UsBank credit card payment opens the door to a world of convenience and financial management for cardholders. Understanding how to navigate the various payment options, due dates, and potential fees can empower you to make the most of your UsBank credit card experience. Whether you’re looking to set up automatic payments or simply want to ensure you avoid late fees, grasping the intricacies of the payment process is essential.

In this discussion, we’ll dive into the different features and benefits of UsBank credit cards, the methods available for making payments, and tips for managing payments effectively. With the right information at your fingertips, you can take control of your credit card payments and boost your financial health.

UsBank Credit Card Overview

UsBank offers a variety of credit cards tailored to meet diverse financial needs, making them a popular choice for many consumers. These cards come with a range of features and benefits that enhance the user experience and facilitate better financial management. With competitive rewards programs, low-interest rates, and robust security features, UsBank credit cards cater to both everyday spenders and those looking to maximize their rewards.The UsBank credit card lineup includes several types designed for different spending habits and financial goals.

Understanding the unique features of each card can help consumers make informed decisions when selecting a credit card that best suits their lifestyle.

Types of UsBank Credit Cards

UsBank offers several credit card options, each with distinct features and benefits. Below is a summary of the main types available:

- UsBank Visa Platinum Card: This card is ideal for those who want to save on interest with its introductory 0% APR on purchases and balance transfers for the first 20 billing cycles. It features no annual fee and is perfect for consolidating debt.

- UsBank Cash+ Visa Signature Card: Designed for cash-back enthusiasts, this card allows users to earn 5% cash back on two categories of their choice, 2% on one everyday category, and 1% on all other purchases. It also offers a $150 bonus after spending $500 in the first 90 days.

- UsBank Altitude Reserve Visa Infinite Card: This premium card is aimed at frequent travelers, providing 3 points per dollar on travel and dining and 1 point on all other purchases. It includes a $325 annual travel credit, no foreign transaction fees, and comprehensive travel insurance benefits.

- UsBank Secured Visa Card: This card is designed for individuals looking to build or rebuild their credit history. It requires a security deposit that acts as a credit limit, enabling responsible credit use.

Each of these credit cards offers unique rewards and benefits, allowing customers to select a card that aligns with their financial habits and goals.

Eligibility Criteria and Application Process, Usbank credit card payment

To apply for a UsBank credit card, prospective cardholders must meet certain eligibility criteria. Key factors include:

- Age requirement: Applicants must be at least 18 years old.

- Credit score: Most UsBank credit cards require a good to excellent credit score, typically 700 or above, although options are available for those with lower scores.

- Income verification: Applicants need to provide information regarding their annual income to assess repayment capability.

- Residency: A valid U.S. address is required for application.

