Sage mobile payments are transforming the way businesses handle transactions, making them faster and more efficient. As mobile payments become increasingly essential in today’s fast-paced business environment, Sage provides a robust solution that integrates seamlessly with other Sage products, ensuring a cohesive experience for users. This innovative approach meets the needs of modern consumer behavior, empowering businesses to stay competitive and responsive.

With its user-friendly interface and strong security features, Sage mobile payments not only enhance customer satisfaction but also streamline operations. Businesses can now manage payments on-the-go, harnessing the power of mobility to improve cash flow and customer engagement.

Overview of Sage Mobile Payments

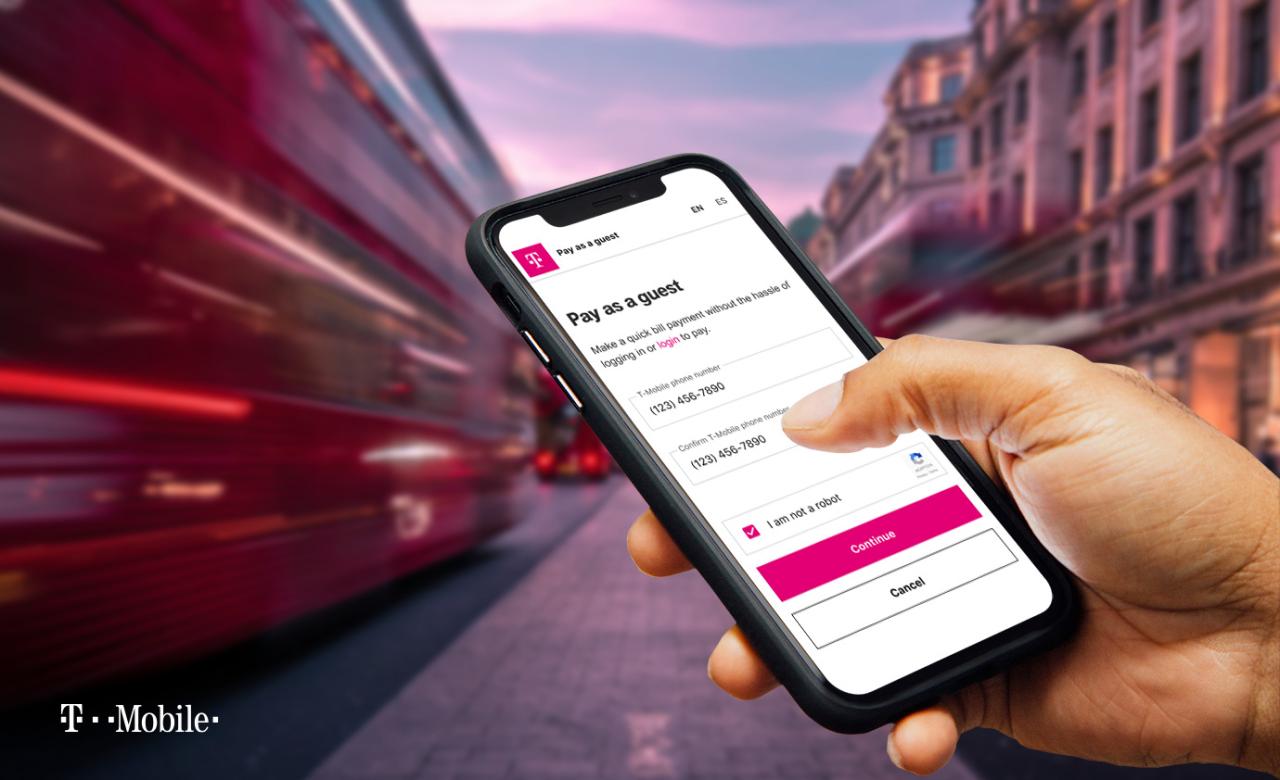

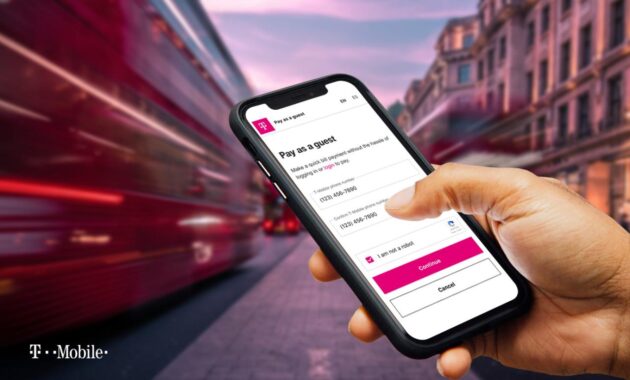

Sage Mobile Payments offers a robust solution for businesses looking to streamline their payment processes. This platform allows users to accept payments on-the-go, making it an invaluable tool for those in the field or at events. With its user-friendly interface and secure transactions, Sage Mobile Payments enhances operational efficiency and customer satisfaction.The significance of mobile payments in today’s business environment is more pronounced than ever.

As consumer preferences shift towards convenience and efficiency, businesses must adapt to meet these demands. Mobile payments not only facilitate quicker transactions but also enable businesses to capture sales from customers who prefer to pay via mobile devices. This trend reflects a broader shift in digital commerce, where speed and flexibility play critical roles in customer engagement and loyalty.

Integration with Other Sage Products

Sage Mobile Payments seamlessly integrates with other Sage products, creating a cohesive ecosystem for managing business operations. This integration enhances functionality and allows for a smoother user experience across various platforms. Key integrations include:

- Sage 50cloud: Users can synchronize payment data directly into their accounting system, ensuring accurate financial records and reducing data entry errors.

- Sage Business Cloud: Connection with this platform provides real-time updates on payment statuses, enabling businesses to manage cash flow effectively.

- Sage CRM: Integration with customer relationship management tools enhances customer profiles with payment history, allowing for personalized service and improved customer interactions.

The ability to connect Sage Mobile Payments with existing systems not only simplifies operations but also provides valuable insights into sales trends and customer behavior. Such integrations help businesses make informed decisions based on comprehensive data analysis.

