Starting with square mobile payments, this innovative solution is reshaping the way businesses and customers engage in transactions. With a blend of advanced technology and user-friendly design, Square mobile payments streamline the payment process, making it easier and more efficient for both merchants and consumers.

Square’s mobile payment system leverages a combination of hardware and software to facilitate seamless transactions, providing users with a reliable platform that enhances their payment experience. By integrating features such as invoicing and inventory management, Square offers a comprehensive solution that caters to a wide range of business needs, ultimately benefiting the entire ecosystem.

Overview of Square Mobile Payments

Square mobile payments simplify the way businesses and consumers engage in financial transactions. By leveraging innovative technology, Square provides a seamless payment experience that supports various payment methods, including credit cards, debit cards, and mobile wallets. This service is particularly beneficial for small businesses and entrepreneurs who need a reliable, user-friendly payment solution that can be used anytime and anywhere.Square mobile payments operate through a combination of hardware and software.

The hardware typically includes a small card reader that can connect to a smartphone or tablet via Bluetooth or the audio jack, allowing for easy card scanning. The software component is the Square app, available on iOS and Android devices. This app not only facilitates transactions but also manages inventory, generates sales reports, and provides analytics. The integration of these components ensures that users can accept payments efficiently, track sales in real time, and manage their finances from a single platform.

Technology Behind Square Mobile Payments

The technology behind Square mobile payments is designed to provide a robust and secure transaction environment. Several elements contribute to its effectiveness:

Card Reader Technology

The Square card reader uses advanced encryption to secure card data during transactions. This protection is essential for maintaining customer trust and preventing fraud.

Mobile App Functionality

The Square app allows users to customize their payment experiences. Features such as tipping, discounts, and digital receipts enhance customer satisfaction and streamline operations.

Cloud-Based Data Storage

Square stores transaction data in the cloud, enabling businesses to access their sales history and analytics from anywhere. This flexibility is particularly useful for entrepreneurs who may not have a physical storefront.

Integration with Other Software

Square seamlessly integrates with various accounting and inventory management systems, simplifying the overall business operation and ensuring accurate financial reporting.Implementing Square mobile payments comes with numerous benefits for both businesses and customers. For businesses, the ability to accept payments on the go can lead to increased sales opportunities, especially at events or in locations where traditional payment systems aren’t available.

Additionally, Square offers competitive transaction fees, which can be more affordable than traditional credit card processors.For customers, Square mobile payments provide a smooth and convenient checkout experience. The option to pay via mobile wallets or contactless methods caters to the growing demand for fast and secure payment solutions. Furthermore, features like digital receipts enhance transparency and simplify record-keeping for consumers.

“Square mobile payments empower businesses to accept payments anytime, anywhere, revolutionizing the retail landscape.”

Overall, the integration of cutting-edge technology into Square mobile payments not only enhances user experience but also fosters a more inclusive and efficient financial ecosystem.

Features of Square Mobile Payments

Square Mobile Payments offers a robust set of features designed to simplify transaction processes for businesses of all sizes. With tools that cater to invoicing, inventory management, and enhanced security, Square enables businesses to streamline their payment systems while ensuring a smooth customer experience.One of the standout features of Square Mobile Payments is its comprehensive invoicing system, which allows businesses to create and send professional invoices directly from their mobile devices.

This feature not only enhances the professionalism of the billing process but also enables customers to pay easily through various methods such as credit cards, debit cards, and digital wallets. Additionally, businesses can customize their invoices with logos, payment terms, and itemized lists, making it convenient to track payments and manage finances effectively.

Invoicing and Inventory Management

Square’s invoicing and inventory management features are integral for businesses looking to maintain efficiency in their operations. The ability to send invoices on-the-go ensures that businesses can keep cash flow steady, even when away from the office.

Invoicing Square facilitates the easy creation and management of invoices, which can be quickly dispatched to clients. Users can leverage automated reminders for unpaid invoices, ensuring timely payments. For example, a freelance graphic designer can send multiple invoices in a day, track their statuses, and follow up with clients automatically if payments are overdue.