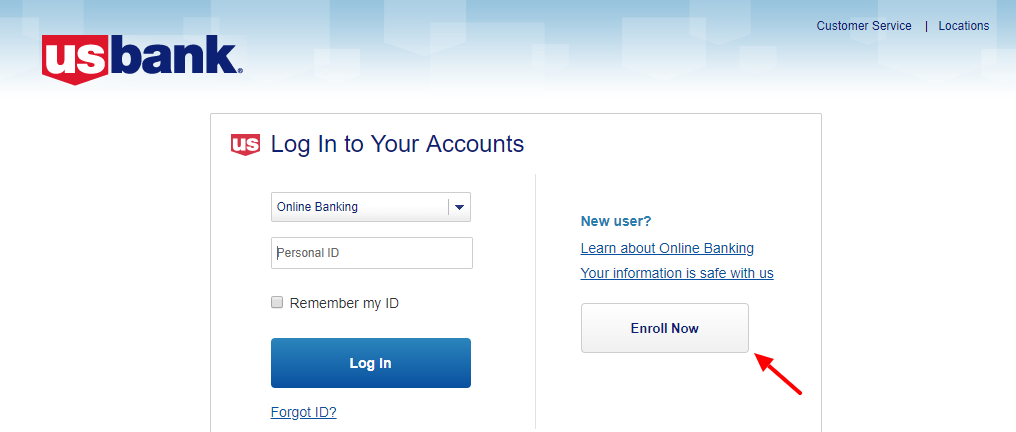

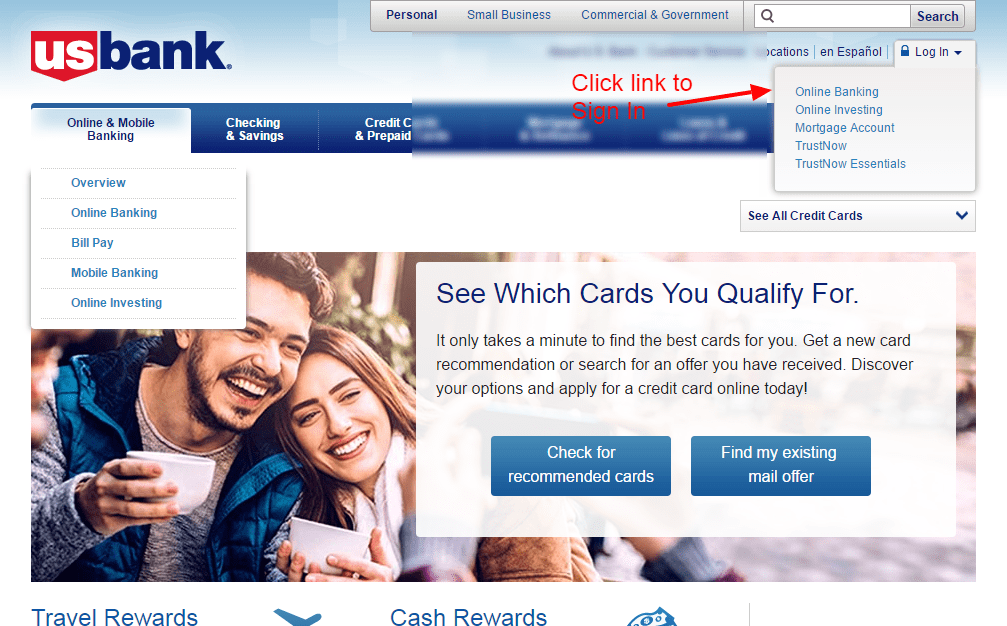

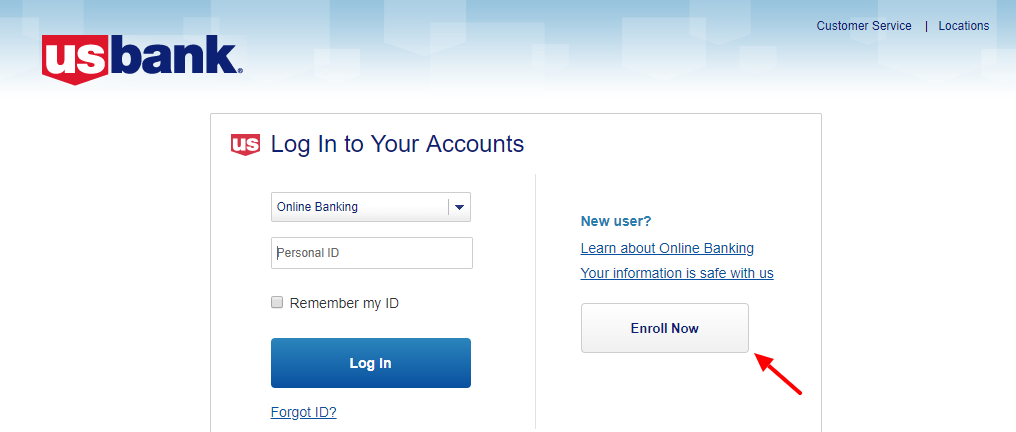

The application process is straightforward and can be completed online or in person at a UsBank branch. To apply online, candidates should visit the UsBank website, navigate to the credit card section, and select the card best suited to their needs. The application will require personal information, such as Social Security number, income details, and housing status. Upon submission, UsBank typically provides an instant decision, though some applications may require additional review.

