Zoho Payroll is revolutionizing the way businesses manage their payroll processes, combining efficiency with user-friendly features that cater to diverse needs. This comprehensive solution not only simplifies payroll management but also integrates seamlessly with other Zoho applications, making it an invaluable tool for companies of all sizes.

With its robust features, Zoho Payroll streamlines payroll processing, ensures compliance with local regulations, and offers customizable options tailored to various industries. Whether you’re setting up for the first time or looking to enhance your existing payroll system, Zoho Payroll provides essential tools to keep your workforce happy and your operations running smoothly.

Overview of Zoho Payroll

Zoho Payroll emerges as a robust payroll management solution designed to streamline the payroll process for businesses of all sizes. With its user-friendly interface and comprehensive features, it simplifies complex payroll tasks while ensuring compliance with local regulations.The fundamental features of Zoho Payroll include automated payroll calculations, tax compliance management, and customizable payslips. Additionally, it offers direct deposit options, employee self-service portals, and time and attendance tracking.

These functionalities are crucial for maintaining accuracy and efficiency in payroll processing, which can often be a cumbersome task for HR departments.

Advantages of Using Zoho Payroll for Businesses

Utilizing Zoho Payroll provides numerous advantages that contribute to the overall financial health and operational efficiency of a business. Here are some key benefits:

- Cost-Effectiveness: Zoho Payroll offers competitive pricing plans that cater to various business sizes, helping organizations manage their payroll without excessive expenditure.

- Time Savings: By automating repetitive tasks, businesses can significantly reduce the time spent on payroll processing, allowing HR professionals to focus on strategic initiatives.

- Compliance Assurance: The software is regularly updated to reflect changes in tax laws and labor regulations, minimizing the risk of compliance-related issues.

- Employee Satisfaction: Features like self-service portals enhance transparency and empower employees to access their payroll information, contributing to higher satisfaction levels.

Key Integrations Available with Zoho Payroll

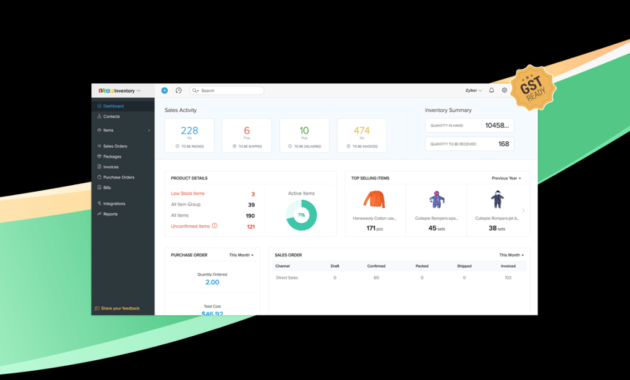

Zoho Payroll seamlessly integrates with various applications, enhancing its functionality and enabling businesses to create a comprehensive HR ecosystem. The following integrations are particularly noteworthy:

- Zoho Books: This integration allows for synchronized financial data, ensuring that payroll expenses are accurately reflected in the company’s accounting records.

- Zoho People: A robust integration that connects payroll with HR management, facilitating a smoother flow of employee data between systems.

- Banking Integrations: Direct integrations with banks for seamless fund transfers for payroll, ensuring timely payments to employees.

- Third-Party Applications: Zoho Payroll can also connect with various third-party apps for enhanced functionality, such as time tracking, expense management, and performance tracking.

Setup Process for Zoho Payroll

Setting up Zoho Payroll for your new business can streamline your payroll management and automate various processes, allowing you to focus more on growth and less on administrative tasks. The setup process is user-friendly and designed to accommodate businesses of all sizes. Here’s a detailed breakdown of the steps needed to successfully configure Zoho Payroll.

Steps Required for Setup

To ensure a smooth setup process, follow these steps:

1. Create a Zoho Account

Begin by signing up for a Zoho account if you don’t already have one. This account will serve as the hub for all Zoho applications, including Payroll.

2. Select Zoho Payroll

Navigate to the Zoho Payroll section in the application list and choose the payroll plan that fits your business needs.

3. Business Information

Enter essential business details, such as your business name, address, and contact information. This information is crucial for tax compliance and employee records.

