Wells Fargo credit card payment processing is a crucial aspect of managing your finances effectively. Understanding the various methods available for making payments can simplify your experience and help you avoid unnecessary fees or complications. With options ranging from online payments to mobile app transactions, Wells Fargo has designed its services to cater to the needs of modern cardholders.

This overview will guide you through the different payment methods, the timeline for processing, and the importance of knowing how these elements can impact your credit card management. Whether you prefer the convenience of online payments or the accessibility of mobile options, being informed will empower you to take control of your credit card usage.

Overview of Wells Fargo Credit Card Payment Processing

Wells Fargo offers a variety of methods for cardholders to make payments on their credit cards, making it easier to manage balances effectively. Understanding these payment options, processing timelines, and their implications on debt management is crucial for cardholders aiming to maintain their financial health.Wells Fargo provides several convenient methods for making credit card payments. These options allow flexibility and cater to different preferences.

The main payment methods include:

- Online Payments: Cardholders can log into their Wells Fargo online banking account to make payments. This method is typically processed immediately on business days.

- Mobile App Payments: The Wells Fargo mobile app offers a user-friendly interface for making payments on the go, ensuring that customers can manage their accounts conveniently.

- Phone Payments: Customers can call Wells Fargo’s customer service to make payments via phone, providing assistance for those who prefer speaking to a representative.

- Mail Payments: Payments can be sent via check to the address specified on the billing statement. However, this method may take longer as it relies on postal services.

- In-Branch Payments: Cardholders can also visit a local Wells Fargo branch to make a payment in person, which can be particularly useful for those who prefer personal interaction.

Understanding the timeline for processing payments is essential for cardholders, as it directly impacts available credit and potential late fees. Payments made online or via the mobile app are generally processed quickly, often within the same day if submitted before the cutoff time. Conversely, mail payments may take several days to process, which can lead to missed deadlines if not timed appropriately.

Timely payments help maintain a positive credit score, while delayed payments can lead to increased interest rates and fees.

The importance of understanding payment processing cannot be overstated when managing credit card debt. Knowing how and when payments are processed allows cardholders to plan their finances better, reducing the risk of accruing high-interest charges due to late payments. Additionally, making payments on time can positively influence credit utilization ratios, which play a significant role in credit scores. By utilizing the various payment methods effectively, cardholders can take proactive steps to manage their credit card debt more efficiently.

Online Payment Methods: Wells Fargo Credit Card Payment Processing

Making payments online for your Wells Fargo credit card is a modern convenience that saves time and effort. With a few simple steps, you can ensure your payments are processed quickly and securely, all from the comfort of your home or on the go. This method not only allows for immediate confirmation of your transactions but also provides a variety of options to suit your paying style.

Step-by-Step Guide for Making Payments Online

To make your credit card payment online through the Wells Fargo website, follow these steps:

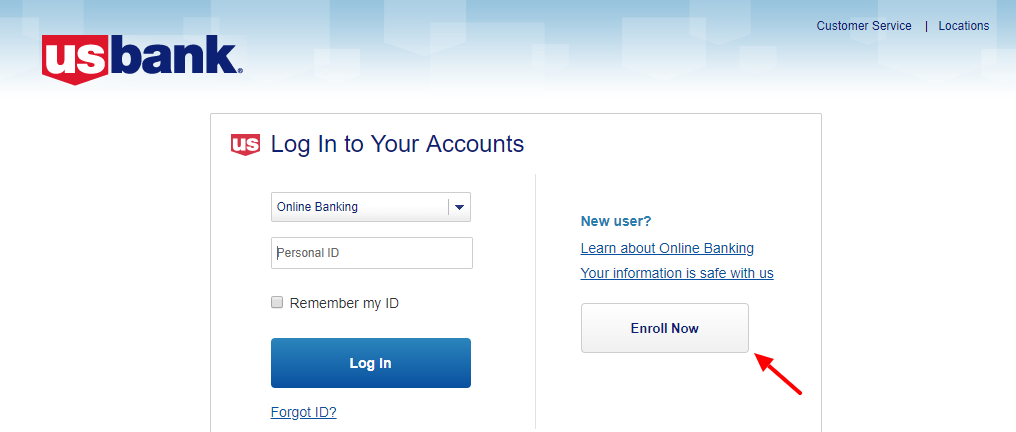

- Visit the Wells Fargo website and log into your account using your username and password.

- Once logged in, navigate to the “Payments” section available in your account dashboard.

- Select “Make a Payment” to initiate the process.

- Choose the credit card you wish to pay and enter the payment amount.

- Select your preferred payment date. You can make a one-time payment or set future payment dates.

