Verizon mobile payment sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This innovative payment solution is designed to simplify how users conduct transactions, leveraging advanced technology to create seamless experiences. By integrating Verizon mobile payment into daily routines, users can enjoy a variety of transaction types while benefiting from robust security features and user-friendly interfaces.

Overview of Verizon Mobile Payment

Verizon Mobile Payment is an innovative service that allows users to make transactions using their mobile devices. By leveraging advanced technology and secure platforms, Verizon offers a seamless payment experience that caters to various consumer needs. With the growing trend of digital payments, Verizon Mobile Payment aims to simplify how users handle their financial transactions.The Verizon Mobile Payment service utilizes a combination of near-field communication (NFC) technology and secure authentication methods to facilitate payments.

This technology enables users to link their bank accounts or credit cards directly to their mobile devices, allowing for quick and easy transactions at participating merchants. The platform supports both in-store and online payments, ensuring that customers can shop conveniently from anywhere.

Supported Transaction Types

Verizon Mobile Payment supports a range of transaction types, catering to diverse consumer preferences and shopping habits. Understanding the various transaction options can enhance user experiences and provide greater flexibility.The main types of transactions supported by Verizon Mobile Payment include:

- In-Store Purchases: Users can make contactless payments at retail locations by simply tapping their mobile devices on enabled point-of-sale terminals.

- Online Payments: The service allows users to complete purchases on e-commerce platforms without entering payment details, enhancing security and convenience.

- Peer-to-Peer Payments: Users can send money directly to friends or family members through the app, facilitating easy fund transfers.

- Bill Payments: Verizon Mobile Payment enables users to pay bills directly from their mobile devices, streamlining the payment process for utilities and services.

- Subscription Services: Users can manage and pay for subscriptions directly through the app, making it easy to keep track of recurring expenses.

Each of these transaction types is designed to provide users with a secure and efficient way to handle their financial activities. By incorporating cutting-edge technology, Verizon ensures that every transaction is protected, giving users peace of mind while engaging in mobile payment activities.

Features of Verizon Mobile Payment

Verizon Mobile Payment stands out due to its unique blend of convenience, security, and user-friendly features. In an era where digital transactions are becoming increasingly prevalent, Verizon ensures that both merchants and customers have a seamless experience while prioritizing safety and efficiency. One of the key aspects of Verizon Mobile Payment is its integration with the latest technologies, making transactions faster and more accessible.

The application is designed to work smoothly across various devices, enabling users to make payments easily from their smartphones. Enhanced features such as loyalty program integration and digital receipts add to the overall positive user experience.

Security Measures in Verizon Mobile Payment

Security is a top priority in the Verizon Mobile Payment system. The platform employs state-of-the-art encryption to protect users’ financial information and transaction data. This ensures that all sensitive information is safeguarded during transmission, significantly reducing the risk of unauthorized access. Additionally, multi-factor authentication is implemented as a security measure, requiring users to verify their identity through multiple means before completing a transaction.

This includes biometric options, such as fingerprint scanning or facial recognition, adding an extra layer of protection.

“Verizon Mobile Payment utilizes advanced encryption and multi-factor authentication, ensuring every transaction remains secure and private.”

User Benefits of Verizon Mobile Payment

Using Verizon Mobile Payment offers numerous advantages for users. The primary benefit is the convenience of making payments on-the-go without the need for physical cash or cards. Users can complete transactions quickly, whether they are shopping online or making in-store purchases.Another significant advantage is the ability to track expenses effectively through the application. Users receive instant notifications and digital receipts for every transaction, helping them keep their spending organized.

Furthermore, Verizon Mobile Payment supports a variety of payment methods, including credit and debit cards, making it a flexible option for users with different preferences.

“Instant notifications and digital receipts empower users to manage their finances better and stay informed about their spending habits.”