Successful applicants will receive their card within a few days, ready to start enjoying the benefits of their new UsBank credit card.

Making Payments on UsBank Credit Cards: Usbank Credit Card Payment

Making timely payments on your UsBank credit card is essential for maintaining a healthy credit score and avoiding late fees. UsBank offers multiple convenient methods to help you manage your payments effectively, ensuring you can choose an option that fits your lifestyle.UsBank provides various payment methods that cater to different preferences and needs. Each method offers unique advantages, whether you prefer online management or traditional methods.

Below, we detail these methods and provide a step-by-step guide for setting up automatic payments to streamline your payment process.

Payment Methods Available for UsBank Credit Cards

Understanding the different payment methods available can help you select the most convenient option for your circumstances. Below are the primary methods for making payments on UsBank credit cards:

- Online Payment: Log in to your UsBank online account or the mobile app to make a one-time payment or set up automatic payments.

- Phone Payment: Call the UsBank customer service number to make a payment over the phone using your bank account information.

- Mail Payment: Send a check or money order to the address specified on your billing statement. Be sure to allow enough time for mail processing.

- In-Person Payment: Visit a local UsBank branch to make a payment directly with a teller.

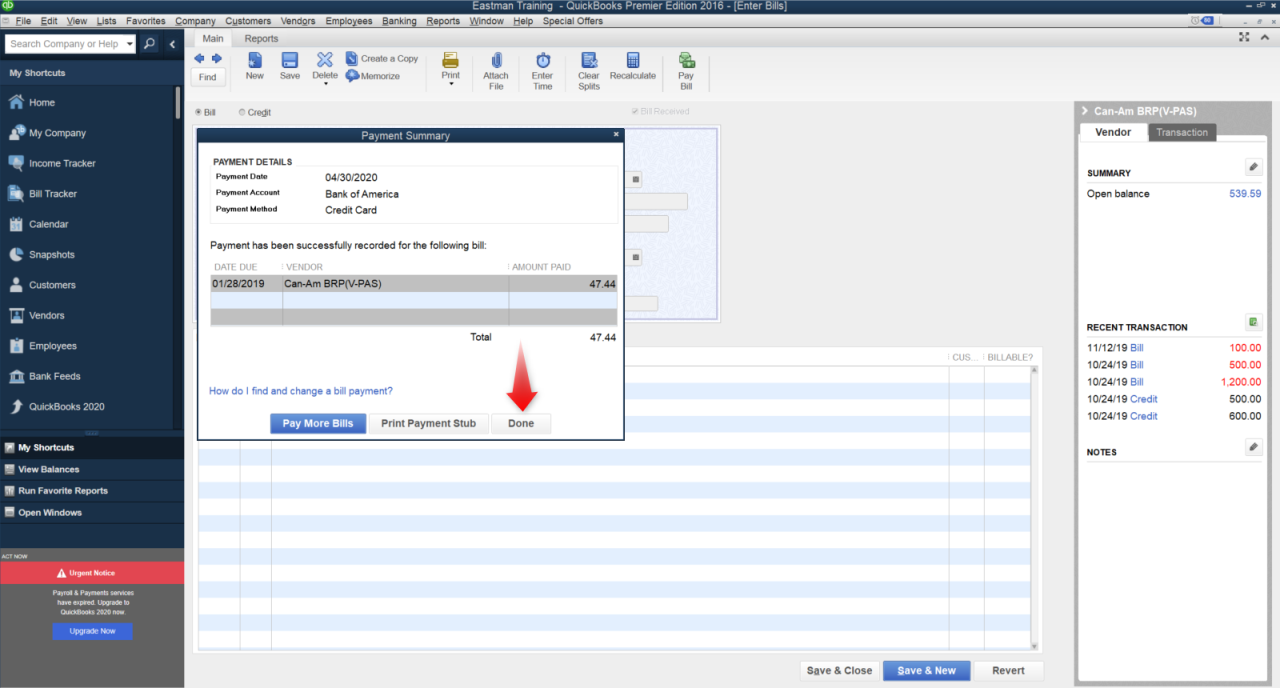

Setting Up Automatic Payments

Automatic payments can simplify your financial management and ensure you never miss a due date. Below is a step-by-step guide to set up automatic payments for your UsBank credit card:

- Log in to your UsBank online account or open the mobile app.

