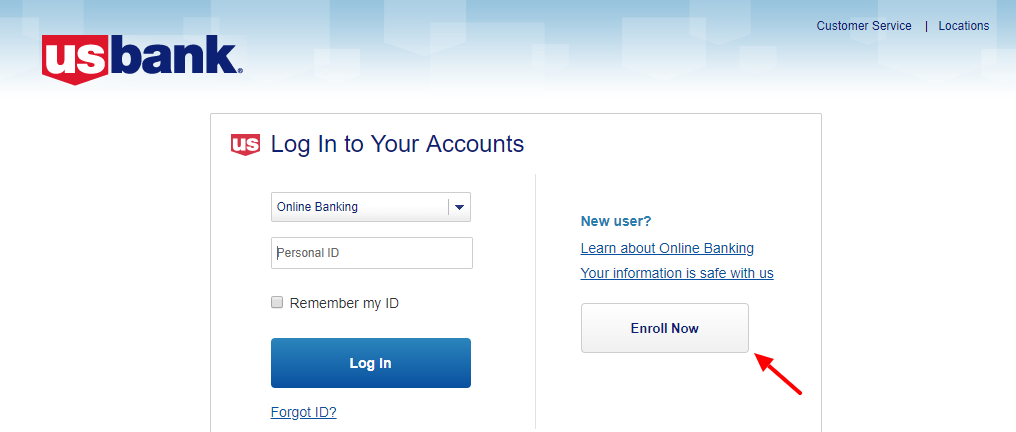

Setting Up an Online Account

To begin managing your Raymour and Flanigan credit card online, you’ll first need to set up an online account. This process is straightforward and can be completed in a few simple steps. Start by visiting the Raymour and Flanigan credit card website and locate the “Sign Up” or “Register” option. You will need to provide your credit card number, personal information, and create a secure password to gain access to your account.

Once registered, you can log in anytime to manage your card.

Viewing Statements and Transaction History

Once your online account is established, you can easily view your monthly statements and transaction history. This feature allows you to monitor your spending habits and stay informed about your balance. To access this information, simply log into your online account and navigate to the “Statements” or “Transaction History” section. You will find detailed records of your purchases, payments, and any applicable fees.

Payment Reminders and Alerts

To help you manage your credit card payments effectively, Raymour and Flanigan offers options for setting payment reminders and alerts. These notifications can be customized based on your preferences, ensuring you never miss a payment. You can typically set up alerts by accessing the “Notifications” or “Alerts” section of your online account. Here, you can choose to receive reminders via email or text message.

- Payment due date reminders help you stay on track with your payment schedule.

- Transaction alerts notify you of any purchases made, keeping you informed of your account activity.

- Balance alerts can be set to inform you when your balance reaches a certain limit, aiding in financial management.

Promotional Offers and Financing Options: Raymour And Flanigan Credit Card Online Payment

Raymour and Flanigan offers exclusive promotional financing options that enhance the shopping experience for cardholders. These promotions allow customers to take advantage of flexible payment plans and seasonal discounts, making it easier to furnish their homes without financial strain. By utilizing these offers, cardholders can enjoy both immediate savings and manageable payment solutions.The promotional financing options provided by Raymour and Flanigan are designed to accommodate various customer needs and shopping preferences.

Cardholders can benefit from special financing promotions that often include zero-interest plans for a set period, allowing them to spread out payments for larger purchases without accruing additional costs. These offers are particularly enticing during peak shopping seasons and promotional events.

Seasonal Promotions and Their Impact on Payment Options

Raymour and Flanigan frequently rolls out seasonal promotions that can significantly affect payment strategies for cardholders. Taking advantage of these deals can lead to considerable savings and better financing options. Here are some typical seasonal promotions and how they can influence payment choices:

- Holiday Sales: During holiday events, such as Black Friday or Memorial Day, cardholders can often access special financing terms, such as 12-month interest-free financing on qualifying purchases. These promotions make it easier to invest in big-ticket items while managing cash flow more effectively.

- Clearance Events: Seasonal clearance sales provide substantial discounts on floor models and discontinued items. Cardholders can pair these discounts with promotional financing options, maximizing their savings by purchasing items at a lower price while still benefiting from flexible payment terms.

- Anniversary Sales: Celebratory sales events often come with exclusive financing offers, like deferred interest rates for up to 18 months. This allows cardholders to make larger purchases while paying less in interest over time.

- Back-to-School Promotions: During back-to-school sales, there may be special offers on furniture and home decor. These promotions typically include attractive financing options to assist families in preparing their living spaces for the school year.

To maximize savings, cardholders should keep an eye on promotional calendars and plan their purchases around these events. Special promotions can help transform the overall experience of shopping for home furnishings, allowing for more significant purchases without immediate financial pressure. Taking advantage of these promotions is crucial, especially during significant sales events. By strategically aligning purchases with promotional offers, customers can benefit from reduced prices and favorable financing terms that enhance their overall shopping experience at Raymour and Flanigan.

FAQ Compilation

What is the interest rate for the Raymour and Flanigan credit card?

The interest rate may vary depending on your creditworthiness, typically ranging from 15% to 25% APR.

Can I make payments through a mobile app?

Yes, you can access your account and make payments through the Raymour and Flanigan mobile app.

Are there any fees associated with late payments?

Yes, late payments may incur a fee, which can vary based on your card agreement.

How can I increase my credit limit?

You can request a credit limit increase after demonstrating responsible credit usage, typically after 6 months.

What should I do if I forget my online account password?

You can reset your password by following the “Forgot Password?” link on the login page.