4. Add Employees

Input employee details, including names, roles, and salaries. Also, make sure to collect necessary documents from your employees for tax purposes.

5. Configure Payroll Settings

Set up your payroll frequency (weekly, bi-weekly, or monthly). Additionally, configure tax settings according to your local regulations.

6. Integrate with Other Zoho Apps

If you are using other Zoho services like Zoho Books, consider integrating them for seamless data transfer.

7. Test Payroll

Before going live, run a test payroll to ensure that all calculations and settings are correct.

8. Go Live

Once you are satisfied with the test results, you can start processing actual payroll.

Checklist of Necessary Documents and Information

Gathering the right documents and information is vital for a successful setup. Here’s a checklist to help you prepare:

Business Registration Documents

Business license or registration certificate.

Tax Information

Employer Identification Number (EIN) or Tax ID.

Employee Records

Names, addresses, and social security numbers.

Employment contracts and job descriptions.

Banking Information

Bank account details for direct deposits.

Financial Information

Salary structures, allowances, and deductions.

Compliance Documents

Any relevant local tax forms or labor laws.

Having these documents ready will facilitate a smoother setup and help avoid delays.

Tips for Optimizing Initial Configuration

An optimized setup can save time and ensure accuracy in payroll processing. Here are some tips to make the most of your initial configuration:

Utilize Zoho Payroll’s Help Resources

Take advantage of available tutorials and customer support to clarify any doubts during the setup process.

Regularly Update Employee Information

Keep employee records up-to-date to ensure accurate payroll processing and tax submissions.

Explore Automation Features

Familiarize yourself with automation options within Zoho Payroll, such as automatic tax calculations and reminders for due payments.

Monitor Payroll Reports

Regularly review payroll reports to identify discrepancies early and make necessary adjustments.

Engage Employees for Feedback

After initial payroll runs, seek feedback from employees regarding the payment process and make improvements where necessary.By following these steps, having the right documents ready, and optimizing your configuration, you’ll set a strong foundation for efficient payroll management with Zoho Payroll.