The integration of Sage Mobile Payments with other Sage solutions allows for streamlined operations and improved financial visibility, enhancing overall business performance.

Key Features of Sage Mobile Payments

Sage Mobile Payments is designed to streamline the payment process for businesses of all sizes. With a strong focus on convenience, security, and user experience, this mobile payment solution delivers a robust set of features tailored to meet the needs of modern merchants. Below, we delve into the key aspects that make Sage Mobile Payments a reliable choice for handling transactions on the go.

Main Features of Sage Mobile Payments

Sage Mobile Payments includes several notable features that enhance functionality and usability. These features not only facilitate transactions but also contribute to the overall efficiency of business operations. Key features include:

- Mobile Card Reader: This compact device allows businesses to accept card payments directly from smartphones or tablets, making it easy to process transactions anywhere.

- Invoicing Capabilities: Users can create and send invoices directly from the app, streamlining the billing process and improving cash flow management.

- Integration with Sage Accounting: Seamless integration with Sage’s accounting solutions ensures that all transactions are automatically updated, reducing the risk of manual data entry errors.

- Transaction Reporting: Comprehensive reporting features provide insights into sales trends, helping businesses make informed decisions based on their sales data.

Security Measures in Sage Mobile Payments

Security is a top priority for Sage Mobile Payments, which is why several measures are implemented to protect sensitive information and transactions. The platform employs state-of-the-art security protocols, including:

- Encryption: All transaction data is encrypted, ensuring that sensitive information is protected during transmission and storage.

- PCI Compliance: Sage Mobile Payments complies with Payment Card Industry Data Security Standards, providing additional reassurance that customer data is handled securely.

- Fraud Detection: Advanced fraud detection systems monitor transactions for unusual activity, helping to prevent fraudulent transactions before they occur.

User Interface Design and User Experience

The user interface of Sage Mobile Payments is designed with simplicity and efficiency in mind. A clean, intuitive layout allows users to navigate the app easily, which is crucial for maintaining a smooth user experience. Key aspects of the design include:

- Streamlined Navigation: The app features a straightforward menu and easy-to-follow workflows that guide users through the payment process without unnecessary steps.

- Customizable Dashboard: Users can personalize their dashboard to display the most relevant information, making it easier to access essential features quickly.