Inventory Management Square also provides tools to manage inventory in real-time. This feature allows users to track stock levels, receive alerts for low inventory, and analyze sales data to make informed purchasing decisions. A small retail store can benefit from this by ensuring popular items are always in stock, thus avoiding lost sales opportunities.

Security Measures

Security is a crucial aspect of any payment processing system, and Square employs several measures to protect transactions and user data. All transactions processed through Square are encrypted, safeguarding sensitive information from potential breaches. Square is PCI compliant, which means it adheres to the Payment Card Industry Data Security Standards, ensuring that all card data is handled securely. Furthermore, Square utilizes advanced security features such as two-factor authentication and regular security updates to protect user accounts.

“Security is not just an option; it’s a necessity in financial transactions to build trust with customers.”

In addition to encryption, Square monitors transactions for fraudulent activity, providing an extra layer of protection for users. For example, if a pattern of unusual activity is detected, Square can proactively reach out to the business to confirm the legitimacy of the transactions, ultimately safeguarding both the business and its customers.

Comparison with Other Mobile Payment Solutions

When it comes to mobile payments, users and businesses alike have a variety of options to choose from. Square Mobile Payments stands out in the landscape, but it’s essential to compare its offerings with other popular platforms like PayPal, Venmo, and Stripe. This comparison will illuminate the unique advantages and disadvantages of each service, especially in aspects such as pricing structures and transaction fees.Square Mobile Payments offers a robust suite of features, but how does it fare against its competitors?

Each mobile payment solution has its own strengths and weaknesses that cater to different business needs. Below, we Artikel the critical differences in pricing, features, and functionality among these services.

Pricing Structures and Transaction Fees

Understanding the pricing structures and transaction fees is essential for businesses to make informed decisions. Below is a comparison of Square Mobile Payments and other popular mobile payment platforms. The following table illustrates the main features and associated fees for each solution:

| Payment Service | Transaction Fees | Monthly Fees | Unique Features |

|---|---|---|---|

| Square | 2.6% + 10¢ per transaction | None | Integrated POS, Inventory management |

| PayPal | 2.9% + 30¢ per transaction | None | International payments, Buyer Protection |

| Venmo | 3% on credit card transactions | None | Social pay features, Instant transfers |

| Stripe | 2.9% + 30¢ per transaction | None | Developer-friendly API, Subscription billing |

The table highlights that Square has a competitive edge with lower transaction fees, especially beneficial for small businesses. The absence of monthly fees makes it attractive for startups or companies that are just getting off the ground.

“Square provides an all-in-one solution with features that can streamline a business’s operations.”

While PayPal offers robust international transaction services and buyer protection, its fees can be higher, particularly for smaller amounts. Venmo, known for its social payment features, caters primarily to peer-to-peer transactions rather than businesses. Lastly, Stripe is ideal for developers looking for customization but may require more technical knowledge to set up effectively.In summary, each mobile payment solution has its unique appeal, and the right choice largely depends on the specific needs of a business, such as transaction volume, type of sales, and the customer base.

By understanding these differences, businesses can select the payment platform that aligns best with their operational strategies and financial goals.