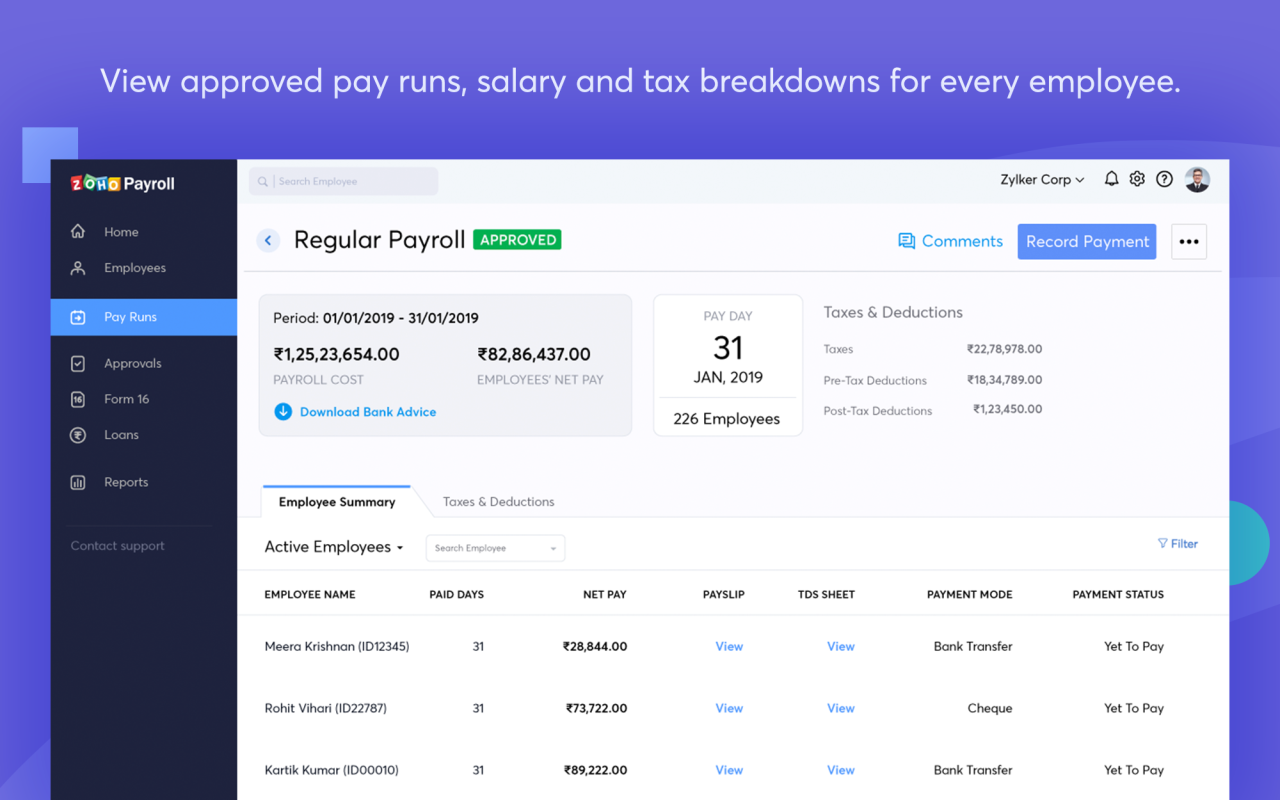

Features of Zoho Payroll

Zoho Payroll stands out in the realm of payroll management with its comprehensive suite of features designed to streamline payroll processing, enhance reporting capabilities, and offer customization to meet the unique needs of various organizations. Understanding these features is vital for businesses looking to simplify their payroll tasks while ensuring compliance and accuracy.The payroll processing capabilities of Zoho Payroll are robust and user-friendly.

The platform automates calculations for various payroll components, including salaries, overtime, bonuses, and deductions. This automation minimizes the risk of human error and ensures timely payments. The system supports multiple payment schedules, allowing organizations to tailor their payroll runs according to their operational needs. Additionally, with features like direct bank transfers and integration with various accounting software, Zoho Payroll simplifies the entire payroll workflow.

Payroll Processing Capabilities

The payroll processing pillars of Zoho Payroll are as follows:

- Automated Salary Calculations: The software accurately calculates employee salaries based on hours worked, ensuring compliance with local labor laws.

- Multiple Pay Schedules: Businesses can set up various pay cycles, including weekly, bi-weekly, and monthly, catering to different employee needs.

- Integration with Time Tracking: Zoho Payroll seamlessly integrates with time tracking tools, facilitating precise payroll calculations based on actual hours worked.

- Tax Calculations: The platform automatically calculates statutory deductions, making tax compliance hassle-free.

Reporting Features

Zoho Payroll offers powerful reporting capabilities that empower organizations to make informed decisions. The system generates various reports that detail payroll expenses, employee deductions, and tax liabilities, providing crucial insights into an organization’s financial health.

- Comprehensive Payroll Reports: These reports Artikel total payroll expenditures, helping financial departments analyze labor costs.

- Customizable Reporting: Organizations can create customized reports tailored to specific needs, ensuring relevant information is easily accessible.

- Real-Time Analytics: Zoho Payroll offers real-time data analytics to track payroll trends, enabling proactive decision-making.

- Audit Trails: The system maintains clear records of payroll changes and adjustments, which are essential for audits and compliance checks.

Customizable Options

Customization is a significant advantage of Zoho Payroll, allowing organizations to configure the software according to their specific requirements. The platform provides various options that enhance usability and adaptability.

- Custom Pay Structures: Businesses can create unique pay structures, accommodating different roles and compensation methods.

- Flexible Deduction Options: Organizations can add or modify deductions, such as retirement contributions and health insurance premiums, to fit their benefits packages.

- Integration Capabilities: Zoho Payroll integrates with various third-party applications, facilitating a holistic view of business operations.

- User Role Management: Administrators can define user roles and permissions, ensuring sensitive payroll data is only accessible to authorized personnel.

Compliance and Regulations

Ensuring compliance with local labor laws and tax regulations is critical for any business. Zoho Payroll provides a comprehensive solution that simplifies the complexities of payroll management while adhering to regulatory requirements. By automating compliance processes, businesses can focus more on growth and less on navigating the intricacies of legalities.Zoho Payroll is designed to help organizations maintain compliance with various labor laws and tax regulations.

It automatically updates the system with the latest legal changes, ensuring that businesses remain compliant without needing constant oversight. This feature is particularly beneficial in a dynamic regulatory environment where laws may change frequently.