- Responsive Design: The application is optimized for various devices, ensuring that users have a consistent experience whether on a smartphone or tablet.

- Support for Multiple Languages: To cater to a diverse user base, the mobile payment solution supports various languages, enhancing accessibility for international users.

“Sage Mobile Payments provides a comprehensive solution that not only meets the needs of today’s mobile businesses but also prioritizes security and user-friendliness.”

Benefits of Using Sage Mobile Payments

Sage Mobile Payments offers a range of advantages for businesses looking to streamline their payment processes. As the digital landscape evolves, the necessity for efficient and flexible payment solutions has never been more critical. By adopting Sage Mobile Payments, businesses not only enhance their efficiency but also improve customer satisfaction and overall management of transactions.One of the standout benefits of Sage Mobile Payments is its ability to facilitate transactions on-the-go.

This flexibility allows businesses to serve their customers in real-time, whether at a tradeshow, a customer’s location, or any remote setting. This contrasts sharply with traditional payment methods, which often require physical infrastructure like cash registers or fixed terminals. The ease of use and accessibility offered by mobile payments can significantly enhance customer experience and engagement.

Comparison with Traditional Payment Methods

When comparing Sage Mobile Payments to traditional payment methods, several advantages become clear. Traditional payment systems often involve cumbersome processes, including waiting for approvals, handling cash, or dealing with paper invoices. In contrast, Sage Mobile Payments offers:

- Speed and Convenience: Transactions can be completed in seconds, reducing the time spent on each sale.

- Reduced Costs: Lower transaction fees compared to traditional credit card processors, which can help businesses save money over time.

- Improved Cash Flow: Immediate access to funds can enhance cash flow, allowing businesses to reinvest quickly.

- Enhanced Security: Advanced encryption and security measures protect sensitive customer information, minimizing the risk of fraud.

- Better Record Keeping: Automatic tracking and reporting simplify bookkeeping and tax preparation tasks.

These elements not only create a more seamless payment experience but also contribute to operational efficiencies and cost savings that are often lacking in traditional methods.

Successful Implementation Case Studies

Numerous businesses have successfully implemented Sage Mobile Payments, showcasing its benefits through real-world applications. For instance, a small retail store reported a 30% increase in sales after adopting mobile payments, as customers appreciated the ease of paying through their smartphones. Another service-based business, such as a landscaping company, noted a drop in unpaid invoices by 50% after utilizing Sage Mobile Payments.

They could collect payments immediately upon service completion, which drastically improved cash flow and minimized overdue accounts.

“Since integrating Sage Mobile Payments, we’ve transformed our payment process and enhanced customer satisfaction. It’s a game changer for our business.”

Owner of a small retail store

By adopting Sage Mobile Payments, businesses are not only keeping pace with technological advancements but also setting themselves up for long-term success.

Setting Up Sage Mobile Payments

Setting up Sage Mobile Payments is an essential step for businesses looking to enhance their payment processing capabilities. This guide will walk you through the necessary steps to effectively implement this mobile solution, ensuring that your business can accept payments seamlessly while on the go. To set up Sage Mobile Payments, you must be aware of the software and hardware requirements, as well as gather the essential documents needed for the setup process.

Proper preparation ensures that you can get started without any hitches.

Step-by-Step Guide for Setup

Follow these steps to successfully set up Sage Mobile Payments for your business:

1. Register for a Sage Account

Starting off, create a Sage account if you don’t already have one. Visit the Sage website and fill in the necessary details to register your business.

2. Download the Sage Mobile Payments App

Go to your device’s app store and download the Sage Mobile Payments application, compatible with both iOS and Android devices.

3. Link Your Merchant Account

After downloading the app, log in with your Sage account credentials. You will need to connect your merchant account to enable payment processing.

4. Set Up Your Payment Options

Within the app, configure your accepted payment methods. This includes credit cards, debit cards, and any other options your business plans to offer.

5. Test the System

Before going live, conduct test transactions to ensure everything is functioning as expected. This step is crucial to identify any potential issues early on.

6. Start Accepting Payments

Once everything is set up and tested, you’re ready to start accepting payments through Sage Mobile Payments.