- Review all details to ensure accuracy, and then confirm your payment.

- You will receive a confirmation page, which you can print or save for your records.

This streamlined process ensures that your payments are handled efficiently and helps avoid late fees.

Setting Up Automatic Payments and Benefits, Wells fargo credit card payment processing

Setting up automatic payments with Wells Fargo is a practical choice for those who want to simplify their financial management. Here’s how to set it up and what benefits you can expect:

To set up automatic payments:

- Log into your Wells Fargo account.

- Go to the “Payments” section and select “Automatic Payments.”

- Choose your credit card and specify the amount to be paid each month.

- Select the date you want the payment to be deducted from your account.

- Confirm your selections and save the automatic payment setup.

The benefits of automatic payments include:

- Consistent on-time payments, reducing the risk of late fees and potential negative impacts on your credit score.

- The convenience of not having to remember payment due dates, freeing you from the hassle of manual payments.

- Potential discounts or rewards offered by Wells Fargo for setting up auto-pay features, depending on your card’s terms.

Comparison of Online Payment Methods versus Traditional Payment Methods

Understanding the advantages of online payment methods compared to traditional payment methods is essential for making informed financial decisions. Here’s a comparison based on key factors:

| Factor | Online Payment Methods | Traditional Payment Methods |

|———————-|————————————————|————————————————|

| Convenience | Can be done anytime, anywhere with internet access | Limited to banking hours and physical locations |

| Speed | Instant processing and confirmation | Delayed processing, especially with mail |

| Security | Encrypted transactions and fraud protection | Risks associated with checks or cash handling |

| Record Keeping | Automatic tracking and digital statements | Manual record keeping required |

| Environmental Impact | Reduces paper waste | Involves paper checks and statements |

Both payment methods have their places; however, online options tend to be more efficient and user-friendly in today’s digital age.

Online payment methods provide a blend of convenience, speed, and security that traditional methods often lack.

Mobile Payment Options

The Wells Fargo mobile app provides a convenient and efficient way to manage credit card payments directly from your smartphone. With just a few taps, you can stay on top of your account, ensuring you never miss a due date or fall behind on payments. This mobile-friendly approach not only saves time but also enhances your ability to track spending and manage finances on the go.Using the Wells Fargo mobile app for credit card payments is straightforward.

Once you have the app installed and your account set up, you can easily navigate to the payment section. Here are the essential steps to follow:

Wells Fargo Mobile App Usage for Payments

- Open the Wells Fargo mobile app and log in with your credentials.

- Select the “Credit Cards” option from the main menu.

- Choose the card you wish to pay from the list displayed.

- Tap on “Make a Payment” and enter the desired payment amount.

- Review the payment details and confirm the transaction.

By utilizing the Wells Fargo mobile app, users benefit from a range of security measures designed to protect their information during mobile payment transactions. Here are some key security features:

Security Measures for Mobile Transactions

Multi-Factor Authentication Users must verify their identity through multiple steps, ensuring that only authorized individuals can access the account.

Encryption Technology Sensitive data is encrypted, making it unreadable to unauthorized parties during transmission.

Account Alerts The app sends notifications for unusual account activity, providing an additional layer of security by keeping you informed of any suspicious transactions.The advantages of using mobile payments for credit card management extend beyond mere convenience. They include:

Advantages of Mobile Payments

Mobile payments offer several benefits that enhance the user experience and financial management:

Real-Time Monitoring Users can check their balances, transaction history, and payment due dates immediately, allowing for better financial planning.

Instant Payments Payments can be made instantly, reducing the risk of late fees and improving credit score management.

User-Friendly Interface The Wells Fargo mobile app is designed for ease of use, making it accessible for all users.

Budgeting Tools The app may include features that help users track their spending habits and set budgets, promoting better financial health.By embracing mobile payment options, Wells Fargo customers can enjoy a modern and secure way of managing their credit card payments.

Payment Processing Fees

Understanding the fees associated with payment processing is crucial for effectively managing your Wells Fargo credit card transactions. These fees can vary based on the payment method chosen and can influence your overall budgeting and credit card usage. Knowing what fees you might encounter can help you make informed decisions and avoid unexpected costs.Wells Fargo credit card payment processing methods may carry different fees, depending on whether you choose online payments, mobile payments, or traditional methods like mail.

Being aware of these fees allows cardholders to optimize their spending and minimize unnecessary charges.

Associated Fees with Payment Processing Methods

Each payment method can come with its own set of fees. It’s essential to recognize these costs to avoid overspending and to manage your credit card budget effectively. Here’s a closer look at the typical fees associated with Wells Fargo credit card payment processing methods:

- Online Payments: Generally, online payments are fee-free if made from a Wells Fargo bank account. However, fees may apply if you use a third-party account or service.