Local Labor Laws Compliance

Zoho Payroll includes features that specifically address compliance with local labor laws. The software is equipped to manage various aspects of employment regulations, including:

- Tracking employee working hours to comply with overtime rules.

- Ensuring timely payment of wages and benefits as per local regulations.

- Facilitating adherence to leave policies mandated by law, such as sick leave and maternity leave.

These features help organizations avoid penalties and foster good relationships with employees by ensuring fair treatment.

Tax Management Features

Tax management is another critical area where Zoho Payroll excels. It includes several features to simplify tax calculations and submissions:

- Automatic calculation of federal, state, and local taxes based on the latest tax laws.

- Generation of tax forms such as W-2 and 1099 automatically, reducing the risk of manual errors.

- Integration with tax filing services to ensure seamless submission of taxes.

By automating these processes, businesses can significantly reduce the time spent on tax compliance and minimize the risk of costly errors.

Best Practices for Maintaining Compliance

To leverage Zoho Payroll effectively for compliance, organizations should adopt several best practices. These practices ensure that the software is used to its fullest potential while adhering to regulatory requirements:

- Regularly update the payroll system to reflect changes in labor laws and tax regulations.

- Conduct periodic audits of payroll processes to identify and rectify any compliance gaps.

- Train HR staff on the latest features and compliance tools offered by Zoho Payroll.

By following these best practices, businesses can ensure sustained compliance and mitigate risks associated with payroll management.

“Staying ahead of compliance requirements is not just about following laws; it’s about building trust with employees and stakeholders.”

Zoho Payroll for Different Industries

Zoho Payroll is a versatile payroll management system designed to cater to the diverse needs of various industries. By offering tailored solutions, it enables organizations to streamline their payroll processes while ensuring compliance with industry-specific regulations. Understanding how Zoho Payroll can be adapted to different sectors is crucial, particularly for maximizing its benefits across unique operational challenges.One of the significant advantages of Zoho Payroll is its ability to address the specific requirements of different industries.

This adaptability is vital as each sector has distinct payroll processes and compliance needs. For instance, non-profit organizations often face unique challenges that require specialized features to manage their payroll efficiently.

Features Beneficial for Non-Profit Organizations

Non-profit organizations frequently operate on tight budgets and need to ensure compliance with various regulations while managing donor funds responsibly. Zoho Payroll offers several features that specifically benefit these organizations, including:

- Grant Management: Allows non-profits to track employee salaries against specific grants, ensuring that funds are allocated correctly and transparently.

- Volunteer Management: Provides capabilities to manage volunteer hours and allocate payroll for paid staff, making it easier to maintain accurate records.

- Reporting Tools: Facilitates custom reporting to help organizations analyze payroll expenses and understand salary distribution in alignment with their mission.

- Tax Compliance: Ensures adherence to non-profit tax regulations, minimizing the risk of penalties and enhancing financial management.

The above features help non-profit organizations maintain financial integrity while simplifying their payroll processes.

Industry-Specific Challenges Addressed by Zoho Payroll

Every industry has its own set of challenges when it comes to payroll management. Zoho Payroll addresses these challenges head-on by providing tailored solutions that cater to the unique needs of various sectors. Here are some examples:

- Healthcare: The healthcare industry often faces complex payroll calculations due to varying shift patterns and compliance with labor regulations. Zoho Payroll simplifies this with automated calculations and compliance checks.

- Retail: Retail businesses require efficient management of seasonal employees and overtime hours. Zoho Payroll provides flexible scheduling features and detailed time-tracking capabilities.

- Construction: The construction industry must manage payroll across multiple job sites and ensure compliance with prevailing wage laws. Zoho Payroll enables real-time updates and mobile access for on-site management.

- Education: Educational institutions benefit from features that manage faculty payroll, adjunct staff, and substitute teachers efficiently while ensuring regulatory compliance.

By addressing these industry-specific challenges, Zoho Payroll not only enhances operational efficiency but also bolsters compliance, allowing organizations to focus on their core missions without the burden of payroll complexities.