Software and Hardware Requirements

To ensure optimal performance of Sage Mobile Payments, it’s important to meet the following software and hardware requirements:

Mobile Device

A smartphone or tablet running iOS 12.0 or later, or Android 5.0 or later.

Internet Connection

A reliable Wi-Fi connection or cellular data plan is necessary for processing transactions.

Sage Software

Ensure you have the latest version of Sage accounting software installed to facilitate seamless integration. Having the right hardware and software will enhance the overall performance of your payment processing, ensuring quick and efficient transactions.

Essential Documents Checklist

Before proceeding with the setup of Sage Mobile Payments, gather the following essential documents. This checklist will help ensure you have everything needed for a smooth setup process.

Business Registration Documents

Proof of your business’s legal status.

Tax Identification Number

Required for tax purposes and to validate your business.

Bank Account Information

Necessary for linking your merchant account to facilitate deposits.

Merchant Account Agreement

Documentation from your payment processor outlining the terms of service.Having these documents ready will streamline your setup process and help avoid potential delays.

Troubleshooting Common Issues: Sage Mobile Payments

When it comes to mobile payments, users may sometimes encounter a few hiccups that can disrupt their experience. While Sage Mobile Payments is designed for convenience and efficiency, understanding common issues and their solutions can enhance your overall usage. Below, we explore typical problems users might face, along with effective troubleshooting steps and resource suggestions for additional support.

Payment Processing Errors

Experiencing payment processing errors can be frustrating. These errors may occur due to various reasons, such as insufficient funds, network issues, or incorrect payment information. Here are some steps to troubleshoot these issues:

- Verify Payment Information: Double-check that the card number, expiration date, and CVV are entered correctly.

- Check Network Connectivity: Ensure that your device is connected to a stable internet connection, as poor connectivity can interrupt the processing.

- Confirm Sufficient Funds: Make sure that the payment method used has enough balance or credit available to complete the transaction.

- Retry the Transaction: Sometimes, simply attempting the transaction again can resolve temporary glitches.

App Crashes or Freezes

An app that crashes or freezes can prevent you from making transactions. This issue may stem from outdated software or insufficient device memory. To resolve this, consider the following actions:

- Update the App: Regularly check for app updates in your device’s app store to ensure you’re using the latest version.

- Restart Your Device: A simple device restart can free up memory and resolve temporary software conflicts.

- Clear App Cache: Navigate to your device settings, find the Sage Mobile Payments app, and clear its cache to improve performance.

- Reinstall the App: If issues persist, uninstalling and reinstalling the app can provide a fresh start.

Issues with User Account Access

Having trouble accessing your account can hinder your ability to make payments. Common causes include forgotten passwords or account lockouts. Here’s how to address these problems:

- Reset Your Password: Use the ‘Forgot Password’ feature on the login screen to receive a password reset link via email.

- Check Account Status: If your account is locked, follow the provided instructions to unlock it or contact customer support for assistance.

- Verify Security Questions: Ensure that the answers to your security questions are correct when prompted during login attempts.

Finding Additional Support

If issues persist or if you encounter more complex problems, Sage Mobile Payments offers various resources to help you. Users can:

- Visit the Sage Support Website: The official support page provides extensive FAQs, troubleshooting guides, and user forums.

- Contact Customer Service: For immediate assistance, reach out to Sage’s customer support via phone or email to get personalized help.

- Utilize Online Communities: Engage with other users in community forums where you can exchange tips and experiences regarding common issues.

Future Trends in Mobile Payments

The landscape of mobile payments is rapidly evolving, with emerging technologies and changing consumer behaviors reshaping how transactions are conducted. Companies like Sage Mobile Payments are well-positioned to adapt to these trends, ensuring they remain at the forefront of mobile payment solutions. The following sections delve into anticipated advancements in mobile payment technology, shifts in consumer behavior, and potential regulatory changes impacting the industry.

Anticipated Advancements in Mobile Payment Technology, Sage mobile payments

The future of mobile payments is marked by several technological advancements that promise to enhance efficiency and user experience. Innovations such as artificial intelligence (AI), blockchain technology, and biometric authentication are set to revolutionize transactions. For instance, AI can streamline fraud detection by analyzing transaction patterns in real-time, reducing the risk of unauthorized access.Additionally, the integration of blockchain can enhance security and transparency in mobile payments, allowing users to track their transactions effortlessly.