- Mobile Payments: Utilizing mobile payment options like Apple Pay or Google Pay typically incurs no additional fees, provided the account is linked appropriately.

- Phone Payments: Payments made over the phone may incur a service fee, which is usually a flat rate. Always check with Wells Fargo for the latest fee structure.

- Mail Payments: Sending payments via mail can be free, but postal delays might lead to late fees if the payment is not received on time.

It’s critical to check the current fee schedule on the Wells Fargo website to ensure you are fully informed about any potential charges.

The impact of these fees can accumulate over time, affecting overall credit card usage and personal budgeting. For example, if you frequently make phone payments and incur a service fee each time, you may find that it adds up and influences your spending decisions. Cardholders should take proactive steps to minimize these costs.

Methods to Avoid Unnecessary Fees

Avoiding fees is a smart strategy that can enhance your credit card experience. Here are some effective methods to consider:

- Set Up Autopay: Automate your payments through a Wells Fargo account to ensure you never miss a due date and incur late fees.

- Use the Wells Fargo App: Downloading the official app allows you to manage payments easily, without worrying about additional third-party fees.

- Pay on Time: Always ensure that payments are made before the due date. Late payments can lead to hefty fees and interest rate increases.

- Monitor Your Statements: Regularly reviewing your statements can help you identify any unexpected fees and address them promptly.

Being proactive about payment methods and keeping an eye on associated fees can lead to significant savings over time.

Payment Posting and Availability

Understanding payment posting and availability is crucial for cardholders managing their Wells Fargo credit cards. When you make a payment, it’s essential to grasp the timing of when your payment is processed and when it will reflect in your account, as this can impact your overall credit utilization and interest accrual.Payment posting dates and transaction dates refer to different moments in the payment process.

The transaction date is when the actual purchase or payment occurs, while the payment posting date is when the funds are officially credited to your account. For example, if you make a payment on a Friday but it doesn’t post until the following Tuesday, your transaction date is Friday, but your payment posting date is Tuesday.

Typical Timeframes for Payment Availability

Knowing the typical timeframes for payment availability can help you avoid potential pitfalls in managing your credit. Wells Fargo generally processes payments in a timely manner, but the exact timing can depend on various factors, such as the method of payment used. Here are some common timeframes to consider:

- Electronic Payments: Payments made electronically, such as through the Wells Fargo app or website, usually post the same day if made before the cutoff time, which is typically 5 PM Pacific Time.

- Mail Payments: Payments sent via mail can take longer to process. It’s advisable to allow at least 5-7 business days for these payments to post to your account.

- Bank Transfers: Payments made from other banks may take 1-3 business days to be processed and posted to your Wells Fargo account.

The implications of payment posting on interest accrual and credit utilization are significant. Payments that post after your billing cycle can impact how much interest you may owe on your balance. If your payment is delayed and posts after your statement is generated, you might incur interest charges on the full amount due.

Understanding your payment posting dates allows you to manage your credit utilization more effectively, as timely payments can reflect positively on your credit score.

In addition, the timing of when your payment reflects in your account can affect your credit utilization ratio. If your balance is high and a payment posts late, it may appear that you are utilizing more credit than you actually are, which can negatively impact your credit score. By being aware of these details and planning your payments accordingly, you can make more informed decisions regarding your credit card usage.

Customer Support for Payment Issues

Navigating payment issues can be a frustrating experience for Wells Fargo credit card holders. Fortunately, the bank has established a robust customer support system to assist users facing payment processing challenges. Understanding how to effectively reach customer support and what information to provide can significantly enhance the chances of resolving issues swiftly.When encountering problems with payment processing, cardholders may face various challenges.

These could include failed transactions, delayed payment postings, issues with online payment methods, or incorrect payment amounts. Addressing these concerns promptly is important to avoid negative impacts on credit scores or account standing.

Guide for Reaching Customer Support

To ensure a smooth experience when contacting customer support, it’s essential to follow a structured approach. Below are the steps for effectively reaching out for assistance:

1. Gather Relevant Information

Before contacting support, collect all necessary details about your account and the issue at hand. This includes your account number, the date of the transaction, and any error messages received.

2. Choose Your Contact Method

Wells Fargo offers several ways to get in touch with customer support:

Phone Support

Calling the dedicated credit card customer service number is often the quickest way to resolve payment issues. The number can typically be found on the back of your card or on the Wells Fargo website.

Online Chat

The online banking portal provides a chat feature for immediate assistance with payment-related concerns.

Email Support

For less urgent matters, you can send an email detailing your issue through the bank’s official website.