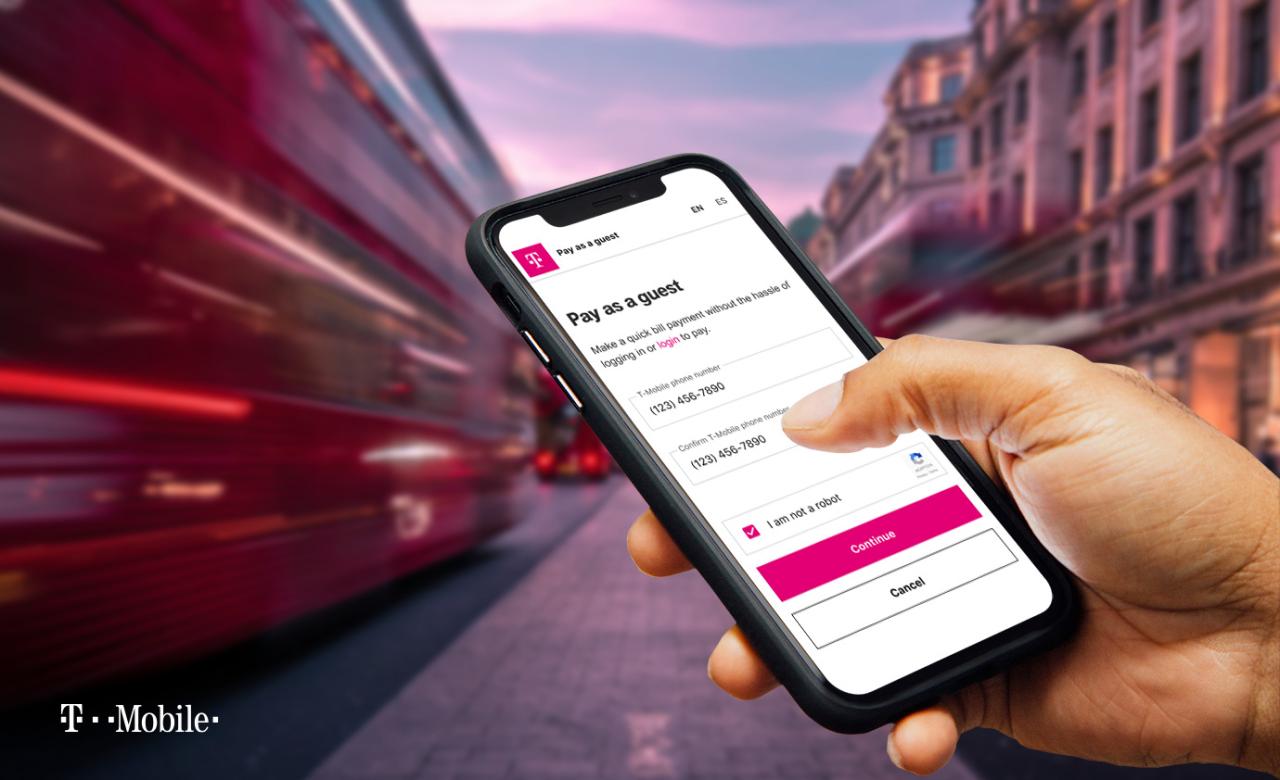

Setting Up Verizon Mobile Payment

Setting up Verizon Mobile Payment is a straightforward process that allows users to make transactions seamlessly using their mobile devices. With just a few steps, you can enable a secure and convenient way to handle payments right from your smartphone.To start using Verizon Mobile Payment, users must meet certain requirements and follow a systematic setup process. Below are the steps you’ll need to take to get started, along with some common troubleshooting tips for any issues that may arise during setup.

Step-by-Step Guide for Setup, Verizon mobile payment

Follow these steps to set up Verizon Mobile Payment on your device:

- Ensure your device is compatible with Verizon Mobile Payment. Most recent Android and iOS devices are supported.

- Download the Verizon Mobile Payment app from the App Store or Google Play Store.

- Open the app and sign in with your Verizon account credentials. If you do not have an account, you will need to create one.

- Link your preferred payment method, such as a credit or debit card, by entering the required information.

- Verify your identity through any necessary two-factor authentication.

- Customize your settings, including transaction notifications and spending limits, to enhance security and manage your budget.