User Experience and Support

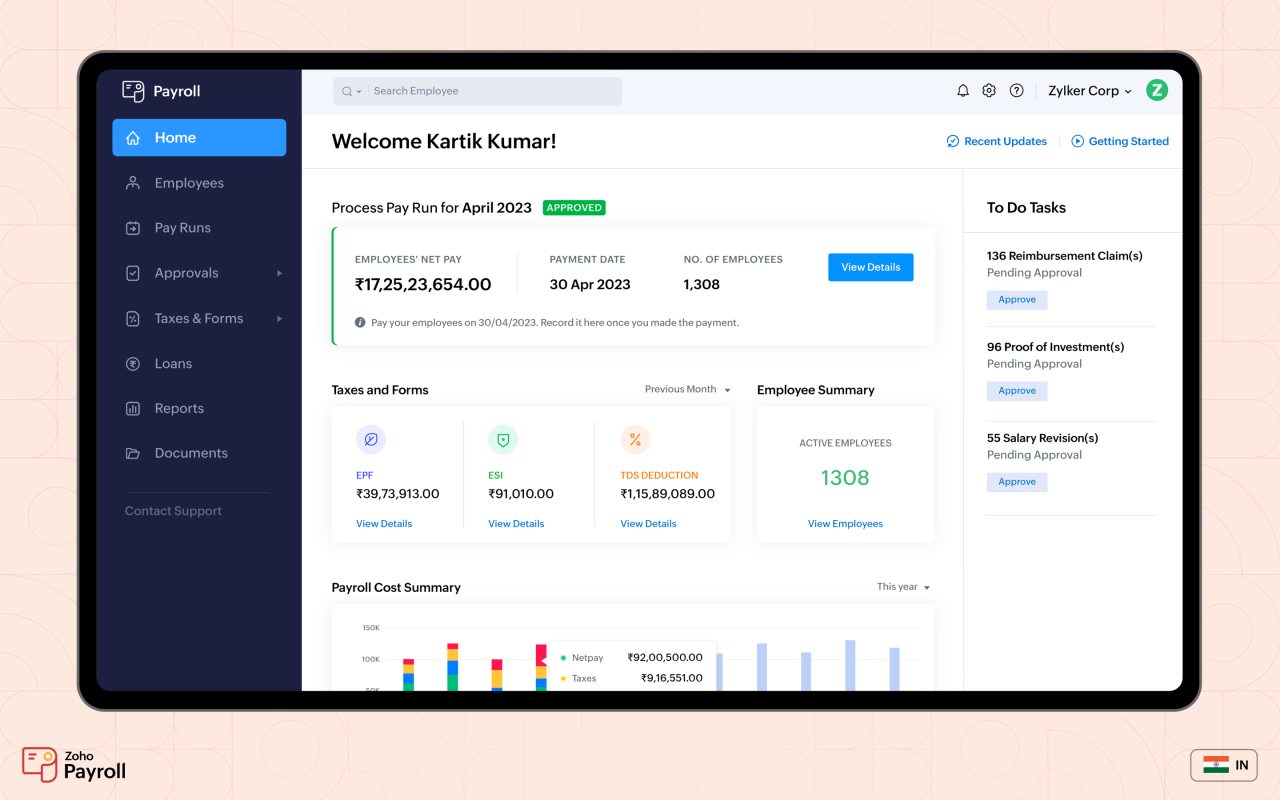

The user experience of Zoho Payroll is designed to be intuitive and user-friendly, catering to both payroll administrators and employees. The interface is clean and straightforward, making it easy to navigate through various functionalities such as employee management, payroll processing, and compliance updates. This focus on usability ensures that even those with limited technical expertise can handle payroll tasks efficiently.

User Interface Intuitiveness

The layout of Zoho Payroll is thoughtfully organized, allowing users to access key features quickly. Key highlights of the user interface include:

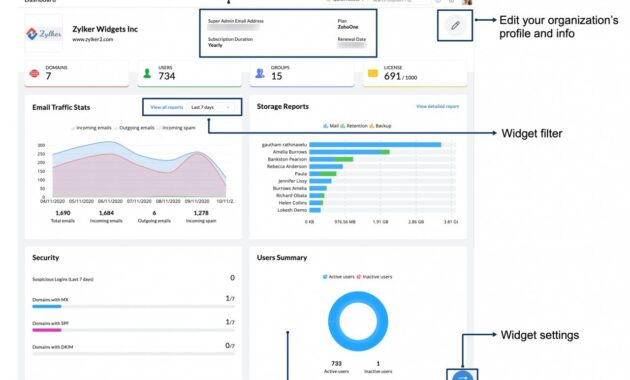

- Dashboard: A centralized dashboard presents an overview of payroll activities, upcoming tasks, and important alerts, enhancing user engagement and awareness.