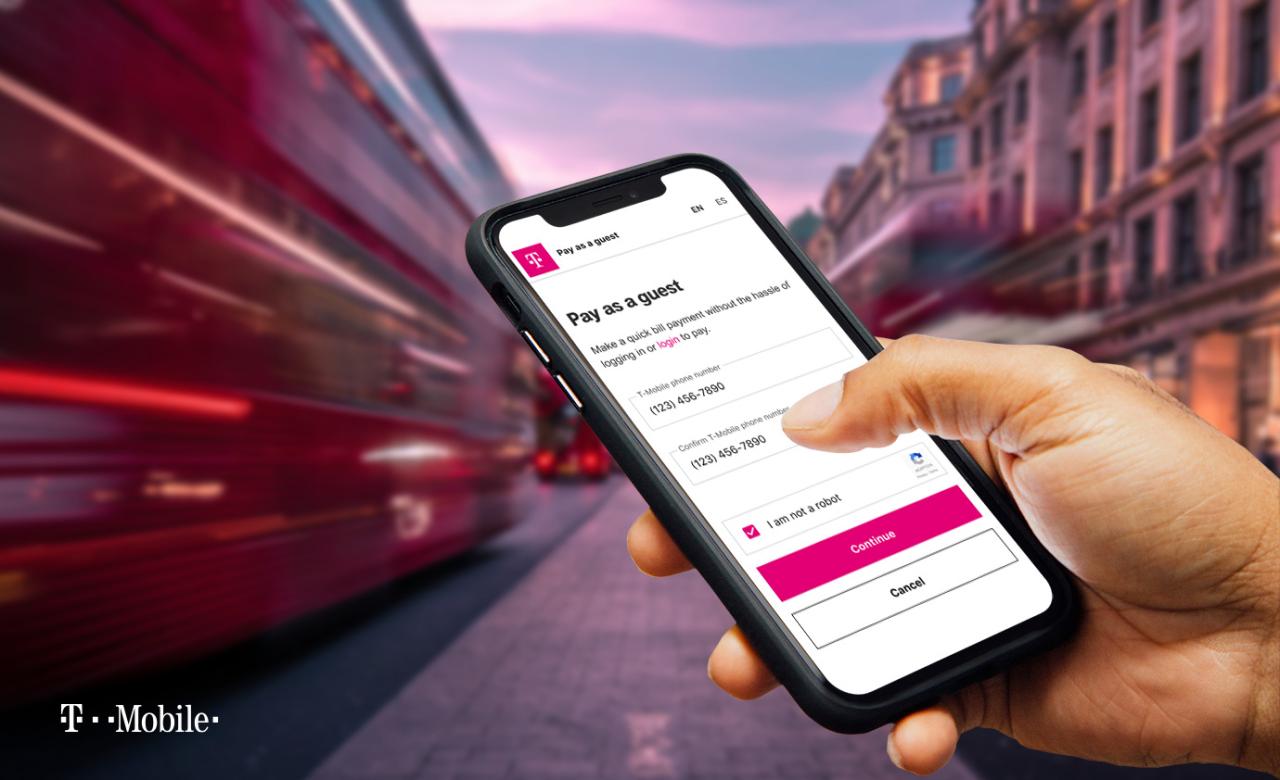

User Experience and Interface

The user experience and interface of Square mobile payments play a crucial role in its popularity among merchants and consumers alike. Designed with simplicity and efficiency in mind, Square enables users to conduct transactions swiftly while ensuring a seamless experience. Its intuitive layout and accessibility cater to a diverse user base, making it a preferred option for many.The interface of Square mobile payments is clean and straightforward, allowing merchants to navigate through various features effortlessly.

The dashboard presents all necessary tools at a glance, including sales tracking, inventory management, and customer insights. For consumers, the experience is equally smooth, with straightforward payment processes that require minimal steps. This design philosophy enhances user satisfaction and promotes repeat usage.

User Feedback and Testimonials

User feedback provides valuable insights into the effectiveness of Square mobile payments. Many merchants appreciate the ease of setting up and using the platform, which often involves minimal training. Consumers, on the other hand, frequently highlight the speed and convenience of making payments. Here are some notable testimonials:

-

“Square has transformed the way I handle transactions. It’s straightforward and reliable, which saves me time.” – Local Café Owner

-

“As a customer, I love how quickly I can check out. No hassles, just a simple tap on my phone.” – Frequent Shopper

-

“The reporting features help me understand my sales patterns better, making it easier to manage my business.” – Boutique Retailer

The overall sentiment from users showcases a high level of satisfaction with the platform’s functionality and performance, reinforcing its position in the mobile payment landscape.

User Satisfaction Ratings Comparison

To further illustrate the user satisfaction levels, a comparison chart can highlight how Square mobile payments stack up against other popular mobile payment solutions. This visual representation emphasizes key areas of strength and potential weaknesses in user experience.

| Payment Solution | User Satisfaction Rating (out of 5) | Key Features Appreciated |

|---|---|---|

| Square Mobile Payments | 4.7 | Ease of use, speed of transactions, reporting features |

| PayPal | 4.5 | Wide acceptance, buyer protection |

| Venmo | 4.2 | Social features, ease of use for peer-to-peer payments |

| Apple Pay | 4.6 | Integration with Apple products, speed |

This chart provides a clear view of user satisfaction across different platforms, illustrating the competitive edge that Square maintains in terms of ease of use and overall satisfaction.