- Once set up, you can start using Verizon Mobile Payment for transactions at participating merchants.

Requirements for Use

Before diving into the setup process, it’s important to ensure you meet the necessary requirements:

- A Verizon Wireless account is mandatory.

- Your device must be running a compatible operating system: iOS 12.0 or later for iPhones and Android 7.0 or later for Android devices.

- A stable internet connection is required, either through Wi-Fi or cellular data.

- Access to a valid payment method, such as a credit or debit card, to link to your Verizon account.

Troubleshooting Setup Issues

Sometimes, users may encounter issues during the setup process. Here are common troubleshooting tips to help resolve these problems:

- If you experience difficulties signing in, double-check your Verizon account credentials for accuracy. Reset your password if necessary.

- Ensure your device’s operating system and the Verizon Mobile Payment app are up to date. Check for any available updates in your device settings.

- If linking your payment method fails, verify that the card details entered are correct and that the card is active and supported by the app.

- For connectivity issues, confirm that you have a stable internet connection. Switching between Wi-Fi and cellular data may resolve the problem.

- If you encounter persistent problems, consider uninstalling and reinstalling the app to reset it.

Always keep your app updated and monitor your account activity for security purposes.

Comparing Verizon Mobile Payment with Other Payment Services

Verizon Mobile Payment has carved its niche in the mobile payment landscape, joining a competitive field that includes giants like Apple Pay, Google Pay, and Samsung Pay. Each of these services offers unique features and advantages, making it essential to understand where Verizon stands in comparison to its peers and traditional payment methods.When considering mobile payment options, consumers often weigh the convenience, security, and usability of these services.

Verizon Mobile Payment stands out with its integration into the Verizon ecosystem, allowing users to manage payments seamlessly alongside their mobile plans. However, it’s beneficial to evaluate both the strengths and weaknesses of Verizon Mobile Payment against other prominent services.

Comparison with Major Competitors

Verizon Mobile Payment can be compared to other major mobile payment services based on several key aspects, including security, ease of use, and integration with other services. Here’s a look at how Verizon aligns with its competitors:

- Security Features: Verizon employs robust security measures, including tokenization and biometric authentication. While competitors like Apple Pay also prioritize security, the unique network infrastructure of Verizon adds an additional layer of safety for users.

- Ease of Use: The user interface of Verizon Mobile Payment is designed for simplicity, allowing users to make payments with just a few taps. In contrast, services like Google Pay provide extensive features that may complicate the user experience for some.

- Integration: Verizon Mobile Payment offers seamless integration with Verizon accounts, making it a top choice for existing Verizon customers. Competitors like Samsung Pay may offer broader merchant acceptance but lack this specific tie-in with telecom services.

Advantages and Disadvantages of Verizon Mobile Payment vs. Traditional Payment Methods

Using Verizon Mobile Payment offers distinct advantages over traditional payment methods such as cash and credit cards, but it also comes with some drawbacks. Understanding these can help users make informed choices.The benefits of Verizon Mobile Payment include:

- Convenience: Payments can be made quickly and easily from a smartphone, eliminating the need to carry cash or multiple cards.

- Transaction Tracking: Users can track their spending through the app, providing better financial oversight compared to cash transactions.

- Promotions and Discounts: Verizon often provides exclusive deals for users of their payment platform, enhancing value beyond traditional payment options.

Conversely, some disadvantages include:

- Dependence on Technology: Users must have a smartphone and internet access to utilize Verizon Mobile Payment, which may not be feasible for everyone.

- Merchant Acceptance: While growing, some merchants may not yet accept Verizon Mobile Payment, limiting its usability compared to cash or credit cards.

User Preferences and Trends in Mobile Payment Services

Recent trends indicate shifting user preferences in mobile payment services, influenced by demographic factors such as age, tech-savviness, and lifestyle. Younger users, particularly Millennials and Gen Z, tend to favor mobile payment solutions due to their affinity for technology and digital transactions. In contrast, older generations may still prefer traditional methods like cash or credit cards due to concerns over security or the learning curve associated with new technology.The increasing adoption of mobile payments can be attributed to several factors:

- Increased Smartphone Usage: As smartphone penetration rises, more users are inclined to utilize mobile payment apps.