3. Explain Your Issue Clearly

When you connect with a representative, provide a concise summary of the problem. Include all relevant details, such as transaction dates and amounts, to facilitate a quicker resolution.

4. Follow Up

If the issue isn’t resolved during the initial contact, don’t hesitate to follow up. Keep a record of your communication, including timestamps and names of representatives.

“Effective communication with customer support can lead to quicker resolutions for payment issues.”

Common Problems and Resolutions

Several common issues can arise during the payment process. Familiarity with these problems and their resolutions can expedite support interactions:

Transaction Declines

Payments may be declined due to various reasons such as exceeding credit limits or suspected fraud. In such cases, contacting customer support can help clarify matters and potentially lift any holds on the account.

Delayed Payment Posting

Payments made online may not reflect immediately on the account. If this occurs, it’s advisable to check the payment method used and verify that it was processed correctly. Customer support can assist in tracking payment status.

Incorrect Payment Amounts

Errors in payment amounts can happen, particularly with auto-pay settings. If you notice an incorrect charge, initiate contact with support for a review and correction.

Technical Issues with Online Payments

Sometimes, technical glitches can impede online payment processing. Documenting the issue, including any error messages, is crucial when discussing the problem with customer support.By keeping these common problems in mind and following the support guide, Wells Fargo credit cardholders can proactively manage payment issues and achieve quicker resolutions.

Resources for Managing Credit Card Payments

Managing credit card payments can often feel overwhelming, but with the right resources and tools, you can streamline the process and gain better control over your finances. Wells Fargo provides a range of services and options designed to help you with tracking payments, budgeting, and utilizing financial tools that complement their banking services.Wells Fargo offers various resources that enable customers to effectively manage their credit card payments.

By leveraging these tools, you can stay on top of your payment schedule, monitor your spending habits, and budget effectively for your credit card expenses.

Wells Fargo Online and Mobile Tools

Wells Fargo provides a comprehensive suite of online and mobile tools that simplify managing your credit card payments. Using these resources helps you stay organized and informed about your payment status and spending habits.

- Wells Fargo Online Banking: Access your account details, payment history, and upcoming due dates all in one place. The dashboard provides insights into your spending and helps track your payments efficiently.

- Wells Fargo Mobile App: Make payments on the go, view recent transactions, and receive alerts for upcoming bills. The app’s user-friendly interface makes it easy to manage your account wherever you are.

- Automatic Payment Setup: Establish recurring payments to ensure you never miss a due date. This feature can help you avoid late fees and maintain a good credit score.

Tracking Payments and Budgeting Tips

Keeping track of your credit card payments and budgeting effectively is crucial for maintaining financial health. Here are some practical tips to help you manage your credit card expenses.

- Create a Monthly Budget: Artikel your income and expenses to allocate funds for credit card payments. A clear budget helps you visualize your spending and prioritize payments.

- Track Your Spending: Use Wells Fargo’s tools or personal finance apps to categorize your transactions. This practice allows you to identify areas where you can cut back and save for payments.

- Review Your Statements: Regularly check your statements for accuracy and to gain insights into your spending habits. This review can help you spot any unauthorized charges early on.

Using Financial Tools and Apps

In addition to Wells Fargo’s built-in resources, there are numerous financial tools and apps available that can optimize your credit card management. These tools can enhance your ability to budget, track spending, and manage payments efficiently.

- Budgeting Apps: Consider apps like Mint or You Need a Budget (YNAB) that integrate with your Wells Fargo account. These apps provide detailed insights into your spending patterns and assist in budget creation.

- Expense Tracking Tools: Use tools like Expensify or PocketGuard to keep a close watch on expenses related to your credit card usage. These tools can help you manage your transactions and forecast future spending.

- Credit Monitoring Services: Services such as Credit Karma allow you to monitor your credit score and receive alerts on changes to your credit report. Staying informed can help you make better financial decisions.

“Staying proactive with budgeting and tracking your credit card payments not only enhances your financial stability but also promotes a healthier credit profile.”

Detailed FAQs

What payment methods are available for Wells Fargo credit cards?

Wells Fargo offers online payments, mobile app payments, and traditional methods such as mailing checks or visiting bank branches.

How long does it take for a payment to process?

Payments typically take one to three business days to process, depending on the method used.

Are there any fees associated with making payments?

Some payment methods may incur fees, such as expedited payments, so it’s essential to check the details for each option.

Can I set up automatic payments for my credit card?

Yes, you can easily set up automatic payments through the Wells Fargo website or mobile app to ensure timely payments.

What should I do if my payment doesn’t post on time?

If your payment doesn’t post as expected, contact Wells Fargo customer support for assistance with resolving the issue.