Biometric solutions, including fingerprint and facial recognition, will likely become standard features, making transactions not only quicker but also more secure. These advancements are expected to bolster user confidence in mobile payment systems, including those offered by Sage.

Changing Consumer Behavior Regarding Mobile Payments

Consumer preferences are shifting towards convenience and speed, driving the adoption of mobile payment solutions. As more people carry smartphones, the expectation for seamless and instantaneous transactions has grown. According to a recent study, nearly 70% of consumers prefer mobile wallets for their ease of use and quick checkout processes.The surge in e-commerce and contactless payments, especially post-pandemic, has resulted in consumers increasingly viewing mobile payments as a preferred method.

Younger generations, particularly millennials and Gen Z, are leading this charge, often opting for digital solutions over traditional cash or card payments. This behavioral shift prompts businesses, including Sage, to enhance their mobile payment offerings continually.

Insights into Regulatory Changes in Mobile Payments

As mobile payments gain traction, regulatory frameworks are evolving to address emerging risks and challenges. Governments and financial institutions are expected to introduce new regulations focusing on data privacy, cybersecurity, and transaction security. For instance, the General Data Protection Regulation (GDPR) in Europe has already set a precedent for how personal data is handled, impacting mobile payment providers significantly.There is also increasing scrutiny over transactions to prevent money laundering and fraud, which may lead to more robust Know Your Customer (KYC) requirements for mobile payment solutions.

Companies like Sage will need to navigate these regulatory landscapes carefully, ensuring compliance while continuing to innovate and meet consumer demands.

Integration with Other Systems

Sage Mobile Payments is designed to seamlessly integrate with a variety of business systems and tools, enhancing operational efficiency and streamlining payment processes. This capability allows businesses to leverage existing systems while improving transaction management and customer experience.Integrating Sage Mobile Payments with other business systems, such as accounting software, inventory management, and customer relationship management (CRM) platforms, creates a more cohesive workflow.

This integration minimizes data entry errors, reduces the time spent on manual processes, and provides real-time insights into financial transactions.

Benefits of Integration for Improving Business Efficiency

The integration of Sage Mobile Payments with existing business tools offers numerous advantages that significantly enhance efficiency. Here are some key benefits:

- Automated Data Syncing: Transactions processed through Sage Mobile Payments can automatically sync with accounting or ERP systems, reducing manual data entry and potential errors.

- Real-Time Reporting: Businesses can access up-to-date financial data across platforms, enabling informed decision-making and strategic planning.

- Streamlined Customer Experience: A unified system allows for swift processing of payments and quicker responses to customer inquiries, improving customer satisfaction.

- Cost Savings: By reducing manual processes and errors, businesses can save on labor costs and avoid penalties associated with financial discrepancies.

- Enhanced Security: Integration with secure systems provides an additional layer of protection for payment data, complying with industry standards.

Comparison of Integration Capabilities with Other Payment Solutions

To understand how Sage Mobile Payments stacks up against other payment solutions in terms of integration capabilities, the following table showcases key features:

| Feature | Sage Mobile Payments | Competitor A | Competitor B |

|---|---|---|---|

| API Availability | Yes | Limited | Yes |

| ERP Integration | Multiple options | Single option | Limited |

| CRM Compatibility | Wide range | Moderate | Wide range |

| Inventory Management Sync | Yes | No | Yes |

| Real-Time Data Updates | Yes | No | Yes |

FAQ Explained

What types of businesses can benefit from Sage mobile payments?

Any business that requires flexible payment solutions, including retail, service industries, and e-commerce, can benefit from Sage mobile payments.

Can Sage mobile payments be used internationally?

Yes, Sage mobile payments support international transactions, making it a versatile option for businesses operating globally.

What devices are compatible with Sage mobile payments?

Sage mobile payments are compatible with most smartphones and tablets, allowing users to accept payments wherever they are.

Is training available for new users of Sage mobile payments?

Yes, Sage offers comprehensive training and support resources for new users to ensure a smooth onboarding process.

How does Sage ensure the security of mobile payments?

Sage implements advanced encryption and security measures to protect transactions and users’ sensitive information, ensuring a secure payment process.