- Health Concerns: In light of recent global events, many consumers prefer contactless payments to minimize physical contact.

- Rewards Programs: Users are increasingly drawn to services that offer rewards and cashback, making mobile payments more attractive than traditional methods.

Use Cases for Verizon Mobile Payment

Verizon Mobile Payment provides a versatile and efficient payment solution that can be utilized across various situations, benefiting both consumers and businesses. Its ease of use and integration capabilities make it an attractive option for merchants looking to streamline transactions.Businesses can effectively implement Verizon Mobile Payment in numerous scenarios. From retail environments to service-oriented industries, the platform enhances customer experiences and operational efficiency.

The following sections will highlight specific use cases where Verizon Mobile Payment proves to be invaluable.

Retail Transactions

In the retail sector, Verizon Mobile Payment can significantly enhance the checkout process. The ability to accept payments directly from customers’ mobile devices reduces transaction times and improves customer satisfaction. Retailers can integrate this payment method into their point-of-sale systems, facilitating quick and seamless transactions. The benefits of using Verizon Mobile Payment in retail include:

- Increased Speed: Transactions can be completed faster, leading to shorter wait times for customers.

- Enhanced Customer Experience: Customers appreciate the convenience of mobile payments, which can boost loyalty.

- Cost Efficiency: Reduced processing fees compared to traditional credit card payments can lower overall operational costs.

Service Industry Applications

In service-oriented businesses such as restaurants, salons, and repair shops, Verizon Mobile Payment can streamline the invoicing and payment collection processes. By offering mobile payment options, these businesses can create a more efficient and modern service experience.The advantages for service providers integrating Verizon Mobile Payment include:

- Mobile Invoicing: Service providers can send invoices directly to customers’ phones for quick payment.

- Flexible Payment Options: Customers can choose to pay via their preferred method, whether through credit, debit, or digital wallets.

- Improved Cash Flow: Faster payment collection allows businesses to manage their finances more effectively.

Case Studies of Successful Integration

Several businesses have successfully leveraged Verizon Mobile Payment to improve their operations and customer satisfaction. For instance, a local café integrated Verizon Mobile Payment into their ordering system, allowing customers to order and pay via their smartphones. This not only reduced wait times but also led to a 30% increase in sales during peak hours due to the efficiency of the system.Another example is a home service company that adopted Verizon Mobile Payment to facilitate on-the-spot payments.

Customers were able to pay through the app immediately after service completion, enhancing customer satisfaction and reducing collection times.

“Utilizing Verizon Mobile Payment has transformed our customer interactions, making transactions smoother and faster.”

Café Owner

These case studies illustrate the effectiveness of Verizon Mobile Payment in real-world applications, demonstrating tangible benefits that can significantly enhance both customer experience and business operations.

Future of Verizon Mobile Payment

The future of Verizon Mobile Payment promises to be an exciting landscape filled with technological advancements and innovative features. As mobile payment systems continue to evolve, Verizon is poised to enhance its platform to cater to the changing needs of consumers and businesses alike. This evolution will likely be driven by emerging technologies that not only streamline transactions but also elevate user experiences.The integration of emerging technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) is set to redefine the mobile payment ecosystem.

For instance, AI can enhance security measures through biometric authentication and fraud detection, making transactions safer for users. Blockchain technology offers the potential for more secure and transparent transactions, reducing the risk of fraud and enhancing trust in the payment process. Furthermore, IoT devices, such as smartwatches and connected cars, could allow users to make payments seamlessly without even needing to pull out their phones.

Preparing for Future Trends in Mobile Payments

As the landscape of mobile payments continues to shift, users and businesses should adopt proactive strategies to stay ahead of the curve. Understanding and preparing for these trends can foster smoother transactions and improved customer relationships. Effective strategies include:

Staying Informed

Regularly updating oneself on the latest advancements in mobile payment technology ensures that users and businesses can adapt quickly to changes.