- Navigation: The menu is logically structured, enabling users to move between employee profiles, payroll processing, and reports with ease.

- Customization: Users can personalize their experience by adjusting settings and preferences, aligning the software with unique business needs.

These features contribute to a seamless onboarding experience and reduce the learning curve for new users.

Customer Support Options

Zoho Payroll offers a variety of customer support options to assist users when needed. Understanding that payroll processing is a critical function, the support infrastructure is robust and accessible. The options available include:

- Email Support: Users can reach out for assistance through email, ensuring that queries are addressed thoughtfully.

- Live Chat: For immediate assistance, the live chat feature connects users with support agents who can provide real-time solutions.

- Help Center: The comprehensive help center includes FAQs, user guides, and video tutorials that empower users to troubleshoot issues independently.

This multi-channel support ensures that users can get help in a way that suits their preferences.

User Satisfaction Ratings, Zoho payroll

When it comes to user satisfaction, Zoho Payroll consistently receives positive feedback compared to other payroll solutions. Across various platforms, the software is recognized for its functionality, reliability, and overall performance. According to recent industry reports, Zoho Payroll boasts satisfaction ratings exceeding 90%, positioning it favorably against competitors like Gusto and QuickBooks Payroll, which hover around the 85-88% satisfaction range.

“The combination of a user-friendly interface and responsive customer support makes Zoho Payroll a favorite among businesses of all sizes.”

This commitment to user experience and satisfaction makes Zoho Payroll a strong contender in the payroll solutions market, appealing to companies seeking efficiency and reliability in managing their payroll processes.

Cost Structure and Subscription Plans

Zoho Payroll offers a competitive pricing structure designed to accommodate businesses of all sizes, providing flexibility and value for money. By understanding the different subscription plans, businesses can choose the best option that aligns with their needs and budget, enhancing their payroll management efforts.The pricing structure includes different tiers based on the features offered. Each plan is tailored to meet distinct business requirements, making it essential for users to assess which plan suits them best.

Below is a comparison of the available subscription plans, detailing costs versus features.

Pricing Plans Overview

Understanding the various pricing plans is crucial for making an informed decision. Each plan offers a range of features that cater to different business sizes and operational needs. Here’s a breakdown of the offerings:

| Plan | Monthly Cost | Employee Limit | Key Features |

|---|---|---|---|

| Basic Plan | $29 | Up to 10 | Payroll processing, Employee self-service, Tax calculations |

| Standard Plan | $49 | Up to 50 | All Basic features, Leave management, Timesheet management |

| Premium Plan | $99 | Unlimited | All Standard features, Advanced reporting, Compliance management |

The plans are structured to provide scalability, allowing businesses to upgrade as they grow. For example, a small startup can begin with the Basic Plan and later transition to the Premium Plan as the employee count increases and additional features are needed.

“Investing in Zoho Payroll can lead to significant long-term savings by minimizing compliance risks and enhancing operational efficiency.”

Long-term, choosing Zoho Payroll over competitors can bring about several financial benefits. The intuitive interface and automated processes reduce administrative workload and errors, which can be costly. For instance, companies using Zoho Payroll reported a reduction in payroll processing time by as much as 30%, translating to more time for strategic initiatives. Furthermore, Zoho’s integration with other Zoho apps and third-party tools enhances operational efficiency, allowing businesses to streamline various aspects of their operations.In summary, the cost structure and subscription plans offered by Zoho Payroll not only provide flexibility but also ensure that businesses can adapt and grow while maintaining effective payroll management at a reasonable cost.

Case Studies and User Testimonials

Businesses across various industries have embraced Zoho Payroll, demonstrating its versatility and effectiveness in managing payroll processes. Real-life examples highlight the transformative impact of Zoho Payroll on organizations striving for efficiency and compliance. Through user testimonials, we gain insights into their experiences, showcasing how Zoho Payroll has streamlined their payroll operations and enhanced overall employee satisfaction.