- Navigate to the “Payments” section.

- Select “Set Up Automatic Payments.”

- Choose the payment amount: Minimum Payment, Full Balance, or a Fixed Amount.

- Enter your bank account details from which the payment will be withdrawn.

- Select the payment date, typically the due date of your bill.

- Review the details and confirm the setup.

Comparison of Payment Processing Times

Understanding the processing times for each payment method can help you make timely payments. Here’s a comparison of the estimated processing times for the different payment methods available for UsBank credit cards:

| Payment Method | Processing Time |

|---|---|

| Online Payment | Same Day |

| Phone Payment | Same Day |

| Mail Payment | Up to 7 Business Days |

| In-Person Payment | Immediate |

“Selecting the right payment method can enhance your financial management and prevent unnecessary late fees.”

Payment Due Dates and Fees

Keeping track of payment due dates is crucial when managing your UsBank credit card. Timely payments not only help you avoid late fees but also contribute positively to your credit score. Understanding how to determine these due dates, along with the associated fees for late payments, is essential for maintaining financial health and avoiding unnecessary costs.The payment due date for your UsBank credit card can be found on your monthly billing statement, which is sent via mail or electronically.

Additionally, you can check your account online through UsBank’s website or mobile app. The due date is typically the same each month, making it easier for you to plan your payments accordingly. It’s important to note that payments made after 5 PM (local time) may be processed the next business day.

Late Fees and Interest Rates

Failure to make your payment by the due date can result in late fees and higher interest rates, which can significantly increase your overall balance. The following points highlight important aspects regarding late fees and interest rates:

- Late Fees: UsBank typically charges a late fee of up to $40 for missed payments. This fee may vary depending on your account history and payment behavior.

- Interest Rates: If you miss a payment, UsBank may increase your interest rate, which can elevate the cost of your outstanding balance over time. The new rate may be significantly higher than your original APR.

- Impact on Credit Score: Late payments can also adversely affect your credit score, as payment history is a crucial factor in credit scoring models.

To avoid late payment fees, consider implementing the following strategies:

- Set Up Automatic Payments: Enabling auto-pay through your UsBank account can help ensure that at least the minimum payment is made by the due date.

- Use Calendar Reminders: Setting reminders on your phone or marking your calendar with payment due dates can help prompt timely payments.

- Pay Early: Making payments a few days before the due date ensures they’re processed on time, even if you encounter unexpected issues with your payment method.

- Monitor Your Statements: Regularly reviewing your statements can alert you to due dates and any changes to your account, helping you stay informed and prepared.

Making timely payments not only helps you avoid fees but also strengthens your credit profile.

Managing Your UsBank Credit Card Payments

Effectively managing your UsBank credit card payments is essential for maintaining a healthy financial profile. With the right tools and strategies, you can ensure that your payments are timely, budget-friendly, and supportive of your credit score. By utilizing the UsBank mobile app and establishing a disciplined budgeting approach, you can take control of your credit card management.