Case Studies of Successful Implementation

Numerous businesses have managed to enhance their payment processes significantly by implementing Square mobile payments. These case studies illustrate how different strategies and features of Square have been leveraged effectively, resulting in improved customer experiences and streamlined operations.One notable example is Baker’s Delight, a local bakery chain that adopted Square mobile payments to handle in-store transactions. By integrating Square’s point-of-sale (POS) system, they streamlined their payment process, reducing wait times during busy hours.

They utilized Square’s inventory management feature, which allowed them to keep track of stock levels in real-time. This integration not only improved sales reporting but also facilitated better decision-making regarding product offerings. Another successful implementation can be seen with The Crafty Corner, a craft store that focused on enhancing its customer engagement. The owner used Square’s customer database feature to analyze purchasing trends and tailor marketing campaigns, providing promotions on popular items.

By employing Square’s email marketing tools, they directly communicated with customers about upcoming workshops and new product arrivals, driving both foot traffic and online sales.

Industries Benefiting from Square Mobile Payments

Various industries have found significant advantages in utilizing Square mobile payments. The following businesses exemplify how different sectors can thrive using Square’s features:The importance of these industries embracing mobile payment solutions cannot be overstated. They benefit from increased efficiency, customer satisfaction, and data-driven insights. Here’s a look at key industries that have successfully integrated Square:

- Retail: Many local shops and boutiques use Square to manage transactions and inventory seamlessly. For instance, The Green Grocer employed Square to enhance checkout speed, leading to a 25% increase in sales during peak hours.

- Food and Beverage: Restaurants and cafes are leveraging Square for mobile payments. Sunny’s Cafe introduced mobile ordering via Square, which increased their customer retention rate as patrons appreciated the ease of ordering ahead.

- Health and Wellness: Gyms and wellness centers utilize Square for membership payments. FitLife Gym adopted Square’s recurring billing feature, allowing for smooth monthly payment processing for members, reducing cancellations.

- Professional Services: Freelancers and consultants benefit from Square’s invoicing capabilities. Jane’s Consulting Services saw improvements in cash flow by using Square to send and manage invoices electronically.

- Event Planning: Event planners increasingly rely on Square for managing ticket sales and vendor payments. CityFest Events streamlined their payment processes, enhancing customer experiences during festivals and events.

Future Trends in Mobile Payments

The mobile payments industry is evolving at an unprecedented pace, driven by advancements in technology and changing consumer preferences. Square, a leader in the mobile payment space, is continuously adapting to these trends to enhance user experience and maintain its competitive edge. As we look ahead, several key trends are expected to shape the future of mobile payments, influencing both the industry and Square’s offerings.

Emerging Trends in Mobile Payments

A few prominent trends are emerging within the mobile payments landscape that are set to revolutionize the way transactions are conducted. Understanding these trends is crucial for businesses aiming to leverage mobile payments effectively.

- Contactless Payments: The adoption of NFC (Near Field Communication) technology has surged, making contactless payments the norm at retail outlets. Square is integrating contactless payment options to simplify transactions and improve customer convenience.

- Cryptocurrency Integration: With the rising popularity of digital currencies, Square has begun exploring cryptocurrency payment solutions. This move allows users to transact using Bitcoin and other cryptocurrencies, appealing to a broader demographic.

- Decentralized Finance (DeFi): The growing interest in DeFi platforms is prompting Square to investigate partnerships that facilitate decentralized transactions, potentially reshaping the payment landscape.

- Increased Focus on Security: As mobile payment systems become targets for cyber threats, Square is enhancing its security protocols, incorporating biometric authentication and end-to-end encryption to protect users’ financial data.