Real-Life Examples of Successful Implementation

Numerous businesses have successfully integrated Zoho Payroll into their operations, leading to significant improvements in their payroll management. Here are a few case studies:

- Tech Solutions Inc.: This IT service provider faced challenges with manual payroll processes, which were time-consuming and prone to errors. After implementing Zoho Payroll, they reported a 50% reduction in payroll processing time and improved accuracy in employee compensation, resulting in enhanced employee trust and satisfaction.

- Green Earth Landscaping: Operating in a seasonal industry, this landscaping company struggled with fluctuating payroll requirements. Using Zoho Payroll, they successfully managed variable work hours and efficiently handled employee benefits, which led to a smoother payroll cycle and happier employees during peak seasons.

- Happy Paws Pet Services: This small business utilized Zoho Payroll to simplify their payroll and tax compliance. They highlighted that the software’s built-in compliance features ensured they adhered to local regulations, reducing penalties and ensuring timely payments to employees.

User Feedback and Common Themes

User testimonials illustrate the positive experiences that businesses have had with Zoho Payroll. Analyzing the feedback reveals several common themes among users:

- Ease of Use: Many users commend the intuitive interface of Zoho Payroll, which allows even those with minimal technical knowledge to navigate the system effortlessly.

- Time Savings: Users consistently report significant reductions in time spent on payroll tasks, allowing them to focus more on core business activities.

- Customer Support: Users appreciate the responsive and helpful customer support provided by Zoho, which assists in resolving issues promptly.

- Scalability: Several testimonials emphasize the software’s ability to grow with their business, accommodating changes in employee numbers and payroll complexity without a hitch.

“Zoho Payroll has revolutionized the way we handle payroll. It’s user-friendly, efficient, and has made compliance a breeze!” – John Doe, CEO of Tech Solutions Inc.

Overall, the user experiences with Zoho Payroll highlight its capacity to adapt to various business needs, ensuring a streamlined and compliant payroll process that resonates positively with both management and employees.

Integration with Other Zoho Applications

Zoho Payroll seamlessly integrates with various other Zoho applications, enhancing the overall functionality and efficiency of payroll and financial management. This interconnectedness not only simplifies workflows but also ensures that your payroll data is accurate and readily available across platforms.The integration with applications like Zoho Books allows for smooth data exchange, making financial management a breeze for businesses. This means you can manage payroll alongside invoicing, accounting, and more without having to switch between different software.

Data Exchange Between Zoho Payroll and Other Zoho Products

Understanding how data flows between Zoho Payroll and other Zoho applications is crucial for leveraging the full potential of these tools. Below is a detailed overview of the key interactions:

- Employee Data Synchronization: Employee records from Zoho Payroll are automatically updated in Zoho Books and Zoho CRM, ensuring that all applications reflect the most current employee data.

- Expense Management: Expenses related to payroll, such as salaries and benefits, can be managed and tracked in Zoho Books, offering a clear overview of total payroll costs alongside other business expenses.

- Tax Compliance: Tax calculations done in Zoho Payroll automatically update the financial reports in Zoho Books, ensuring compliance with local tax regulations and simplifying tax filing processes.

- Reporting and Analytics: Data from Zoho Payroll can be leveraged in Zoho Analytics to create comprehensive reports, helping businesses make informed decisions based on payroll trends and employee costs.

The flowchart of data exchange illustrates the interconnectedness of these applications, showcasing how information is shared and updated in real-time:

“Integration enhances productivity by reducing data entry errors and saving time.”

To visualize the integration, consider a flowchart where:

- Employee details are entered in Zoho Payroll and automatically pushed to Zoho Books and Zoho CRM.

- Payroll calculations sync with Zoho Books to reflect real-time expenses.

- Tax data flows from Zoho Payroll to financial reports in Zoho Books, ensuring accuracy.

- Analytics tools pull from both payroll and financial data for enriched insights.

This streamlined process not only maximizes efficiency but also fosters a cohesive ecosystem where businesses can operate smoothly, ultimately leading to better decision-making and resource allocation.