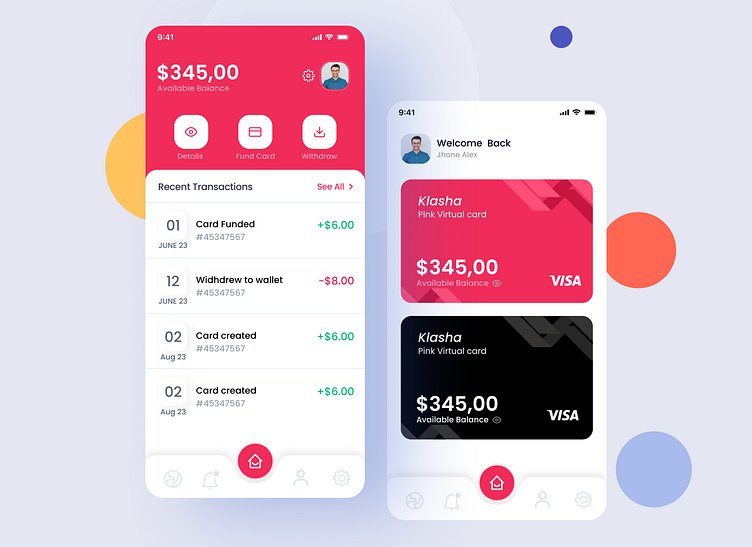

Tracking Payments Through the UsBank Mobile App

The UsBank mobile app provides a comprehensive platform for monitoring and managing your credit card payments seamlessly. Within the app, you can access features that allow you to check your balance, view transactions, and set up alerts for upcoming payment due dates. This proactive management helps you stay informed about your spending and upcoming obligations, minimizing the risk of late payments.To maximize the app’s functionality, consider these features:

- Transaction Alerts: Set up custom alerts to be notified of transactions made on your card. This keeps you updated and allows for real-time monitoring of expenditures.

- Payment Scheduling: Schedule your payments directly through the app to ensure timely submissions. You can set up one-time or recurring payments to automate your dues.

- Budgeting Tools: Utilize built-in budgeting tools to categorize spending and track your monthly budget against your credit card usage.

Tips for Budgeting Credit Card Payments

A well-crafted budget is a cornerstone of effective credit card management. By planning your payments monthly, you can avoid interest charges and maintain a strong credit score. Consider these budgeting tips to streamline your credit card payment process:

- Evaluate Monthly Expenses: Take the time to assess your regular expenses and determine how much you can allocate toward credit card payments each month.

- Prioritize Payments: Always prioritize your credit card payments in your budget to ensure they are met on time, safeguarding your financial standing.

- Build an Emergency Fund: Establish a small emergency fund that can cover your credit card payment in case of unexpected expenses, reducing reliance on borrowed funds.

Importance of Payment History for Credit Score Improvement

A strong payment history significantly influences your credit score, making timely payments a top priority. Payment history accounts for 35% of your FICO score, emphasizing the importance of maintaining a consistent record of on-time payments. Regularly tracking your payment history through the UsBank app enables you to see your progress and reinforces positive habits.To further improve your credit score, adhere to these practices:

- Make Payments On Time: Always aim to pay your bills on or before the due date to establish a reliable payment pattern.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum due. This not only reduces your balance more quickly but also reflects positively on your credit utilization ratio.

- Review Your Credit Report: Periodically check your credit report for inaccuracies or late payments. Disputing errors can help improve your score.

“A consistent payment history is the foundation of a healthy credit score.”

Customer Support and Resources

For UsBank credit cardholders, access to reliable customer support and resources is essential for navigating any inquiries or issues that may arise. Whether you have questions about your account, need assistance with payments, or simply want to understand your benefits better, UsBank offers various options and resources designed to assist you.UsBank provides multiple avenues for customer support to ensure that cardholders can find the help they need quickly and efficiently.

From direct phone support to online resources, there are plenty of ways to get in touch or find answers to common questions.

Customer Support Options

UsBank credit cardholders can take advantage of several customer support options, ensuring assistance is available when needed. Below are the main support channels.

- Phone Support: Call the customer service number on the back of your card for immediate assistance with your account.

- Online Chat: Access the UsBank website to utilize their online chat feature for real-time help from a representative.

- Email Support: Reach out through the secure messaging option in your online banking account for non-urgent inquiries.

- Mobile App: Use the UsBank mobile app to manage your account and access customer support features directly.

Online Resources and FAQs

In addition to direct support, UsBank offers a variety of online resources that can help address common payment-related inquiries. Having access to these resources can save you time and provide quick answers to your questions.