Investing in Security

Leveraging advanced security protocols, such as two-factor authentication and biometric verification, will help businesses protect sensitive customer information.

Enhancing User Experience

Focusing on user-friendly interfaces and offering multiple payment options will encourage customer loyalty and facilitate smoother transactions.

Embracing Integration

Businesses should integrate mobile payment solutions with existing e-commerce platforms and customer relationship management systems to streamline operations and offer a cohesive experience.

Utilizing Data Analytics

By analyzing transaction data, businesses can gain insights into customer behavior, allowing for targeted marketing strategies that can drive sales.

“The most successful businesses will be those that understand the evolving technology landscape and adapt their strategies accordingly.”

By implementing these strategies, both users and businesses can navigate the changing dynamics of mobile payments and fully leverage the advancements that Verizon Mobile Payment and similar platforms will bring to the market.

Customer Support and Resources for Verizon Mobile Payment

Verizon understands that users may encounter questions or issues while utilizing their mobile payment services. To facilitate a smooth experience, the company provides various customer support options and resources designed to assist users effectively. This section details the available support channels, valuable reading resources, and a comprehensive FAQ section catering to common inquiries.

Customer Support Options for Verizon Mobile Payment Users

Verizon offers multiple avenues for customer support to ensure mobile payment users receive timely assistance. These options include:

- Phone Support: Users can reach out to Verizon’s customer service via their dedicated support line for immediate assistance regarding mobile payment issues.

- Online Chat: The Verizon website features a live chat option where users can interact with customer service representatives in real-time for quick resolutions.

- Help Center: A comprehensive online help center is available, offering articles, troubleshooting guides, and step-by-step instructions for common problems.

- Social Media Support: Users can also connect with Verizon’s customer support through social media platforms like Twitter and Facebook for inquiries and updates.

Resources for Further Reading and Learning

For those interested in expanding their knowledge about Verizon Mobile Payment, several resources are available. These resources offer detailed insights into features, updates, and best practices for using the service effectively.

- Verizon’s Official Website: The website includes extensive documentation, user guides, and FAQs designed to help users navigate the mobile payment system.

- Blogs and Articles: Various tech blogs and financial websites regularly publish articles discussing recent developments and tips for using Verizon Mobile Payment.

- Video Tutorials: Platforms like YouTube feature video tutorials created by both Verizon and independent content creators that walk users through the mobile payment setup and troubleshooting processes.

Frequently Asked Questions about Verizon Mobile Payment

This section presents a curated list of frequently asked questions regarding Verizon Mobile Payment, along with their concise answers to provide clarity and assistance.

“Understanding the common questions can enhance user experience and streamline the support process.”

- What devices are compatible with Verizon Mobile Payment? Verizon Mobile Payment works with a wide range of smartphones equipped with NFC capabilities, including both Android and iOS devices.

- Is there a fee for using Verizon Mobile Payment? Generally, there are no additional fees for using the mobile payment service, but users should check their account terms for any specific conditions.

- How do I secure my mobile payments? Verizon recommends using a strong password, enabling two-factor authentication, and regularly updating device software to enhance security.

- What should I do if my payment fails? If a payment fails, users are advised to check their internet connection, ensure their payment method is valid, and retry the transaction.

- Can I use Verizon Mobile Payment internationally? While Verizon Mobile Payment is primarily designed for domestic use, some international transactions may be supported depending on merchant capabilities.

Common Queries

What devices support Verizon mobile payment?

Verizon mobile payment is compatible with most smartphones that support NFC (Near Field Communication) technology.

Are there any fees associated with using Verizon mobile payment?

Generally, users do not incur additional fees for transactions, but it’s advisable to check with Verizon for any specific conditions.

Can I use Verizon mobile payment internationally?

It may depend on the merchant and country, so it’s best to verify before traveling.

Is my personal information safe with Verizon mobile payment?

Yes, Verizon employs strong encryption and security measures to protect user data during transactions.

How can I track my transactions made through Verizon mobile payment?

Users can view their transaction history within the Verizon mobile payment app or on their Verizon account online.