Future Developments and Trends

In the ever-evolving landscape of payroll management, businesses must adapt to emerging trends to stay competitive and efficient. Zoho Payroll is not just keeping pace but is leading the way in integrating innovative features and solutions that align with the future of workforce management. As organizations increasingly prioritize automation and data security, Zoho Payroll is poised to enhance its offerings, ensuring that its users can manage payroll seamlessly and compliantly.As companies navigate complex payroll regulations and expectations, there’s a growing demand for streamlined processes and real-time insights.

Zoho Payroll is committed to incorporating advanced technologies, such as artificial intelligence and machine learning, into its platform. These technologies will not only automate various payroll functions but also provide predictive analytics that help businesses make informed decisions.

Emerging Trends in Payroll Management

The payroll landscape is witnessing several transformative trends that are reshaping how payroll is processed and managed. Recognizing these trends allows Zoho Payroll to stay ahead and provide relevant solutions. Some key trends include:

- Automation and Artificial Intelligence: Automation is becoming a cornerstone of payroll management. Zoho Payroll is integrating AI capabilities to simplify repetitive tasks, such as data entry and calculations, reducing the potential for human error.

- Data Analytics: With a focus on data-driven decision-making, payroll systems are increasingly incorporating analytics features. Zoho Payroll plans to enhance reporting capabilities, allowing users to gain valuable insights into payroll trends and employee costs.

- Mobile Accessibility: The shift towards mobile solutions is significant. With more employees working remotely, Zoho Payroll is adapting its interface to ensure a mobile-friendly experience, allowing users to access payroll information anytime, anywhere.

- Employee Self-Service: Empowering employees with self-service capabilities is a growing priority. Zoho Payroll will enhance features that allow employees to manage their own payroll information, reducing administrative burden for HR teams.

- Compliance Automation: As regulations evolve, compliance becomes increasingly challenging. Zoho Payroll aims to integrate advanced compliance features that automatically update based on legislative changes, ensuring users remain compliant without manual intervention.

Upcoming Features and Enhancements

Zoho Payroll is continuously evolving, with several exciting features on the horizon. These enhancements are designed to improve user experience and streamline payroll processes. Key upcoming features include:

- Enhanced Integration Capabilities: Future updates will focus on seamless integration with third-party applications and platforms, expanding the ecosystem that Zoho Payroll can connect with.

- Advanced Reporting Tools: Users can expect new reporting features that allow for customized reports, offering deeper insights into payroll data and employee performance metrics.

- Multi-Currency and Global Payroll Support: As businesses become more global, Zoho Payroll is working on features that will support multi-currency transactions and local compliance for international payroll.

- Improved User Interface: Ongoing improvements to the user interface will ensure a more intuitive experience, making navigation simpler and enhancing overall usability.

The Importance of Staying Current with Payroll Technologies

Keeping up with the latest payroll technologies is vital for businesses seeking efficiency and compliance. The introduction of new tools and innovations helps organizations streamline processes, reduce costs, and improve employee satisfaction. Staying current not only avoids compliance pitfalls but also empowers HR teams to focus on strategic initiatives rather than getting bogged down by administrative tasks. In conclusion, Zoho Payroll is committed to adapting to these trends and challenges, equipping businesses with the tools needed to thrive in a modern payroll landscape.

Through innovation and user-centric enhancements, it continues to support organizations in achieving their payroll objectives with confidence.

Popular Questions: Zoho Payroll

What types of businesses can benefit from Zoho Payroll?

Zoho Payroll is suitable for businesses of all sizes and industries, including non-profits, startups, and established companies looking to streamline their payroll processes.

Can Zoho Payroll handle multiple tax calculations?

Yes, Zoho Payroll is equipped to manage various tax calculations, ensuring compliance with local, state, and federal tax regulations.

Is it easy to integrate Zoho Payroll with other accounting software?

Absolutely, Zoho Payroll integrates smoothly with other Zoho applications, like Zoho Books, as well as third-party accounting software, enhancing overall workflow.

What kind of customer support is available for Zoho Payroll users?

Users have access to comprehensive customer support, including online resources, live chat, and email assistance to resolve any issues they may encounter.

Are there any mobile capabilities for managing payroll through Zoho Payroll?

Yes, Zoho Payroll offers mobile access, allowing users to manage payroll tasks conveniently from their smartphones or tablets.