Predictions on Future Mobile Payment Technologies

The future of mobile payment technologies is bright, with several predictions indicating transformative changes in how consumers and businesses interact financially. Analysts suggest that by 2025, mobile payment transactions will surpass traditional payment methods significantly, driven by the increasing smartphone penetration and the seamless user experience offered by applications like Square.Additionally, the integration of augmented reality (AR) in mobile payments is anticipated to provide a more engaging shopping experience.

For instance, consumers may use their devices to view product information and make payments directly through AR-enabled platforms, streamlining the purchasing process further.

Artificial Intelligence and Machine Learning in Mobile Payments

Artificial Intelligence (AI) and Machine Learning (ML) are set to play pivotal roles in the evolution of mobile payment systems. By leveraging these technologies, Square is enhancing transaction efficiency and security. AI algorithms analyze transaction data to identify and flag potential fraudulent activities in real-time, providing users with peace of mind regarding their financial security.Moreover, machine learning can personalize the payment experience by offering tailored recommendations and insights based on user behavior.

Such advancements enable Square to deliver a more customized service, driving customer loyalty and satisfaction.In summary, as the mobile payments landscape continues to evolve, Square is well-positioned to adapt to these emerging trends and leverage technological advancements. By embracing contactless payments, cryptocurrency, heightened security measures, and the integration of AI and ML, Square is ensuring it remains at the forefront of the mobile payment revolution.

Integration with Other Business Tools

Square mobile payments offer seamless integration with a variety of business management tools and software, significantly enhancing operational efficiency. By connecting Square to other platforms, businesses can streamline their processes, improve data accuracy, and gain valuable insights from integrated systems. This cohesion allows for better financial management, customer relationship management (CRM), and inventory control, making it easier for businesses to operate smoothly.Integrating Square with other business tools is beneficial as it eliminates the need for duplicate data entry and ensures that information flows across systems effortlessly.

For example, when a sale is processed through Square, it can automatically update the inventory levels in an inventory management system. This real-time synchronization between platforms helps businesses maintain accurate records and reduce the likelihood of human error.

Examples of Workflows Illustrating Integration Benefits

Consider a retail business utilizing Square for payments, QuickBooks for accounting, and a CRM tool like HubSpot. When a customer makes a purchase, the following workflow can occur:

1. Transaction Processing

The customer pays via Square, and the transaction details are recorded.

2. Automated Accounting Entry

The sales data is instantly sent to QuickBooks, where it is categorized and accounted for without manual entry.

3. Customer Data Update

The customer’s information and purchase history are automatically updated in HubSpot, allowing for targeted marketing campaigns based on their buying habits.This integration not only saves time but also provides a comprehensive view of customer interactions and financial health.

Popular Third-Party Applications Compatible with Square, Square mobile payments

Many third-party applications work seamlessly with Square mobile payments, enhancing its functionality across various business needs. Here’s a list of some popular applications that integrate effectively with Square:

- QuickBooks: Streamlines accounting by automatically syncing sales and expenses.

- Xero: Offers real-time financial data and simplified bookkeeping.

- Shopify: Enables online sales alongside in-person transactions, providing a unified sales platform.

- Mailchimp: Enhances marketing efforts by integrating customer data for email campaigns.

- Zapier: Connects Square with hundreds of other apps, automating workflows between them.

These integrations allow businesses to customize their software ecosystem, creating a tailored platform that meets their specific operational needs while maximizing efficiency.

FAQ Summary

What types of businesses benefit from Square mobile payments?

Square mobile payments are beneficial for a variety of industries, including retail, food services, and professional services, offering tailored solutions to meet diverse needs.

How secure are Square mobile payments?

Square employs robust security measures including encryption and fraud detection to ensure that transactions and user data are protected at all times.

Are there any monthly fees for using Square mobile payments?

No, Square does not charge monthly fees; instead, they charge a percentage fee per transaction, making it cost-effective for businesses.

Can I integrate Square mobile payments with my accounting software?

Yes, Square mobile payments can be easily integrated with various accounting and CRM software, streamlining financial management for businesses.

Is customer support available for Square mobile payments?

Yes, Square provides customer support through various channels, including online resources, email, and phone support to assist users with any issues.