- UsBank Help Center: A comprehensive resource that covers everything from account management to dispute resolution.

- FAQs Section: Contains answers to frequently asked questions about payments, fees, and account management.

- Video Tutorials: Step-by-step guides on using features within the UsBank app and website.

- Community Forums: A platform where customers can share experiences and solutions regarding common issues.

Contact Numbers and Hours

UsBank provides dedicated contact numbers for various services, ensuring that you can reach the appropriate department based on your needs. Below is a table outlining the contact numbers and their corresponding hours of operation.

| Service | Contact Number | Hours of Operation |

|---|---|---|

| General Customer Service | 1-800-USBANKS (1-800-872-2657) | 24/7 |

| Lost or Stolen Card | 1-800-USBANKS (1-800-872-2657) | 24/7 |

| Fraud Assistance | 1-800-USBANKS (1-800-872-2657) | 24/7 |

| Payment Assistance | 1-800-237-8982 | Monday – Friday: 7 AM – 9 PM CT |

Remember, having your account information handy will help expedite your support experience.

Troubleshooting Payment Issues

Managing credit card payments can sometimes be a bit tricky, and users might encounter various issues along the way. It’s essential to know what common problems might arise and how to efficiently resolve them to ensure your payments go through smoothly. Understanding these challenges can help you take proactive steps to avoid payment-related stress.One of the most frequent issues users face is when payments do not appear as processed on their accounts, which can lead to worries about late fees or potential damage to credit scores.

If a payment is not reflected in your account, there could be several reasons behind this. It’s vital to check the status of your transaction and the payment methods used to identify any discrepancies.

Common Payment Issues

Users may encounter a range of payment issues, each with straightforward remedies. Here are some of the more common challenges, along with potential solutions:

- Payment Not Processed: Sometimes, a payment may not process due to connectivity issues or errors with the payment portal. If this occurs, retry the payment after checking your internet connection.

- Incorrect Payment Amount: Always double-check the amount before confirming your payment. If you’ve overpaid or underpaid, contact customer support for adjustments.

- Payment Declined: A denial may happen due to insufficient funds or exceeding credit limits. Review your account balance and spend limits to ensure you’re within acceptable ranges.

- Delayed Reflections: Payments might take time to reflect in your account. Check your payment history and allow a few business days for processing.

Steps for Unreflected Payments

If a payment does not appear in your account, follow these steps to resolve the issue:

1. Verify Payment Method Confirm that the payment was made using the correct method linked to your UsBank account.

2. Check Transaction History Look at your account’s transaction history to ensure the payment was initiated.

3. Contact Customer Support If you do not see the payment reflected after a few days, reach out to customer support with your transaction details for assistance.

4. Keep Documentation Maintain records of your payment confirmations and any correspondence with customer support for reference.

Payment Processing Checklist

Ensuring a successful payment process can be simplified with a handy checklist. Review the following items each time you make a payment:

- Confirm that you have sufficient funds in your bank account or available credit on your card.

- Ensure you are using the correct payment portal or app.

- Double-check that you have entered the correct payment amount and account details.

- Monitor your internet connection to avoid disruptions during the transaction.

- Record the confirmation number or receipt for your transaction.

“A proactive approach to managing payment issues can prevent financial stress and ensure timely processing.”

Key Questions Answered

What payment methods are available for UsBank credit cards?

You can make payments online, via mail, through the UsBank mobile app, or by phone.

How can I set up automatic payments for my UsBank credit card?

You can easily set up automatic payments through your UsBank online account by selecting the payment amount and frequency.

What should I do if my payment doesn’t reflect in my account?

Check your payment confirmation and wait a few days. If it still doesn’t appear, contact UsBank customer support for assistance.

Are there any fees for late payments?

Yes, late payments may incur fees, and interest rates could increase, so it’s important to pay on time.

How can I track my payments effectively?

You can track payments using the UsBank mobile app, which provides real-time updates and payment history.